Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — March 4, 2022

BMN trading goes live, Swiss city legalizes BTC and USDT, Mexico could follow El Salvador, Bill Miller & Novo see Ukraine conflict as bullish for BTC, and the EU scraps plan to ban POW as BTC rips back above $40,000.

By Jesse Knutson

May you live in interesting times

Bitcoin is on pace to end the week solidly above $40,000 for one of the best weekly gains of the past six months.

Bitcoin’s rebound this week was driven by a 14.5% jump early in the week — the largest single-day move in 13 months and a nice last-minute save for February as a whole. All in, February ended +12.2% for the first up month after three consecutive red candles.

Newsflow this week was light with macro and geopolitics dominating headlines.

Traditional markets were volatile on the back of escalating violence in Ukraine, unprecedented sanctions imposed on Russia, and rate hike concerns. Commodities gained to a 6.5 year high after one of the biggest weekly moves on record, the USD gained to a 14 month high, gold-sputtered at $1,950 resistance, global stocks continued to slide and the Russian Rubble imploded — falling to its lowest level ever.

New money

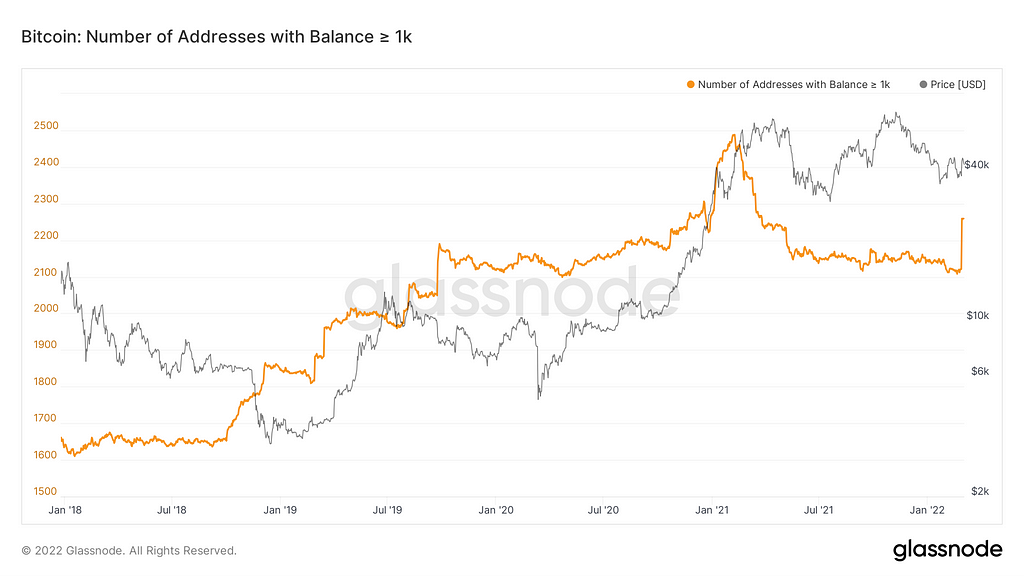

Data from Glassnode this week showed one of the largest, fastest upticks in large wallet growth on record.

It looks like this growth was clustered in very large wallets, those with more than 1,000 BTC. While Glassnode’s co-founder, Rafael Schultze-Kraft, was quick to dismiss the data as related to adjustments to custodial wallets, that wouldn’t explain the ~ 15% single-day price move.

Given the news flow around Russian sanctions — to me — this looks more like an influx of new money.

