Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Authored by William Lee, Eno Zhang, Fubing Yang, Researcher at Huobi Research Institute

Abstract

Since April, global capital markets have crashed. Another dangerous signal is the emergence of the Inverted Yield Curve, which means that an economic crisis is brewing. The reason behind these events is the market’s expectations for the Fed to raise interest rates, a foregone conclusion under the monetary policy decision based on the Taylor Rule.

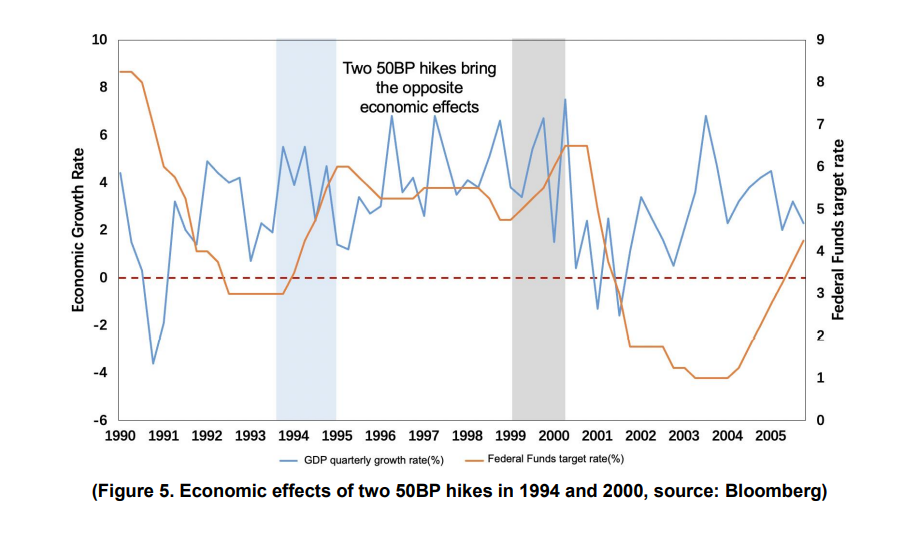

In this context, one of the main points of interest raised by the Federal Open Market Committee (FOMC) in May is whether the Fed will raise interest rates by 50BP.History shows that , the 50BP interest rate hike in 1994 and 2000 produced different effects: the former achieved a soft landing of the US economy and maintained healthy economic growth; the latter punctured the stock market bubble and caused the U.S economy to fall into recession.

Inflation in the United States was already high prior to this impending rate hike. Judging from this, it will not be a precautionary rate hike similar to the one in 1994, and the impact of COVID-19 and the Russian-Ukrainian war also need to be taken into account. This impending rate hike is not expected have a similar effect to 1994 due to current stock market volatility.. Subject to the time lag of the monetary policy, it is expected that the effect of the monetary policy will appear in the cryptocurrency market in the next six months to one year.

I. Fed expected to raise interest rates aggressively; global capital market in turmoil

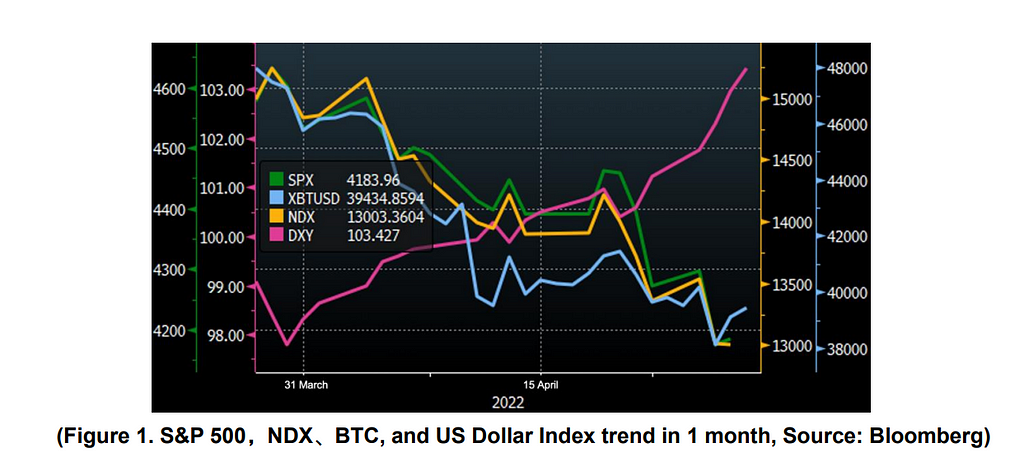

Since April, the performance of the global capital market has not been satisfactory. Be it the S&P 500, Nasdaq 100 or Bitcoin, there has been a certain degree of decline observed. Bitcoin fell from a high of US$48,000 to a low of US$38,000, with a drop of more than 17%. On the other hand, the U.S. dollar continues to show strength, and has now risen above 103.00, hittinga five-year high.

