Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This past week, Bloomberg reported that the CFTC (Commodities Futures Trading Commission) subpoenaed Bitfinex to audit their Tether issuance process.

The widespread fear is that $2 Billion worth of Tether, a virtual currency that is supposedly backed 1:1 by real USD in a conventional bank account, is in reality backed by nothing at all.

I do not propose to know what the reality is. Whether for malicious reasons or not, the Tether financial structure is anything but transparent.

Either Tether-associated bank accounts maintain full reserves, only partial reserves, or are an outright fraudulent scheme that allow zero meaningful reserve/redemption. The first option would be great, the second could be mitigated, and the last would be catastrophic for the Cryptocurrency market.

The looming possibility of the latter, catastrophic option, has injected FUD into the market for months, most especially this past week.

If Tether proves to be severely overleveraged, or if it fraudulently forbids redemption for virtual Tether to real USD, then the Cryptocurrency market would have figured out this hard truth soon enough- with or without the help of the CFTC.

Thankfully, the CFTC is preemptively investigating the Bitfinex and Tether situation. Moreover, the subpoena has been served while the Cryptoeconomy is still relatively young (if you consider a nearly $.5 trillion total market cap to be young).

Although $2 Billion worth of Tether market cap is somewhat minor compared to the total overall market cap, it will certainly affect many other exchanges if its scheme proves to be corrupt. Despite being most closely tied to the Bitfinex exchange, Tether is issued and traded across other exchanges like Binance and Bittrex. It is undoubtedly a systemic risk, and therefore this fear has crashed the system’s valuation.

While the market will recover, this type of violent volatility betrays a critical question against the ideal of Bitcoin being a global “store of value”:

Who should trust a “store of value” that can crash 40% in a week?

Moreover, it may lead us to an even more dire interrogation:

If Cryptocurrency as an alternative has even more manipulation, volatility, and fraud than the traditional economy, does that defeat its purpose entirely?

These are sobering questions.

Because there is a real possibility that we have become the system that Bitcoin was created to offer an alternative for: a system controlled by predatory whales who exploit central points of failure and who enjoy political immunity or anonymity when their tactics poison the entire ecosystem.

It is certainly hard to sustain any kind of moral high-ground every time there is a ~$500 million dollar hack, or the Ripple founder becomes richer than the creators of Google, or the Venezuelan dictator who has financially ruined his country creates a cryptocurrency to circumvent sanctions.

Despite Cryptocurrency still being in its experimental or beta phase, it is experiencing mainstream interest that are now having very real effects when something goes wrong.

Cryptocurrency needs to actively work to eliminate all of its central-points of failure — because if it does not and yet still continues its explosive speculative growth, there will inevitably be catastrophic consequences.

If hypothetically the cryptoeconomy had reached a $6 trillion market cap and then Tether melted down, it could take the entire world economy down with it. And rather than mitigating the effects of a worldwide financial meltdown as it was originally intended to do, Cryptocurrency would incite it:

Years of speculators chasing centralized hype-coins that could be turned on or off with the flip of a switch by overnight billionaire founders like Tron and Ripple, and premined marketing-driven coins like Dash, would have an end result be a truly Global Depression.

Instead of an alternative means of hope against a corrupt traditional system — cryptocurrency would become the villain it swore to fight against.

At the current pace, this dark future is a real possibility.

Getting rich quick has overshadowed permissionless, decentralized technology and the groundbreaking political/economic ideals that would result from such a system.

Therefore before any dystopia can occur, we need to root out points of failure, beef up security, and crash all billion-dollar hype for vaporware.

Coinbase and other major exchanges are a central point of failure — If you live in the US, try the new Robinhood Crypto service, to incentivize a variety of new on-ramps across the world (use this ref-link to get a free stock). One million people are on the waitlist already. Regardless of what exchange you use, please store your digital currency off exchanges, and ideally in hard wallets. Decentralized exchanges like Bancor, 0x, and altcoin.io are on their way, which is even better than centralized counterparts.

Tether is a point of failure — Yet its $2 billion valuation proves that there is a real demand for a more stable digital currency. Hopefully projects like Dai and Basecoin will be readily available to the public soon, so that this niche can be filled by a variety of different protocols. So that if one fails like Tether might, its damage will be contained.

No matter what, it is great the CFTC is investigating Tether before any catastrophic meltdown. Good regulation by political authorities should be welcomed in this new economy. And good regulation at the very least means: investigating points of failure, and then punishing any bad actors.

