Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

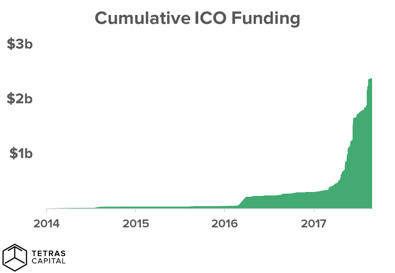

The ICO market has raised over $3bn with no sign of slowing down. Why? ICO fundraising may be the greatest form of capital raise that has ever existed for a startup.

Little regulation + global capital base + nine figure pre-product valuations + non-dilutive capital = ICO Mania.

An ICO is obviously an attractive avenue for startups. Shockingly, it is for early investors too. Low seven or eight figure valuations are turning into ten. Wash, rinse, repeat….

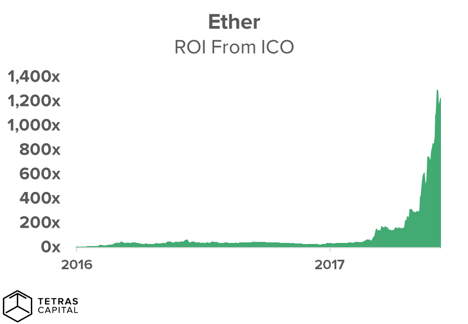

On one hand, part of this phenomenon is completely rational. For certain tokens that aim to be a medium of exchange and store of value, like Bitcoin, increases in price actually do increase its value. It’s a very paradoxical and non intuitive occurrence, partially stemming from the fact that most of us have only invested in debt or equity — never currencies that are just starting to gain adoption. When the price of BTC goes up, hash rate increases, volatility decreases and confidence in the token increases. The key is separating those tokens where this phenomenon holds true from all of the others.

Utility tokens are a completely different story, but investors don’t seem to realize or care. Why?

The status of the average crypto investor right now is analogous to a casino floor high roller. They’ve gotten wealthy from being risk-seeking and aren’t about to stop now.

The ICO market has become exuberant, and the prices of certain assets do not currently reflect their experimental nature and relatively low TAMs. The risk / reward of investing in many of the protocols launching is no longer compelling from any fundamental standpoint.

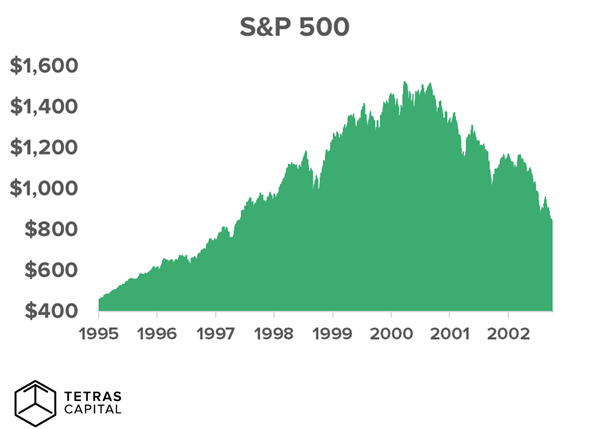

The pendulum cannot swing forever in this direction and price will eventually settle upon some semblance of fundamental value. No strategy can perpetually produce high rates of return without risk, and the investors that assume otherwise will end up humbled rather quickly. The same psychological factors causing people to disassociate price from value that occurred in the tech bubble are happening again today.

Greed, fear of missing out, envy, and self-deceit are rampant.

I’m not arguing we’re close to a crash. But, we are sowing the seeds for it now, and by having some accountability, restraint and by building a strong foundation, we can ultimately lessen the impact of what is likely to follow.

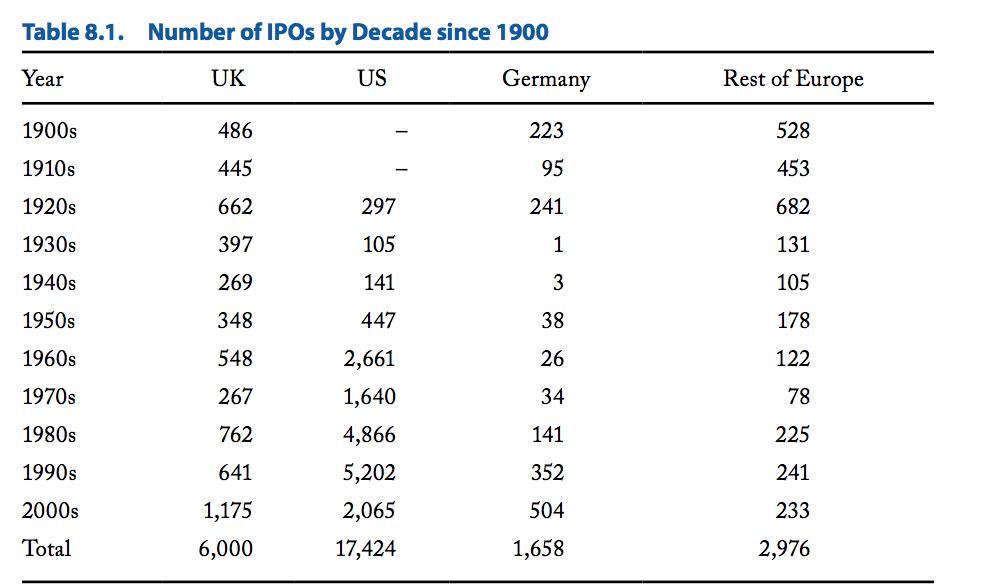

Radical innovation is exciting, but let’s not throw out things that work. The current IPO process works, and it works well. Yes, it has its flaws, but there’s still a lot to learn.

Creating a proper structure and process to launch ICOs will allow us to sustainably develop this technology without a premature crash and unnecessary regulatory oversight.

We all want blockchain technology to scale. Let’s be responsible about it. When things seem too good to be true, they usually are.

Lessons from the Equity Markets

Since the first IPO in 1625, the market has matured tremendously. Taking a company public today is an elaborate, lengthy and painstaking process. Investment banks, or “underwriters,” will take the lead alongside the company to manage all the required regulatory components, conduct due diligence, build the book of interested investors, and most importantly for this argument, value the company and structure the sale.

