Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

After being involved in the cryptocurrency space for the last couple of years, I have made three observations. Believe me, I have gathered this information by making sure that at every social gathering I attend, Bitcoin is the topic of conversation. Through this experience, I have found that the people who don’t believe cryptocurrencies will work are the ones who:

- Don’t understand how money is created in our current financial system

- Have the most to lose from the success of cryptocurrencies, like our friend Jamie Dimon

- Just don’t understand the technology at all, so they fear what they don’t know

Who controls the money supply in the United States?

Who controls the money supply in the United States?

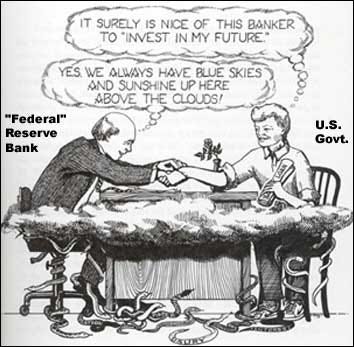

Well, most people do know that the Federal Reserve Bank controls the money supply through the monetary policy. However, the majority of the population believes that the Federal Reserve Bank is a government entity. IT IS NOT!!! The federal reserve bank is a private entity and like other private corporations, it has shareholders that receive an annual 6% dividend.

Who are the shareholders of the Federal Reserve Bank?

The Wall Street Banks of course. Which ones? “Oh, we’re so sorry that’s private information”, but I’m sure you can make some guesses.

So, let’s think about that. We have a private entity controlling the money supply for the United States government. Anyone else thinks that the Wall Street Banks may have an alternative agenda, other than the well being of the American people? I sure do. Don’t forget to thank these guys for all the lives they ruined in 2008 while getting away scot-free.

I’m sure many of you have heard the Federal Reserve Bank using a 2% target inflation rate, but what does this really mean?

I’m sure many of you have heard the Federal Reserve Bank using a 2% target inflation rate, but what does this really mean?

Using a 2% inflation target basically means that the dollar in your pocket becomes 2% less valuable than the year before. Don’t believe me. In 1913, the Federal Reserve Bank came into existence with legislation from Congress. In that year, $1 could buy you 16 loafs of bread. Today, that same dollar cannot even buy you one slice of bread. Feel free to thank Wall Street for that. However, what will eventually happen is hyperinflation, exactly what we see happening in Zimbabwe and Venezuela today (That’s why Bitcoin trades at 2x the value in these countries). It might not happen in 20, 50, or even 100 years, but it will eventually happen because our current system is broken.

Ever wonder what happens to your $100 when it’s deposited in the bank? Many think it sits in a vault, doesn’t it?

ABSOLUTELY NOT!! For every $100 that you deposit into the bank. They turn around and lend out $94 dollars of your hard earned money to someone like, Joe, who needs to pay his bills. Joe takes that $94 and puts that into his account, the bank turns around and lends out another $88 to Sally. This cycle continues until someone blows the whistle. Essentially, once your hard earned money gets deposited into your bank account, it is no longer really yours. Big banks know they are about to lose their control of the United States money supply and they will do whatever they can to prevent it.

Do you think it is a coincidence that New York State has the toughest laws against Bitcoin?

Out of 50 states, New York State is the only one that requires businesses to apply for a Bit-license to operate any kind of legal entity relating to cryptocurrency. This is the work of the deep seeded financial influence in the state. Banks know they are in trouble and want to make it as difficult as possible for cryptocurrencies to succeed.

The mainstream media has also done an incredible job of portraying Bitcoin as a means to fund criminal activity. But, let me ask you? What is the most commonly used financial instrument in illicit markets today?

It’s not Bitcoin. It’s actually the U.S. Dollar. However, it is true that Bitcoin can be used similar to the Dollar, but just because people have found a negative application of the technology doesn’t make it “dark money”. Think about how the Russians applied Facebook’s technology to influence the U.S. elections. Do we think of Facebook as the “dark web”? Certainly not. It’s the common fallacy of people fear what they don’t know.

Why are banks so scared of cryptocurrencies like Bitcoin?

Why are banks so scared of cryptocurrencies like Bitcoin?

They are many reasons, but I will give you some of the main points here.

- It is completely decentralized. There is not one company or person or entity that owns or controls Bitcoin. It is a peer-to-peer system, like so many of our other beloved apps — Uber, Postmates, Airbnb, etc but without the centralization

- There are only two ways to stop Bitcoin. You can either shut off the internet or turn off the world’s power grid. Those are the only ways you can stop Bitcoin. Yes, you can hinder its growth with premature regulations but you cannot stop it.

- It is free from any type of monetary policy or political influence. Imagine your money actually being yours. What a crazy thought. Also, this makes Bitcoin a perfect candidate for a universal currency or reserve currency.

- Every single transaction that happens on the blockchain is visible for people around the world to see and your identity is hidden by a long string of letters and numbers, similar to a person’s bank account number.

