Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Credit: hurricanehank / Shutterstock.com

Credit: hurricanehank / Shutterstock.com

The internet today has become a place where large corporates control and dominate cyberspace.

A place where these centres of power are primarily motivated by turning a profit for shareholders who do not represent or possibly care about the real users of the network.

The effect has been the rise of social networks where the norm is:

- Users curate content for free. Users uploading content and personal information in order to build a social status and reputation.

- The network extracts this value by selling this to third parties such as advertisers.

I believe there is a better way:

Networks that are owned and regulated by its user base, who share and benefit financially from its success.

The Challenge

The difficulty is the Network Effect that makes it difficult to challenge the established status quo.

Credit: Bloomicon / Shutterstock.comThe Network Effect: The more people who participate in a network, the more useful that network is.

Credit: Bloomicon / Shutterstock.comThe Network Effect: The more people who participate in a network, the more useful that network is.

When a social network passes a certain threshold, power becomes consolidated. Users have established a social and repetitional status and find it difficult to switch to alternatives, which may have fewer participants and where they will have to rebuild their social status.

The Solution

Monetary Value Inclusion — participants share in the network’s success by being financially rewarded and where early adopters receive the greater reward for being first movers.

Introducing Lightstreams

Lightstreams is a network with that financially rewards participants for curating great content for other users.

Our mission is to create a peer-to-peer publishing network for all things digital. A network that is owned and regulated by the community, where artists and fans can directly connect in a low cost, fair and open marketplace.

We believe there should be no distinction between the users and the owners of the network. More specifically, those participants whose activities are part of the common shared goal of curating great content for the community will share in the financial benefits they generate.

Fanbase Content Curation

Fanbase Content Curation is based on concepts known as Token Curated Markets and Token Curated Registries.

The goal of Fanbase Curated Content is to create the conditions where fans are financially rewarded for the content they curate while simultaneously they build their social status and reputation on the network.

In Fanbase Content Curation, fans form communities around particular music genres or artists that they are passionate about. These groups are moderated by the community, similar to how subreddits are community moderated.

For each group, a new cryptocurrency token is established to be used for voting on proposals and for ranking content. The token will have value based on the Lightstreams native token called a Photon (PHT). This new token can be sold on secondary markets.

An Example: The TSWIFT Token

Imagine Taylor Swift is an unknown artist. She had just been discovered by a Tom who has seen her performing at a local bar and thinks this she is amazing. Tom decides to create a TSWIFT token, to build a Taylor Swift community around her. The TSWIFT token will be used for:

- Unlocking benefits and merchandise including discount tickets to concerts.

- Voting on proposals, such as where Taylor Swift should play her next gig.

- Funding Taylor Swift’s career via selling TSWIFT tokens.

- Building financial wealth for Tom and others who invest in TSWIFT tokens.

The Value of a TSWIFT token

So how does the TSWIFT token have financial value?

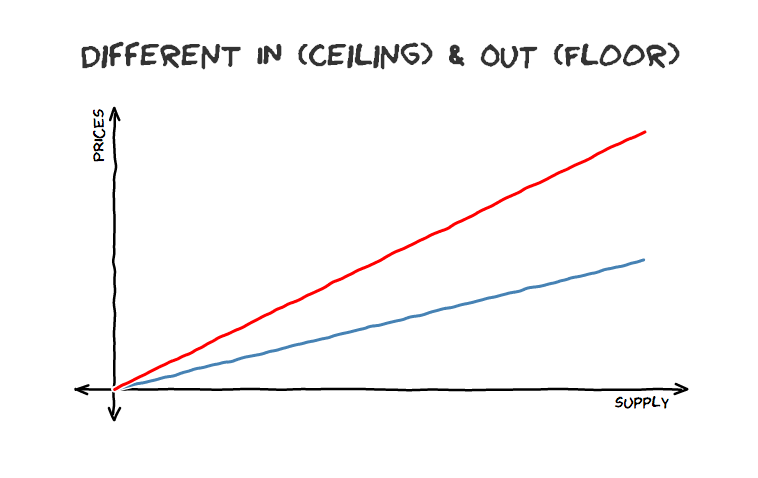

The token’s value represents the attention of fans around Taylor Swift. The market price of a TSWIFT token is a function of a smart contract algorithm. That is, the smart contract defines the price for minting a new TSWIFT token such that as the total supply increases the price of minting a token increases. The algorithm cannot be modified once the smart contract is published.

