Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Synopsis. Bitcoin is a perfect fit for the Pay as You Go (PAYG) mobile user population. The excellent Bitrefill service processes 16,000 top ups per month where users pay with Bitcoin to top up their air-time. It is only a small step to these users adopting Pay as You Go Bitcoin, charged with Azteco Vouchers, that they are already familiar with.

The Pre Paid User Market

Usage of prepaid cellphone service is common in most parts of the world. Around 70% of customers in Western Europe and China use prepaid phones with the figure rising to over 90% for customers in India and Africa. 23% of cellphone users in the United States were using prepaid service as of 2011, a share that’s expected to rise to 29% by 2016.

Methods of payment (Wikipedia):

- Credit card or debit card or online payment processors such as PayPal or SafetyPay.

- Direct draw from bank account using an ATM

- Retail store purchase with a “top-up voucher” or “refill card” at retail. These vouchers and cards carry a unique numeric code which must be entered into the phone in order to add the credit onto the balance.

- Retail store purchase using a swipe card where the balance is credited automatically to the phone after the retailer accepts payment.

- Retail store or online purchase: a person can top-up a prepaid phone in another country by asking for “international top-up”. Often, migrant workers will send prepaid top-up internationally as a form of support.

- Other mobile phones on certain networks which provide international top-up services, where the initiator of the top up is often a migrant worker wanting to add minutes to the prepaid mobile phone of a family member back home.

