Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

If you have managed to hold tight as bitcoin has corrected down 70%, then you’re made of stronger stuff than most crypto ‘investors’. Either that, or you have some understanding of bitcoin’s value proposition, rather than just jumping on an exponentially rising price, only to panic sell at a loss as things turned south.

For those of us who have been watching bitcoin for some time, these kinds of marked consolidations are quite normal; 50, 70, even 90 percent corrections are par for the course. If you can’t handle the downs, you shouldn’t get involved on the ups.

Why is bitcoin so volatile, is this volatility going to decrease, when is the best time to buy, and has the bitcoin bubble finally burst? Let’s take those questions one at a time.

Why is bitcoin so volatile?

Bitcoin is the ultimate speculative asset. It has no inherent value, just like gold, it is traded 24/7, there is no market downtime, and it is available to anyone with a credit card and a computer with internet access. When a large proportion of the world become ‘investors’, you’ve got to know that there’s too much money sloshing around the world’s economy.

Some of that money goes into bitcoin when the price is rising in a bull market, and some of that money leaves bitcoin when it enters a bear market. The relative lack of sellers when the price is rising exacerbates the price rise, while the relative lack of buyers has the same effect in a downturn. If bitcoin had a real use case, if it was something people used — say to buy real estate — rather than speculative FX trading, its volatility would decrease. Given the deflationary nature of bitcoin, and the demand for these limited resources, there will always be rallies and downturns, it’s baked into the code.

Is it going to get any better?

As bitcoin adoption increases, and more and more people acquire bitcoin in their own portfolio, the proportion of those trading it will become a smaller proportion of overall transaction activity. This means less money entering or leaving. People get excited about the market cap of bitcoin, but compared to the big league banks who can conjure up funny money at will, bitcoin is small fry. Tiny. With such a small overall market size, transaction activity has a far greater effect on price.

Let’s say you’re a government wanting to buy the world’s most secure, decentralised, globally accepted money, to the tune of £5bn. Firstly there’s not going be enough bitcoin for sale, and secondly if you bought it in any way other than piecemeal acquisition, you’d drive the price up against your own interest. Bitcoin is not yet the big leagues. Not yet.

When is the best time to buy bitcoin?

This is an excellent question. The answer is always with hindsight, around 2009, or 2014–15. Ideally you’d have been mining it on your home computer back In the early days, and would have 2,500 bitcoin in your possession worth £13.6m at today’s price. It’s worth pointing out that in December 2017, your fortune would have been worth £37.5m. What’s a few million quid here and there when you’re talking bitcoin?

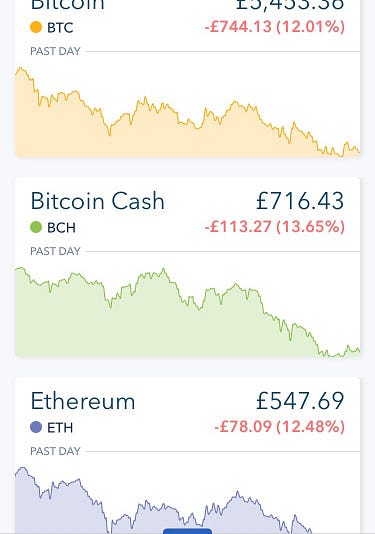

Yes folks, the best time to buy bitcoin is now. Obviously you should be looking to buy the dips, watching out for inevitable consolidations as they flush out weaker investors, and setting a new baseline, currently around £5000. Remember a lot of the volatility is down to traders, and traders all read graphs, and all program their trading bots to behave in similar ways. Ever wondered why all the price charts for cryptos look the same? (See photo above) It can only be down to investor groupthink, or automated trading bots triggering trades at set prices. Accepting that bitcoin transactions are pricey, put aside a small amount each month and when you have a reasonable amount saved, execute your buy order. £100–200 is probably a minimum purchase of BTC. Don’t see this as a short term investment, think of it like a pension fund for you and your wife/husband, or a potential school fund for your daughter. Think of it as an insurance policy, something that is diametrically opposed to the madness of zero and negative interest rate policy, quantitative easing and all of the other shenanigans that central bankers and governments have been up to since 2008. They didn’t fix anything, they just made it even worse. You might lose all your money, but equally that £200 investment might save your sorry arse from destitution. Don’t get the cake out of the oven until it has had a chance to rise. Come back in 2025.

Has the bitcoin bubble burst?

Well, let’s look at it this way. The world has too much money, pumped into the system via central banks’ QE, and the result has been inflation. Maybe not inflation in the ‘basket of goods’, but inflation in the assets which that abundance of debt money has purchased. House prices? To the moon! Equities? Never been higher! Your salary? Don’t want to talk about it. Fair enough.

Meanwhile the economy is barely ticking over above idle. As this financial nonsense unwinds, where is all this money going to go? If you hold your wealth in pounds or dollars, and inflation hits, your money is going to realise it’s true value — that of a paper (or even plastic) bill. If you’re one of those who’s been near the fountain of money creation, say you’re a banker working for JP Morgan or Goldman Sachs or HSBC, where do you put your big pile of money? And in haste, as the longer you wait the more you lose. You can only buy so much property in the next 3 months. No, you need to buy the oldest hedge against the inflation created by the aforementioned funny money; gold, silver and their 21C equivalents, bitcoin & litecoin. I hesitate to put ethereum in the list as it is an inflationary asset. There is no limit on its creation, which means that it is a poor store of value compared to things in short supply (land, gold, bitcoin, paintings by Renoir etc.)

So hold onto your hats folks. If you thought bitcoin was toast, think again. We’re really only just getting warmed up for the main act, flushing out the next round of ‘investors’.

People are going to flock to BTC, not because they want to, but because they can’t afford not to, if they want to preserve their wealth. Buying a £3m house is a lot of work, and involves a lot of taxes, paperwork, and maintenance and it takes 3–6 months minimum to transact. Meanwhile a £3m BTC transaction is instantaneous, easy, and very cheap by comparison. Easier even than buying gold as there’s nothing to store. Get yourself a hardware wallet and you hold the rights to the lot. Individual Sovereignty for you.

Bitcoin is the successor to the great fiat money experiment started since Richard Nixon’s gold shock back in 1971 when America (and those whose money was pegged to the dollar) left the gold standard. Its time has come, and like it or not, people are going to have to buy it to preserve their wealth.

It will be interesting to see where the next high and consolidation for bitcoin will be. I hear that $100,000 is the next target price. In 2018? I wouldn’t bet against it.

Originally published at Andrewgoodman.me.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.