Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Key metrics describing Rocket Pool current status after the recent DAO Nodes Hack.

On May 26, 2022 Rocket Pool network revealed they had suffered an attack on two of their DAO runned nodes. The exploit occured after the attacker managed to gain access into one of Rocket Pool’s developers machine. This granted the intruder complete control over two of the DAO run nodes, which resulted in the theft of $28k worth of ETH and RPL, that in perspective was insignificant to the damage the attacker would have been able to cause.

The attack was followed with an announcement from Rocket Pool’s team. This one informed the accident’s detection, rocket pool’s response, how it was contained, and finally internal and external impacts. In addition they also announced their recovery plan, and how they will manage security moving forward.

RPL Governance Token

Having decentralization as its main objective, Rocket Pool DAO is run by its governance token RPL. This allows the protocol to provide direct incentives, insurance, and governance over the protocol.

Source: IntoTheBlock

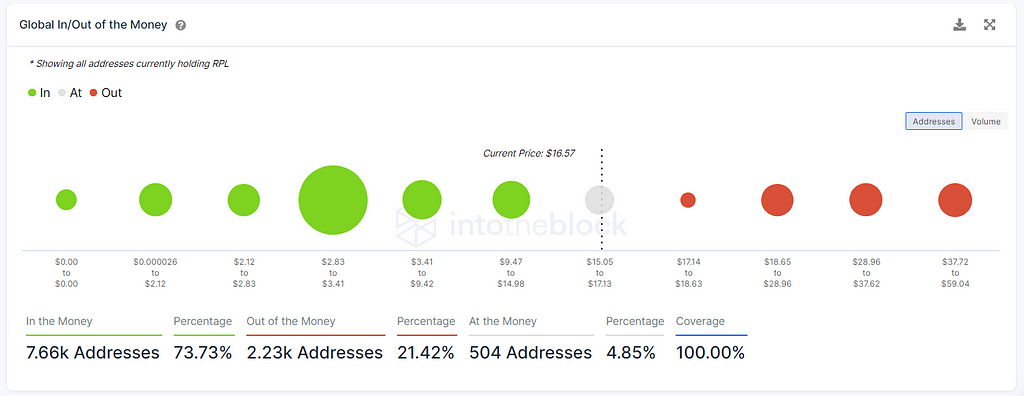

In this case, the RPL token price has not been drastically affected by the recent exploit news, with 73% of the token holders currently making a profit. IntoTheBlock’s Global In/Out of the Money indicator identifies any address with a balance of tokens, the average price (cost) at which those tokens were purchased and compares its current price. If the current price is greater than average cost, address is “In the Money.” If the current price is less than average cost, address is “Out of the Money.”

This high percentage of addresses in the money also stands out as a positive sign in the light of the recent bear market. Competitive tokens like LDO, Lido governance token, portray a 2.2% of addresses in the money and have drawdown up to 84% of its value.

Peg Overview

rETH, Rocket Pool’s liquid staking ETH, gives holders the ability to gain rewards over time from staking on Ethereum’s proof of stake Beacon chain. This token is valued at the same market price as ETH, which has led to the belief that it is pegged to ETH, which is not really the case. The truth is that there are strong arguments for why it should trade at a discount as to why it should trade at a premium.