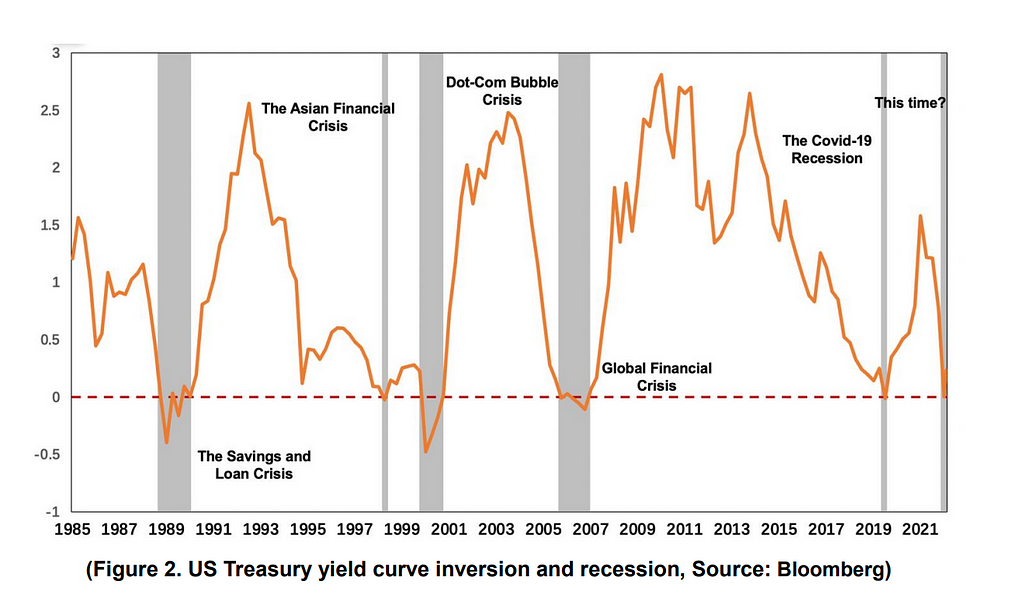

In addition, compared with the decline of the capital market, a more dangerous sign is the emergence of the Inverted Yield Curve, wherethe two-year/ten-year yield curve spread inverted in the last week of March. The Inverted Yield Curve refers to the condition when the two-year treasury yield tops the ten-year rate. In general, the longer the bond’s maturity, the higher its yield. When the yield inversion occurs, it often signals that the market is pessimistic about long-term economic development.

In the past 30 years, the two-year and ten-year U.S. treasury yield curves have inverted five times, which occurred in 1989, 1998, 2000, 2006, and 2019 respectively. These five inversions correspond to five famous crises-the 1990 Savings and Loan Crisis, the 1998 Asian financial crisis , the 2000 Nasdaq Dot-com bubble crisis, the 2008 global financial crisis, and the 2020 COVID-19 economic recession.

While the yield curve inversion remains a controversial measurement , it is still one of the most popular economic recession predictors in the market. The yield curve inversion at the end of March raises concern about whether the global economy will go into recession in the future.

