Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Demons in Digital Gold, Part 6

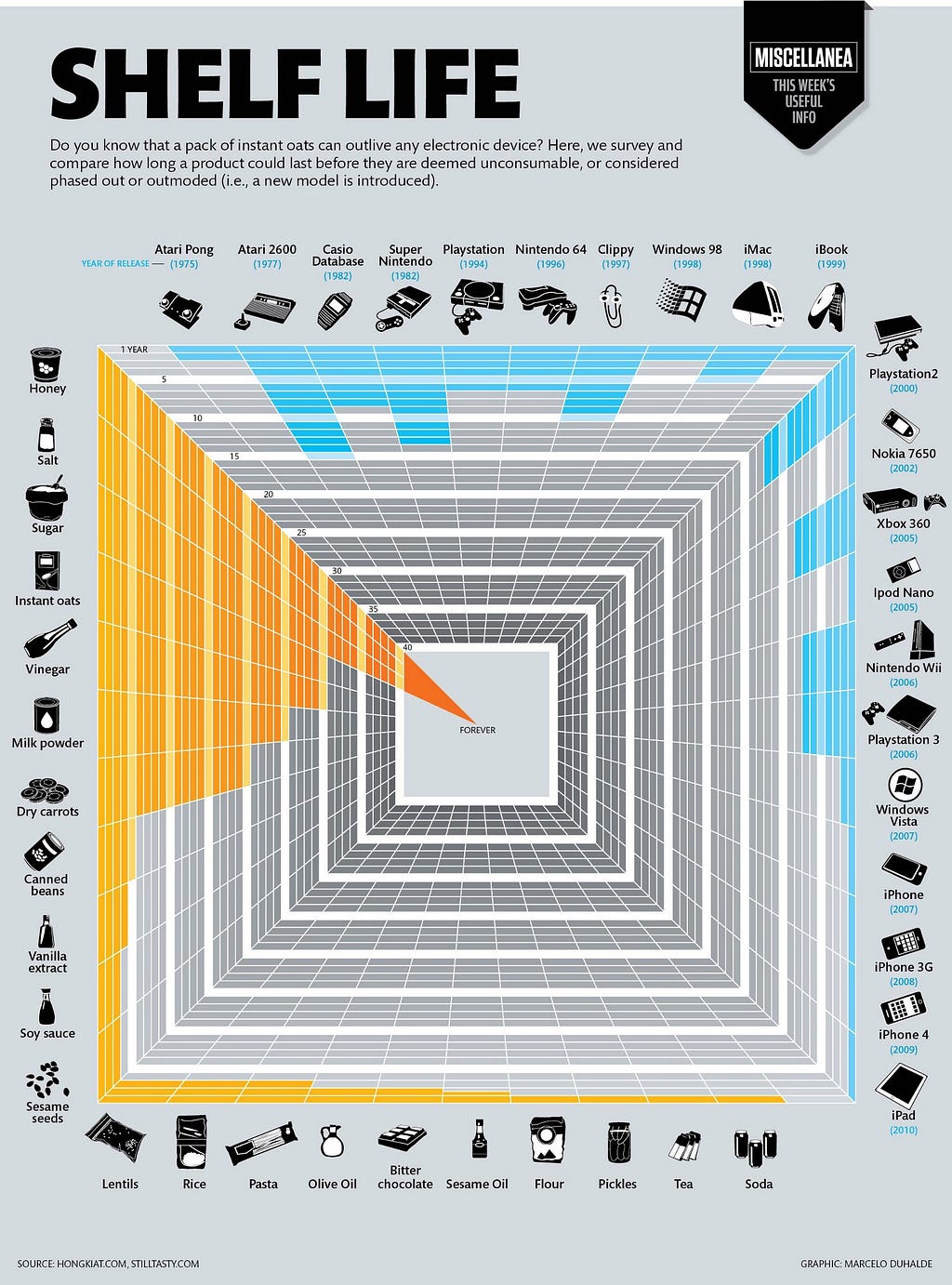

do note that this graphic is — ahem — woefully out of date

do note that this graphic is — ahem — woefully out of date

If you have not already done so, please read the introduction to this series.