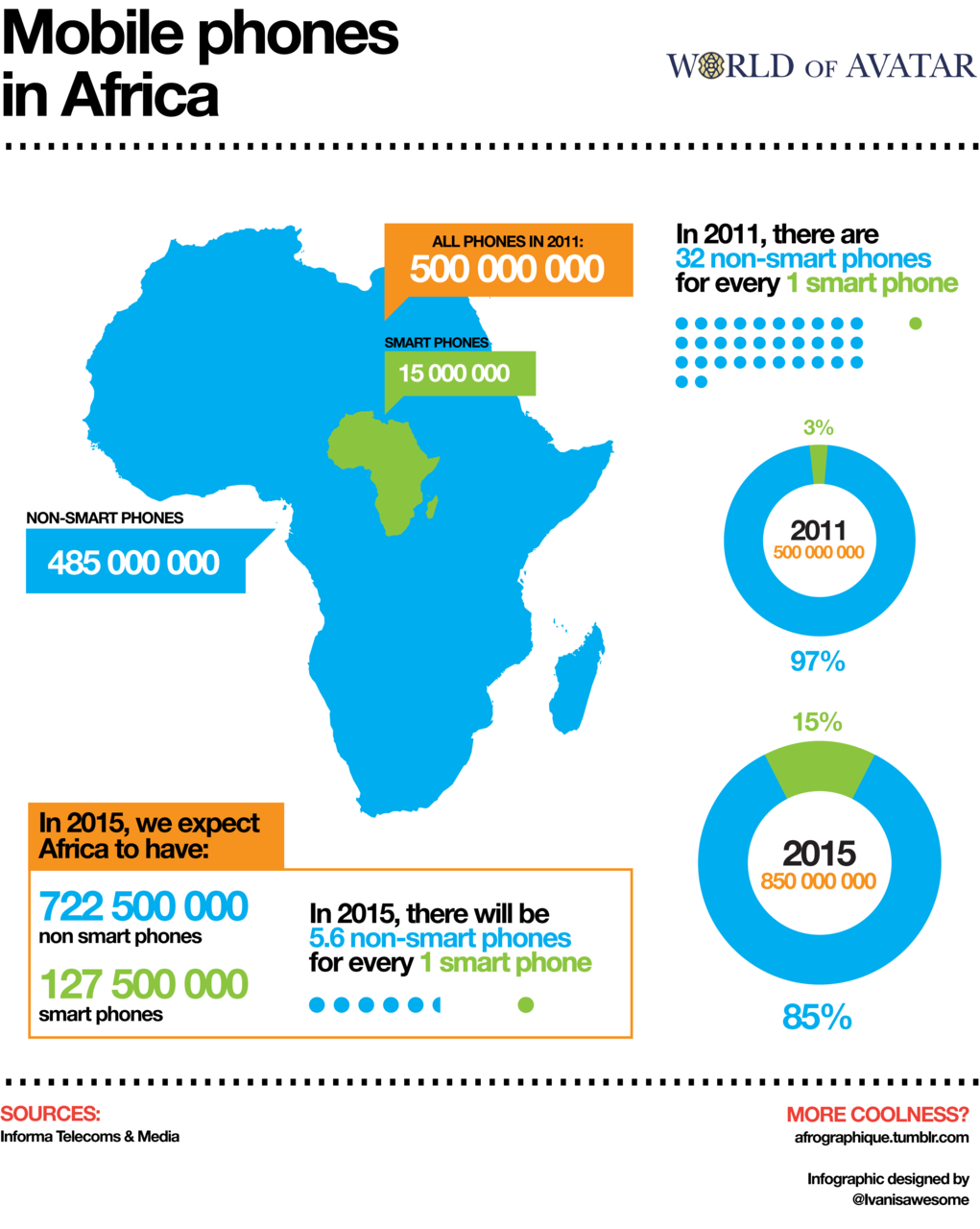

The Numbers

There are half a billion mobile phone users in Africa, and 70% of these users are on PAYG That means there are 350,000,000 users in Africa relying on PAYG to top up their phones. For them, topping up and running phones in this way this is perfectly normal, and not the activity of “the financially excluded”. In 2015 it was projected that there will be 125,500,000 smart phone users. Each of these is capable of running their own Bitcoin wallet.

Out of the 350 million PAYG mobile users in Africa, 226 million are smart phone users. This means there are 226 million potential Bitcoin wallet users in Africa alone. All of these people:

- Do not have bank accounts or credit cards

- Are used to mobile top ups by voucher or refill card

- Use remittance services to send and receive money

And remember; these users will be fed Bitcoin by their diaspora populations, as well as Bitcoin moving from these populations to foreign destinations.

Clearly, in this scenario, Bitcoin Wallets serve as universal “flexible SIM for money”. Every user can download a Bitcoin wallet for free, and charge it in the same way that they do their PAYG SIM cards, through a voucher supplied by a local vendor.

Beating Western Union, Rio and its Ilk

Sending money to Africa using Western Union has a base level transfer fee service charge of $4.99. Bitcoin, once it is purchased, has fees that are in the pennies on the Lightning and “Layer 2” infrastructure.

Walmart in the USA costs $4.50 for transfers up to $50 and $9.50 to send up to $900. That means their fees are 10%. Western Union, in comparison, charges $5 for a money transfer of up to $50, but a transfer of $900 could cost $76. There are a number of price points in between, dependent on the amount of money to transfer. (CNN)

At 4% Azteco beats both Walmart, Rio, Western Union and all other remittances services. On top of this price advantage, the money arrives instantly at the recipient’s wallet, and does not have to be collected. Furthermore, that money can be spent directly by the recipient at any retailer on line, including Amazon (via Purs.io) globally. It can also be sent to any other Bitcoin user globally, for extremely low fees, without reference to any third party.

Finally, Western Union customers, by figures published by them, are 70% banked. That means we are not competing directly with Western Union when we address and serve everyone who un-banked. There are 2bn people in that demographic, 60m in Mexico 88m in the USA (for example). These people are not Western Union users, and we will not be competing against the 700lb Gorilla. At first.

Fear, Uncertainty and Doubt

We must include a section analysing the perceived downsides, so here it is.

As of July 2013, at least 80 countries globally (including 37 on the African continent) have mandated, or are actively considering mandating, the registration of prepaid SIM users.

The reason is a concern of police and security agencies that anonymous use of prepaid mobile services facilitates criminal or terrorist activities. Note that this is a “concern” and not legislation designed to stop something that is actually happening in real life.

Prepaid phone users can be anonymous for two reasons:

- In certain countries, the prepaid SIM card can be sold in a shop like any other goods. There is no need to register them at point of sale, unlike postpaid phones who have to credit check the user before allowing them to purchase and enter into a contract.

- Prepaid services can often be topped up using cash and vouchers, there is no way to trace the payment and hence determine the identity of a prepaid phone user from payment records.

