Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In a galaxy far far away, there exists a decentralized exchange that doesn’t cost an arm and a leg to use…

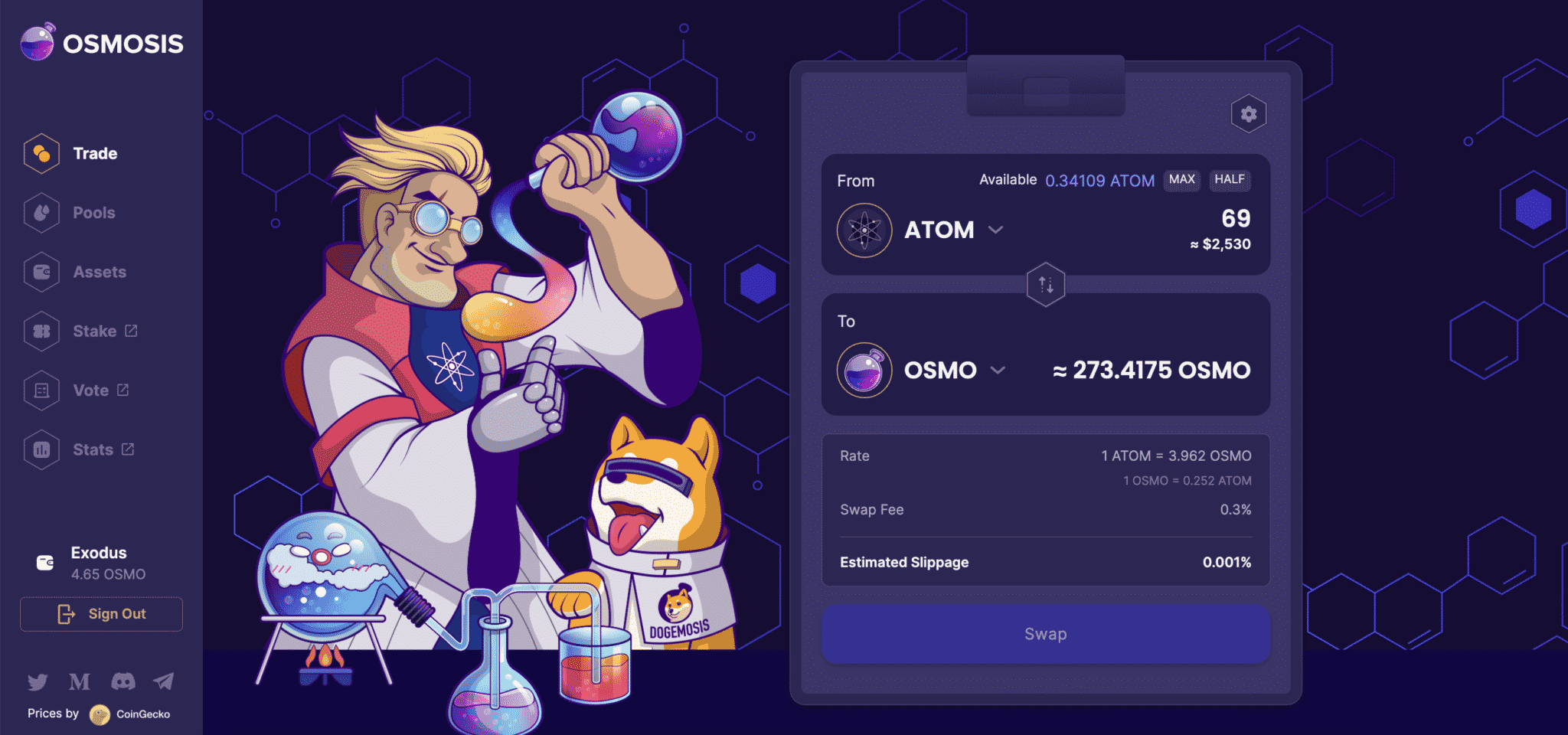

Osmosis is the most active decentralized exchange in the Cosmos ecosystem, and it enables tokens on “IBC-compatible” blockchains like Cosmos, Regen, Akash, and more to be swapped, with fees under $1.00.

The Cosmos “Cosmoverse” aims to rethink how cryptocurrency projects work together. Rather than pledging allegiance to a single blockchain for better or for worse, Cosmos projects retain complete sovereignty over their individual blockchains, while also leveraging the strengths of the greater Cosmos network and beyond.