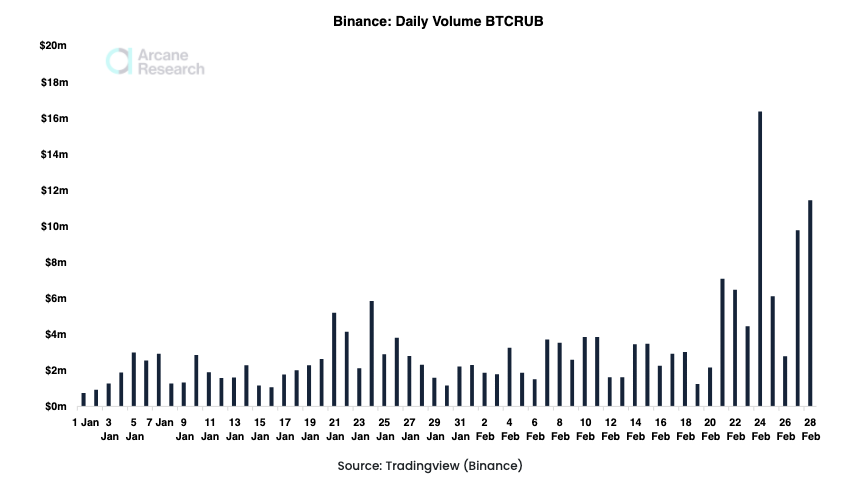

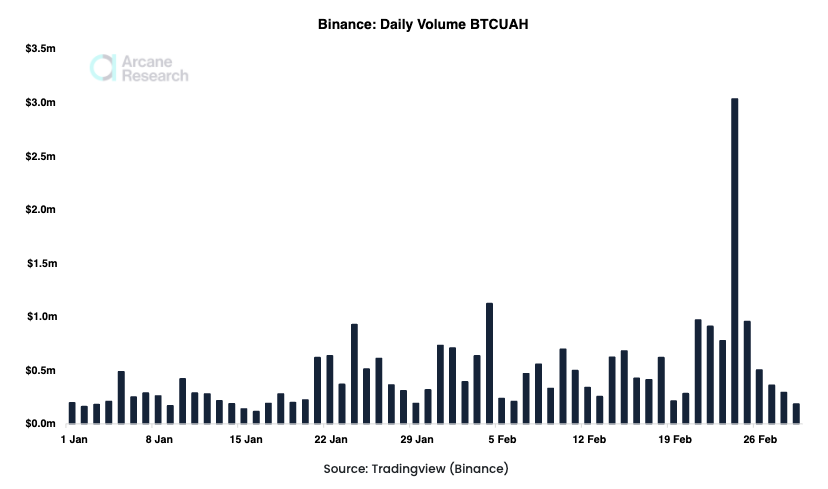

A note from Arcane Research this week highlighted that both Ukrainians and Russians have looked to Bitcoin and Tether as a safe haven as the conflict continues and capital controls intensify.

Hyperbitcoinization

With the US and its allies announcing unprecedented sanctions against Russia, the war in Ukraine looks like it could evolve into a war for global currency hegemony.

An escalation of economic tensions between Russia and the West is a very real potential inflection point for a larger global discussion about the fiat system in general. Russia and China are likely keen on a reset of the global banking system. With Russia locked out of SWIFT and its economic options narrowing, a closer relationship with China looks likely. That could mean a sharp uptick in non-USD denominated transactions.

While I’m sure BTC isn’t the solution China or Russia currently have in mind, for the first time in a very long time global de-dollarization is a very real possibility. Even Federal Reserve Chairman Jerome Powell admitted this week that it was possible to have more than one large reserve currency.

For individuals, who have been caught up as collateral damage between geopolitical competitors, Bitcoin looks like one of the few outs. As billionaire investor Bill Miller commented this week, decentralized, censorship-resistant money offers a refuge of last resort when the traditional banking system breaks down.

It might make sense to get some…

Looking forward, Bitcoin’s return above the $40,000 level is an encouraging first step.

But as mentioned over the last couple of weeks, the $45,000-$50,000 level is also a major area of resistance given how much volume has accumulated there over the last 12 or 13 months.

Again, there’s a lot going on in the world and an unprecedented degree of volatility and uncertainty in markets. What happens next is really anyone’s guess.

