Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

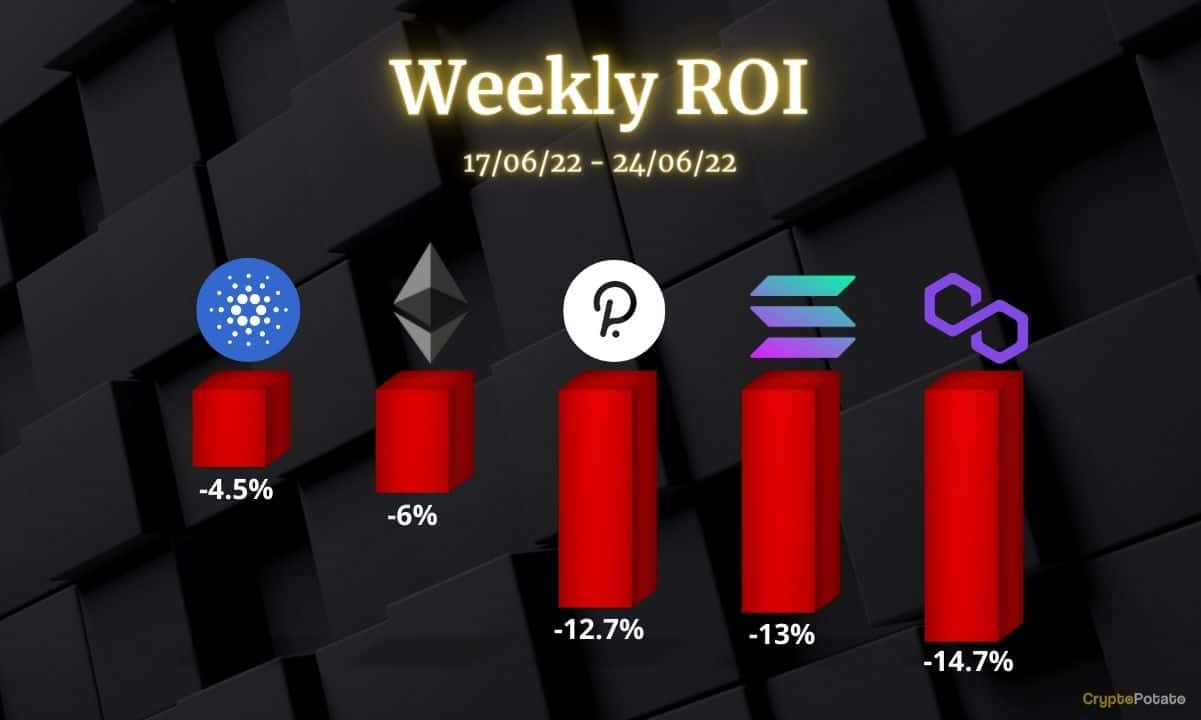

This week, we take a closer look at Ethereum, Cardano, Solana, Polkadot, and Polygon.