Osmosis has seen rapid growth since its launch in late 2021. Osmosis is a decentralized protocol founded by Osmosis Labs founders Sunny Aggarwal and Josh Lee. Upon raising $21 million in an October 2021 token sale, Osmosis has generated a loyal core of users and established itself as a core feature within the Cosmos ecosystem.

The Osmosis home page

As a decentralized exchange, Osmosis has become particularly popular in the DeFi for its various liquidity pools, with advertised APRs between 20% and 120% for IBC-compatible pairings like ATOM/COSMO, AKT/OSMO, and so on.

CoinCentral spoke with Osmosis Founder Sunny Aggarwal about building in the Cosmos ecosystem, DEX features Osmosis is tinkering at, the value proposition for liquidity providers. Sunny is also a Cosmos and Tendermint developer.

What makes the Cosmos ecosystem notable for entrepreneurs, developers, and users?

Unlike other blockchain platforms, Cosmos is not a singular blockchain that developers build on top of. Instead, it’s a network, an “internet of blockchains” that are all linked and able to communicate with each other thanks to an innovative inter-blockchain consensus mechanism that enables generalized cross-chain communication between disparate chains.

The vision of the Cosmoverse is to enable any blockchain projects to retain complete sovereignty over their chains while also reaping the benefits of being able to communicate and transact with other chains.

The Cosmos home page

Just as the age of empires crumbled before our current political paradigm of nation-states swept the globe, we believe that a model that prioritizes sovereignty allows for communities to pursue their unique sets of internal interests to the maximum extent, with maximum flexibility, as they build various projects. And just as some countries in today’s world are more insular and others more open to trade or immigration, each community in the Cosmoverse can decide as it goes just how tightly integrated it wants its blockchain to be with other chains.

We believe this arrangement enables innovation to take place as fast as possible and has more potential to scale than any other model.

Could you explain how Osmosis is becoming the center of gravity in the Cosmos ecosystem?