Obsolescence and death, the reign of the archaic, the abandoned, and the corny: Really, if you saw [a Motorola Razr] on the sidewalk, would you bend over and pick it up?!?!

— Bruce Sterling

Obsolescence never meant the end of anything, it’s just the beginning.

— Marshall McLuhan

If there is one constant with innovative technology, it is obsolescence. Today’s must-have killer app/smartphone/widget is tomorrow’s landfill. Yet outside of the headline-making Bitcoin hard forks, one never reads about an up-and-coming cryptocurrency posing a threat to a top-of-the-heap coin. Why would cryptocurrencies get a ‘bye’ from historical rules of obsolescence?

What are the likely competitive threats to today’s cryptocurrency leaders? How might a long-time-horizon INVESTOR (nee, HODLer) plan for near-certain coin obsolescence? Now underway, a discussion of competitive obsolescence in cryptocurrencies. Buckle up!

Read this section, please

First and foremost, this post is NOT a tit-for-tat “my coin is better than your coin, because, dammit, your coin is a LOSER.” My examples use existing coins , which are bound to create all forms of finger-pointing. Using existing coins is flat-out silly when you think about it, as odds are reasonably good that the coins doing the obsoleting don’t yet exist. Illustrative examples are better than abstract example, hence the choice of silliness.

Next, astute readers will observe that ALL of my example coins are built atop the Bitcoin codebase. Worth noting that the common codebase supports the assertion that “the coins doing the obsoleting don’t yet exist.” Leveraging a rock-solid codebase is a fabulous idea, though the practice lends itself to incremental rather than truly disruptive improvements.

Finally, we will focus on UTILITY as the driving force behind obsolescence. This could be an entire blog series unto itself, so I’ll be brief. At some point in the post-speculative-mania phase, fundamentals will matter and the price of a coin will be driven by underlying measures of its value. I know, I know, crazy talk! Indulge me, I can but dream.

When price is driven by fundamentals, whatever the metrics, a NEW coin with substantially superior metrics will appreciate in price. In an efficient market — bold assumption that — the new and superior coin will command a higher total value of circulating supply (nee, market cap). Should the new coin closely overlap the properties of an OLD coin, competitive forces will obsolete the old coin over time.

Let’s dissect that last sentence, so that we are on the same page. There is no such thing as a “perfect coin” (oh, that’s gonna’ upset one set of believers). Different coins are and will be optimized for certain properties, and therefore appeal to certain applications and people. Two coins “overlap” when they have very similar profiles: they optimize the same things and trade-off the same things, therefore serving the same applications and people.

A set of properties

Making no claim of exhaustiveness, we examine competitive obsolescence through six different properties …

- Transaction throughput: how many transactions per second can the ecosystem sustain?

- Transaction confirmation time: how long does it take (statistically speaking) for a new transaction to be mined onto the blockchain and confirmed to a specified degree of certainty.

- Transaction cost: what does it COST to mine a transaction into a block? [NOT the transaction fees you pay, rather the underlying cost of mining.]

- Anonymity: degree of identity privacy afforded by the entire ecosystem.

- Security: strength of defense of the entire ecosystem against attacks, “known knowns” and “known unknowns.”

- User experience: relative ease-of-use by Normal People. [In contrast with Silicon Valley People, who think that command-line interfaces, writing JavaScript, and parsing JSON are everyone’s idea of a great UI.]

Transaction throughput

At the risk of stating the obvious, a bloody war is being fought right now over this property mano a mano: Bitcoin Core versus Bitcoin Cash (BTC and BCH, respectively). Problem in a nutshell: with growing popularity, the BTC ecosystem is increasingly unable to process new transactions onto the blockchain in a timely manner. On many occasions in 2017, reasonable transactions paying a “fair” fee could take as long as ONE WEEK to be mined into a block. Major PITA.

Bitcoin Core addressed this problem with the scalpel of SegWit, via a soft fork that maintained backward compatibility. Bitcoin Cash addressed this problem with the sledgehammer of 8MB blocks, via a hard fork not backward compatible. Defying predictions by both sides of assured doom on the other side, BTC and BCH are both entirely viable at the time of writing.