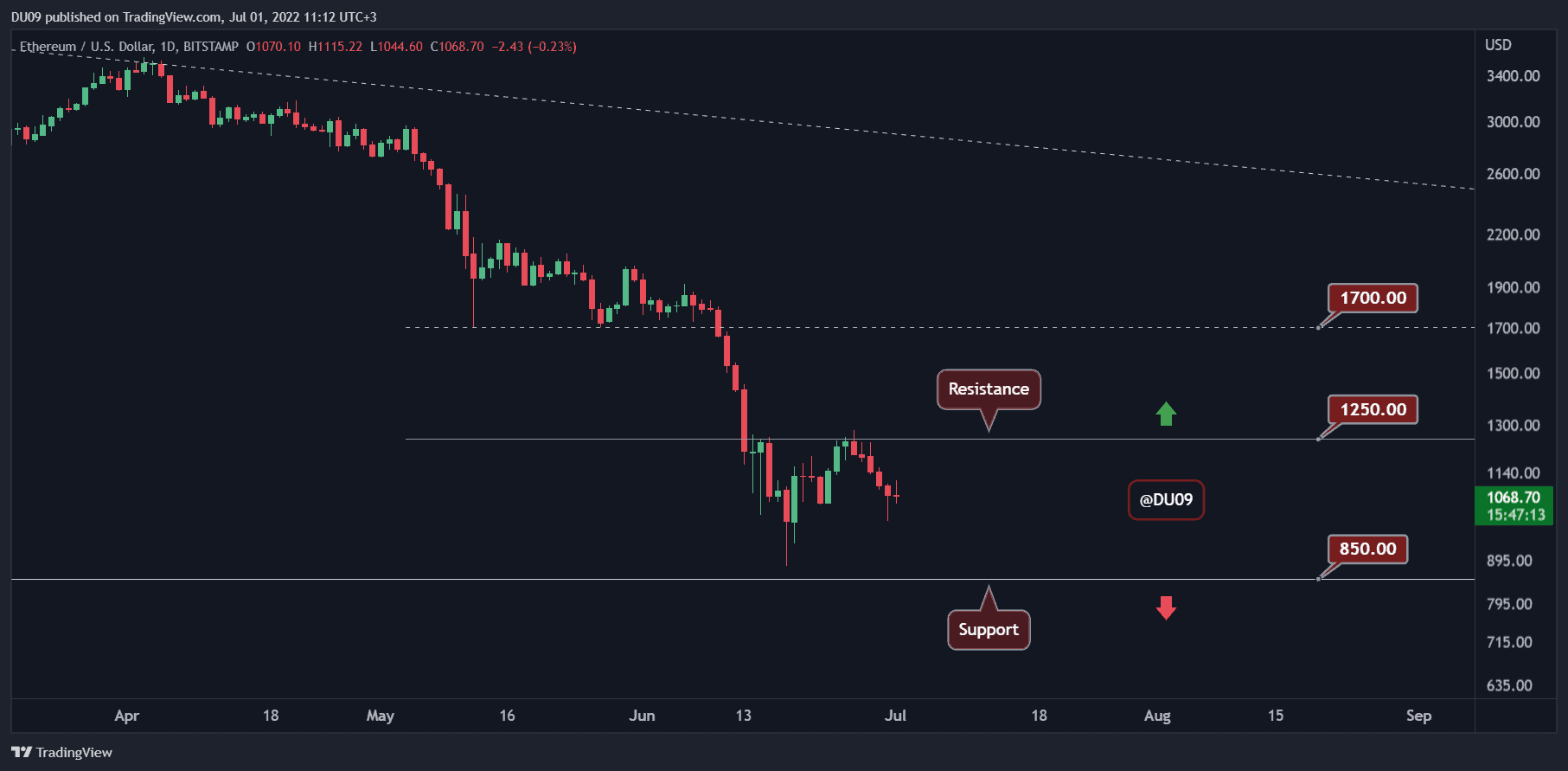

Ethereum (ETH)

The June monthly candle close was one of the worst in crypto history with over 40% loss for Ethereum. For this reason, July does not look too optimistic and this monthly candle also opened in red today. Overall, ETH had another bad week, losing 6%.

In June, the cryptocurrency found support just above $850 and managed to bounccriticalll the way to the key resistance at $1,250. Unfortunately for bulls, they could not push higher and since then, the price fell back to $1,000.

Looking ahead, it seems more likely for ETH to continue lower in search of a bottom. Historically, it has found a bottom after falling by over 90% from its all-time high. This would place the price at around $500, which is also one of the key support levels, should $850 fall.

Chart by TradingView

Cardano (ADA)

It was another difficult week for Cardano, with the price clinging to the key support at $0.45 after recording a 4.5% loss. This level has been tested four times before, and bulls managed to save the price from falling lower on each occasion. The question is if they can do it again. If they fail, then ADA will likely fall to the next key support at $0.38.

The resistance at $0.55 was not even tested during this most recent bounce in the market. This signals weakness for the cryptocurrency, and bears may speculate on this to attempt a break of the key support that has held well to date.

The indicators are flat on the daily timeframe but give signs of weakness which could lead the price lower. Buyers have to defend this key level at all costs – otherwise, they will quickly be overrun by sellers which can take ADA to new lows.