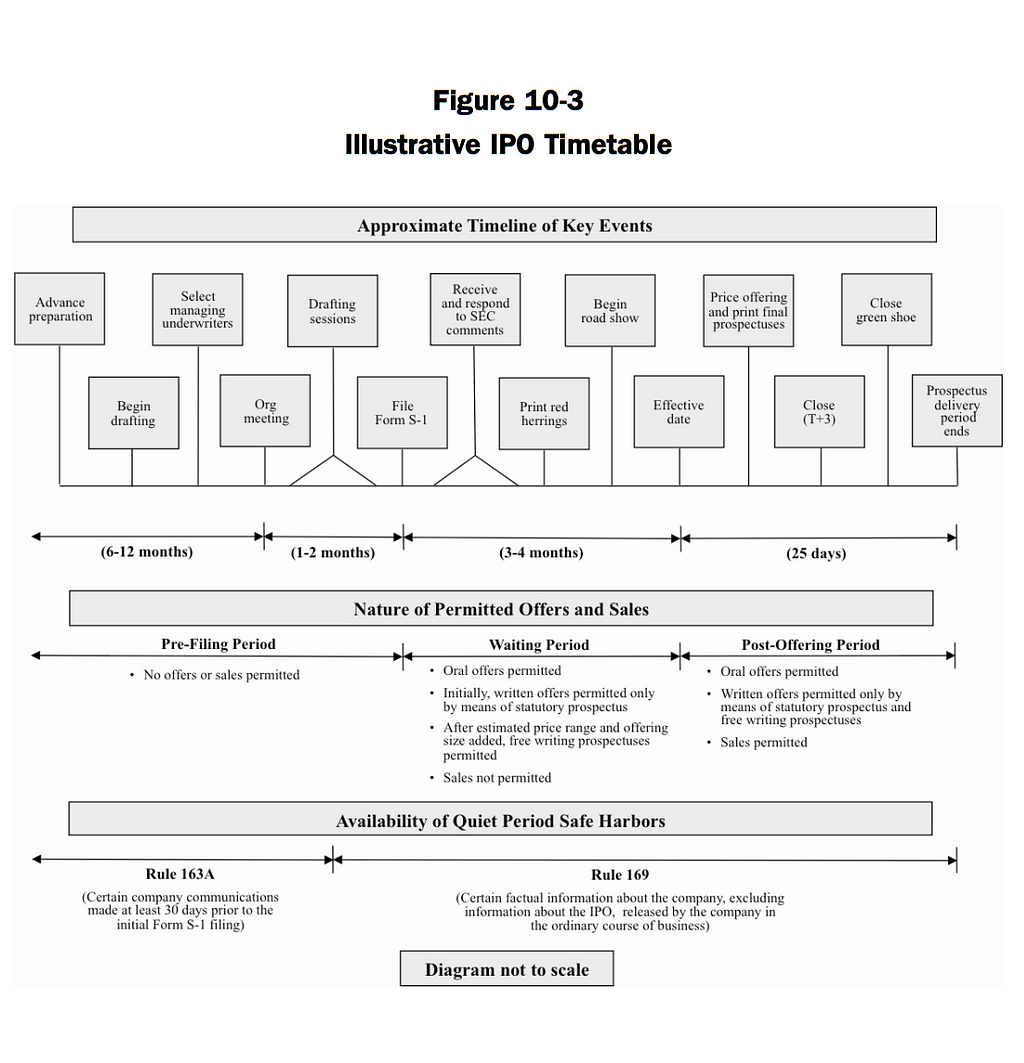

Below is a breakdown of the timeline and key stages of a typical IPO:

Why go public if it takes north of a year, thousands of pages of legal work and is clearly a pain in the ass? It’s a transformational event for a company and opens much deeper pools of capital. If structured and executed properly, it can act as a great marketing opportunity and attract high quality investors that will partner with the company for years to come.

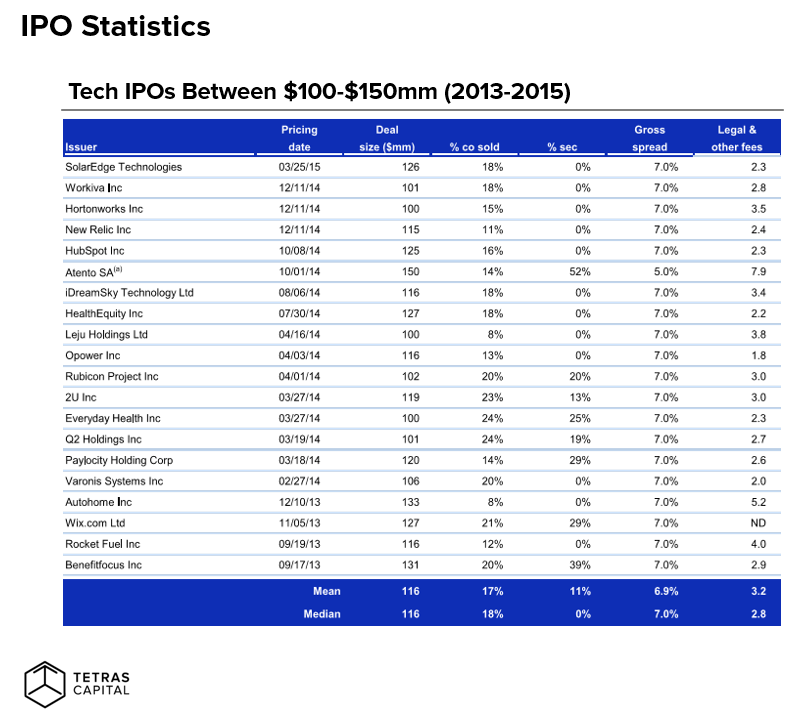

When conducting an IPO, companies need to carefully balance their anticipated future capital requirements with the desire to retain equity. They must also price the company reasonably to incentivize all early investors and adopters. What’s remarkable is the consistency in the structure that the IPO market has converged on over the years with regards to the % of the company sold.

