Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — April 22, 2022

Australia ETFs expected next week, Morgan Stanley says the Lightning Network allows BTC to compete directly with Visa and the USD, GS and FTX CEOs meet, Russia wants to use BTC for foreign trade, US lawmakers want the EPA to look into POW mining and consolidation continues.

By Jesse Knutson

Halfway

Bitcoin is on pace to squeeze out a modest gain, bouncing after three consecutive weekly losses.

Global stonks saw gains trimmed by hawkish comments from the Fed with Powell reiterating efforts to front-end load inflation-fighting efforts with a possible 50bps rate hike in May.

Policy divergence between the Fed, the ECB, and the BOJ continued to drive the dollar higher with the USD index continuing to trade around 24-month highs and the USD/JPY rocketing to a new 20-year high.

With central banks and policymakers struggling with inflation, Bitcoin is getting closer to its quadrennial supply tightening. The fourth having is estimated to fall on May 4th, 2024, putting Bitcoin almost halfway through the current cycle. The next halving will see the Bitcoin block reward fall from 6.25 BTC to 3.125 BTC.

Supply or Demand?

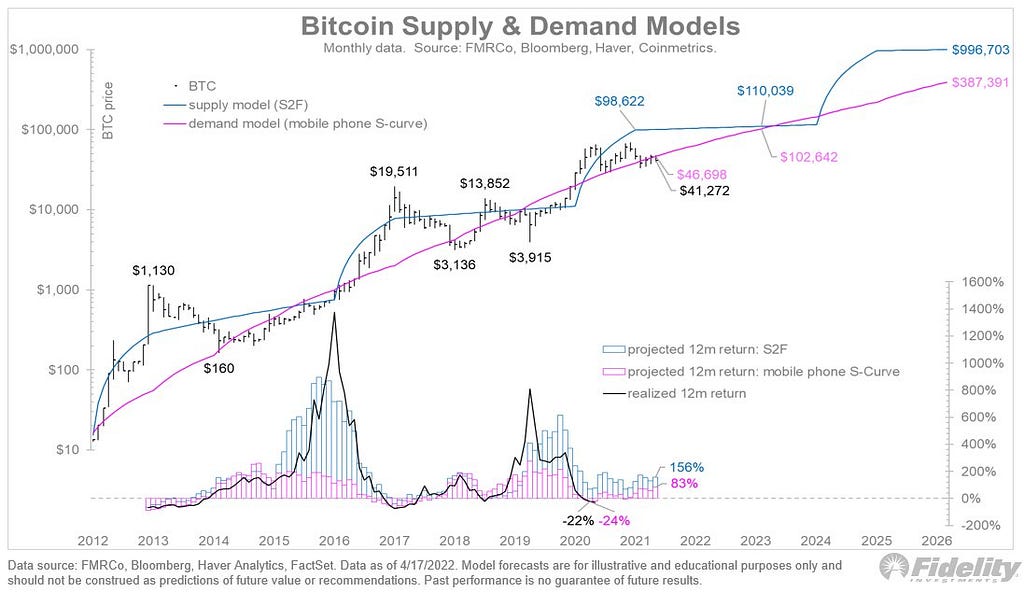

Up until around May of last year, supply-side modeling (Stock to flow) looked to explain a lot of Bitcoin’s price action.

Stock to flow offered a fundamental central point around which price fluctuated in step with Bitcoin’s four-year halving cycles. Fragmented liquidity, aggressive leverage, and a largely retail-driven market drove Bitcoin prices to extremes in bull and bear markets.

Jurrien Timmer, Fidelity’s Director of Global Macro, argued this week that while the stock-to-flow model has been effective in the past, going forward the demand curve will be the more dominant driver (chart below).

With greater institutional participation and a broader recognition of Bitcoin’s value proposition, investors are more likely to buy the dips and sell the moons.

I think this is an interesting observation and probably helps explain why this cycle appears to be so different from previous ones.

Consolidation

As mentioned last week, a relief rally this week was probably to be expected given declines over the previous three weeks. Four-week losing streaks are pretty rare, we haven’t had one of those since June of 2020, so odds were in our favor this week.

Glassnode this week noted a sell-side exhaustion forming from short-term holders that had entered the market after the all-time high, but above the $50,000 mark.

As highlighted last week, Bitcoin pullbacks have a tendency to wash out weak hands and concentrate ownership in very, very reluctant sellers.

Bitcoin has been bouncing between $36,000 and $50,000 for most of the past 80 days. This is already one of the longest periods of consolidation in years. The 50% correction from the all-time high has significantly reshuffled ownership and concentrated more Bitcoin in the hands of very reluctant sellers.

