Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin has remained relatively calm after the recent rollercoasters and sits below $39,000. Most altcoins are also in a similar position, with little-to-no decisive moves in either direction. Aside from ALGO, which soared by double digits, Terra and Avalanche are a few other coins with slight gains.

Bitcoin Stalls Below $39K

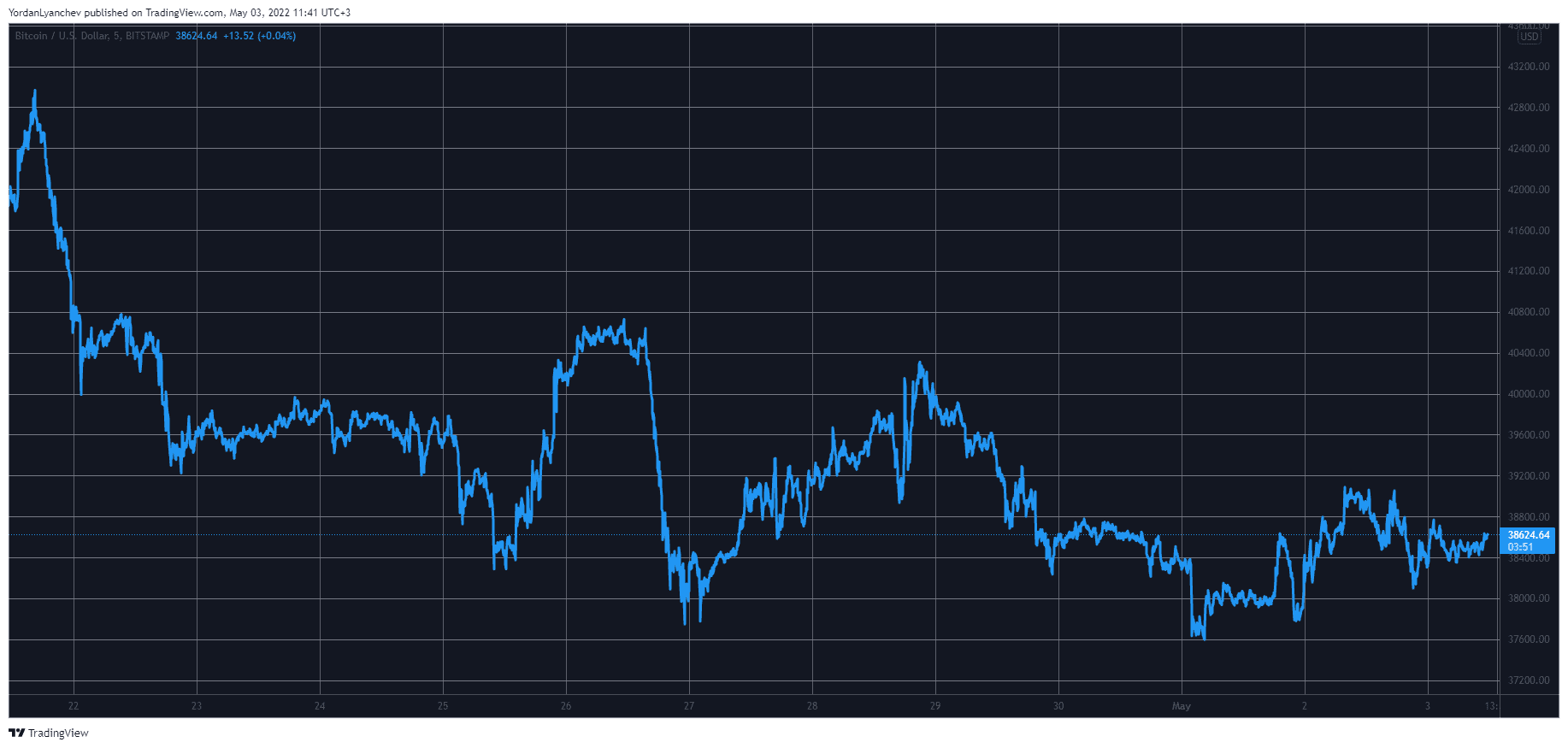

The past several days were rather intense for the primary cryptocurrency as the asset failed at $41,000 on April 26 and headed straight south. In just hours, it lost nearly $3,000 and fell below $38,000.

Despite reacting well to this price drop initially and surging to above $40,000 once more, BTC was once again stopped in its tracks. As a result, it dropped to a two-month low a few days later at just over $37,000.

