Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Brought to you by AngelLoop.

Brought to you by AngelLoop.

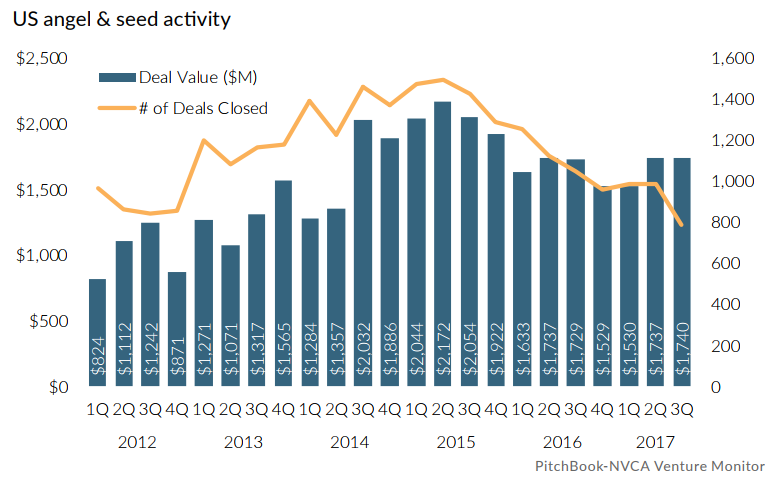

Over the last three years (2014 to 2017), the funding ecosystem for early stage founders have been high in dollar amounts and low in number of deals that were being funded. VCs were more interested in maintaining their positions and helping their current portfolio companies stay afloat longer by investing more money into them versus adding new companies to their portfolio.

This had a big impact on upstream investors (Angels and Pre-Seed Stage folks). One of the questions early stage investors ask themselves when reviewing a deal is whether or not the company will be able to secure additional funding from later stage investors. They do this because they believe that fundraising is an essential building block for early stage companies.

In the last several years, the slowdown in the later stage VC community triggered a slow down for early stage investors and seed stage deals took a hit.

That is all changing.

The StartUp ecosystem is diversifying (or at least providing founders with alternatives to VCs).

The bullish economy is already here. More money in the market mixed with tax cuts and less regulations is having a major impact on founders that have been idle in bringing their ideas to market.

