Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Metaverse is a little known blockchain project that I believe has tremendous potential to make a lasting impact on the cryptocurrency market. Right now, Metaverse has a market cap. of a little over $110mm, but as you read through my write up, you will begin to realize how undervalued this digital currency is in relation to similar projects on the market, namely NEO and Ethereum. CEO Eric Gu is branding Metaverse as the Chinese substitute for Ethereum, and has extensive experience working in the blockchain space on projects like Mastercoin, Bitshares, and NEO. Today, Metaverse is trading at around $3.10 a coin, but because of the extensive drivers of growth that I have identified below, this project could potentially shoot up to $33 a coin.

Basics:

- Launched in June 2017, Metaverse is a leading public blockchain project based in Shanghai, China

- Metaverse is a decentralized smart contract platform based on blockchain technology that allows users to build their own digital identities and register their digital assets. CEO, Eric Gu, plans on turning this project into China’s Ethereum but with the additional capabilities offered by Vinny Langham’s blockchain project, Civic

- This project was launched by a Chinese company, Viewfin.com, but operates independently through the Metaverse Foundation

- The ETP token can be used to measure the value of smart contracts on the Metaverse protocol or as collateral in financial transactions

- Ticker: ETPRanking by Market Cap: 38Market Capitalization: $112,832,863Circulating Supply: 36,386,291 ETPTotal Supply: 55,786,291 ETPMax Supply: 100,000,000 ETPAverage Trading Volume: $3,735,233Allocated to system maintainers (PoW mining): 30 million ETPBlock Time: 24 secondsDev Language: C++Consensus: PoW+PoS

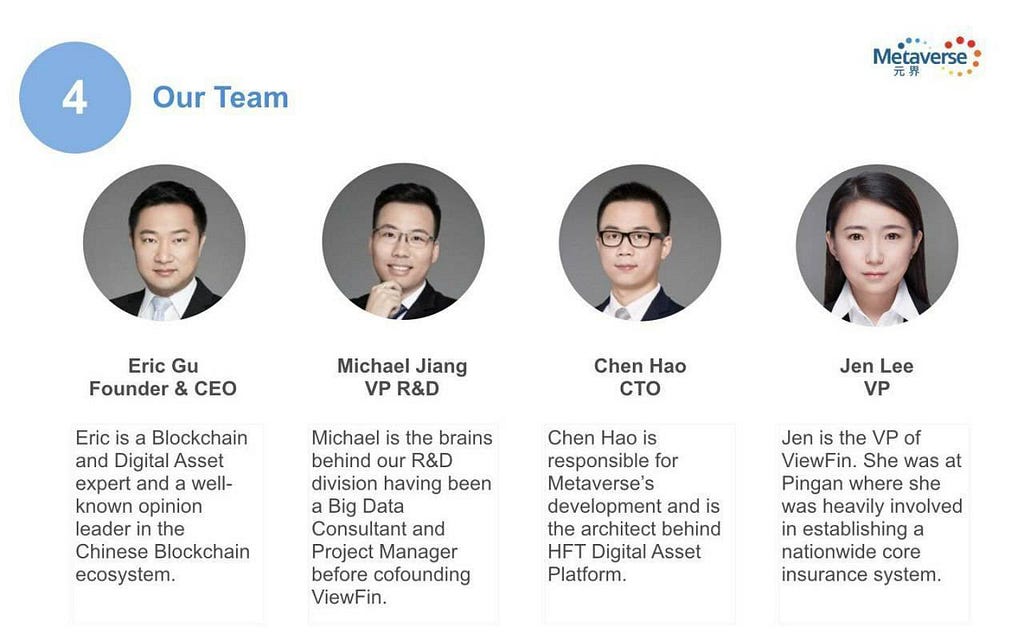

Metaverse Team:

- CEO is Eric Gu. Mr. Gu has more than 20 year of programming experience from the USA, Canada, and China. He started participating in the blockchain community in 2013 with investments in Mastercoin and Bitshares. Mr. Gu was also one of the seven founders of the blockchain project NEO, and in 2014 he went on to launch his own projects, Viewfin.com and Metaverse

- CTO is Hao Chen. Mr. Chen brings more than 15 years of deep technical experience across the entire computing stack from enterprises like Microsoft, Zynga

- Metaverse currently has 5 developers working on this product, not including front-end developers

- The parent company, Viewfin.com, has more than 60 employees and is the same size as NEO’s parent company, OnChain

Drivers of Growth:

- Metaverse has partnered with Moscow’s based KICKICO and investment bank CyberTrust to extent its reach

- After only six months of launching Metaverse, there has been at least 30 companies who have plans to launch Initial Coin Offerings (ICO) on the Metaverse platform. One successfully launched ICO on the Metaverse platform was ZenAir, who has over 100mm customers

- Over the next 12 months, Metaverse plans to conduct about 100 ICO projects on their platform. However, they will be temporarily based in Russia, until the Chinese government resolves the temporary ICO ban. As a point of reference, when NEO announced their first ICO, Red Pulse, NEO surged more than 30% on the announcement

- Metaverse offers the ability to freeze your coins for either a 6 month period, giving you ROI of 8%, or for 1 year period, giving your ROI of 20%

- As previously mentioned, Metaverse is branding themselves as the Chinese substitute for Ethereum (current market cap. — $31,412,020,714). However, Metaverse will also have the digital identity capabilities offered by Civic (current market cap. — $98,780,191)

- Tim Draper recently started an investment fund, DraperDragon, in Silicon Valley to help launch startups on the Metaverse Platform

- CEO Eric Gu was one of the founders of NEO (current market cap. — $1,893,788,000)

- Metaverse allows Chinese people to write code in characters. This is big because Chinese people don’t write in alphabets, they write in characters. So to tell them to write a programming language in alphabets makes it twice as hard

- Metaverse is currently listed on Bitfinex and HitBTC, but plans on having their coin listed on additional platforms. This will increase liquidity and extend its reach to more users

Headwinds:

- Temporary ban of ICO’s by government officials in China make it difficult to gain any transparency on a timeline

- Faces competition from a widely known blockchain project NEO

- Digital currencies are an ever evolving industry that are subject to new and unforeseen regulations

Summary:

Based on the current valuations of projects similar to ETP:

Neo

Price: $29.12Market Cap: $1,892,676,500 Volume: $6,183,424Circulating Supply: 65,000,000 NEOTotal Supply: 100,000,000 NEO

ETH

Price: $329.69Market Cap: $31,573,849,515Volume: $135,368,872Circulating Supply: 95,769,167 ETH

Without incorporating a growth rate my 12 month price target for ETP is:

Current:

Price: $3.10Market Cap $112,832,863Ranking by Market Cap: 38Circulating Supply: 36,386,291 ETP

12 Month Price Target:

Price: $28Market Cap: $1,055,608,148Rank: 12Circulating Supply: 37,700,291 ETP

Taking into account a compound average growth rate of 20% my 12 month price target would be closer to $33 a coin.

I hope you all enjoyed reading my write up or at least see the value in the information that I have outlined above. I’ll be providing insight on more digital currencies on a weekly basis, but will focus more on assets that are outside the top ten coins.

Investment Case for Metaverse (ETP) was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.