The bulls tried to initiate a recovery session, which drove BTC to about $39,000, as reported yesterday. However, bitcoin failed to overcome that level and now sits under it.

Consequently, its market capitalization remains well below $750 billion, but its dominance over the alts is just over 42%.

BTCUSD. Source: TradingView

ALGO Leads, Terra Follows

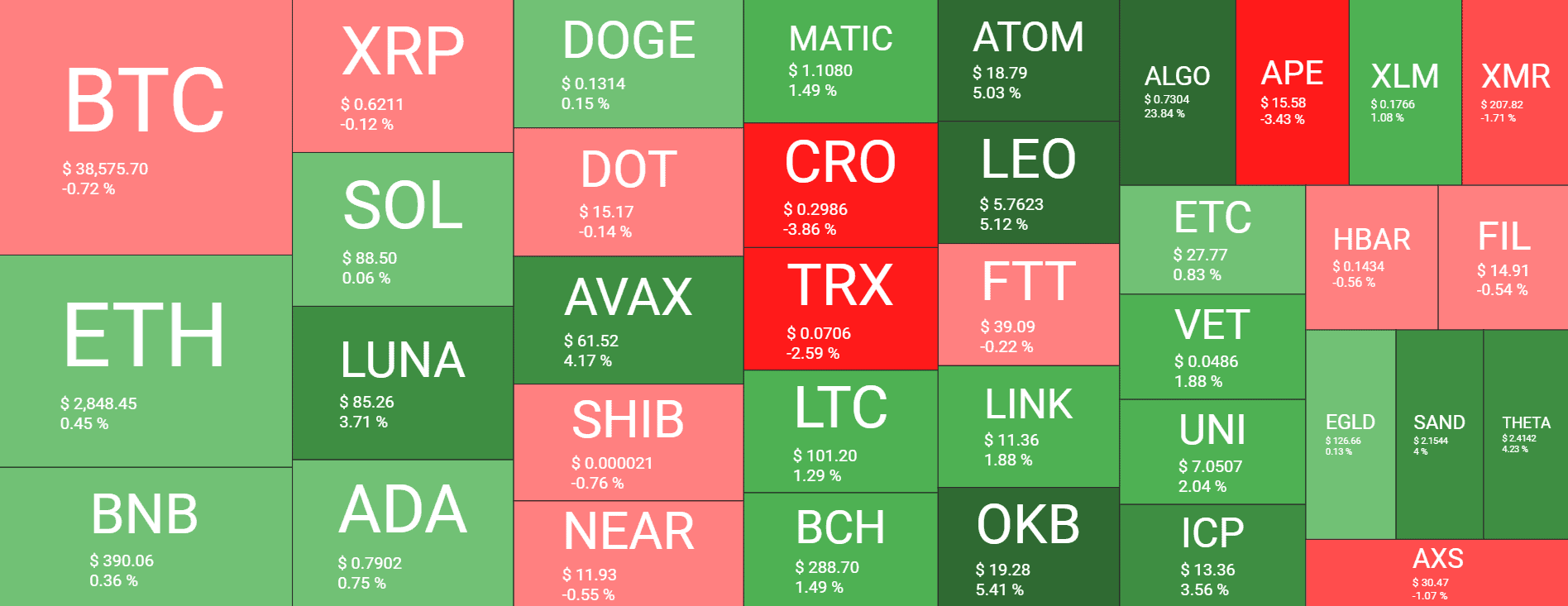

The altcoins have also been in better shape, with most larger-cap ones either with insignificant gains now or slightly in the red.

Ethereum failed at $3,000 last week, and the subsequent rejection drove it south by around $250. It bounced off yesterday, and a minor daily rise now means that the second-largest crypto trades at $2,850.

Binance Coin, Solana, Cardano, and Dogecoin are with minor increases, while Ripple, Polkadot, and Shiba Inu have charted slight declines.

Terra and Avalanche have increased the most from the larger cap alts, with approximately 4% each. As such, LUNA sits at $85, while AVAX is at $61.

Algorand is the most substantial gainer with a massive 24% surge. This came following an impressive partnership with FIFA, which CryptoPotato reported earlier.

The crypto market cap sits relatively calm as well at around $1.750 trillion.

Cryptocurrency Market Overview. Source: Quantify Crypto

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.