Given the length of the current period of consolidation, odds are we’re probably getting close to some sort of resolution.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Bitcoin ETFs approved for launch down under

- Cosmos Asset Management and 21Shares both have ETFs in the regulatory pipeline that are expected to see a green light next week

- My understanding is that regulators are expecting to approve a number of ETFs (to avoid playing kingmaker). There’s probably more coming than the two listed in the article above.

- Cosmos’ Dan Annan commented that there is a lot of pent-up demand in Australia for this type of product. Globally,

MS: Bitcoin and the LN compete directly with Visa and USD.

- Morgan Stanley’s note follows Strike’s announcement at Bitcoin 2022 that they had partnered with a number of major retail payment platforms

“In essence, Strike is directly competing with Visa Direct, which offers real time settlement. The main difference for merchants will be charged a much lower transaction fee while the benefit to the consumer is that they can, if they want, host their bitcoin on a private, secure network, allowing an element of privacy associated with their transaction”

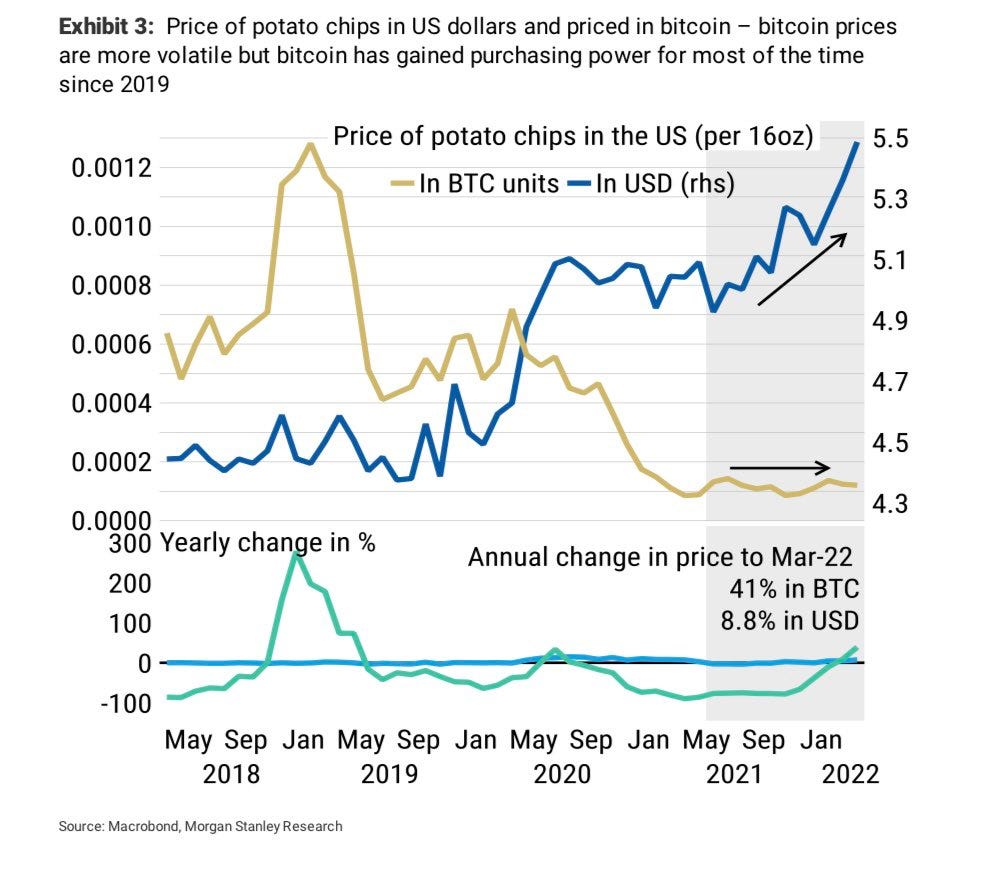

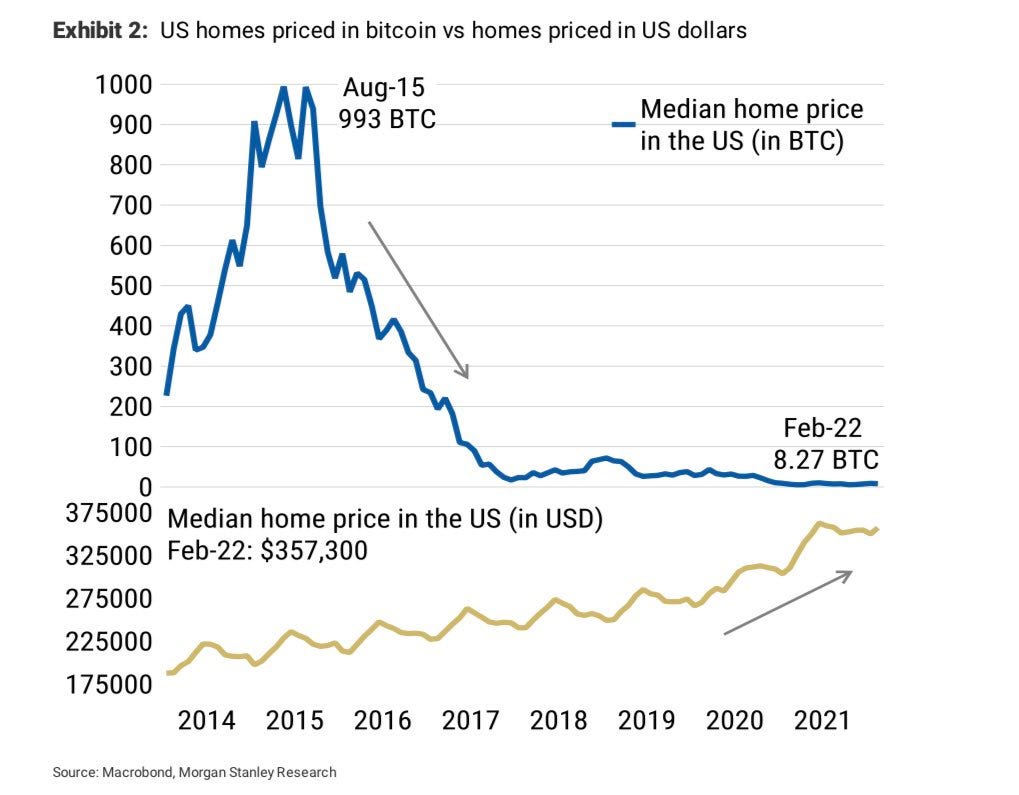

- Some good charts are also in the note that I’ve included below. The main theme is that while Bitcoin remains volatile, long term Bitcoin holders have seen purchasing power increase over time

Russia’s Tax Authority argues for BTC to be used in foreign trade

- The Russian Federal Tax Service has made a suggestion for the bill “On Digital Currency,” proposing that entities be allowed to engage in foreign trade using bitcoin and crypto

Goldman Sachs and FTX CEOs meet

- Sam Bankman-Fried and David Solomon discussed Goldman Sachs advising FTX in talks with U.S. regulators and a possible IPO

- The two chief executives discussed Goldman Sachs advising FTX, which was valued at $32 billion in January, on future funding rounds and taking a role in a potential initial public offering (IPO)

- The two also discussed collaborating on market making in crypto trades

- The herd is coming…

Tesla’s Bitcoin position remains unchanged

- Tesla’s quarterly report shows its Bitcoin position has remained unchanged for the fourth consecutive quarter

- Overall, 1Q EPS came in at $3.22 versus the $2.26 expected by analysts

- Revenue came in at $18.8 billion against the $17.85 billion expected

