Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin has calmed just under and around the $30,000 level after the recent massive volatility that brought the asset south by five digits. Most altcoins are also quite stagnant on a daily scale, with a few exceptions, such as Polkadot, Bitcoin Cash, and Monero.

Bitcoin Stands Still Below $30K

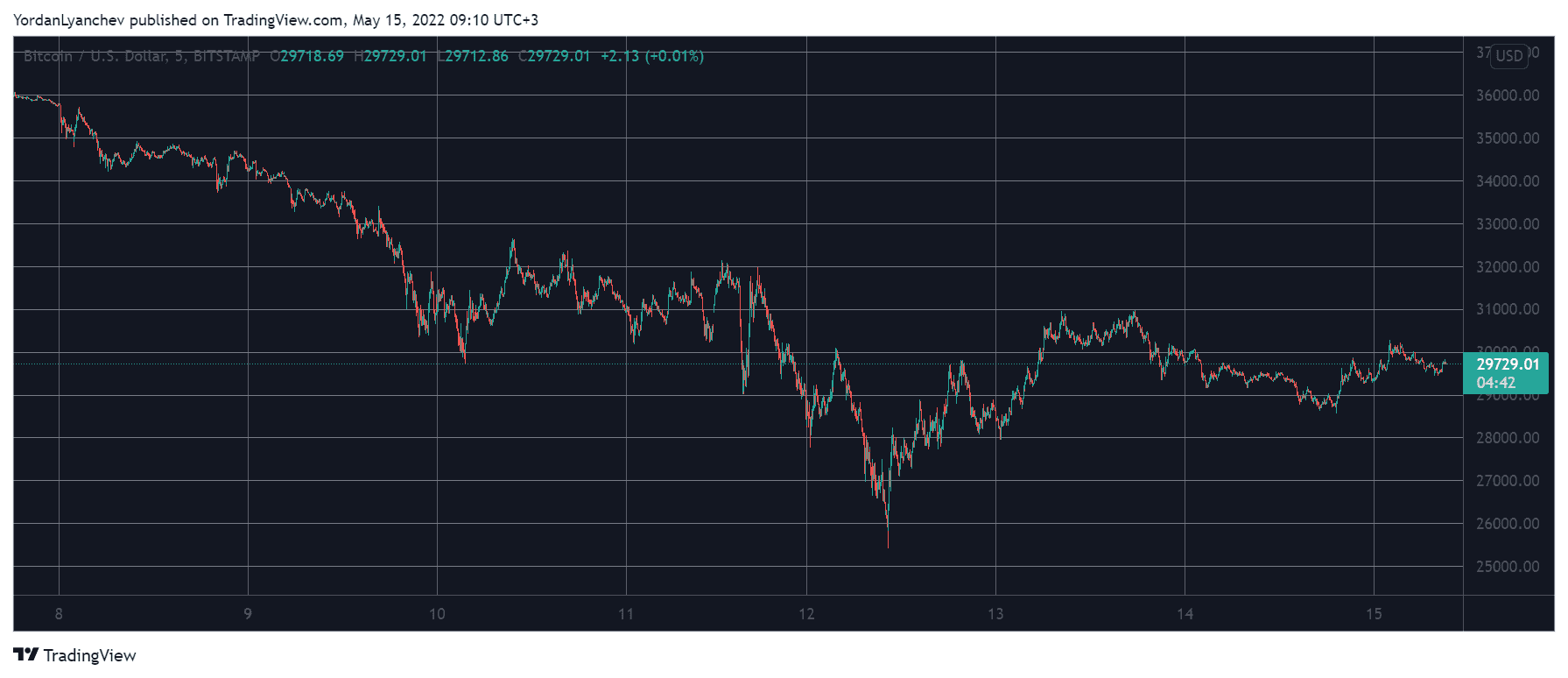

The past ten days were nothing short of a volatile rollercoaster for bitcoin and the rest of the market. The largest digital asset stood close to $40,000 before it plummeted by $4,000 in a day. It dumped further more in the next couple of days and found itself struggling to remain above $30,000 by May 11.

However, it seemed almost inevitable that it will break below that level, and it did on May 12. At that point, BTC slumped by nearly $5,000 to its lowest price position since December 2020 at $25,300 (on Bitstamp).

After this $15,000 drop in about a week, it reacted well and recovered $6,000 in a day, briefly tapping $31,000. Nevertheless, it failed there and retraced below $30,000 where it’s currently sitting. As such, its market cap stands at just over $550 billion.

BTCUSD. Source: TradingView

Altcoins Stall, DOT Soars

The altcoins went through something quite similar to bitcoin. Ethereum traded at $3,000 earlier in May but dumped to a multi-month low at $1,700 during the correction’s most violent day. It bounced off at that point and reclaimed the $2,000 line days later.

Binance Coin is close to $300 now, after dipping to $230 days ago. On a daily scale, though, most larger-cap alts are slightly in the red. Ripple, Cardano, Solana, Polkadot, TRON, and Shiba Inu have retraced by up to 4%.

Polkadot and Avalanche are the only two with notable price gainers. AVAX is up by 3%, while DOT has soared by more than 7% and trades north of $11.

From the lower- and mid-cap alts, Bitcoin Cash and Monero have gained the most – between 5% and 7%.

The crypto market cap has remained relatively sluggish in the past two days and is now at $1.250 trillion.

Cryptocurrency Market Overview. Source: Quantify Crypto

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.