Tossing out some ROUGH numbers of transactions per second (TPS) …

- Vintage BTC = 4 TPS

- SegWit BTC = 5–20 TPS, increasing with SegWit adoption/penetration

- BCH = 32 TPS

… which would SEEM to say “game over, BCH wins!” in terms of competitive obsolescence. Two major spanners thrown into the works prevent us from reaching any such conclusion:

- BTC versus BCH is not just a bloody war, it is bloody trench warfare. Both sides spouting vitriol, most of it coming from USERS picking sides and taking up arms. Re-phrasing for clarity: no Normal People in the picture.

- We are still knee-deep in the speculative-mania phase. “Fundamentals, hahahaha!” goes the majority of what passes for thinking, “which coin is going up faster today (nee, right NOW this second).”

Suffice to say, 20–32 TPS is not gonna’ light the world on fire and enable hundreds of millions of Normal People to use a coin as a many-times-per-day medium of exchange. BCH developers are already testing MUCH larger blocks to chase the “replace credit cards” dream, however, much larger blocks carry trade-offs (yes, I know what I’m talking about; no, I don’t have a horse in this race) and may or may not lead BCH to the promised land.

Whatever the current realities of Bitcoin(s) internecine war, one can envision a future in which a coin fully capable of serving as a credit card replacement — with transaction throughput and other properties required — would have extremely high utility, beat the stuffing out of lesser coins aimed at the same objective, thereby rendering the inferior coins obsolete.

And what might those “other properties required” include?

Transaction confirmation time

In geek speak, we’re talking about how long it takes to get a new transaction onto the blockchain with full confirmation. In Normal Person speak, we’re talking about “I just bought a car with Ultimo Coin. How long do I have to sit here in the dealership before they give me the keys?”

Transaction confirmation time varies — you knew this couldn’t be simple — with the degree of certainty (a.k.a. trustworthiness) required. Handing a set of keys over to a total stranger? You want to be pretty damn certain. Selling someone a cup of coffee? Works with a much lower bar of certainty.

For purposes of this section, we’re sticking with the Normal Person speak as stated above, say, “money good” as a confirmed bank wire transfer. For coins using the Bitcoin codebase, this is a function of the block mining time. BTC and BCH target mining a block every 10 minutes (on average).