- Today, credit cards charge customers 3–5% of the total transaction amount and take 3–5 business days for the funds to settle. Does that seem ancient to anyone else? Cryptocurrency transactions can be broadcasted instantly, so you know when your funds have been sent or received right away, and cryptocurrencies cost less than .25% for each transaction.

Just as a heads up. Now that you are aware of these benefits, anytime you read an article claiming that a Wall Street Bank or some form of Government is going to issue their own form of digital currency to dethrone Bitcoin, you can go ahead and stop reading it. Because either the author or their sources have no idea what they are talking about.

Summary

In the simplest sense, cryptocurrencies take all the benefits of cash, gold, and credit card payment networks, while leaving all the negatives behind. Cryptocurrencies can settle all transactions, big or small, instantly, like cash, while recording the transactions in the blockchain. Cryptocurrencies can hold and transfer value, like gold, but without the cost and hassle of buying and storing gold bullion. Cryptocurrencies can send or receive money anywhere in the world, like credit card payment networks, while doing so at the fraction of the cost.

Today, it seems like everyone has not only an opinion on Bitcoin but also a price target. There are countless bankers out there who say Bitcoin is overvalued and that it is the bubble of the century, but never in our life time have we seen technology like this. This is hands down the most innovative technology since the invention of the internet, because blockchain is a transformative technology that can be applied to every single industry.

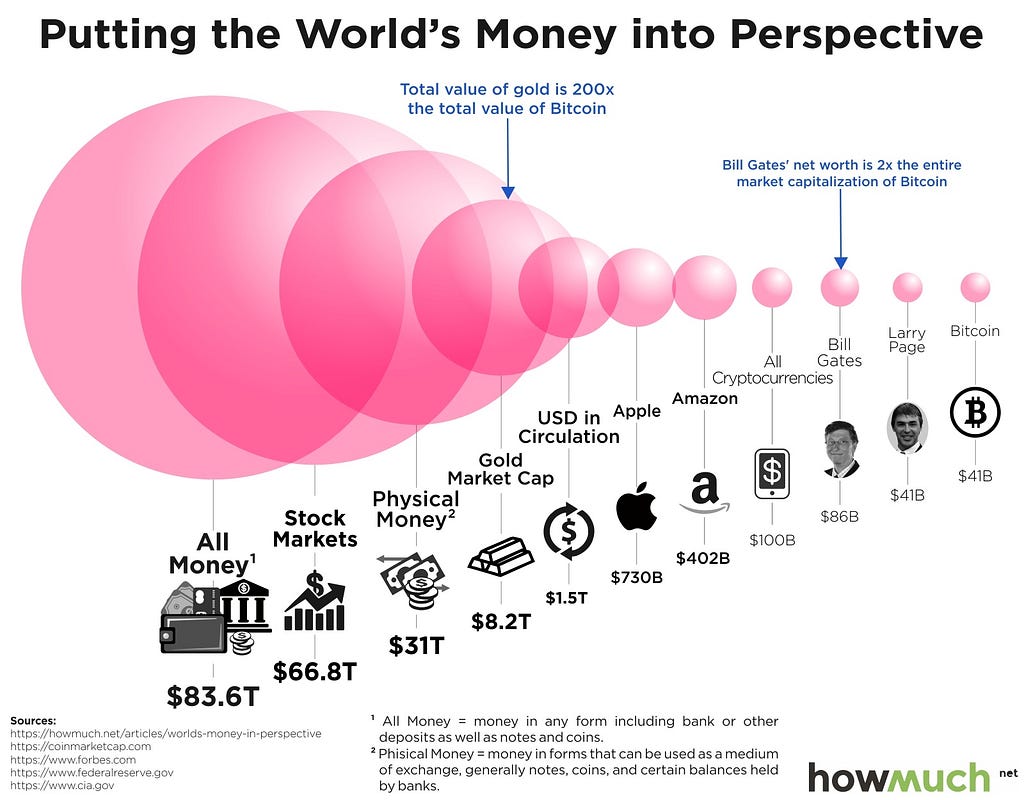

What if we took the market capitalization of Bitcoin and analyzed it through a proper lens? As previously mentioned, cryptocurrencies, like Bitcoin, take the form of cash, gold, and credit card payment networks. Well, let’s break this down.

Monetary Base of the United States: $4 Trillion Dollars

Value of the World’s Gold Market: $8 Trillion Dollars

Value of Credit Payment Networks: Let’s use our national debt of $22 Trillion Dollars

Total: $34 Trillion Dollars

Market Capitalization of Bitcoin: $191 Billion Dollars

Difference: $34 Trillion — $191 Billion = Plenty of Room to Grow

Thank you!

I hope you guys enjoyed this weeks write up! I had an amazing 5K people read my last week’s post and I appreciate all the kind words. Next week, I’ll turn my focus back to digger deeper into some of the smaller coins in the market.

Why We Need Bitcoin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.