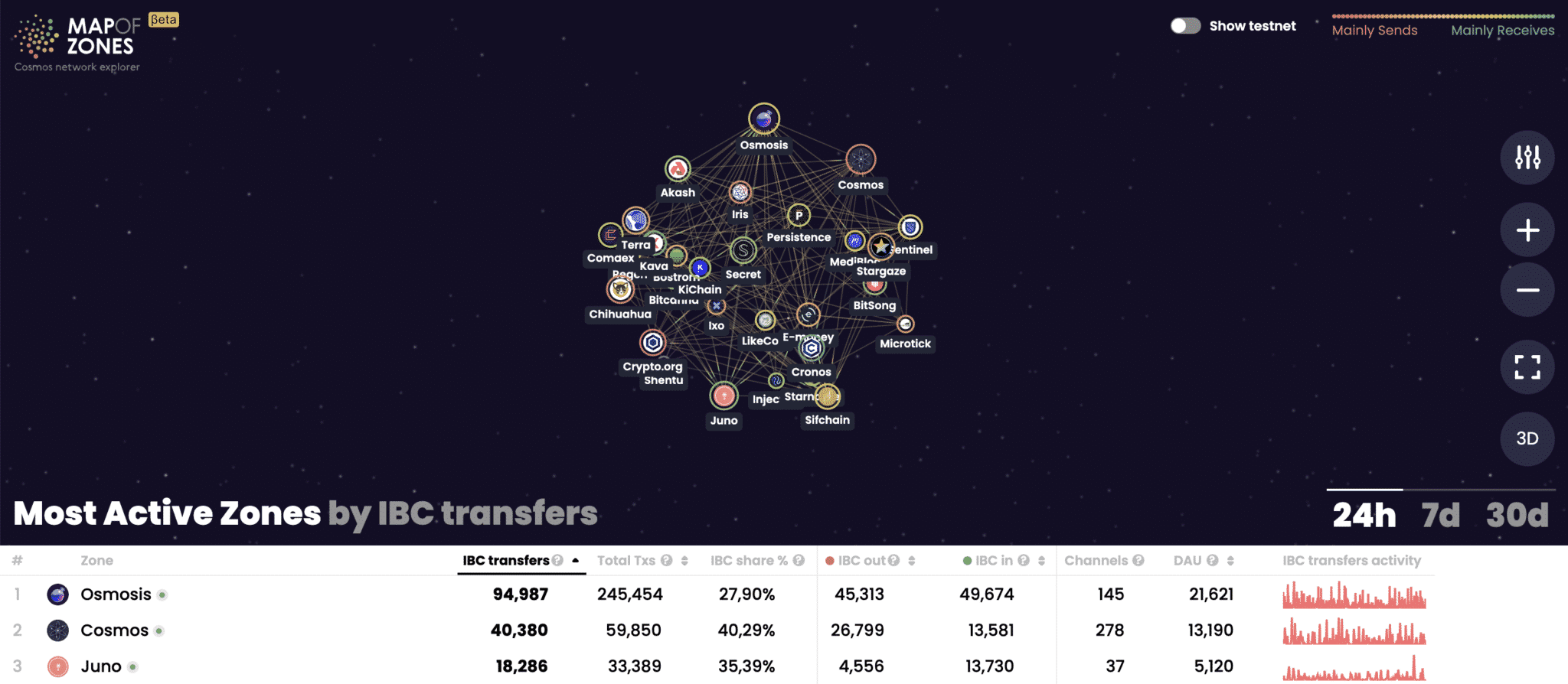

As explained, Cosmos is a web connecting many different blockchains. The community-developed Map of Zones is a great real-time visualization of this web, and it shows how Osmosis is more deeply connected with the other chains in the Cosmoverse than any other blockchain.

The Cosmos Map of Zones

Not only is it connected to nearly every other chain in the Cosmos, but there’s also more inter-blockchain communication happening between Osmosis and those other chains than any other project in the ecosystem.

Much of that has to do with just how hot DeFi is at the moment – it makes sense that a decentralized exchange would be the biggest hub in the Cosmoverse.

Osmosis allows for dynamic adjustments of swap fees, multi-token liquidity pools, and custom-curve AMMs. Could you describe why an LP might want to use one of these other methods?

Our belief is that the design space of AMMs is still massively underexplored. By creating custom curves, we can create new pools that can do things like concentrated liquidity and IL resistance. But even bigger than that, with a rethinking of how to reason about AMMs, we can expand them into automated algorithms for things we might not even think of today as market-making, but rather new primitives such as index fund style pools and even leverage pools.

DeFi is about taking many of the traditional financial primitives today, and enabling them to work in a more continuous algorithmic way, and powerful AMMs / bonding curves are the way to that.

What makes Superfluid staking unique?

With Superfluid Staking, investors no longer have to decide between staking and acting as a liquidity provider in token exchange pools, meaning they can boost their earning power. In principle this is relatively straightforward – if you’re an LP and already locked into holding tokens, then you’re also providing all the benefits of staking to those chains, so why not formalize that relationship and be rewarded as such?

Osmosis is uniquely suited to enable both activities simultaneously because it’s built from the ground up as a Cosmos DeX and therefore is set up to handle the inter-blockchain contracts needed to make Superfluid Staking work.

What are your thoughts on the tug of war between CeFi and DeFi?

There’s a time and a place for both to co-exist, but ultimately, this speculative casino game will act as the Trojan horse that ushers in the new decentralized financial system of the future.

For now, CeFi is great for providing fiat onramps into DeFi, but once the switch has flipped and the majority of mainstream users have been onboarded into DeFi, then that’s when you know we’re operating in this new DeFi paradigm and relegating Wall St and central exchanges to relics of history.

Could you describe the Cosmos ecosystem’s developer activity?

Thanks to Osmosis providing the utility that the Cosmos ecosystem needed, the entire Internet of Blockchains has exploded in growth just this summer. But even before this growth, the Cosmos ecosystem development strategy was always about prioritizing providing the best tools with developer ergonomics at top of mind, which is possibly why so many projects picked up the Cosmos stack to deploy their appchains.

With Osmosis breaking open liquidity rails for the whole ecosystem, it further incentivizes developers to build within the Cosmoverse. You could even conceive of Osmosis as yet another dev tool that solves the problem of exchange listings for the long tail of Cosmos appchains.

Soon, with Confio, the team that developed CosmWasm, adding their smart contracting solution to Osmosis, this will enable a new host of developers to come easily build in the ecosystem and build complementary products and new features to the Osmosis platform.

Could you describe the AMM/DEX evolution, and how you see Osmosis fitting in the DeFi history books?

Automated market makers have been an interesting concept discussed in academic circles for many years, and the concept was first introduced to the crypto community by the Gnosis team who proposed creating an automated market-making smart contract for prediction market shares using the LSMR algorithm created by Robin Hanson.

While some of the earlier designs garnered discussion and interest, the first team to execute on creating a working construction of the concept and bringing it to market was Bancor. By taking the ideas behind bonding curves, and combining them to construct a market-making mechanism that could be used to trade a large variety of assets, not just bespoke ones.

Uniswap then came along and built a much simpler and cheap solution, by instead of using bonding curves, used the famous x*y=k algorithm (aka constant product) to provide spot pricing for assets. The efficiency and ease of Uniswap propelled it to become one of the biggest DeFi protocols.