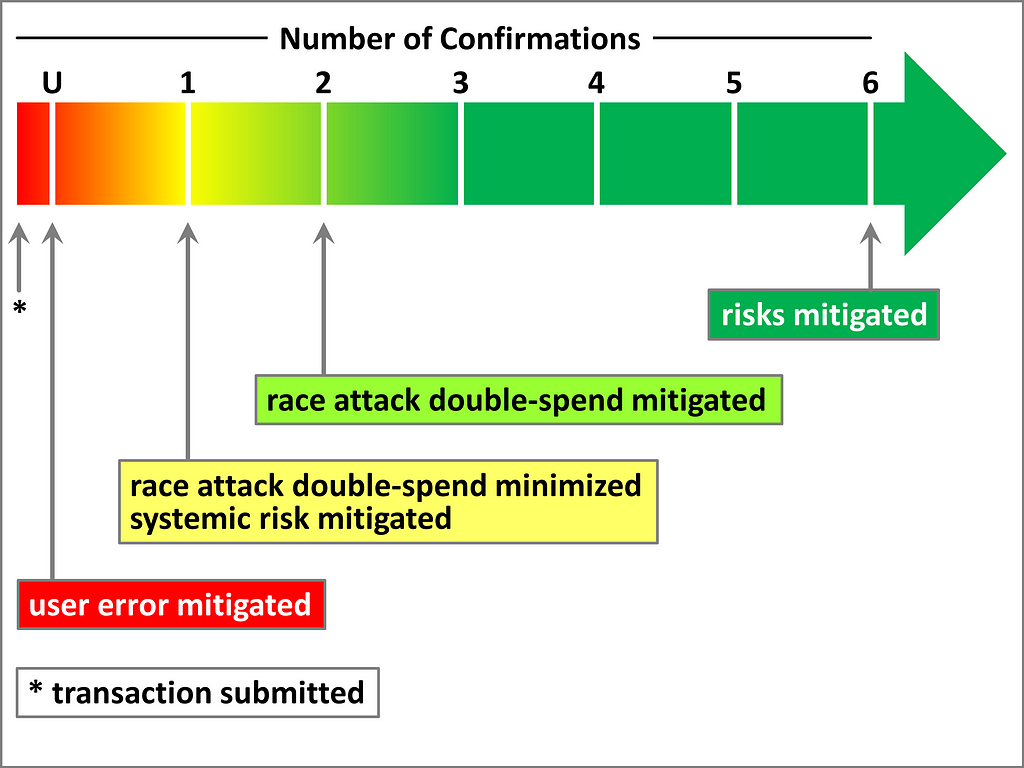

A modest-to-reasonable amount of confidence accompanies the point at which new transaction is mined into a block and added to the blockchain. That point is ‘1’ below (diagram from The Bitcoin Tutorial), and does carry some residual transaction risk as implied by the orange-yellow color.

if you were reading The Bitcoin Tutorial, you would find this diagram surrounded by a wealth of explanation

if you were reading The Bitcoin Tutorial, you would find this diagram surrounded by a wealth of explanation

“What’s with all these ‘risks’ in the diagram?” you ponder. We celebrate the DISTRUBTED nature of blockchain technology, and routinely downplay protests of “Why do I have to wait for six f — ing confirmations?” Here’s the staccato burst summary:

- Nodes are connected in a peer-to-peer network over the Internet. Fast as it may be, stuff takes time to make its way across the Internet. New data arrives at nodes at slightly different times, and may arrive in slightly different ORDER.

- Ne’er do wells can exploit such differences in a “double-spend attack.” Envision a pair of attackers, on opposite sides of the globe, spending the exact same coin at the exact same time.

- Because new data may arrive in different order, it is entirely possible for different nodes to produce different VERSIONS of the blockchain. This is called a “blockchain branch” and occurs with statistical regularity. (Roughly once a month, in case you were curious.)

- The ecosystem is built to recognize and resolve blockchain branches via distributed consensus of a majority of nodes, and that process takes TIME. How much time? At least one additional block.

- Ne’er do wells with requisite skills can produce and exploit a blockchain branch, as the basis for a so-called “race attack” to abscond with coins.

- Waiting for three confirmations — two additional blocks mined after the block containing the transaction in question — mitigates the risk of most attacks. With an added dash of caution, long-standing tradition states:

A block with six confirmations is broadly considered to be an immutable part of the blockchain

And that is why, madame et monsieur Normal Person, you will be sitting in the car dealership about an hour before they give you the keys.

A fairly obvious method to reduce transaction confirmation time is to “speed up the clock” by reducing the block mining time. For example, Litecoin (LTC) uses a 2.5 minutes target block mining time. LTC delivers six confirmations in about 15 minutes, getting you out of the car dealership more quickly.

Good side effect: cranking up the mining frequency increases transaction throughput, as the LTC ecosystem produces four times as many blocks per hour compared to BTC and BCH.

Bad side effect: cranking up the mining frequency increases the likelihood of blockchain branches, potentially making the associated attacks easier.

Updating the closing paragraph from the previous section …

One can envision a future in which a coin fully capable of serving as a credit card replacement — with transaction throughput, transaction confirmation time, and other properties required — would have extremely high utility, beat the stuffing out of lesser coins aimed at the same objective, thereby rendering the inferior coins obsolete.

Thought experiment #1: increasing the block size (BCH) and reducing the transaction confirmation time (LTC) are brute force adjustments to the “Vintage Bitcoin” protocol. Brute force can be a straightforward and evolutionary solution to a problem, and MIGHT deliver the “replace credit cards” dream.

Thought experiment #2: truly disruptive solutions often employ novel outside-the-box techniques. Some ideas are already in use, some in development, some on the drawing board, etcetera. A truly REVOLUTIONARY solution — not leveraging an existing codebase — may be needed to reach the promised land of credit card replacement utility.

Transaction cost

I continue to use “credit card replacement” as if it was the holy grail of ALL cryptocurrencies. It is fairly easy to grasp and handy for our illustrative purposes. Keep in mind that it is but ONE holy grails for cryptocurrencies.

Let’s have some fun and open our own mining operation! BTC mining uses a GINORMOUS amount of electricity. Our mining OpEx will be dominated by electricity cost. And we will need a fat wad of CapEx for a state-of-the-art mining rig capable of making the undertaking interesting AND maximizing efficiency to minimize power consumption.