Below you can see the typical % of company sold for $100mm-$150mm tech IPOs during a recent bull market:

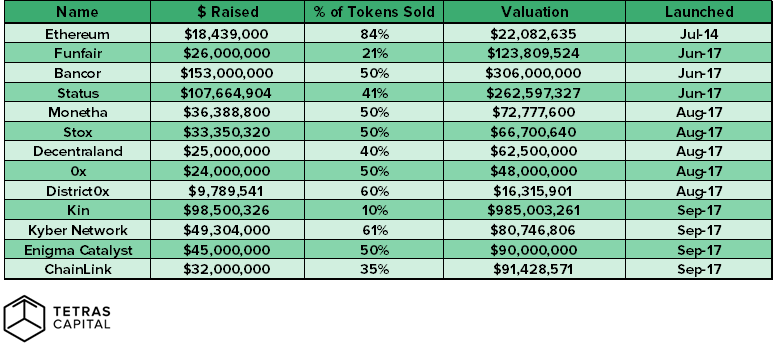

Compare this with some recent ICOs, and the wide range of % of tokens sold and valuation:

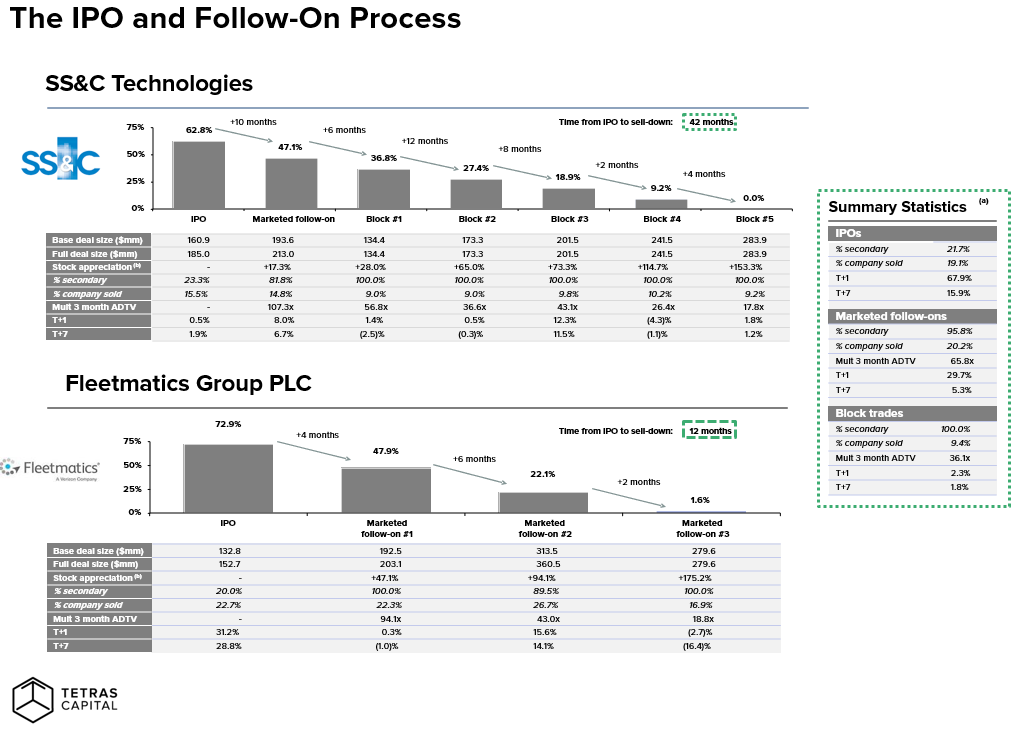

A company going public will typically sell 10–25% of equity in the first offering with plans to sell down the remainder in a course of 3–6 block trades. At a high level, the market has converged on this range in order to (1) develop enough liquidity for the market to “accurately” price the company and (2) allow the company to retain enough equity to compensate employees and have the option to raise future capital.

Below, the structure of two select tech IPOs and subsequent follow-on sales can be seen for reference:

IPO Valuation

The initial valuation of the IPO is the most important part of the process. It is what ultimately drives the market’s perception of the company in the public markets for years to come, which includes their ability to raise capital in the future. This is not only important for current and future investors, but also existing and potential employees. Nobody wants to work for a company and get compensated in stock if the price is consistently falling.

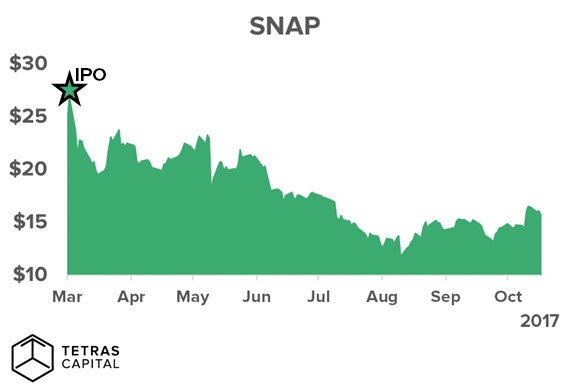

SNAP is a good recent example of a suboptimal IPO. There have already been new sell ratings on SNAP just months after a rigorous valuation process, most likely because the underwriters over shot the price. Since then, the price has fallen close to 40%. I’m sure Snapchat is now having a tougher time retaining and hiring talent and a lot less investors are excited about the company than otherwise would be, which could impact future capital raising.

Investment bankers will typically use a complex suite of analyses to land upon a target valuation. They are anything but exact, but nonetheless important to gauge how the market will likely think about the equity. This is half an art, half a science. Bankers turn every stone over with onsite due diligence, comparable company analysis, precedent transaction analysis, and projections of every scenario of cash flows possible. Still, the bankers will slightly “underprice” the IPO to where they feel fair value is to help drive an initial uptick in price after the sale, signaling to the market that the company’s equity is in demand and rewarding the investors in the IPO. This helps to set up a strong runway for future growth and capital raises.

Meanwhile, the ICO suite of analyses usually looks a lot more like this (and probably minus the suit and tie):

I’m certainly not claiming all ICOs have looked like this. We’ve actually seen some prudent and thoughtful approaches recently. However, the IPO bankers have worked out a lot of kinks over the years and there’s a lot we can learn from it, particularly in the realm of structure and valuation. Let’s throw away the suits and ties, but not the IPO structure and approach that banking has created that has withstood the test of time.

Setting a Fair Valuation & Why Valuation Even Matters

An optimal ICO starts with setting a fair valuation. Like with IPOs, it’s the most important part of the process — and not just for investors, but for founding teams too. The methodology for setting the valuation needs to be consistent from protocol to protocol — just like how DCFs and comparable analyses are used for all IPOs.