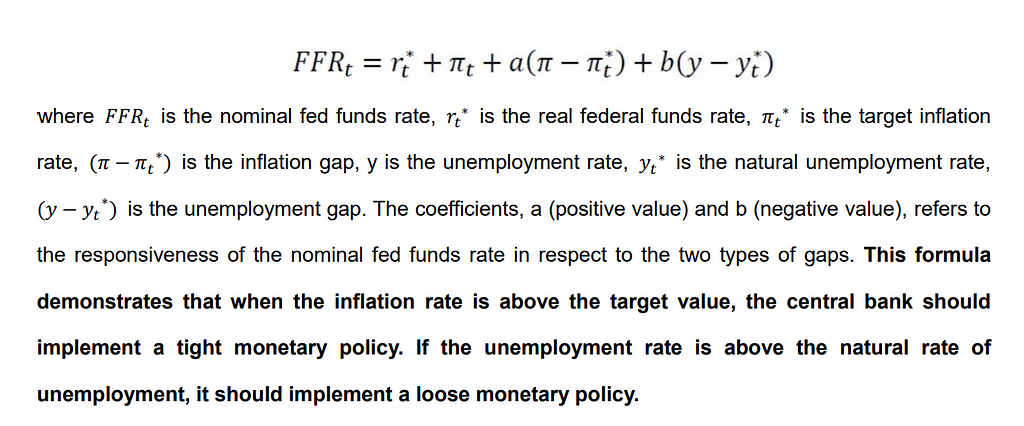

In a volatile capital market,, the reason of a recession intensifying is that the market is expecting the Fed to raise interest rates more aggressively. Before reviewing the reasons for the changes in the Fed’s monetary policy, we need to understand the Fed’s monetary policy decision-making framework — the Taylor Rule. Taylor’s rule is expressed as follows:

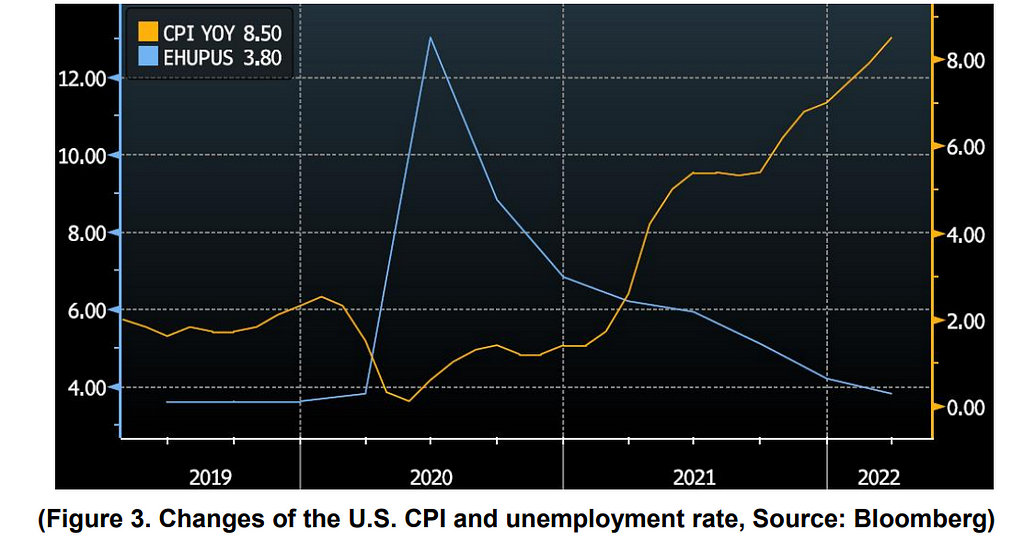

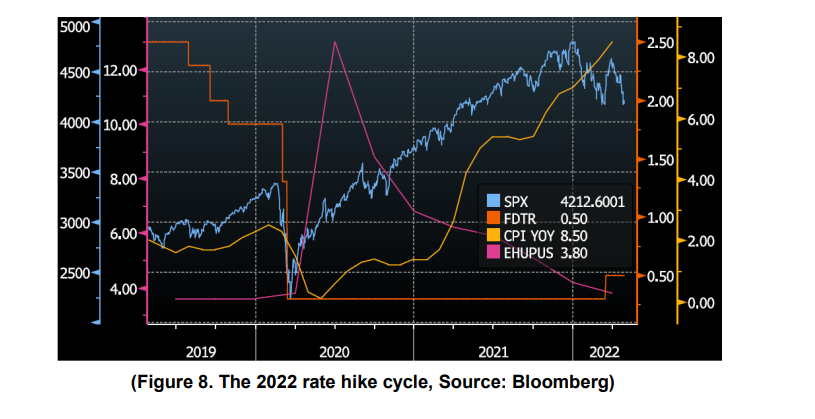

Since 2012, the Federal Reserve has maintained a relatively stable long-term goal for eight years. It consistently holds the inflation rate target of 2% in the long run and reduces its forecast for the long-term natural unemployment rate annually according to the structure and changes of the labor market. In August 2020, the Federal Reserve initially proposed the concept of an average inflation rate. While emphasizing the long-term inflation expectation of 2%, it allowed an inflation rate moderately higher than 2% during a period of time. Therefore, Fed’s tolerance for short-term high inflation has increased. Even so, , the U.S. CPI has repeatedly hit record highs since the second half of 2021. The CPI in March increased by 8.5% year-on-year, which can no longer be explained by “transitory inflation”. On the other hand, the employment market in the U.Scontinues to improve, and the unemployment rate is also gradually declining. The current unemployment rate is 3.8%, returning to pre-pandemic levels.