We are going to overlook quite a few costs in the interest of simplicity AND erring on the optimistic side: [a] CapEx for the mining rig and infrastructure [depreciation schedules give me headaches] and OpEx incidentals such as rent and manpower [rackspace and people are SO 2016].

Let’s go back in time and setup our solo mining operation in February 2017, with the goal of winning the “mining competition” once a month. That is, we will successfully mine one block per month and receive the 12.5 BTC block reward, plus transaction fees, for a total of roughly 15 BTC per month.

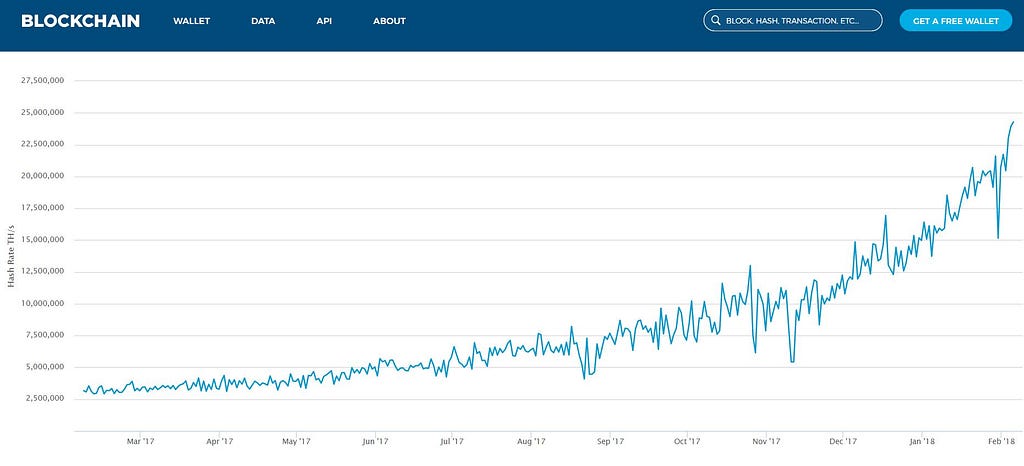

4,380 blocks are mined per month, on average, so we are shooting for a 0.02% win rate. Sounds pretty unselfish and reasonable! Eyeballing the chart below, we blindly and simple-mindedly calculate 3,000,000 TH/s times 0.02% and commission a 700 TH/s mining operation. [Roughly $200K in CapEx — that we are ignoring — in case you were wondering.]

Our 700 TH/s mining rig burns a little over 100 KW. [That requires REAL cooling, which will significantly increase our power needs. We’ll put our operation somewhere chilly and ignore the additional OpEx for cooling costs.] Our simplified and overly optimistic monthly power usage is 75,000 KWh.

As if we haven’t done enough hand-waving and sweeping-under-the-carpet, we now ignore the uncomfortable fact that power companies tend to employ PROGRESSIVE pricing: the more power you use, the more you pay per KWh. On the flip-side, however, we will use RESIDENTIAL base rates. In most of the developed world, we’re looking at roughly 4–10 cents per KWh.

Bargain hunting, we’ll fudge down to 3 cents per KWh. [And remember the free cooling!] Thanks to our inexpensive electricity, our monthly bill is $2,200. BTC was around $1,000 when we flipped the switch and went live in February 2017. At the time, our monthly take of 15 BTC was worth $15,000. Woo hoo! We were minting money!

Good news: BTC shot to the moon and then some over the course of 2017. That 15 BTC was worth north of $150,000 in December 2017!

Bad news: we’ve not taken one of the most important variables into account, a variable that is completely out of our control: aggregate hashpower. That is the competition we are up against, all mining rigs presently working on BTC. It is not just out of OUR control … it is OUT OF CONTROL, period.

aggregate worldwide hashpower in the BTC ecosystem, past 12 months

aggregate worldwide hashpower in the BTC ecosystem, past 12 months

As the calendar turned to February 2018, aggregate hashpower passed 22,500,000 TH/s. Yup, “the competition” did not stand still during 2017. Aggregate hashpower increased 8-fold over the year we’ve been live. Comparing our operation in February 2017 to February 2018 …

- Our win rate dropped from 0.02% to 0.003%

- Translation: our monthly wins dropped from 1.0 to 0.1

- Statistically speaking, our monthly take dropped from 15 to 2 BTC

- BTC is $8,000 at the time of writing [which is bound to be funny, one way or the other, when you read this], so our monthly take nudged up from $15,000 to $16,000. Woo hoo! We are minting (slightly) MORE money!

