Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — March 11, 2022

Biden executive order overhang clears, CS: money will never be the same — and BTC will benefit, S Korea elects BTC friendly president, Dubai passes new crypto regs, Skybridge reiterates $500K price target and the White House says 40M Americans have skin in the game.

By Jesse Knutson

Roller Coaster

Bitcoin is on pace for the second green weekly candle in a row. Trading remained a roller coaster ride with Bitcoin on track to end in the middle of a 15% range.

Traditional markets remained volatile with commodities spiking to a nine-year high, the London Metal Exchange pausing Nickel trading after a 250% surge to above $100,000, gold briefly breaking above $2,000, stonks tanking for the second straight week and inflation data refreshing a new 40-year high.

New World Order

Credit Suisse’s short-term rate strategist, Zoltan Pozsar, had an interesting note out this week.

Pozsar says that we are witnessing the birth of Bretton Woods III, and the early days of a new world (monetary) order anchored on commodity-based currencies. He sees this new system as weakening the Eurodollar and driving inflation in the West.

Pozsar thinks that the seizure of Russia’s FX reserves by the G7 was an inflection point signaling the beginning of the end of the legacy monetary system. From a credit perspective, what had previously been thought of as risk-free is now subject to a not insignificant degree of confiscation risk.

In Bitcoiner terms; not your keys, not your coins.

Meanwhile, in Beijing, de-dollarization probably looks a lot easier now than ever.

The note concludes that Bitcoin will likely be a beneficiary of this shake-up.

Consolidation

As noted by Jurrien Timmer, Fidelity’s Director of Global Macro, Bitcoin is currently stuck in a triangular consolidation pattern and there’s really not much new to say until price breaks out in one direction or the other.

Dragging this formation out to its apex, we could potentially see consolidation continue into April before we get a definitive resolution.

At the risk of reiterating my comments over the previous few weeks, the Bitcoin value proposition is becoming increasingly on display for the world to see. Record inflation, de-dollarization, and what looks like the early days of a new global monetary order make for chaotic markets, but as Credit Suisse noted this week — Bitcoin will probably benefit from all of this.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Bitcoin pumps as Biden executive order overhang clears

- After weeks of speculation around the possibility of new draconian controls incoming, the order looks to have taken a broadly supportive stance toward the industry

- Travis Kling, CEO at Ikigai Asset Management, said:

″[It’s] unequivocally bullish for the crypto ecosystem over all timeframes…It’s easy to lose sight of how much ground this ecosystem has covered in the last two years in terms of legitimacy and stance from the US government, but this E.O. makes it clear the US government is not banning crypto, it is embracing it.”

Credit Suisse: Money will never be the same, Bitcoin will benefit

- Zoltan Pozsar, global head of short-term interest strategy with Credit Suisse, said the crisis-level crunch could eventually benefit Bitcoin after the current market bedlam passes

- Read the full note here

“We are witnessing the birth of Bretton Woods III — a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West…“Money’ will never be the same again…and Bitcoin (if it still exists then) will probably benefit from all this.”

South Korea elects a Bitcoin-friendly president

- On Thursday, the leader of South Korea’s People Power Party, Yoon Suk-yeol, clinched a narrow victory over the incumbent Democratic Party’s candidate to become the country’s new president, securing roughly 49% of the popular vote

- He had previously pledged to raise the threshold for paying capital gains tax on earnings from Bitcoin and other cryptocurrencies

Dubai introduces new crypto law, establishes regulatory authority

- Dubai’s ruler, Sheikh Mohammed Bin Rashid announced on Wednesday that the emirate has enacted its first law governing virtual assets and has also formed an independent regulator to regulate the cryptocurrency sector

“Adopting the virtual assets law and establishing the Dubai Virtual Assets Regulatory Authority is an essential step that establishes the UAE’s position in this sector, a step that aims to help the sector grow and protect investors”

- Seem to be hearing a lot of buzz out of the Middle East in the broader digital asset industry. It’s an interesting region given its deep pools of capital and long-standing efforts to diversify away from oil

Skybridge’s Scaramucci reiterates $500,000 BTC price target

- Scaramucci says Bitcoin will hit $100,000 in the next two years before eventually gaining to $500,000

- $100k in ≤ two years is probably fairly high probability

White House: 40 million Americans have skin in the game

- I think this is probably an important political constituency that crosses traditional party and demographic groupings

“Surveys suggest that around 16 percent of adult Americans — approximately 40 million people — have invested in, traded, or used cryptocurrencies”

Charts

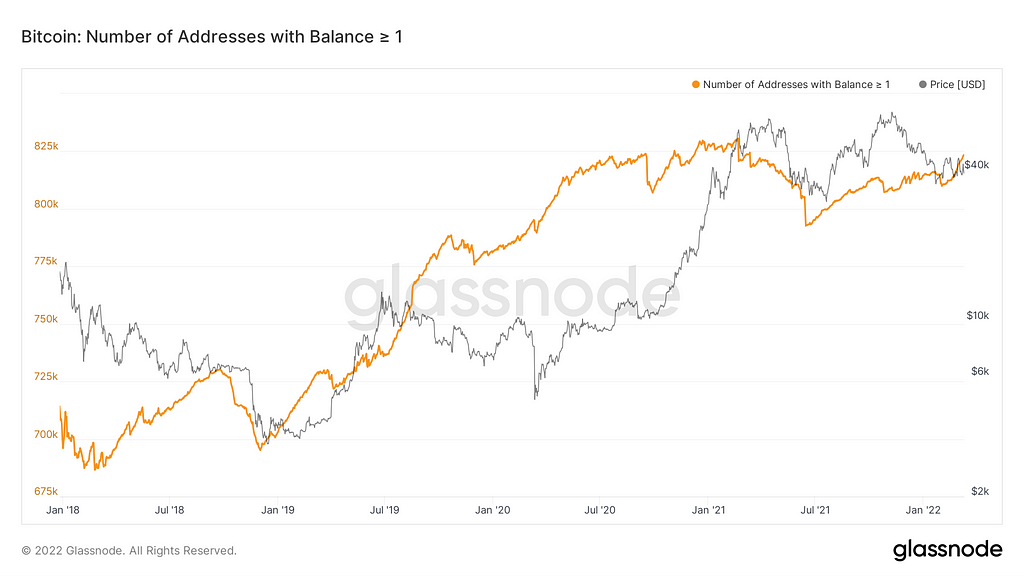

BTC Addresses ≥ 1

- The number of Bitcoin wallets ≥ 1 BTC have started to accelerate

- Looks a bit like Oct 2020 and July 2021

Chart credit: Glassnode

Consolidation

- As noted by Jurrien Timmer, Fidelity’s Director of Global Macro, Bitcoin is currently stuck in a triangular consolidation pattern

- Dragging this formation out to its apex, we could potentially see consolidation continue into April before we get a definitive resolution

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — March 11, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.