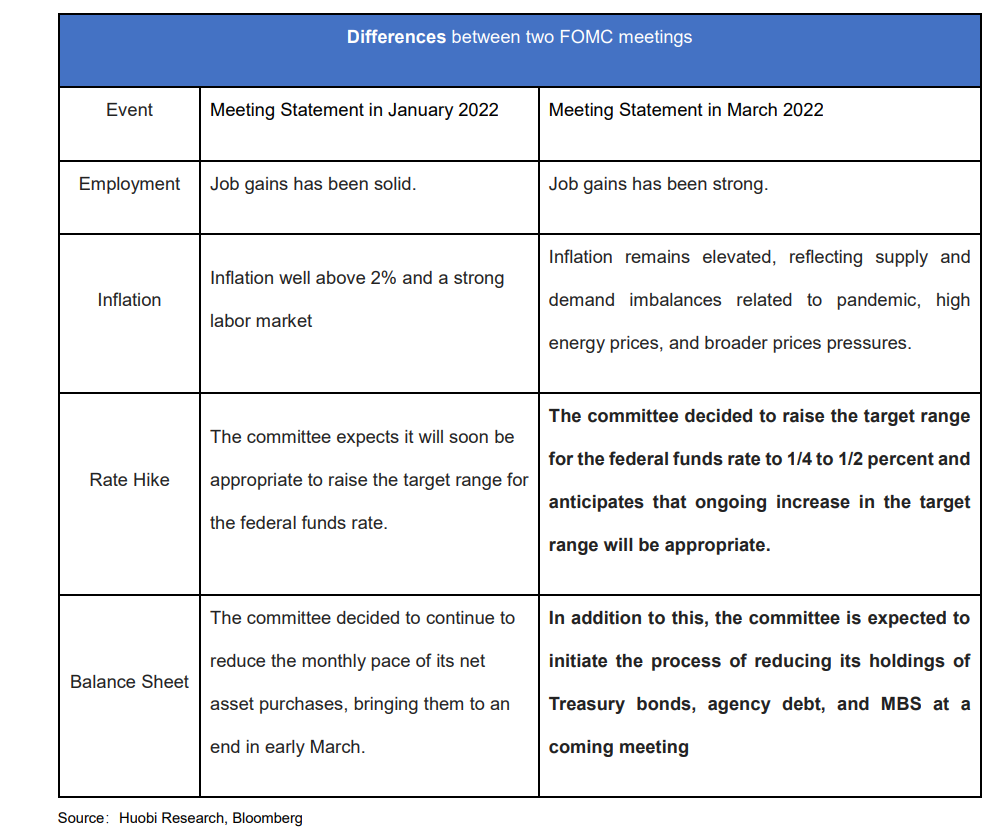

In this case, the Fed’s monetary policy trend has been determined. The clues can also be found from the Fed’s meeting statements in January and March. The Fed has not yet clearly raised interest rates in January, and the measures are relatively modest when it comes to two key indicators of “employment” and “inflation.” However, the wording on “employment” and “inflation” in March statement was more intense, with an explicit increase of interest rate by 25bps and a hint to start a balance sheet reduction.