Source: IntoTheBlock

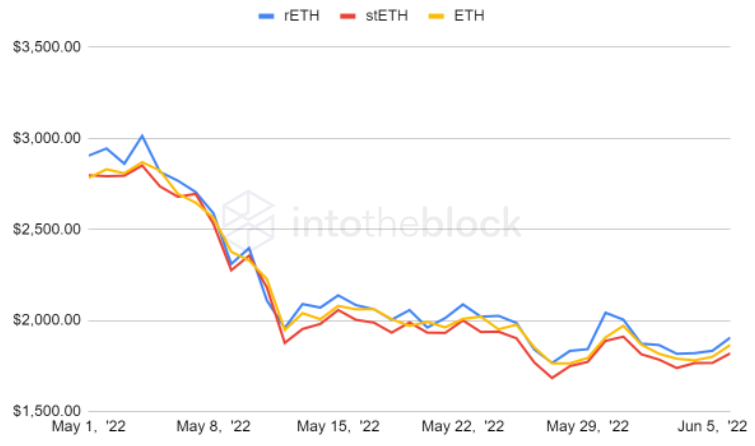

On the graph above, a price evolution of rETH, stETH and ETH can be seen. Clear divergences among rETH and stETH token prices can be seen when compared to ETH. Currently trading at a slight premium, rETH seemed unaffected by the recent hack. 182,432 ETH are being staked using the platform and 1 rETH currently represents 1.02 ETH, meaning a 2% premium.

This premium could be accredited to the fact that yield-bearing instruments are typically priced in at a premium. On the other hand, a strong argument could also be made for a discounted trading price. Some of the main risks for holding rETh are: the success of Ethereum’s merge to proof of stake, smart contract risk involved, as was the case with the recent hack and finally less asset liquidity, which could harm large depositors when trading from and to the asset.

Liquid Staking Tokens Market Share

When it comes to users, Rocket Pool essentially solves two problems. People that want the opportunity to get involved in liquid staking and nodes that want to operate and stake those funds in the right way. Rocket Pool works in a decentralized mechanism model contrary to other liquid staking providers like Lido. They accomplish this by pairing those who want to stake with those that want to run nodes.

Source: IntoTheBlock

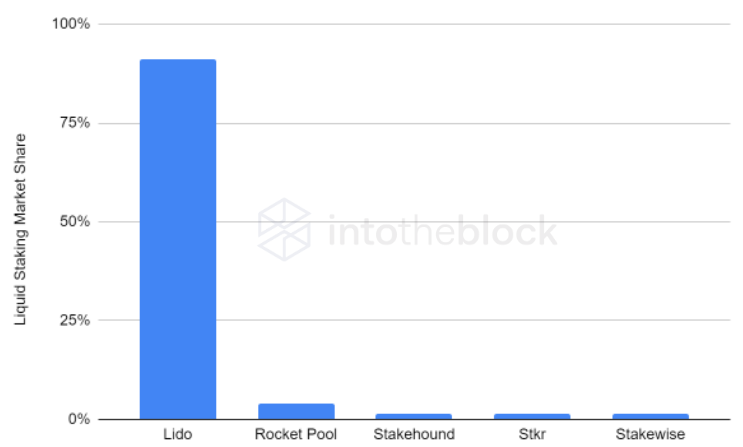

The above table shows the Ethereum liquid staking tokens market share. The market is currently led by Lido with 91% of the market, Rocket Pool follows with 4%, in third comes Stakehound with 1.4% and finally Stkr and Stakewise each have 1.3%. Following the recent series of events, Rocket Pool seemed unaffected as well in the number of ETH staked and hence preserved its position in the market.

Rocket Pool’s complex mechanism ensures a decentralized network of node validators. Contrary to other liquid staking providers node validator selection process, to run a Rocket Pool node validators need to economically bond with the network. This means that at least 16 ETH needs to be provided by the validator, in this way the validators will act in good faith. Rocket Pool will provide the remaining 16 ETH needed to run a successful node, this come from the liquid staking market. If node operators don’t run nodes appropriately and end up losing ETH. Rocket Pool has an insurance mechanism built into their smart contracts. In this way if the validator ends up with less than 32 ETH the missing ETH will come from the validator’s original 16 ETH. On the other hand validators gain from running a free node with half the needed ETH.

Conclusion

Rocket Pool staking services essentially solve two problems: the Ethereum 2.0 barrier to entry with a decentralized mechanism and liquid staking tokens for users wanting to get involved with the market. DeFi was proven to be a dark forest, and protocol security remains a top concern for depositing users. Rocket Pool has managed to overcome the recent attack and also maintain its position in the market.

Rocket Pool Overview After Experiencing Nodes Hack was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.