Valuation is both an art and science, and the current state of ICOs has managed to be neither scientific nor artistic — random seems to be a more appropriate term. The ICO market feels like a playground for misfits in comparison to IPOs, which have a standardized % of equity sold and reasonable ranges of P/E and valuation ratios.

Before we dive into the nuances of valuation, why should it even matter in the utility token market? The broad sentiment in the ICO market is that early investors get a discount, ICO investors get a pop when the token is added to exchanges, and all decentralized protocols will grow fast and large enough to sustain nearly any market cap.

It’s believed these markets are “different.” Market cap is all relative to BTC, which has massive room to run and the growth of technology is faster than ever before. But, history tells us it can’t be that simple.

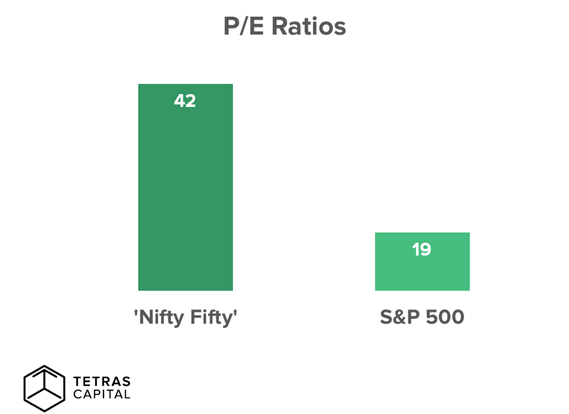

We’ve talked about the 2000 tech bubble enough, but remember the ‘nifty fifty’ of the 1960s? It was a group of 50 stocks that represented some of the fastest growing companies on the planet, which were bought regardless of price. These stocks were meant to be bought and held, not sold. Because of that, they didn’t believe the price should matter. “Hold!” they said. The resulting P/e ratios in 1972 are shown below

Remind you of anything?

When price starts to diverge from value, and growth at any price becomes the general market sentiment, we’re usually in store for a large correction and sobering drop back to reality. Investors are once again mistaking objective merit with investment opportunity. When making an investment decision, price relative to value is the most important factor. Any asset can be a good buy at the right price — and there’s no asset that’s a good buy at any price. Price and investment merit cannot be separated. Investors will ultimately need to have a strategy, other than selling the token to a greater fool.

Much more thought needs to go into ICO pricing. Below are five critical reasons why:

- Utility tokens are used as currencies within their economies, and price will ultimately contract to underlying economic value. Price will converge to economic value when large holders exit positions. Ultimately the majority of a utility token’s valuation will come from usage and not speculation, thus estimating the market size and usage within the system is critical. The market is far from efficient today, but as more institutions enter the space, and when shorting is easier to do, it will ultimately get closer to efficient. As an investor, you will not make long run, sustainable returns consistently buying above fair value. As a founder, your locked up holdings will evaporate in value if the price is set too high.

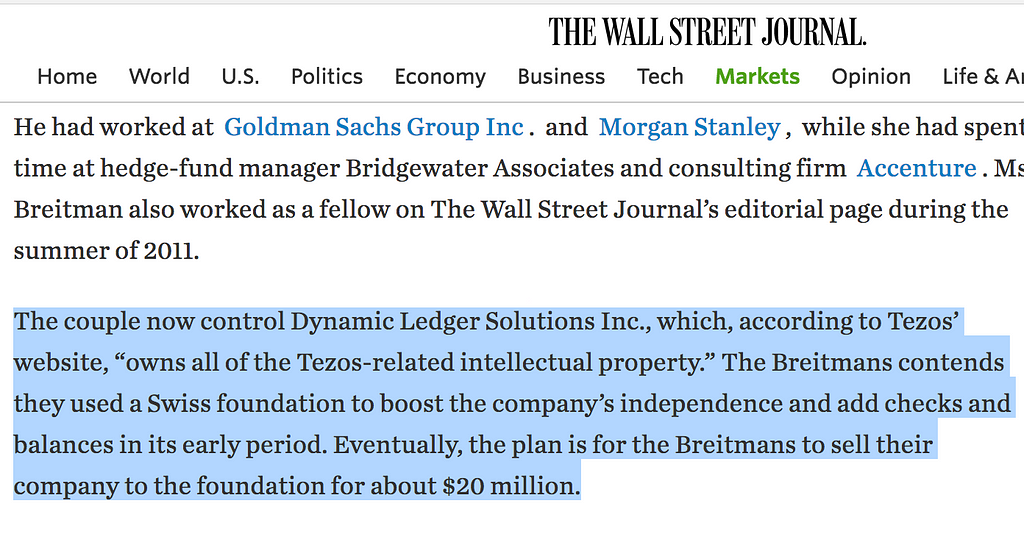

- Protocols don’t need and shouldn’t control significant “war chests” of capital. By setting a fair valuation, you’ll force your first investment round to be for a reasonable amount of capital. You don’t need $300m for your pre product company. As Fred Wilson says, being resource constrained is often a blessing not a curse. Having too much capital will likely perverse behavior and could ultimately hurt long term viability. See the debacle w. Tezos, for example. Focus is key and having $100s of millions up front rather than over time and as needed will cause most teams to lose that focus.

- Token valuation is reflexive in that price increases will likely lead to more adoption, demand for the token, customers and developer interest (and vice versa). Unlike equities, tokens are used to both speculate on future value and use the protocol you’re speculating on. If I was debating mining for filecoin, but FIL was perpetually decreasing in value, I’d probably reconsider. This ultimately decreases storage capacity available, decreasing economic activity and price of FIL even further. The same can turn into a virtuous cycle if price reflects economic activity.

- Many investors are under the assumption that increasing usage will yield increases in price. However, if the price is initially set too high, this will not be the case. One of the biggest benefits of protocol tokens is to solve the bootstrapping problem of a network, allowing early users and adopters to partake in the upside. However, if early buyers and users cannot expect a price increase, this will cease to be the case as they liquidate and lose interest (I break this down in detail below). Instead, high initial valuations compensate founding teams at the expense of users. What matters is the amount of usage that’s priced in and how future actual usage compares to it.