Table 1. Comparison between FOMC meeting statement in January and March

II. Highlights of the FOMC meeting in May

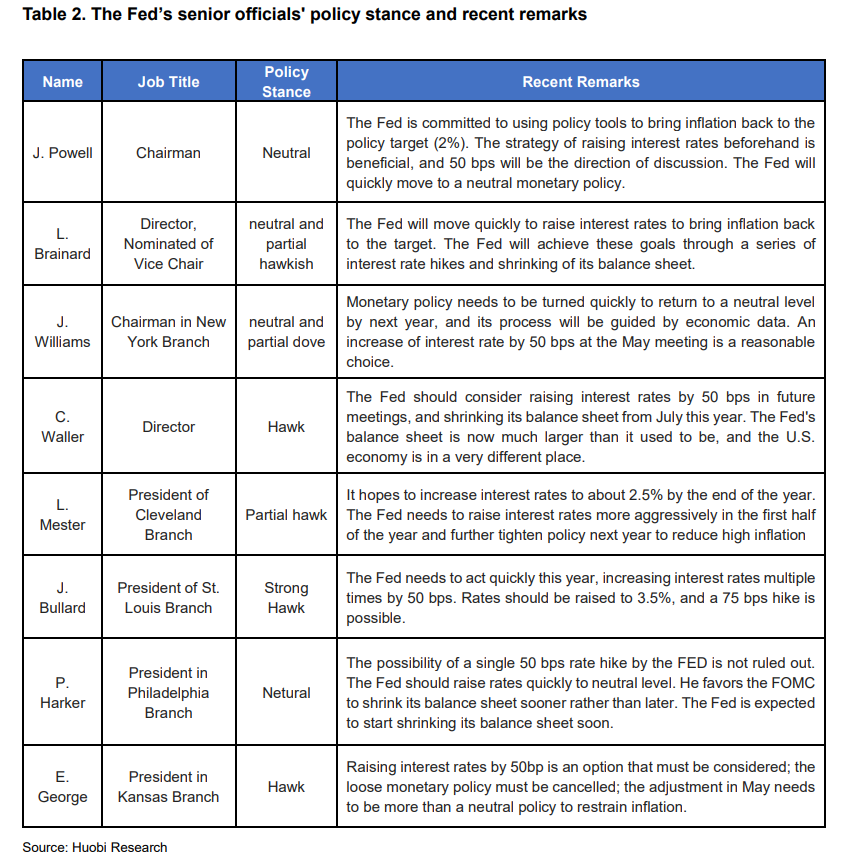

From the decision-making framework of the Taylor Rule, we know that further rate hikes in the May FOMC meeting are being determined. So, is the May FOMC meeting still worth paying attention to? We look at the recent public statements of Fed executives. According to the arrangement of the table below, we can see that the keywords frequently mentioned by Fed officials are “50BP” and “shrinking balance sheet”. These two keywords are also the main highlights of the May FOMC:

Will the Fed increase interest rate by more than 50 bps?

Will the Fed start to shrink its balance sheet? What is the path and scale of the reduced balance sheet?

Guided by the intensive speeches of Fed officials, a 50bp rate hike in May seems to be a certainty, and there are many views that the Fed will hit a combination of “50bp rate hike + balance sheet reduction” in May. In this paper, , we will analyze the impact of a 50BP hike.

Looking back at history, it is not common for the Federal Reserve to raise interest rates by 50bp in a single meeting. In the past 20 years, there have been five interest rate hikes equal to or more than 50, mainly in the two rounds of interest rate hike cycles from February 1994 to February 1995 and June 1999 to May 2000. May 1994 (3.75% to 4.25%), August 1994 (4.25% to 4.75%), November 1994 (4.75% to 5.5%), January 1995 (5.5% to 6%) and May 2000 (6% to 6.5%).

Interestingly, the two 50BP hikes in 1994 and 2000 produced different policy effects. The rate hike in 1994 was exceptionally successful and achieved a “soft landing” of the U.S. economy. The economy continued to grow strongly, and to a certain extent created the economic glory of the 1990s in the U.S. This rate hike was also praised as the “Greenspan Moment.” “. However, the rate hike in 2000 was an unsuccessful one — I t directly punctured the tech bubble in the U.Ss and triggered the 2001 recession. At this critical moment of the impending FOMC interest rate hike in May, we review the two interest rate hikes in 1994 and 2000, and make a forecast analysis of this round of interest rate hike.

(1)Interest rate hike cycle in 1994 (1994.2–1995.2)

After the recession in the early 1990s, the U.S. economy began to recover in 1993, and the quarterly growth rate of the U.S. GDP in Q1 1994 reached 3.4%. It is worth noting that although the U.S economy as a whole is in the process of recovery, ithas not yet shown the characteristics of overheating in 1994.