To give you a simple example, Tom publishes a Taylor Swift smart contact and mints the first TSWIFT token by depositing 0.10 PHT into the smart contract, which holds Tom’s funds in escrow. The price of 0.10 PHT was defined by the smart contract algorithm. If Tom wants to buy another TSWIFT token the algorithm says he will need to deposit 0.20 PHT and then there will be then two TSWIFT tokens in circulation.

At any time Tom can cash out his TSWIFT tokens and receive some of his PHT tokens back. When this happens, these TSWIFT tokens will be removed from circulation. The price of minting a TSWIFT reduces since the supply of tokens in circulation has reduced.

Source: Token-Curated Registries 1.0

Source: Token-Curated Registries 1.0

Note: There is a margin price between minting (buying) a new token and cashing out (selling) a token. Tom will need other fans to come along and mint tokens for him to break even and to make a profit.

Tom also has the option to sell his TSWIFT tokens to somebody else on a secondary market as an alternative to cashing out directly with the smart contract.

Taylor Swift can be a beneficiary of the smart contact such that as new tokens are minted by fans, the smart contract will also mint her a ratio of free tokens. For example, for every new TSWIFT token minted by a fan, Taylor Swift will also receive say 0.30 of a TSWIFT token. Taylor Swift can then fund her music career by withdrawing some PHT funds from escrow or by selling her TWIFT tokens on a secondary market.

Another Example: Ranking of Top 50 Hits

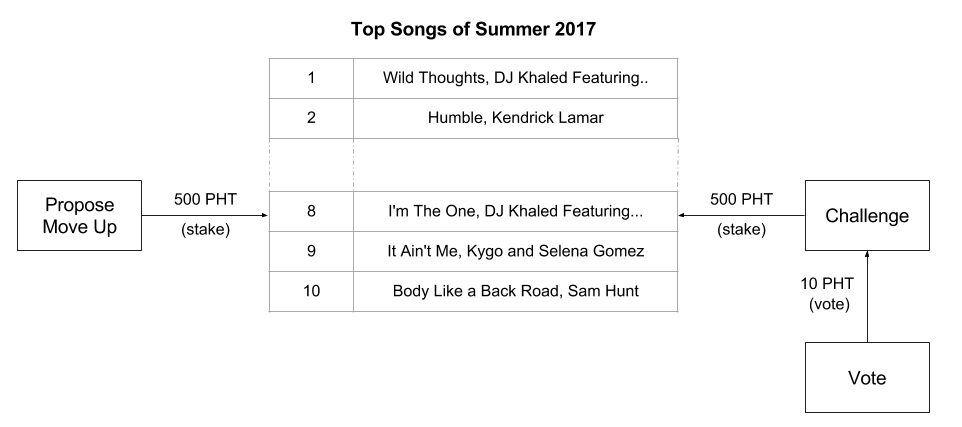

We can also apply Fanbase Token Curation to genres of music. For example, a Top Summer Hits token called a SUMHITS could be minted for creating a community around this genre. Those fans that own SUMHITS tokens can suggest tracks and vote on their favourite top hits.

How this works is anybody can make a proposal by staking an amount of SUMHITS tokens. A proposal can be:

- A proposal to add a track to the Top Summer Hits chart.

- A proposal to move a track higher up the chart.

There is a period when someone can challenge this proposal. To challenge the proposal the challenger must stake the same amount as the proposer. Once a proposal is challenged, it is then voted by the community. If the proposal is not challenged after the period then it immediately comes into effect.

- If the community votes for the challenger, then the challenger takes the proposer’s stake.

- If the community votes for the proposer, then the proposer’s takes the challenger’s stake.

To vote the community must also stake token. Those voters that win the vote take a proportional share of the tokens staked by the losing voters.

Follow us

If you have any questions about this article or our project feel free to join our Telegram group to ask away.

Also, if you like what you have read… please clap. Thanks!

Content Curation Using Blockchain Tokenomics was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.