- Current liquidity and daily active trading volumes cannot support nine figure valuations for many utility tokens, especially because many projects hold a significant amount of tokens in reserve. Let’s say I am a founder of a protocol and own 30% of tokens pre-ICO. If my ICO launches at a $100m valuation, I will hold $30m worth of tokens. However, the daily active trading volume of my token may very well be <$1.5m given today’s exchange ecosystem. This phenomena isn’t entirely unique to crypto markets, but the problem is we don’t have the proper infrastructure yet to trade out of such assets and do the OTC block trades necessary for many smaller assets. Conventional micro-cap wisdom states that if you trade >10% of the daily volume of a stock you’ll likely move the price substantially and end up with massive slippage (declining fill prices as you sell) or paying an OTC desk a large premium. Combine these generalization with the lack of infrastructure necessary to do so in today’s crypto markets and you’ll likely end up with substantially less than the $30m of value you thought you had in your bank account.

Protocol valuation is not just important for investors but also for the founding team and users that are aiming to create a sustainable long-term protocol. If the protocol and sale is structured properly it will dramatically increase the probability of long term gains and align all incentives. If not, the reverse will hold true. Investors and founders need to work together to understand why valuation is so important for ICOs.

Challenges with Valuing Crypto-assets

Stepping back, one of the biggest challenges and problems with valuation today stems from the radically different types of tokens: “money tokens” and “pure utility tokens”. It’s crucial that investors understand this nuance. Money tokens are those used primarily as a form of money, satisfying its three use cases (usually some much better than others): store of value, medium of exchange and unit of account. In this category I’d put assets like BTC, ZEC and XMR. Pure utility tokens are instead used to incentivize and access a narrow decentralized economy, whose value will largely stem from usage in that economy alone. FIL, FUN, REP and GNT are all examples. Utility tokens will have little to no store of value component and will rarely act as medium of exchange outside of the protocol.

Slight caveat: theoretically any of the utility tokens are technically capable of acting as a store of value or currency in a separate economy. However, I don’t believe this will be a substantial component of their value. BTC is miles ahead of any other digital asset in its security and decentralization — as of now I don’t believe many users would prefer to hold a utility token as a store of wealth over bitcoin.

The value of money is a largely based on faith and incredibly strong feedback loops exist. What I mean by that is belief money has value, gives it utility, which in turn will further substantiate its value. Ben Thompson puts it well:

“Compare cryptocurrencies to, say, the U.S. dollar. The U.S. dollar is worth, well, a dollar because…well, because the United States government says it is. And because currency traders have established it as such, relative to other currencies. And the worth of those currencies is based on…well, like the dollar, they are based on a mutual agreement of everyone that they are worth whatever they are worth. The dollar is a myth.”

The market cap of gold at $10tn is not necessarily driven by technical demand for the metal, but the desire to store wealth. You can’t use gold to buy groceries, but what you can do is buy gold, store it in a trust for your kids and have some reasonable amount of confidence that they’ll be able to convert that gold to fiat currency to buy groceries at some point in the future. Given the median life of a fiat currency is just 27 years, this may not be the case for most assets in the world.

The same market cap dynamic will likely hold true for BTC — the large majority of its value will not come from its usage as a medium of exchange, but from its value as a censorship resistance and scarce store of value. Like gold, if enough people believe BTC is worth something, well, then it is. The “competitors”, if you will, that BTC and other cryptocurrencies are going after are laughably large. Due to network effects, there will likely only be a few winners, which helps to potentially justify valuations in the $bn’s. It’s the Pascal’s wager of our time.

To BTC’s digital gold, utility tokens are like digital copper — the demand is driven almost entirely from fundamental usage instead of through a deeply ingrained societal myth.

The use cases will be much narrower and the token will ultimately be valued more from usage in an economy than from a positive feedback loop of value. The high valuations we’re seeing for utility tokens stems partially from this difference in classification — many investors are valuing utility tokens like gold, when they’re really just copper.

Unlike BTC which is going after a market in the trillions of dollars and has a very large store of value component, the TAM’s for utility tokens are lower, and they will also have much less usage as a store of value. It would be like valuing a pre product VC investment at $100bn because USD M1 is $3tn and my SAFE could potentially become a store of value.

What Does Buying a Utility Token Get You?

Say somebody pitched me to create a utility token that gave me access to decentralized beer production. The service is presumably useful because beer production is way too centralized — the token is the only way to access this decentralized beer economy and thus the only way to buy the censorship resistant beer.

How should I think about valuation? Let’s compare this to a traditional centralized operation. Traditionally, equity in a centralized company gives the owner a residual claim on cash flows of the business after all expenses are paid. To come up with a fair value, I’d then use my fine tuned DCF skills and price the asset based on the estimated discounted future cash flows I could reasonably project.

Valuation methods are widely known and used in public markets and because of the sheer quantity of professional actors, public equity markets can be said to efficiently price in these cash flow expectations.

Contrast this with the beer token. Unlike equity that would entitle me to a residual claim on cash flows, what I’d be holding with beer coin is access to this hypothetical beer economy. It’s a tradable ticket that must be used for entrance. I couldn’t care less about the gross margins of the beer, balance sheet or CEO pay. The value of the ticket ultimately comes down to the utility the token generates for its holders and the supply and demand for it (which will stem from utility). It’s a completely different calculation than I’d make with buying equity and requires an entirely different mental model to analyze its potential.

Determining a Fair Value for ICO tokens and Perils of Mis-pricing

How should I value the beer coin? Currencies are fundamentally valued through the quantity theory of money, which captures the underlying usage: MV = PQ. What this formula boils down to is that activity in the economy will ultimately equal the market cap of all the currency in existence multiplied by its velocity (how frequently the currency changes hands).

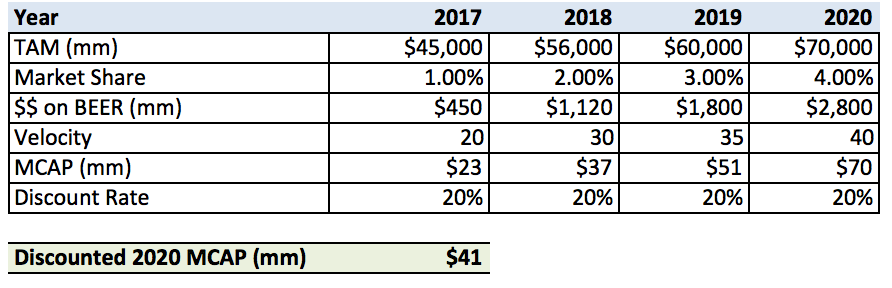

Using the quantity theory of money, below is a rough calculation of the “market cap” of the beer economy I was pitched.