From the perspective of inflation data, the CPI rose by 2.5% year-on-year in the first quarter of 1994, which was better than the data during the recession in 1991. However, it was still lower than the level before the recession. In addition, the year-on-year CPI growth rate fluctuated in the range of 2.5%-3.2% as a whole, and there was no obvious upward trend. From the unemployment rate data, the unemployment rate reached 6.6% in the first quarter of 1994. It was still at a high level, but the labor market has recovered significantly compared to 1991.

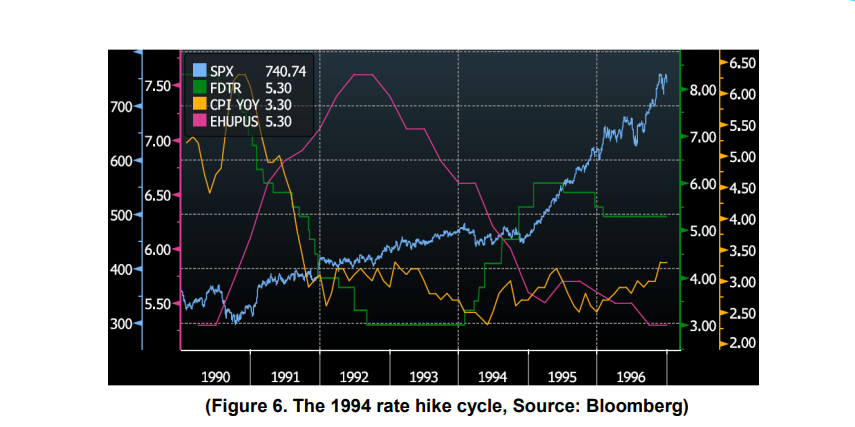

From the above data, it can be seen that when the Federal Reserve started raising interest rates in 1994, the economy had not yet overheated, so in essence, this interest rate hike was a “pre-emptive” precautionary interest rate hike. The Federal Reserve raised interest rates by 25bp in April 1994, and raised interest rates by 50bp in the subsequent interest rate meeting. In November, it raised interest rates by 75bp, and stopped in February 1995. On hindsight, the rate hike was very successful. Themonetary policy smoothed the economic cycle and the economy achieved a “soft landing”. The U.S economy maintained a growth rate of 4%-6%, which was very rare in developed countries. On the other hand, the U.S. stock market remained buoyant during the rate hike, with the S&P 500 rising..

Of course, the success of raising interest rates in 1994, in addition to Greenspan’s “flexible and precise” manipulation, was also inseparable from the stability of the external environment. At that time, the Cold War had just ended. Following the wave of globalization in the 1910s, major countries reached multilateral trade agreements. The countries of the former socialist camp have started economic market-oriented reforms one after another. Internet technology began to develop rapidly, high-tech companies were established one after another, and the global economy was thriving. It is precisely with the stability of the external environment that the U.S economy showed huge potential for growth, which supported the adjustment of monetary policy.

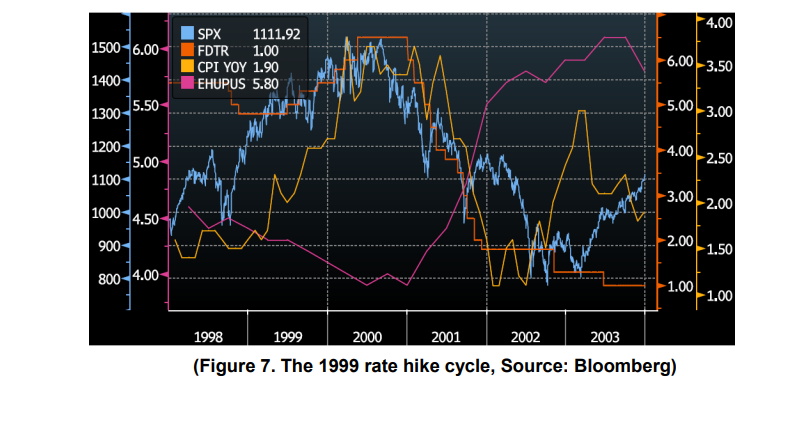

(2)Interest rate hike cycle in 1999 (1999.6–2000.5)

In 1998, the Federal Reserve cut interest rates by 75BP in response to the Asian financial crisis. With low interest rates and the Internet boom at the time, the U.S. economy remained prosperous. Although the U.S. CPI in the second quarter of 1999 only increased by 2% year-on-year, which was at a normal level, the stock market was overheated, especially where technology stocks were wildly sought after by the market,. In view of the above situation, the Federal Reserve raised interest rates by 25BP five times between June 1999 and March 2000, but the CPI and the stock market remained high, and the economy did not cool down. To this end, the Federal Reserve decided to raise interest rates by 50BP to 6.5% in May 2000.

