Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This is the May 2022 monthly market insights report by Bitcoin.com Exchange. In this and subsequent reports, expect to find a summary of crypto market performance, a macro recap, market structure analysis, and more.

Crypto Market Performance

May got off to a rough start as the Federal Reserve confirmed a hawkish bias on the back of lingering inflation. Markets reacted by going risk-off.

The collapse of LUNA and UST added fuel to the fire, with the result that crypto markets saw historically large drawdowns.

BTC reached a low of $25.4k USD, which is 60% off its all-time high of $65k. ETH saw a comparable drawdown.

Other large-cap coins fared even worse, with AVAX and SOL being down over 75% and 80% respectively from their all-time highs.

During the first week of the month, gaming (play-to-earn) saw the worst performance across crypto sectors, followed by top assets (large caps) with losses of 9.6%, and Web3, which was down 8.9%.

Macro Recap: Quantitative Tightening (QT) Is Here to Stay

As expected by the market, on May 3rd the Federal Reserve announced that it had voted for a rate hike of 50 basis points to the funds rate. This announcement was on the back of “robust” job gains and a decrease in unemployment, which has led to increases in inflation. There was also the reduction of the balance sheet, starting from $47B per month to up to $95B per month after the first three months. According to the Federal Reserve’s later statements, System Open Market Account (SOMA) will reduce its holdings of U.S. agency debt and U.S. agency mortgage-backed securities (MBS).

The narrative was focused on uncertainties regarding the macro environment, as Russia’s invasion of Ukraine intensifies and supply-chain issues in China contribute to lackluster growth globally.

CPI data provided no relief, as it marked 8.3% for the month of April, beating expectations by 20 basis points. April’s numbers were down only slightly from the 40-year high of 8.5% reached in March.

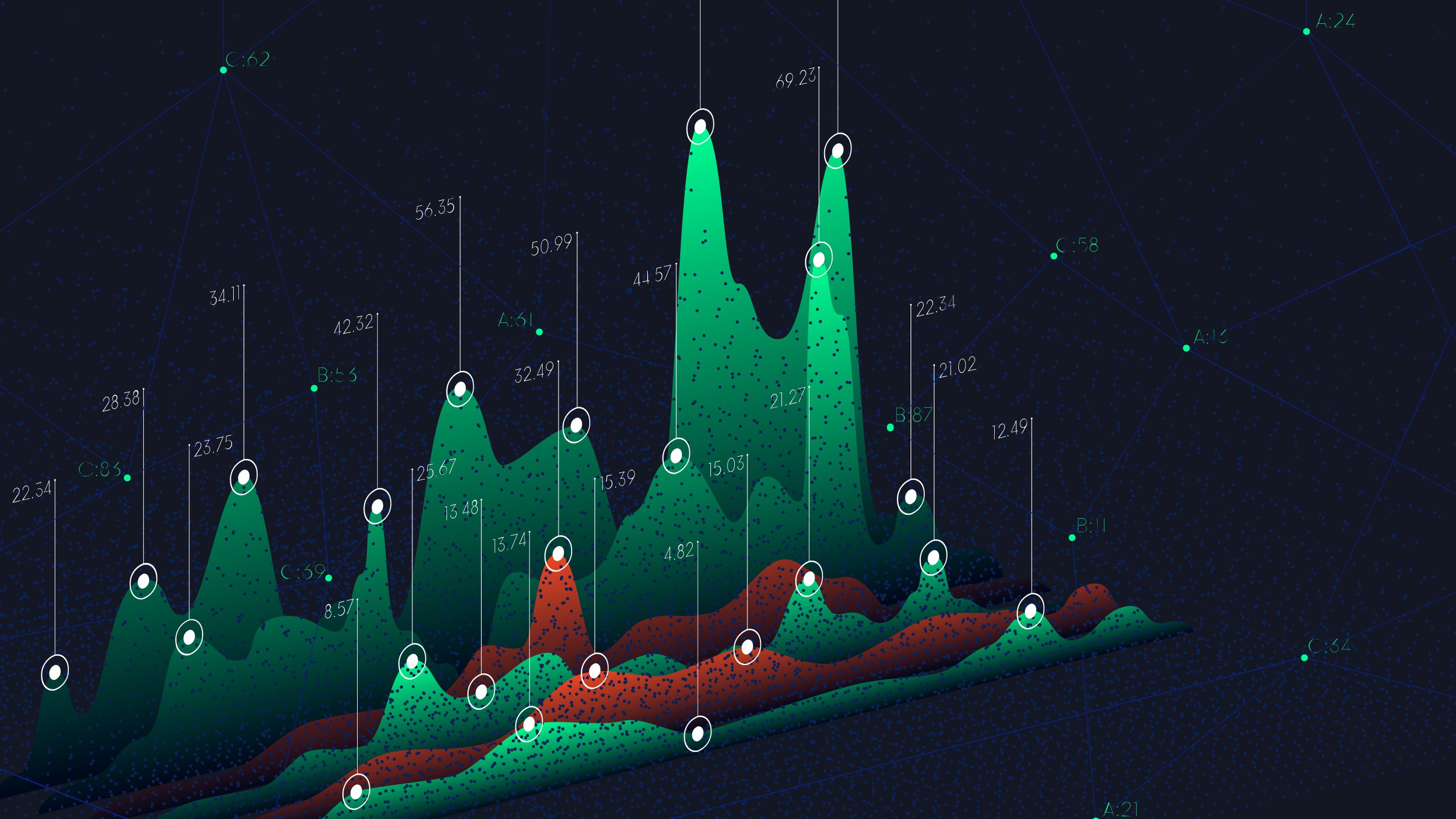

Market Structure: Decrease in Flows and Long-Term Holders Continuing Capitulation

As macro conditions seem to worsen, we take a look at on-chain metrics to better understand price action with the aim of providing a clear view on what could come next. There are two areas we will focus on. These are 1) decrease of profitability by long-term holders (and capitulation) and, 2) stablecoin supply/demand.