Chart by TradingView

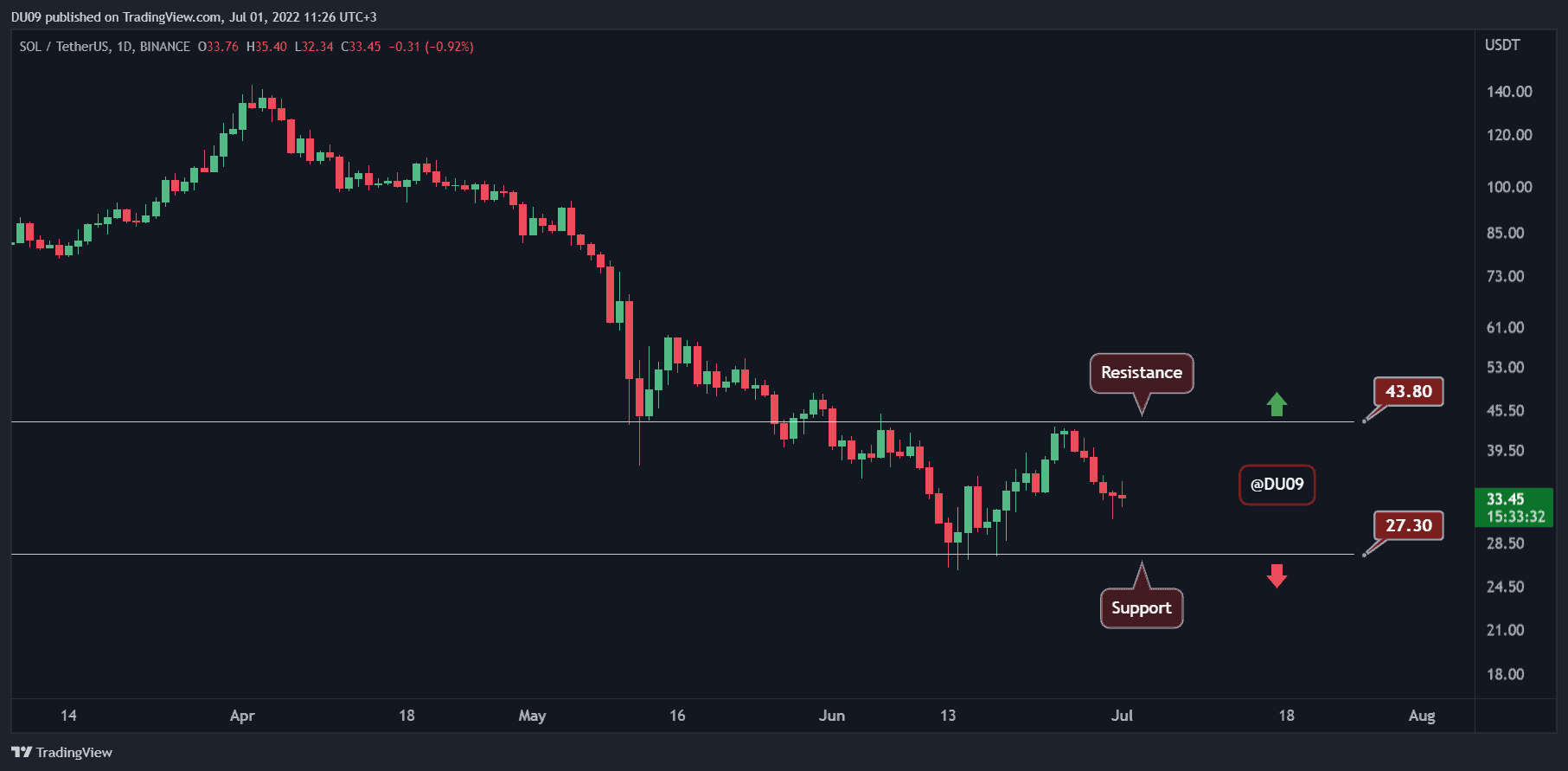

Solana (SOL)

Solana managed a sustained rally in June, and this brought a lot of optimism. Unfortunately for the bulls, as soon as the price hit the key resistance at $44, the price action reversed, and SOL lost 13% of its valuation in the past seven days. The cryptocurrency remains in a downtrend, and the outlook is still bearish.

So far, the price has not made a lower low, with the critical support at $27 still some distance away from today’s rates. However, a re-test of this level becomes likely, particularly if the overall market remains bearish in July.

Looking ahead, the best hope for Solana, at this time, is to enter into a range and consolidate between $27 and $44. The alternative, considering the current market, is for the price to continue lower.