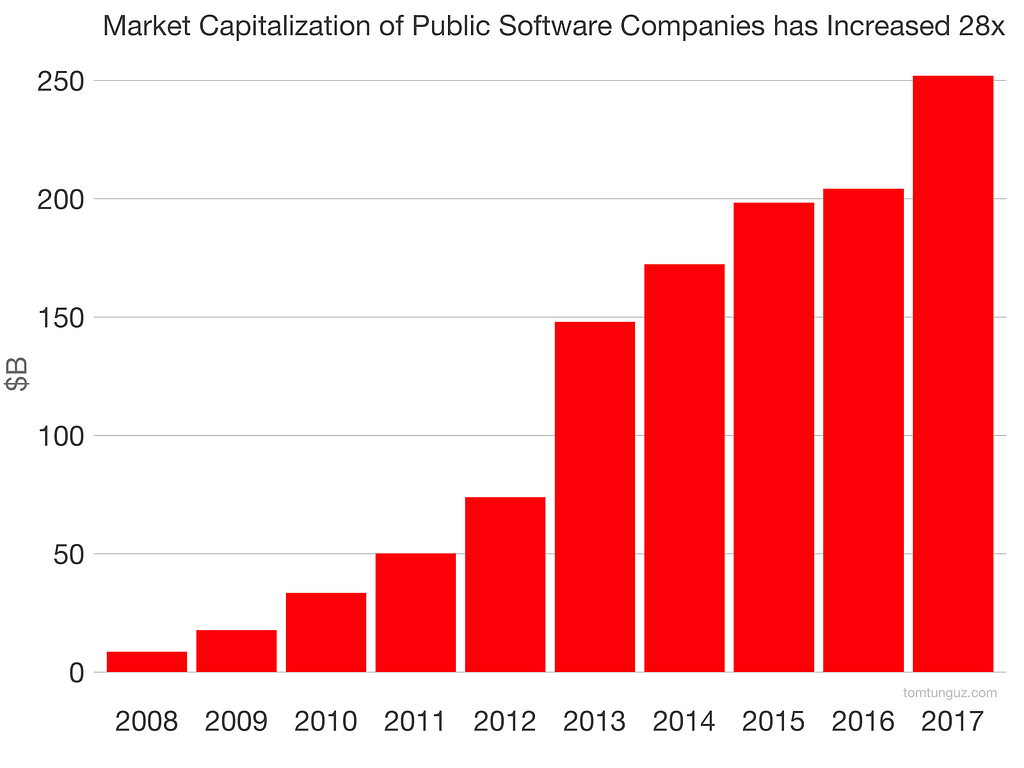

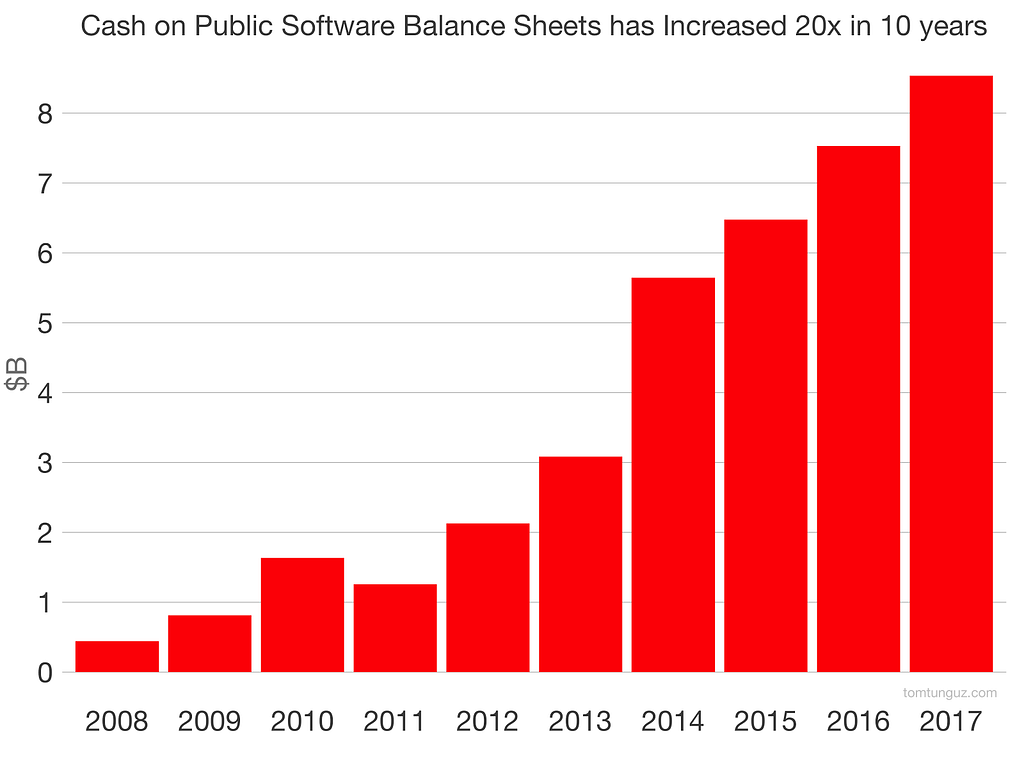

The appetite for acquisitions — If you aren’t planning on taking your venture public, the other path to a significant liquidity event is through selling your venture to a bigger player and right now you are just in luck. The purchasing power of publicly traded companies have swelled and in the tech segment, purchasing power is at $30B. This is enough money to acquire 30 unicorns. Here’s how that breaks down.

- Publicly traded tech companies (not including Google/Amazon/MSFT/Facebook) have grown their cash reserves by 20X over the last ten years and haven’t been too acquisitive with that dough. As of Q3 2017 the combined balance came to $8.5B.

- Also, over the last ten years, these tech Co’s have grown their market cap by 28X and are currently hovering at $250B.