Chris Burniske does a great job writing about valuation and modeling it extensively so I won’t belabor it. To quickly summarize: effectively what I did here was project out TAM, market share, and the velocity of my beer token until 2020. This yields a projected market cap in 2020 of $70mm on economic activity of $2.8bn. To account for my cost of capital and risk of the protocol, I discounted that value back to calculate the pure, present utility value of the token — what the MCAP would be to support this exact economy with 0 additional speculation (that’s not to say there is no speculation embedded in this price — major assumptions need to be made around TAM, market share, velocity, and discount rates to ultimately arrive at this valuation. Assumptions for purposes of this analysis are purely illustrative). According to this math, I’d be willing to invest at no more than a $41mm market cap today.

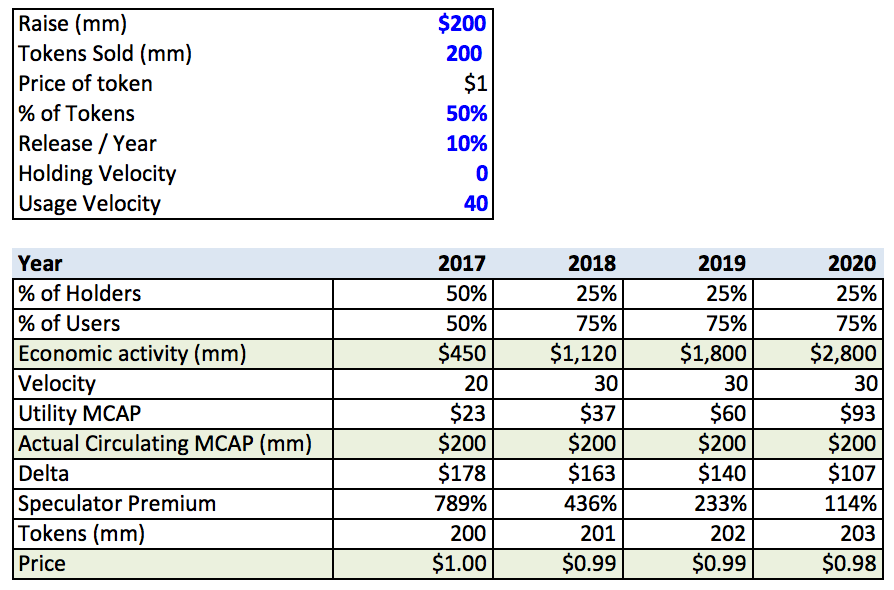

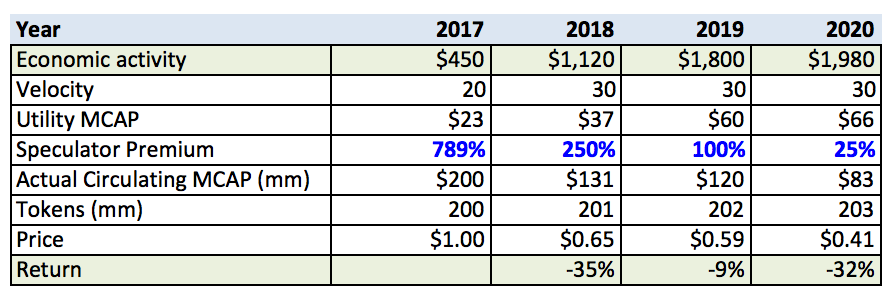

I insist on this valuation, but instead the founder of the protocol decides to raise $200m for 50% of the tokens, pricing the protocol at a $400m MCAP (or a circulating MCAP of $200m), instead of the $41m that I calculated above (choosing to use the circulating vs total market cap is an interesting question for these valuations. It’s my view that valuation should be based off projected supply discounted back to present. If the full supply is not circulating by the end of your investment horizon, like in this case, then it shouldn’t be fully baked in). Let’s see what happens to valuation:

Economic activity in the beer economy increases from $450mm — $2.8bn from 2017–2020, but the price of the token actually decreases. It assumes that the “speculator premium” (the difference between the utility mcap and the circulating mcap) contracts from 789% to 114%, while the fundamental utility MCAP goes up 4x from $23mm — $93mm. Instead of the price and market cap tracking this 4x utility increase, the token price decreases as a result of the speculator premium contraction combined with the yearly increases in token supply. Token velocity will also go up over the years as less people hold and more begin to actually use the protocol.

An important factor in this analysis is the speculator premium, which ultimately stems from the initial valuation set by the team and market reaction. Who are the speculators? Likely the large initial token holders that are part hanging on for dear life and part forced to hold because the liquidity isn’t significant enough to sell.

In reality, I actually think it turns out much worse for token holders. A more bearish and likely scenario is that these speculators vanish much quicker after their early gains, and what happens looks more like the following scenario:

Similar to the scenario above, the utility MCAP increase of 3x from 2017–2019 doesn’t yield the same for the token price. When the promise of economic alignment doesn’t hold true, economic activity actually starts to level off between 2019 and 2020 as people abandon the platform. Price ultimately ends up declining from $1.00 to $0.41 from 2017–2020 even though the protocol usage increased substantially over the same period.

The blanket statement that tokens align incentives is false. Incentive alignment has been a fantasy — an outcome of the poor structure of many ICOs. When founders can raise at arbitrarily high valuations and cash out their tokens they received at 0 cost basis, their incentives are not aligned with early token purchasers.

