Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

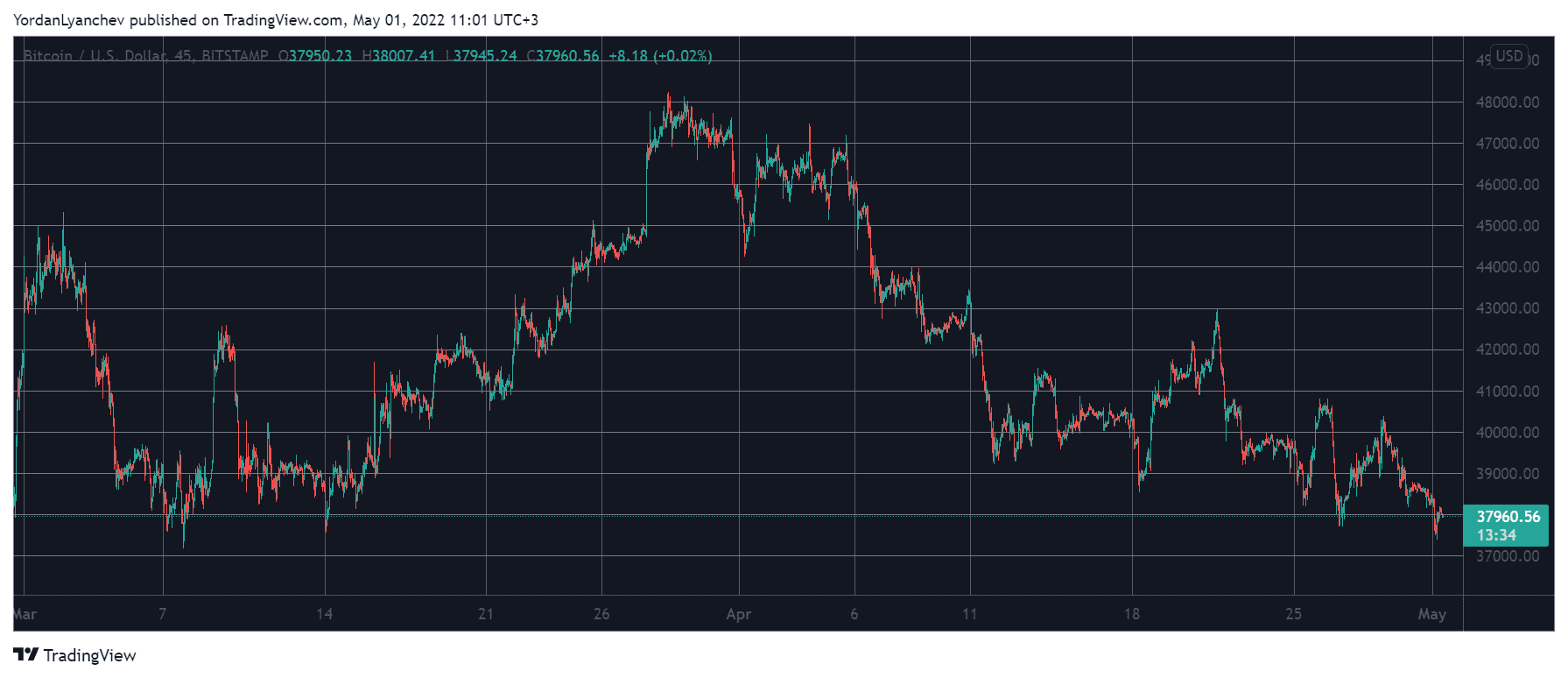

Bitcoin continues to gradually lose value and dropped to a near two-month low of just over $37,000. The altcoins are also deep in the red, with notable price losses from Solana, Cardano, Terra, Polkadot, and many others.

Bitcoin Sees 2-Month Low

It’s safe to say that the primary cryptocurrency has seen better days. In fact, they weren’t all that long ago, as BTC neared $41,000 roughly a week ago but was rejected in its tracks.

The subsequent correction drove the asset south hard, and it lost about $3,000 in hours. However, it reacted well and went on the offensive once more. This time, it spiked above $40,000 again but, just like the previous example, failed to continue upwards.

Instead, bitcoin started losing ground again, fell below the coveted $40,000 line, and dropped to $38,000, as reported yesterday.

The situation worsened in the following 24 hours as BTC dumped below $37,500. This became its lowest price tag since early March.

As of now, bitcoin has regained some traction and stands around $38,000. Nevertheless, its market capitalization has declined to $720 billion.

BTCUSD. Source: TradingView

Alts in Deep Red

The alternative coins are also in bad shape today. Ethereum was riding high several days ago as it stood above $3,000. However, the broader bearish market sentiment pushed the second-largest cryptocurrency south. As of now, ETH stands below $2,800 after another 2% daily decline.

Binance Coin was also sitting above $400 until recently but is now down to $380. Solana, Ripple, Terra, Cardano, Dogecoin, Polkadot, Avalanche, and Shiba Inu are also deep in the red.

ApeCoin has lost the most in a day (-30%) following the sale of BAYC’s Otherside. Fantom, Kava, FIlecoin, Zilliqa, Harmony, Gala, Decentraland, The Sandbox, and THORChain have also declined by double digits.

Consequently, the market cap is down to $1.7 trillion, meaning that the metric has seen $130 billion gone in two days.

Cryptocurrency Market Overview. Source: Quantify Crypto

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.