Chart by TradingView

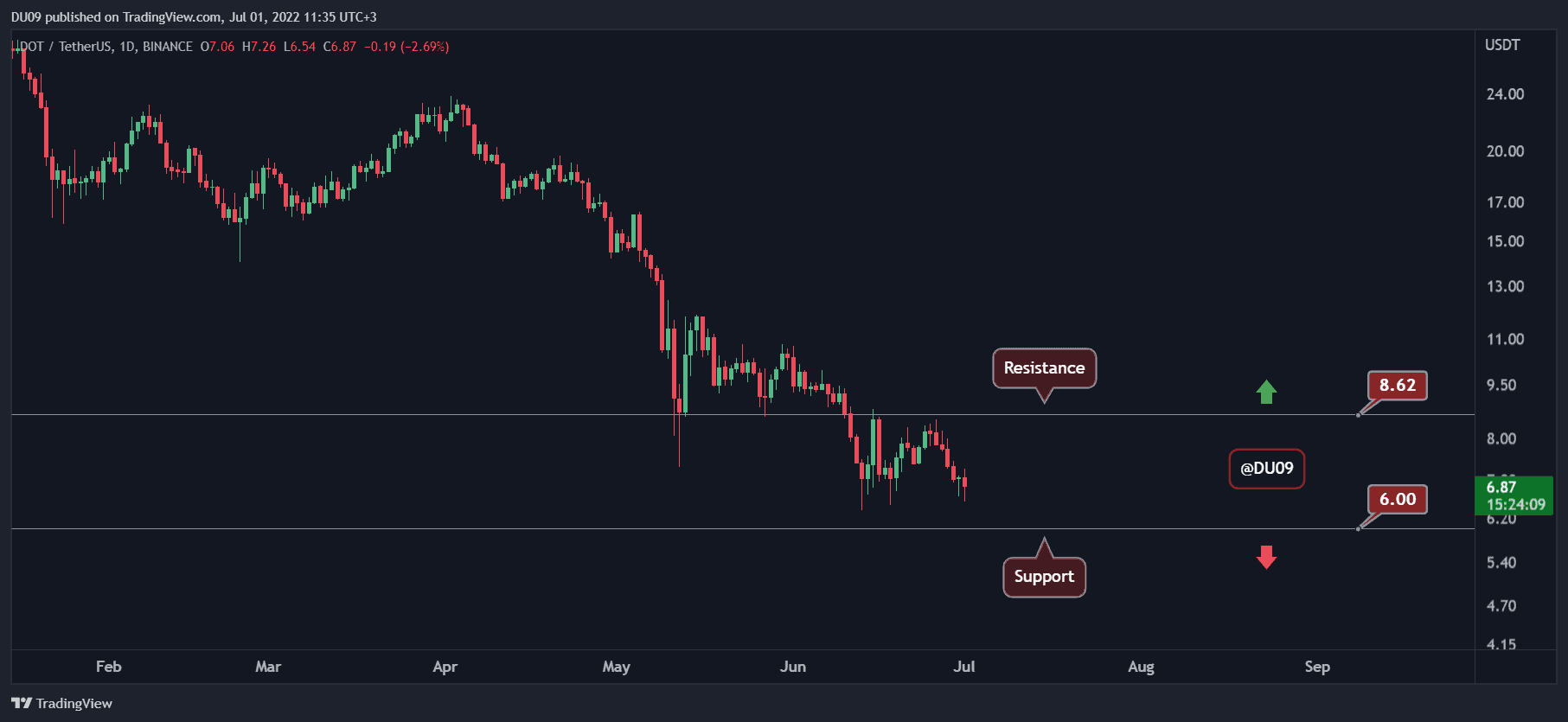

Polkadot (DOT)

With a 88% price crash from the all-time high at $55, Polkadot finds itself in a precarious situation. The price is close to the support at $6 and has reached levels not seen since 2020. The rejection at the $8.6 resistance has pushed DOT much lower, ending the last seven days with a 12.7% price loss.

Unable to stop the downtrend, DOT’s price action has remained in a downtrend for nine months to date (since November 2021). Every time there was an attempt by bulls to escape the downtrend, sellers rejected it.

Bulls have to defend the $6 key support level. Otherwise, DOT risks to end up much lower.