Since these companies acquire smaller ventures using a mix of cash and equity we can assume that they will reserve 10% of their $250B market cap ($25B) and add to it the $8.5B in cash reserves and use both during an acquisition.

Newly Minted Millionaires — The global millionaire count is growing. The biggest driver of growth is an overall uptick in global wealth. Strong Markets, liquidation events and newly opened markets will help mint 4.5M new millionaires by 2021.

Facebook alone created 1,000 new millionaires, many of which went on to invest in the early stage ecosystem and helped spur the growth of companies like AirBnB, DropBox, Spotify and Uber. Now it’s their portfolio companies turn to give their early investors an ROI as well as help mint new millionaires that will continue the cycle.

Repatriation of Taxable Revenue — It is estimated that some $2.7 trillion of US companies income is sitting in foreign bank accounts and enjoying favorable tax treatment. With the 2017 Tax Cuts cutting repatriation tax rate to 15.5%, many of our tech companies are now considering repatriating their money back home. It is estimated that US companies will repatriate $400B in 2018 of which Apple will account for little over half of that.

What will Apple do with the $250B they repatriated back to the US besides paying $60B to the federal government? Well for starters pay down their US debts, buy back more of their publicly traded stock and acquire Netflix (that piece is speculative).

The two things to take note off is the buy back of their stock and their interest in making acquisitions. Stock buybacks have a tendency to increase the value of a company’s stock and apple is not new at artificially inflating its stock price. This impact will be felt by all investors including those that work in apple (through their RSU aka restricted stock units therefore minting more millionaires for you to pitch).

Fundraising is no longer a barrier to entry — Fundraising has never been easier (hodl for the period leading up to the dot com collapse). With new funding channels available to founders and a boatload of new VCs and Angels coming into the scene, fundraising is not a barrier to entry any longer.

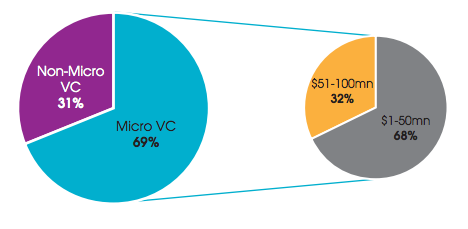

- There are more micro-VCs — 550 New micro-VCs have entered into the ecosystem since 2016. Most of these funds are looking for pre / seed stage deals and their average check sizes range between $150K to $500K.

Here’s a list of them that Samir Kaji from First Republic Bank has been compiling.

- Bigger VCs have scouts looking for early stage deals — Namely Sequoia Capital, and AngelLists very own Spearhead are funding mentors and founders that have cultivated networks of entrepreneurs and want to help these founders gain access to capital. Most of these deals will come in the form of notes and will not require the founder to share information rights with them, however they act as an option for these bigger VCs have an opportunity to come into the future rounds.

- ICO Markets have grown nearly 100X since early 2017 — The bitcoin bubble has minted many millionaires and these investors are looking to keep that momentum going while also minimizing their risk. They do this through diversifying across multiple investments or ICO’s to be specific. If your company is disrupting [enter nascent industry name here] by decentralizing through the blockchain, you have a good chance of closing your first $100M round. Just Google It.

With all these investors and money coming into our early stage startup ecosystem, fundraising is becoming less strenuous and cryptic (no pun intended) for founders. All the resources you need are a google search away.

So get that valley cheddar, build your team, grow your revenue and stay hungry for more.

I love you,

— Igor

About Author:

Igor Feerer is a 3X founder working on a better way for founders and their investors to communicate and collaborate on scaling their venture through his new venture AngelLoop. It’s strange that founders raise money from investors and forget about the real value that they can provide them with, i.e. advice, intros and a kick in the butt when to get the founders creative juices flowing.

Connect with Igor on: LinkedIn, Twitter, and Medium

Like the article? Receive AngelLoop’s latest posts in your inbox — Subscribe here!AngelLoop, our weekly sponsor, is the communication and collaboration tool for founders to improve transparency with their stakeholders and save time on their investor updates. Track, share and leverage today.

Fundraising For Your Startup Has Never Been This Easy. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.