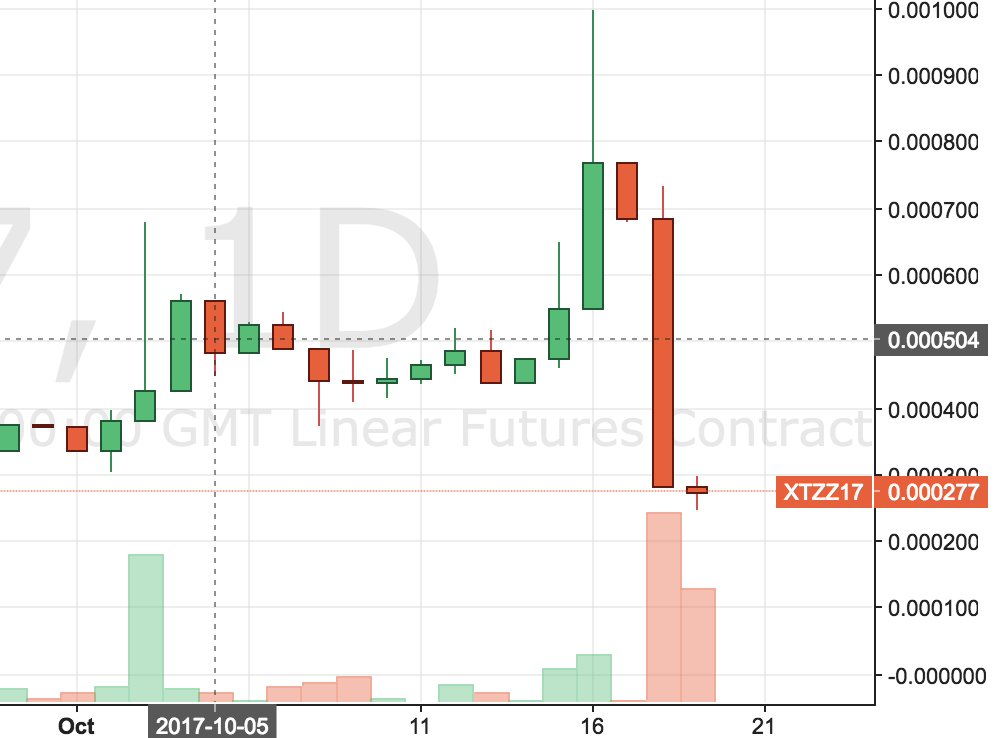

While the Tezos futures crash 75%, the Breitmans will be selling their tech for $20m.

Short aside: The interesting or unfortunate (depending on who you are) bi-product of the mechanics of currency valuation is that if you compare a token protocol with no store of value component head to head with an identical centralized company, the market cap of the protocol should be lower. This is because the value a currency captures is completely different than cash flow from equity in a centralized entity.

Instead of starting a decentralized beer protocol from scratch, the founder actually just decides to convert an existing centralized beer company into it. The company is already generating $20m of revenue, but the allure of decentralization is too tough to resist. Apples to apples, the valuation of the company will contract from ~$40m (at 2x EV / revenue) to a MCAP of $4m for the tokens (at a velocity of 5). This happens because, as an investor, we’re no longer receiving a yield on cash flow — we’re speculating on usage in the economy. If you’re a centralized company looking to transition to a decentralized protocol, the bet you’re making is that activity will increase substantially enough to counteract these effects (or maybe you just have no other options). In this case, revenue would have to increase 10x to $200m, just to have the same $40m MCAP for the tokens ($200m / 5 = $40m).

It is paradoxical in some ways, especially with the siren call of decentralization. As blockchain investors and entrepreneurs we need to be careful to (1) not compare valuations of utility tokens to money tokens and (2) not compare valuations to traditional equities and (3) not get lost in the hype and FOMO of a brand new market and asset class.

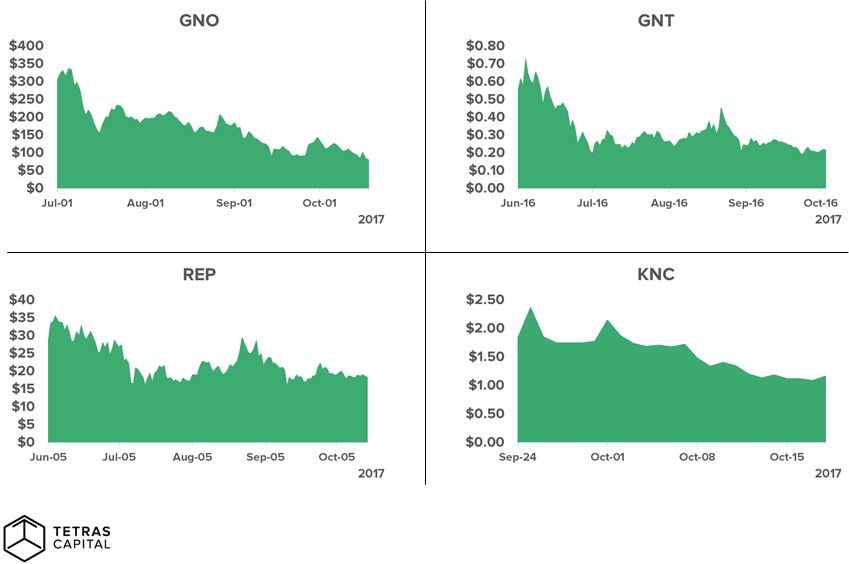

To put the final stamp on this point, recent returns for some of the largest dapps by market cap can be seen below:

Recognize any trend?

Beyond many other factors, what we may be seeing here is a product of large early holders leaving the protocols before any real usage begins.

Recommended Structure of ICOs

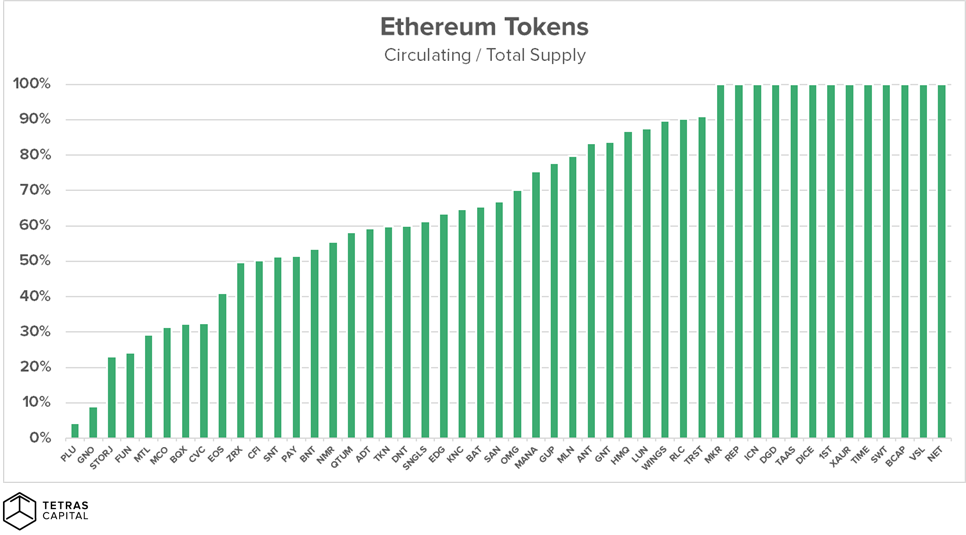

Every protocol is slightly different, but when it comes to ICO structures, what will ultimately be most important for the industry is consistency and prudence. When there’s not consistency, we get the below:

An incredibly wide variety in circulating vs total supply and thus quoted market caps. Creating a benchmark and auditing relative valuations becomes a daunting task. The novice and even professional investor thus ultimately ends up looking at quoted market cap on whichever site he / she prefers to use and valuation, which is so critical, gets potentially gets skewed up to 10x (in the case of 10% of tokens circulating).