While there is no doubt that criminals and terrorists use prepaid SIM cards to help stay anonymous and avoid easy detection, to date there has been no empirical evidence to indicate that:

- Mandating the registration of prepaid SIM users leads to a reduction in criminal activities; and

- The lack of any registration of prepaid SIM users is linked to a greater risk of criminal or terrorist activities.

In fact, a publicly available policy assessment report from Mexico showed that mandatory SIM registration introduced there in 2009 had failed to help the prevention, investigation and/or prosecution of associated crimes. As a result, policymakers decided to repeal the regulation three years later.

Clearly, it makes sense not to go down this route, as it has no effect on the prevention or detection of crime. The needs of the many outweigh the needs of the few, and crime is an extremely small percentage of the billions of PAYG top ups that have taken place since they were introduced. All of this applies directly to Bitcoin.

Conclusion

It is clear that we are on the cusp of a perfect storm, where Bitcoin will sweep across the entire globe. There is an enormous population of potential users who are familiar with mobile PAYG systems and topups via vouchers.

Azteco addresses this market perfectly. We remove all the complexity from obtaining Bitcoin, and fit it into a paradigm that removes any need for in depth education, since all the users are already pre disposed to using it.

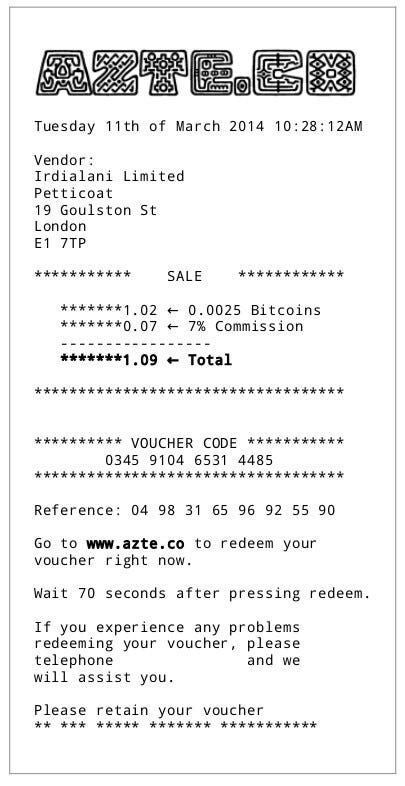

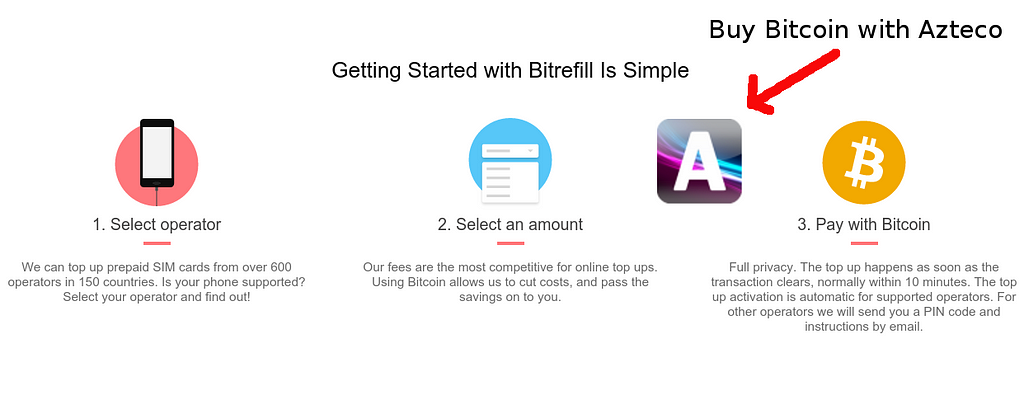

Simple to use retail Bitcoin is the missing link. It is the final step that will onboard billions of people to global e-commerce. The image above from the Bitrefill is illustrative of the problem Azteco solves; it has a missing step in its, Getting Started with Bitrefill diagram; how do their customers obtain Bitcoin to buy their top-ups? Azteco.

We can say for certain that when Azteco launches, Bitrefill and services like it that need this important step to be inserted will see an increase in their numbers, as we close the missing part of the Bitcoin ecosystem circle: how to easily obtain Bitcoin.

The Perfect Storm was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.