Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Terra continues to lead the market-wide correction as LUNA has plummeted below $1, meaning a weekly drop of almost 99%. Bitcoin and the altcoins are also in the red, with the total liquidations exceeding $700 million on a daily scale.

- CryptoPotato reported earlier today that the cumulative market capitalization of all cryptocurrency assets had lost over $400 billion in less than a week, dropping to a 10-month low of $1.350 trillion.

- The landscape has only worsened since then as BTC failed at $31,000 and started dumping once more. Minutes ago, the primary cryptocurrency charted its latest low since July 2021 of $29,000 (on Bitstamp).

- As it typically happens, the altcoins are in no better shape. Just the opposite, Ethereum is down by 10% to below $2,200, BNB is beneath $300 (-15%), While Solana, Avalanche, Polkadot, Dogecoin, and many others have lost over 20% on a daily scale.

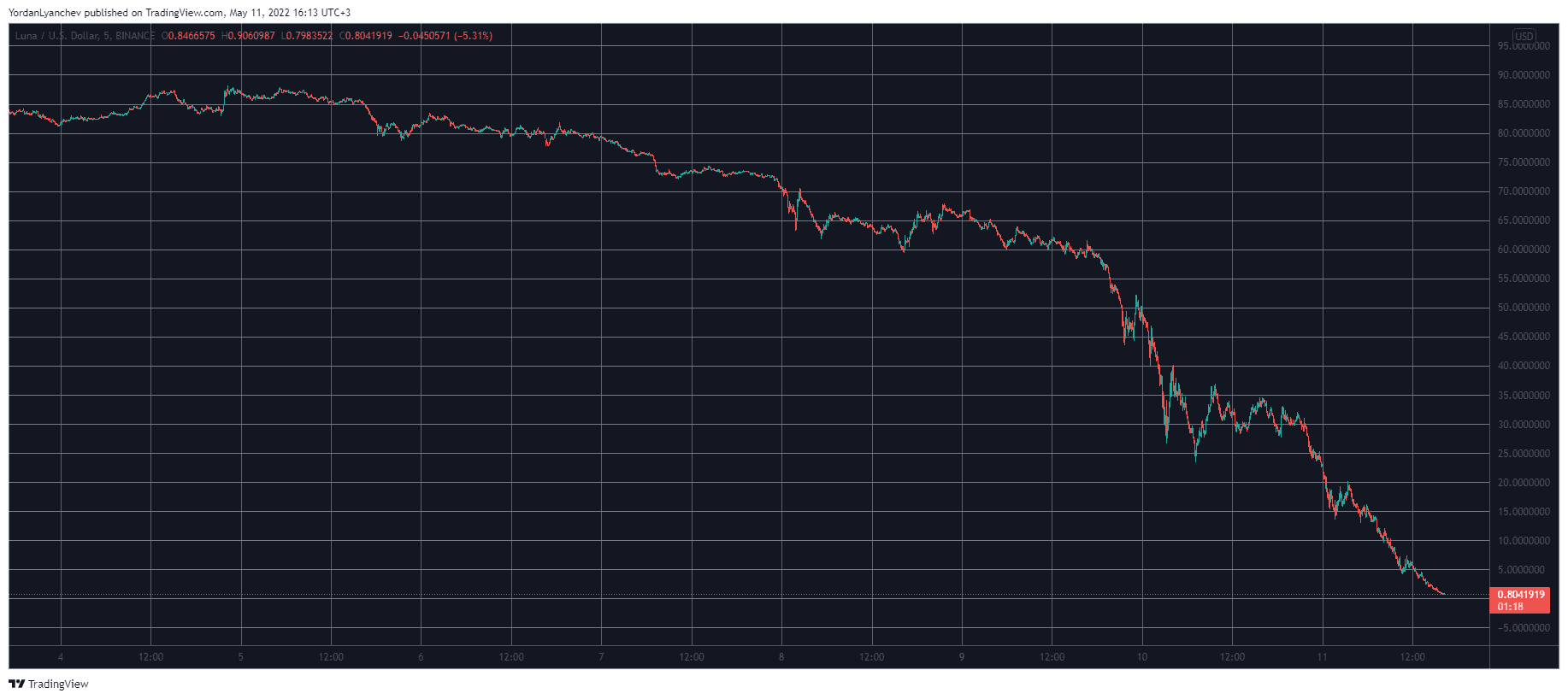

- Yet, no other coin has suffered as much as Terra’s native cryptocurrency – LUNA. The saga that unfolded in the past week or so, leading to UST de-pegging from its supposed price of $1, meant that users could profit by arbitraging LUNA.

- Thus, the selling pressure propelled a massive price slump for LUNA, which dumped below $1 earlier today. Just for reference, the asset traded at $90 six days ago. This means it has lost about 99% of its value in less than a week.

LUNA/USD. Source: TradingView

- Naturally, this enhanced volatility caused mass pain for over-leveraged crypto traders, with the total liquidations skyrocketing to over $700 million on a 24-hour scale. The number of liquidated trades is close to 300,000, and the largest single liquidated order transpired on Binance worth $20 million (ETH-USDT).

Publication date

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.