The followed Balancer and Curve, which both expanded upon the model created by Uniswap by modifying the curves. Curve modified the constant product algorithm to create what’s called the constant sum algorithm, to create an AMM specialized in trading stablecoins and other like-assets. Meanwhile, Balancer took the simple x*y=k algo and figure out how to make it multi-dimensional i.e. x*y*z=k

Osmosis is working to further expand the design space of AMMs with a complete reimagining of them.

Instead of thinking of reasoning about AMM’s by their constraints (e.g. Uniswap XY=K), we should plot them by their LP payoff curves. (As is used in most of the ACE papers =p)

The zero fee payoff curves have very insightful geometric interpretations.

— Dev (@valardragon) November 25, 2021

This will enable the creation of new AMM types, for primitives such as index fund pools and leverage pools, which perfectly hedge impermanent loss. Also, because Osmosis is its own blockchain, it is far more easily modified and updated than an app built atop a blockchain like Ethereum.

For instance, the Osmosis Labs team is working on an update to the core layer of the Osmosis blockchain in order to encrypt the MemPool, where transactions are queued up before being added to new blocks on the chain. This privacy upgrade will prevent attacks like frontrunning which have plagued other Dexes.

In the interchain framework, it is also possible to connect any number of blockchains to Osmosis using the Tendermint consensus mechanism, meaning that the tokens available on Osmosis will not be limited to, say, ERC tokens. A bridge between Osmosis and Ethereum is the first slated to be built, and others are in the works for the future.

Does the customizability of launching a pool on Osmosis open LPs to more threats (rug pulls, etc)? If not, how so?

Any system that is on the decentralized/open/permissionless side of the spectrum tends to generate lots of innovation, which means a higher magnitude of experimentation occurs. Just as in the DeFi summer of 2020, or even the dotcom bubble, there will be a lot of illegitimate projects, ponzis, and pretty much any other cash grab you can think of. It is natural to see projects that actually capture value flourish and separate themselves from the pack over time.

Adding tokens to Osmosis is permissionless, and so it’s important for the community to build tooling and educational materials to help users to due diligence and make safe decisions. The development teams contribute to this by creating standards like Assetlists to help share information on assets, while the Osmosis DAO has created a Community Support DAO that helps create materials and docs to educate users.

What makes a liquidity pool most attractive on Osmosis? If I’m a big LP, how can I design my pool the best?

Usually, the APR is the first thing osmosis natives are attracted to, as we have seen most of the liquidity chasing the higher-yielding pools since launch. On average, most of the pools have remained above 100% APR since their inception. This yield is derived from the osmosis daily-epoch inflation that subsidizes LP rewards and delegators that validate the chain. Osmosis has popularized the trend of matched external incentives.