Chart by TradingView

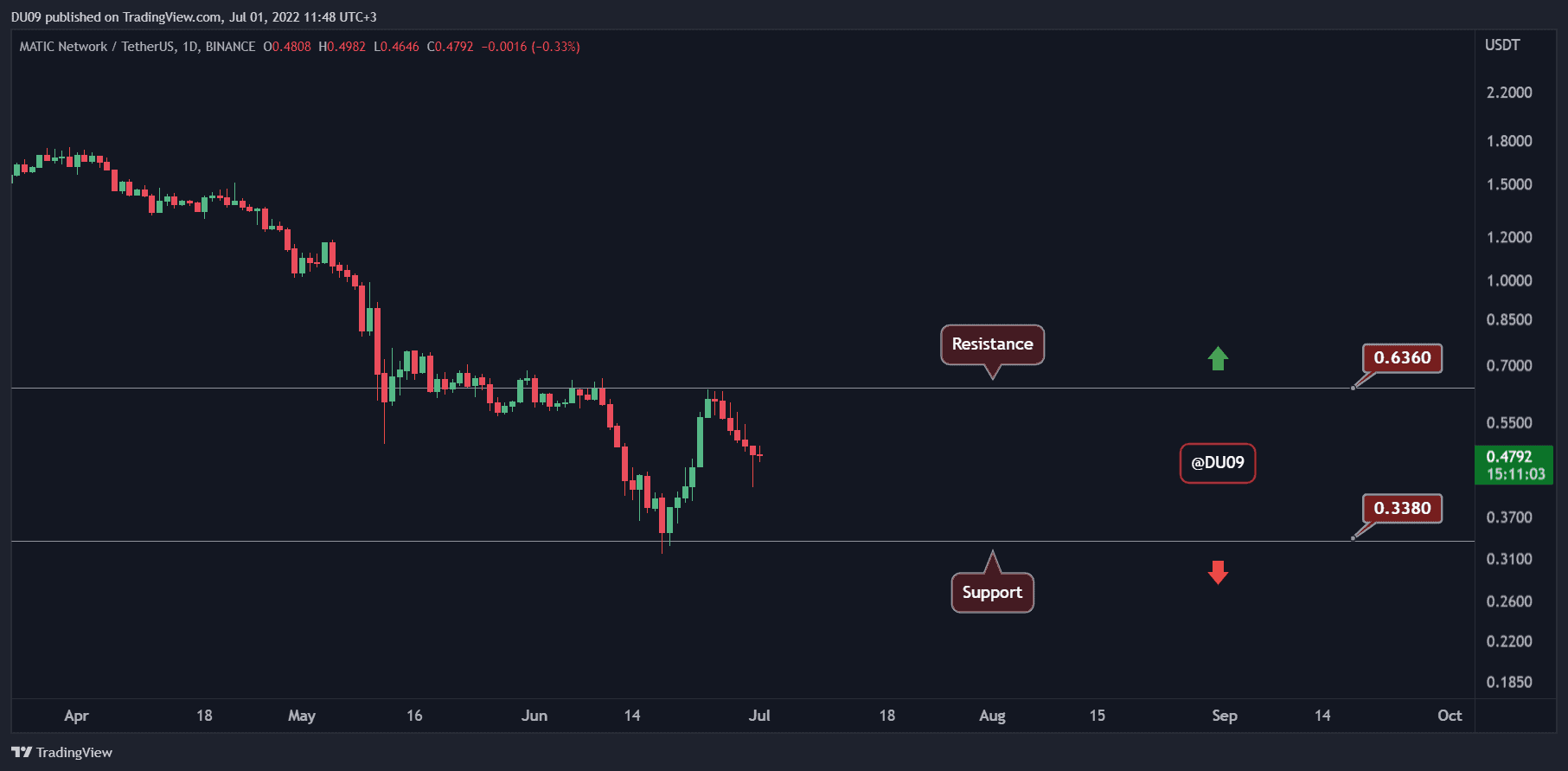

Polygon (MATIC)

MATIC’s price action mirrors Solana with a significant rally in June, only to then be rejected at the key resistance of $0.67. Since then, the price fell by 14.7% in the past seven days, making it the worst performer on our current list. The key support is found at $0.34, and this level attracted a lot of buyers when it was tested last time.

Buyers for MATIC may return to the key support once more, but there is one concern. The volume on this latest drop in price has been increasing. An increasing volume as the price falls is a very bearish indicator. By comparison, Solana’s volume has been decreasing as its price fell, which calls for optimism.

Either way, MATIC has seen sustained selling pressure, and this could take it to the key support once more in the coming weeks. Therefore, it’s possible for the cryptocurrency to revisit $0.34 should the overall market remain bearish.

Chart by TradingView

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.