The what-if scenario laid out above provides a real-world grounding in the economics of mining, enabling us to calculate meaningful metrics for BTC, at the time of writing …

Cost per block = $2,200 per month / 0.1 blocks per month = $17,000[As you may have surmised, calculations maintain more precision than shown]

Cost per transaction = $17,000 / 3,500 transaction per block = $4.80 [The “transactions per block” number is fairly generous at the time of writing]

“Holy shit!” you say, apologizing for the profanity in a family blog like this, “The BTC ecosystem spends $5 to process each and every transaction?” Well, yeah, that’s a pretty reasonable estimate. [Sure, you can tweak the model to use cheaper electricity, thoough keep in mind that I left out a LOT a real costs AND my model assumes everyone is on state-of-the-art mining rigs.]

Good news: with 100% SegWit adoption/penetration, BTC could approach $1.50 per transaction.

Bad news: with history as a guide, aggregate hashpower will continue its inexorable march higher, and another 8-fold annual increase would push that from $1.50 to about $12 per transaction.

That dampens the quest for the holy “credit card replacement” grail, no? I know what you’re thinking: “Hey! what about BCH?”

While the model yields much better numbers for BCH at the time of writing, it is foolhardy to conclude that BCH is inherently more efficient. Miners are entirely free to move hashpower from the BTC ecosystem to the BCH ecosystem, thanks to the fact that they share the exact same “proof of work” algorithm. Plain English: miners can readily switch between BTC and BCH.

When the price ratio BCH:BTC increases enough in favor of BCH, miners move hashpower from the BTC ecosystem to the BCH ecosystem. They are maximizing their profit potential, a function of [a] relative aggregate hashpower and [b] relative coin price. Should BCH:BTC increase enough, the BCH ecosystem would attract MORE hashpower than the BTC ecosystem (nee, The Flippening).

Et voilà! BCH believers envision a positive feedback loop: an increasing BCH:BTC price ratio attracts more hashpower, which in turn increases the price ratio further, which in turn attracts more hashpower …

Goods news: during said feedback loop, BCH believers hope that all those BTC backers come out of their haze, realize the error of their ways, sell their BTC for BCH, therein relegating BTC into obsolescence.

Bad news: during said feedback loop, all of the POWER CONSUMPTION tied to the increased hashpower gets dumped onto the BCH ecosystem.

Back of the envelope time, assuming a total BCH takeover …at the time of writing, cost per transaction = $1 now, rising to $8 after an 8-fold annual increase in aggregate hashpower. [Yes, yes, BCH with 1GB blocks could drop cost per transaction significantly, from $8 to a reasonably impressive 6 cents. LOTTA’ stuff needs to happen to make it there, and OH YEAH, there is bad news — in the form of tradeoffs with 1GB blocks—to go with the good news.]

Where were we? Oh Yes.

That dampens the quest for the holy “credit card replacement” grail, ESPECIALLY when contemplated in tandem with transaction throughput and transaction confirmation time … at least in terms of BTC, BCH, and LTC … which brings us back to a common reprieve: a truly REVOLUTIONARY solution — not leveraging an existing codebase — may be needed to reach the promised land of credit card replacement utility.

And while we’re thinking all revolutionary and such — let’s find a solution that requires LESS electrical power than a medium-sized developed nation.

Anyone still reading? Anyone? Bueller?

We will tackle the other three properties — anonymity, security, and user experience — in Partie Deux. And we will discuss the impact of obsolescence on long-timeframe cryptocurrency investing. I leave you to ponder:

Thier’s Law: good money drives out badNext in the series …

Competitive coin obsolescence, concluded

Follow me @Pressed250 on Twitter

Copyright © 2018 Bruce Kleinman. All Rights Reserved.

Competitive coin obsolescence was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.