The importance of structure is not just about circulating vs total supply. When structuring an ICO, there are five main questions to ask:

- What should the valuation be?

- How do i make sure to get tokens in the hands of as many long term holders or users as I can?

- What % of the protocol should be sold?

- How much capital is necessary?

- How many rounds of token sales should there be?

Unfortunately, there’s not a perfect sale structure that encompasses all of the properties we’d like. Valuation and certainty of participation are the two major tradeoffs for any ICO that cannot be entirely reconciled. Vitalik talks about this dilemma in great detail in his post here. Given all of the text above you just trudged your way through, it’s clear that I feel the market should prioritize valuation certainty over participation certainty in most cases.

If you’re launching an ICO and have some benevolence, exhibit it in the form of a reasonable valuation, not “unlimited participation”. Unlimited participation is usually a veiled excuse to raise as much as possible.

With that being said, I understand the danger of capping an exciting sale too low and allowing early arbitrageurs to fill it. If you care to prevent this, we’d suggest doing so by limiting the amount each participant can commit, instead of creating an uncapped sale.

Another mistake I see is selling too much of the protocol early on. Unlike with early stage startups your protocol that’s not rent seeking (1) will never generate cash flow to fund operations and (2) cannot generate tokens out of thin air like centralized companies can do when raising an equity round. You’ll need more capital at some point, and by choosing to sell >50% of your protocol early on, you’re either forced to raise surplus capital or are going to be shit out of luck when you realize you need to hire scarce, high paid talent.

Part of the reason teams continue to do so is because they don’t understand that there are alternative structures available. As we learned from the IPO market, there are multiple options and just because ethereum sold 85% of tokens, doesn’t mean you should too.

The Tetras Capital team has combined our learnings into a structure that we recommend to protocols considering an ICO. It won’t be perfect for everyone, just like the standard IPO process is not, but formalizing an approach will benefit all parties.

Before the ICO Process

- Sit down with the executive team members and a group of advisors to carefully plan out the fundraising cycle, capital needs and potential structures

- Valuations, budgets, team member lock ups, legal documents and marketing materials should be carefully crafted

- As hard as it may be to do, pretend to be an investment banker — also try looking at the deal from the eyes of a potential investor, user, and even regulator

Plan to have multiple sales

- We suggest to split the token sale into multiple rounds instead of doing so once for the aforementioned reasons

- Having multiple sales will (1) allow you to raise less capital at a reasonable valuation early on and (2) create an important feedback mechanism for investors to continue to fund the most reliable and talented teams

- This can be done through a combination of private strategic sales and public sales. Given Cooley’s SAFT framework, a private round will likely be necessary for all protocols to fund the development period until the protocol is live and a public ICO for tokens can be launched

Valuation

- Determine a fair valuation for the protocol based on utility projected 3–5 years out with the quantity theory of money, discounted back to the present day using a conservative (relatively high) discount rate

- Take an additional discount to that value to compensate for what is likely overzealousness and risk that has not been taken into account (potential smart contract bugs, changes in the regulatory environment, scaling challenges, etc.)

Capital Needs

- Carefully project how much capital you’ll need for the next 6–18 months, before your next sale — this should be a realistic amount that takes you to your next major milestone

- I’ll say it again. You don’t need $300mm up front for your pre product company. And if you think you do, you’re wrong

Create sufficient lock ups

- Investors should require multi year lockups for team members in any protocol they’re investing in. This is crucial to both ensure valuation is reasonable and to incentivize team members to help increase protocol value for years to come

- Structure lock-ups around these milestones for team members or even early investors that were given large discounts

- Consider creating lock-ups specified and enforced in code.

- The ICO should not be a liquidity event for early team members, 3 months after the idea is created

First Sale Structure

- Similar to early venture capital rounds and IPOs, the first public sale should be around 20–30% of your protocol valuation. If you’d like to raise at a $20m valuation, you probably need no more than $4–6m

- Consider requiring potential investors to register in advance of the sale to cap the amount each individual can purchase if decentralization amongst holders is to be optimized (or even an element of airdropping tokens)

- Potentially consider “building an order book” and only allowing known value add individuals or users into the sale (who will actually use the protocol, will be long term holders or can bring marketing, legal, tech, or financial expertise)

Second Sale + Beyond

- After the market has a chance to digest the initial sale, development success or lack thereof, and market, plan to launch a second round sale for an additional 20–30% of tokens

- Hopefully at this point, valuation has increased substantially from development and protocol usage and this 20–30% additional raise will yield substantially more capital

- Repeat if necessary with lower % of protocol sold for more capital

All of this should be abundantly clear to prospective investors — valuation (including estimated velocity, discount rate, TAM), projected token release schedule, capital usage and lock ups.

Much More Work Needed On ICO Structuring and Valuation

ICO structuring and valuation still needs a lot of work, but the goal here is to get the conversation moving in the right direction. Carefully considering valuation and its implications should be top of mind for founders, investors and ultimately users of protocols. Raising $300m in an ICO is tantalizing — but my argument is that turning down that urge will lead to higher long term returns for all parties.

Ultimately, our proposed structure provides: (1) clarity around valuation, (2) certainty of participation (with whitelist), (3) proper incentives for the team to continue to increase long term protocol value and (4) the option to raise more capital if and when necessary.

If you’re thinking about crypto asset valuations, ICO structures or are planning on launching your own, I’d love to hear from you.

Thanks to Josh Nussbaum, Evan Van Ness, Julian Moncada, Alex Sunnarborg, Tom Garrambone and Mike Karnjanaprakorn for your help on this post

Structuring Optimal Token Sales Amidst 2017’s ICO Mania was originally published in techburst on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.