- Tesla holds a total of 43,200 BTC

Bank of Canada: Bitcoin investors are financially illiterate

- The Bank of Canada also sold off virtually all of its gold reserves in 2016, Canada has one of the highest government debt to GDP ratios in the world, and government policies have fuelled one of the largest gaps between real estate prices and incomes in the G7….so….who’s the illiterate?

- ‘The experts’ are getting kind of mean…last week a study revealed that Bitcoiners tend to score high in narcissism, Machiavellianism, psychopathy, and sadism

US lawmakers want the EPA to look into Bitcoin mining

- U.S. lawmakers have called on the Environmental Protection Agency (EPA) to look into Crypto mining

- U.S House of Representatives member Jared Huffman and others sent a letter to the EPA raising concerns over Bitcoin mining in the U.S.

“PoW mining relies on massive server farms, which, in addition to contributing to significant greenhouse gas emissions, results in major electronic waste challenges due to the highly specialized and short-lived computing hardware needed to secure the network.”

- Swedish financial regulators and the European Commission have also reportedly discussed the possibility of banning POW mining

Charts

Consolidation

- Eyeballing recent periods of consolidation, it looks like the current period is one of the longest in the past couple of years

- Given the length, odds are we’re probably getting close to some sort of resolution

- I’ve shown the chart below in log to allow the earlier periods to be readable. It’s also worth noting that we’re seeing higher lows (red= rolling 50-day low) and that price looks to be constricting in a triangular pattern

Supply and Demand

- Jurrien Timmer, Fidelity’s Director of Global Macro, notes that Bitcoin price looks to be tracking a demand curve more than the stock-to-flow model

- Timmer uses a mobile phone s-curve to forecast Bitcoin price

- He sees Bitcoin’s intrinsic value at around $50k currently and around $100,000 two years out

Chart credit: Jurrien Timmer

Purchasing power — 1

- While Bitcoin remains volatile, long term Bitcoin holders have seen purchasing power increase over time

Chart credit: Morgan Stanley Research

Purchasing power — 2

- While Bitcoin remains volatile, long term Bitcoin holders have seen purchasing power increase over time

Chart credit: Morgan Stanley Research

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — April 22, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.