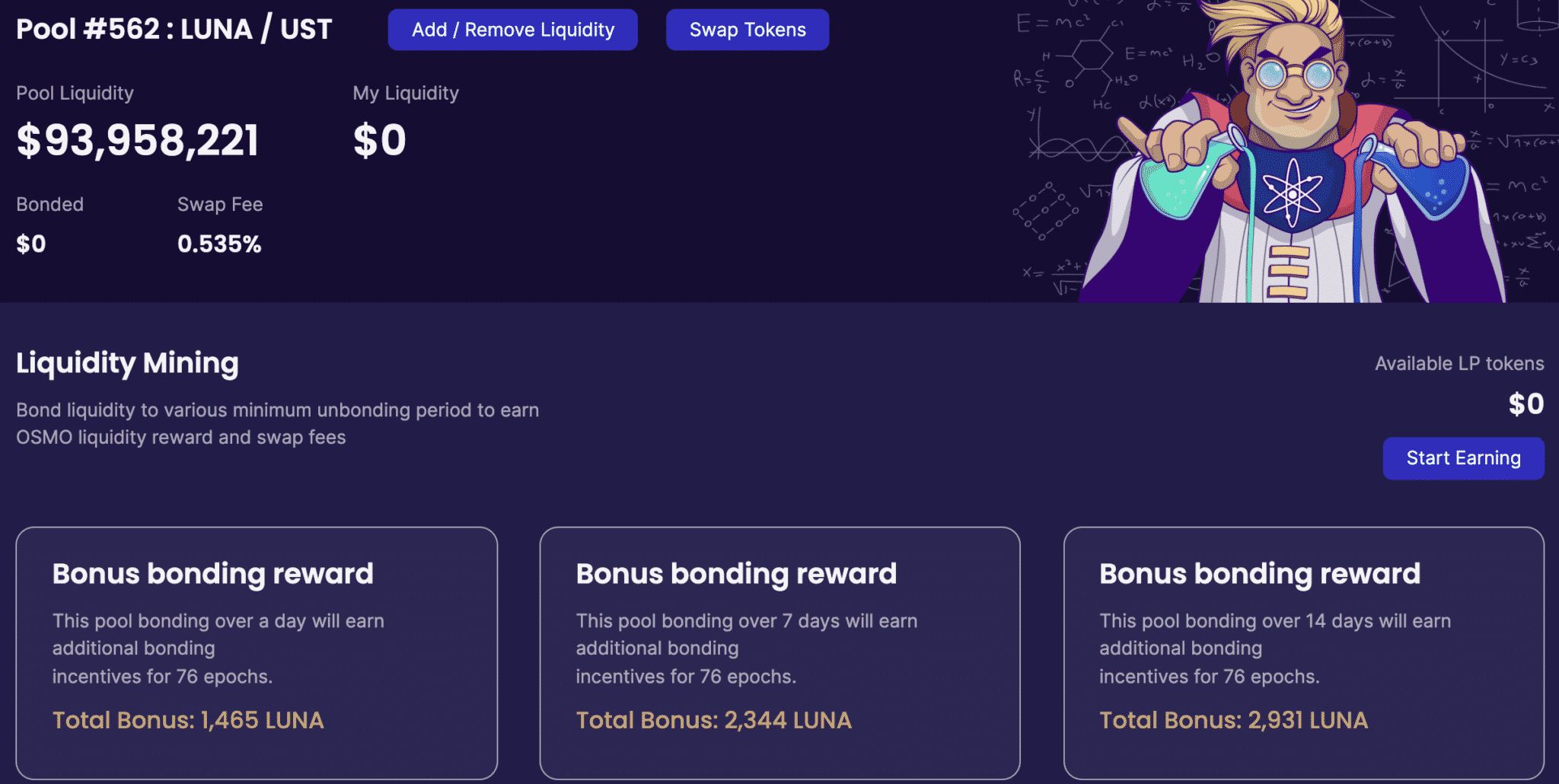

Take the LUNA/UST pool, for example; it earns OSMO daily epoch rewards, swap fees, and LUNA rewards because the Terra community voted to match OSMO incentives on the UST pools. These ‘triple incentive’ pools have attracted a considerable amount of the liquidity on Osmosis and have proven successful in bootstrapping short-term liquidity.

The LUNA/UST pool on Osmosis

How are LPs protected from potential malicious governance attacks?

Osmosis is governed by staked $OSMO token holders, who are long-term incentivized to see the platform grow. With the introduction of superfluid staking, LPs will be represented in the staked set, and thus will be able to vote in governance proposals, thus being able to represent their interests and protect against misaligned incentives.

What are your thoughts on liquidity provider mercenaries, where LPs move from pool to pool seeking the best yields, often to the dismay of the pool they leave?

Many AMMs are plagued by short-term mercenary farming, in which liquidity providers quickly remove and add back liquidity from pools in pursuit of the best yields. AMMs sometimes encourage this type of farming through “vampire attacks,” in which a protocol offers special incentives to liquidity providers from other protocols for migrating their liquidity over.

If enough LPs are engaging in short-term yield strategies, it can cause serious disruption to the quality of the AMM. Liquidity within pools becomes volatile, resulting in an inconsistent and unreliable trading experience for users.

Instead, with Osmosis we want to build a platform conducive to Long-Term Liquidity. Osmosis reduces short-term farming via a system of Bonded Liquidity Gauges.

Bonded Liquidity Gauges are mechanisms for distributing liquidity incentives to LP tokens that have been bonded for a minimum amount of time. 45% of the daily issuance of OSMO goes towards these liquidity incentives.

Osmosis users can choose to bond their LP tokens after depositing liquidity. Similar to OSMO staking, LP tokens remain bonded for a certain length of time, except users are allowed to choose the length of their own unbonding period. Staking requires a two-week unbonding period.

This encourages the long-term locking of liquidity and helps prevent things like vampire attacks.

Thank you, Sunny!

For more information, people can check out the Osmosis site at https://app.osmosis.zone/, or connect with Sunny through his personal website.

For a deeper dive, we recommend going through the Cosmos SDK documentation, our guides on Cosmos, Osmosis, and liquidity pool basics.

The post Osmosis Founder Sunny Aggarwal on DeFi Innovation, Cosmos, & More appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.