That said, Bitcoin’s value proposition is on display for the world to see and I think today, more than ever before, investors of all kinds and creeds are coming to see the importance of digital, decentralized, censorship-resistant, hard money.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

BMN secondary trading goes live on Bitfinex Securities

- Marks the first asset listed on Bitfinex’s new STO platform

- The Blockstream Mining Note has now issued a total of ~ $45M over eight tranches

Brrrrrrr…..Biden asks congress for another $32.5B

- The Biden administration on Thursday unveiled a $32.5 billion emergency plan to help Ukraine respond to Russia’s military invasion and provide more money to fight the COVID-19 pandemic

Canada lifts rates 25bps, Powell says rate hikes are coming

- The Bank of Canada hiked interest rates for the first time since October 2018 on Wednesday — from a record low of 0.25% to 0.5% — and said they would need to go higher despite increased uncertainty following Russia’s invasion of Ukraine

- Fed Chairman Jerome Powell said kind of the same thing…he still sees interest rate hikes ahead though he noted the “implications for the U.S. economy are highly uncertain” from the Ukraine war

- Analysts and economists are expecting five 25bps rate hikes starting from later this month

Mexico could follow El Salvador on Bitcoin

- Former Blockstream CSO, Samson Mow, recently left the firm to focus on facilitating sovereign Bitcoin adoption

“I’m working with people from a number of countries and it’s still too early to say for sure but bitcoin adoption in some form will be inevitable”

- Samson noted that Mexico is on the list

Swiss town of Lugano adopts Bitcoin and Tether as legal currency

- Reads primarily as a proof of concept with Tether and Lugano looking to showcase real-world use cases for digital asset payments

- Tether is also partnering with universities and research centers and starting a fund to support related startups

Senator Ted Cruz: Texas should be ground zero for Bitcoin

- Cruz has been a vocal advocate of Bitcoin in the past

Billionaire investor, Bill Miller, says Russia conflict is bullish Bitcoin

“They (Russia) have almost 50% of their reserves in currencies that are controlled by people who want to do them harm…they have 22% in gold that is the only part of their reserve that other countries can’t control…It’s very bullish for Bitcoin.”

Novo: Russia-Ukraine will boost BTC, drive de-dollarization

- Mike Novogratz, CEO of digital assets company Galaxy Investment Partners, predicted that the Russia-Ukraine war will boost crypto adoption and lead to the marginalization of the dollar.

“This is a big deal, in a lot of ways. This is starting the acceleration of de-dollarization of the world”

Bitcoin set for first negative difficulty adjustment since November

- Mining difficulty undergoes automatic adjustment every 2,016 blocks, or roughly every two weeks, to maintain a target block time of 10 minutes

- The difficulty adjustment follows a ~ 10% drop in hashrate from the February peak of ~ 215 EH

- I think the decrease in hashrate was driven initially by a crackdown in unregistered mining in Kazakhstan. Although it’s unclear to what degree the Ukraine-Russia conflict is impacting miners, I think that’s probably also a factor as well

The EU is no longer considering a ban on POW-based assets

- The lawmakers of the European Union have deleted a passage that called for a ban on Bitcoin and other crypto-assets that rely on the PoW blockchain-based algorithm

- The original passage argued that no cryptocurrencies could be created, sold, or traded within the European Union region that does not follow environmentally sustainable consensus mechanisms

Citadel Securities to start trading BTC and crypto this year

- Citadel is a top 10 hedge fund with ~ $37B in assets under management

- Founder Ken Griffen said he was wrong about Bitcoin and other digital assets

“The crypto market today has a market capitalization of about $2 trillion in round numbers, which tells you that I haven’t been right on this call?

Charts

New Money

- Bitcoin wallets ≥ 1,000 BTC saw one of the largest increases on record this week

Chart credit: Glassnode

Russians bought a lot of BTC this week

- Both Ukrainians and Russians have looked to Bitcoin and Tether as a safe haven as the conflict continues and capital controls intensify

Chart credit: Arcane Research

Ukrainians bought a lot of BTC this week

- Both Ukrainians and Russians have looked to Bitcoin and Tether as a safe haven as the conflict continues and capital controls intensify

Chart credit: Arcane Research

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — March 4, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.