However, this move bursted the Internet bubble. Nearly half a month after raising interest rates by 50BP, U.S. stocks fell by 5% and entered a bear market. Then the U.S. economy entered a recession and unemployment was high. In order to save the economy, the Federal Reserve began an emergency rate cut six months after announcing a 50BP hike. By 2003, the federal funds target rate had fallen to 1%. Although it saved the U.S economy to a certain extent, it also paved the way for the crisis. Low interest rates led to an increase in the scale of housing loans, which became one of the triggers for the subprime mortgage crisis in 2008.

(3)What is the impact of this 50BP hike?

As mentioned earlier, the 50BP interest rate hike in 1994 was successful for two main reasons: one was a precautionary advance rate hike, and the other was a stable external environment. The failure of the 50BP interest rate hike in 2000 was mainly due to the fact that the U.S. stock market was already volatile at that time, and the 9/11 incident in 2001 shook the security and market confidence of the U.S.

Compared to 1994 and 2000, the macroeconomic backdrop in 2022 is volatile and highly uncertain. Since the outbreak of COVID-19 in 2020, the Omicron virus has spread significantly.. Although many countries have eased community and mobility restrictions, China is still imposing large-scale lockdowns as part of its Zero-Covid strategy. This weakened consumer confidence.

In addition, the Russian-Ukrainian war directly affected the supply of oil and natural gas to a large extent, resulting in rising energy costs. Global energy demand has increased and energy prices have risen. At the same time, commodity prices continued to climb. Among the 22 major commodities, nine have seen their prices rise by more than 50% — coffee rose by 91%, cotton rose by 58%, and aluminium rose by 53%. In November 2021, the U.S. inflation rate reached 6.8%,=. At this time, the rate hike is no longer a precautionary rate hike, which happened in 1994. The impact of the COVID-19 and the Russian-Ukrainian war has amplified the uncertainties of the stock market. will The expected effect of this hike will not reach the heights similar to the one in 1994.

III. The impact of interest rate hikes on the cryptocurrency market

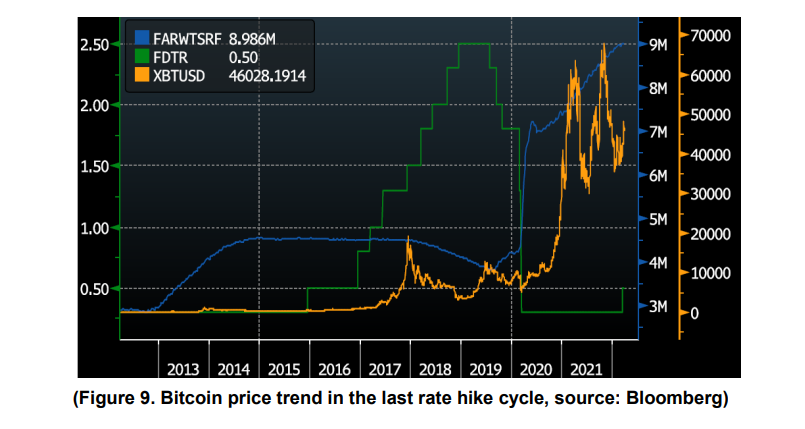

Generally speaking, monetary policy has a certain external time lag, that is, there is a certain time interval from when the monetary authority takes action until it has an impact on the policy objective. According to the statistics of some scholars, it takes an average of nine to 10 months from the change of money supply to the change of economic growth rate or price. For example, the central bank implemented an accommodative monetary policy in March 2020, but the CPI did not start to rise until February 2021.

Judging from the actual situation of the cryptocurrency market, , cryptocurrencies were not affected after the Federal Reserve started raising interest rates in December 2015. Instead, they ushered in a big bull market in 2017. It did not plummet and entered a bear market until nearly a year after the rate hike began (November 2017). Therefore, it is expected that in the six months to one year after the rate hike in March, the effect of the implementation of monetary policy will begin to showin the market.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information), and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Huobi Strategy Weekly Report How will the May FOMC meeting affect Bitcoin (Part 1) was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.