The problem is, and the reason Bitcoin was created for, is that the history of good regulation by the government over reckless financial magnates, has potentially been corrupted. While the CFTC/SEC/the Fed do some fair due diligence in investigating bad actors like Wells Fargo last week, there are far too many instances where gross negligence goes unpunished, or is even rewarded:

Such as how the investigation into the Equifax data breach has been halted. The leaders of an organization that mishandled vital personal data for 143 million Americans, have essentially walked away with a slap on the wrist.

What’s even worse is that Equifax’ type of morally hazardous regulation pales in comparison to the response to financial firms that nearly broke the global economy, with LTCM in 1998 and Bear Sterns/Mae & Mac in 2008.

LTCM set the stage in 1998 as the harbinger for the dot-com crash of the world economy. Long Term Capital Management, a star of Wall Street, used 100:1 leverage to gamble trillions on government bonds (debt). When a black-swan event occurred and Russia defaulted on their debt, LTCM‘s bad gamble threatened to take down the entire world economy. The Fed realized LTCM’s too-big-to-fail nature, and helped negotiate a billion-dollar bailout for them. Not a single person on the LTCM board was legally reprimanded, in fact they were financially rewarded. Alan Greenspan, the Fed chairman at the time, warned that such a Fed-negotiated bailout would encourage this type of risky behavior in the future, thereby creating a “moral hazard.”

Greenspan was right, and ten years later severely overleveraged Bear Stearns gambled on fraudulent securutized mortgages issued by Fannie Mae/Freddie Mac, to ultimately incite the Great Recession.

Rather than simply negotiating a bailout between banks like in 1998, the Federal Reserve went so far as to use trillions of dollars from indebted American taxpayers, to prop up a crashing financial house of cards. Not a single executive was indicted, and the Federal Reserve still holds trillions’ worth of troubled assets to this day. People wonder what will happen when the Fed starts to unwind this kind of state-sanctioned hedge fund portfolio, to eventually flood $1.75 trillion worth of mortgage books and government bonds onto the open market.

As Trump dismantles financial regulations that were created as a response to the 2008 crisis, a new financial magnate is almost certainly gearing up to crash the world economy again (intentionally or otherwise). And this time around, it may not be a private firm at fault. It may be the Federal Reserve itself, and other central banks around the world, who are responsible for melting down the system:

Trump’s tax plan reveals another four years of the US having no intention to ever pay off its bondholders across the world. Debt-to-GDP across the world is at an all-time high and is quickly growing. At a certain point of ballooning debt-to-GDP in the US and central banks abroad, the only means of escape will be monetary inflation or default.

At the first sign of a bear market or a black swan event like the Russian debt crisis in 1998, this house of cards could fail miserably. And then who will bail out the Federal Reserve, or the Chinese central bank, in the case of widespread default or devastating inflation?

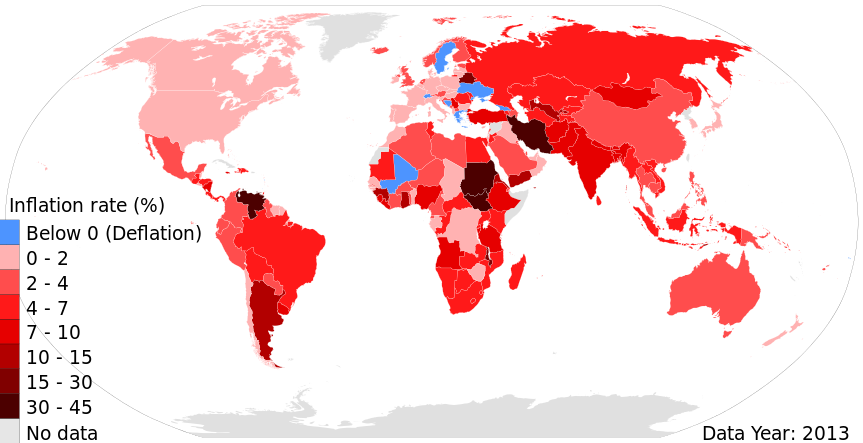

Eroding the value of government money- which is essentially based in faith rather than directly tied to any tangible asset- is a very dangerous slope. Fiat money has a disturbing history of hyperinflation, and a longer history of devaluation:

In conclusion, Cryptocurrency still has hope and time enough to root out its own central points of failure, so that if (or when) the traditional economy folds in on itself, there might be a viable failsafe in the Cryptoeconomy.

In the meantime, we need to thank people like @giancarloCFTC for promoting level headed regulation of Cryptocurrency’s possible faults, before they erupt. And if Tether digital currency melts down to destroy people’s real savings across the world, hopefully any bad actors will be punished by federal authorities. Unlike Bear Stearns in 2008, and LTCM in 1998.

Thank You for the Crypto Crackdown was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.