The graph below is the Long-Term Holder Spent Price vs Cost Basis, which depicts capitulation in the market by Long Term Holders (LTHs). The blue line represents the Long-Term Realized Price, which is the average buying price of all coins that LTHs hold. This is declining, as you can see from the graph, meaning LTHs are selling off their coins. The pink line represents the average purchase price of the coins being spent by LTHs on that day. As you can see, it’s trending higher, meaning that LTHs are selling at break-even on average.

Stablecoins are a key component of the market, as they facilitate entries of new players as well as standardizing a unit of exchange for crypto. By looking at the supply of stablecoins we can know whether or not more participants are entering the market. As seen on the graph below, stablecoin supply grew tremendously during the last bull market due to the increase in demand for crypto and thanks to new players entering the market. The supply of major stablecoins went from $5.33 billion to $158.2 billion in less than three years. Note, however, that aggregate stablecoin supply has been flat so far in 2022.

This was driven mostly by an increase in redemptions of USDC (into fiat), totalling $4.77B since the start of March despite an increase of $2.5B in USDT over the same period. In the below chart, we can see the 30-day change in aggregate Stablecoin Supply vs the Contribution by USDC. USDC has seen a supply contraction by a rate of -$2.9bn per month, which can be identified in the bottom right corner of the graph by the dashed red circle.

Being one of the most widely used stablecoins, USDC supply contractions indicate a move of money from stablecoins as a whole back to fiat. More significantly, this indicates a risk-off sentiment as well as weakness in the crypto market overall.

LUNA and Do Kwon, The Man Who Flew Too Close to the Sun

In this section we would like to go over the rise and fall of UST and the Terra ecosystem, and the resulting domino effect that impacted the markets. UST, one of the largest stablecoins ever created, was an undercollateralized algo-stablecoin in the Terra ecosystem. It was created and sponsored by the Luna Foundation Guard (LFG), led by outspoken founder Do Kwon.

As an algorithmic stablecoin, UST implemented a two-token system where the UST and LUNA supply should remain similar and where both tokens were redeemable between themselves. If the price of UST exceeded $1, traders were incentivized to burn LUNA in exchange for one dollar worth of UST, which increased its supply and theoretically drove the price back to $1.

Meanwhile, Anchor, a DeFi staking protocol within the Terra ecosystem, was offering “saving account” deals for users to stake their UST. This was paying a whopping 20% APY. Anchor generated this yield by borrowing and lending UST to other users for collateral. A large sum of this collateral was LUNA.

So what went wrong? Due to its early success, the Terra ecosystem grew enormously to become one of the largest projects by market capitalization, at $40B. LFG, led by Do Kwon, began to think of ways to improve the backing of UST. Thus, they decided to back part of their reserves with large cap cryptocurrencies such as BTC and AVAX among others, making UST a multi-collateralized algo-stablecoin. Having done that, the stability of UST peg became inherently correlated with the value of the collateral in its reserves. On May 8th, 2022, 4pool Curve, one of the largest stablecoin pools, saw an increase in UST supply of 60%, as shown in the chart below.

Shortly thereafter, an $85 million UST-to-USDC swap brought the pool back to being only slightly imbalanced. Big players subsequently came in and, by selling ETH in the market, bought the value of UST back nearly to its $1 peg, as shown in the chart below.

You can see that the balance of the Curve pool was temporarily restored to previous levels and the peg was temporarily saved. However, on May 9th, we see that a similar situation occurred when another massive sell of UST was executed on the Curve pool, pushing the imbalance to above 80% of UST in the pool. The price of UST dropped to about $0.60 around the same time. The crypto market entered into a panic and the collateral held by LFG became less valuable in a downward spiral. This impacted the value of LUNA, as it’s supposed to be continuously sold to keep the peg – and this was the beginning of the end. The peg never went above $0.8 from that point on, and the value of LUNA nose dived by over 99%, currently sitting at $0.00026 USD.

A lot of questions are still unanswered from the Terra/Luna episode. Specifically, who was responsible for the massive selling of UST on Curve? Was this an orchestrated “attack” to depeg UST? Why didn’t LFG come up with a contingency plan to stop the devaluation of LUNA and UST? Why was the process of restabilization of the token done manually by the foundation and Do Kwon? Are BTC collateralized tokens safe in highly correlated scenarios?

We are yet to see the aftermath of this black chapter in crypto history, as the Terra ecosystem and UST are mostly marketed towards retail money. You may well see increased scrutiny from regulators towards stablecoins and crypto overall. One thing you must remember from this is that crypto is still an immature market and being the decentralized, crowdsourced environment that it is, comes with high risk. Thus, you should always keep in mind that every investment has its risks and doing your own research continues to be paramount.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.