Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — March 18, 2022

IMF wants to block BTC adoption, Bill Gross warms to BTC, EU votes down POW ban, Hut 8 posts record ’21 results, Riot sees year of mining consolidation and BTC regains footing north of $40,000 as consolidation continues.

By Jesse Knutson

Hikes

Bitcoin is on track to extend several weeks of consolidation. Trading remained choppy with Bitcoin continuing to oscillate around the $40,000 mark. Price action was mostly positive this week, though, with BTC recovering back above $40,000 and currently on pace for the best weekly win in six weeks.

Markets looked to mostly shrug off a 25bps rate hike from the Fed, the first increase since December 2018. In total, seven hikes are expected in 2022, which should bring the Fed Funds rate to 1.9% by the end of the year.

The dollar fell, crude recovered back above $100 and global stonks were mostly higher. Global equities saw some big moves this week with Chinese stonks retreating somewhat after ripping 21% earlier in the week for the biggest two-day gain since 1998 and US stonks posting the best three-day streak since November 2020.

Divergence

Bitcoin has looked amazingly resilient over the last 50-days gaining ~ 10% while US tech stocks have fallen as much as -20%. Given Bitcoin’s volatility and correlation with equities throughout the course of 2021, you’d expect it to be trading much, much worse.

Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, suggested this divergence may be a major step forward in Bitcoin’s maturation as markets go risk-off and safe-haven assets look set to outperform.

Historically rate-hike cycles have been supportive of gold. McGlone sees that as positive for Bitcoin and expects Bitcoin to continue to demonstrate outperformance relative to gold.

De-dollarization

Last week I highlighted a note from Credit Suisse’s short-term rate strategist, Zoltan Pozsar.

Pozsar thinks that the seizure of Russia’s FX reserves by the G7 was an inflection point signaling the beginning of the end of the legacy monetary system.

This week we saw more signs of de-dollarization with reports that Saudi Arabia was considering accepting Yuan instead of dollars for Chinese oil sales. This seems like a potentially massive crack in USD reserve currency status given that ~80% of global oil sales are done in USD and that Saudi oil has traded exclusively in USD since the mid-1970s.

Aggressive sanctions probably have a lot of central banks recalculating the risk/reward of the petrodollar system now that the downside is total forfeiture. Cracks in the incumbent system are good for upstarts like Bitcoin and the Yuan.

Interestingly, one area where USD demand continues to grow is stablecoins. The total market cap of all USD stable coins is now up to $190B — a new all-time high.

Green shoots

Bitcoin is currently stuck in the tightest, most prolonged consolidation pattern since 2Q21.

Interestingly, Bitcoin’s fear and greed sentiment index has also been below 30 for most of the past 100 days — the longest run of very bad sentiment since 2018.

Given the backdrop of a very long run of very bad sentiment, it’s tentatively encouraging to see signs of US institutional buying, higher lows, resilience relative to stonks, and a continued increase of Bitcoin in wallets that have a low historic propensity to sell.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

The IMF aims to block BTC adoption in Latin America

- An MOU between Argentina and the IMF targets discouraging the use of cryptocurrencies as part of a plan to extend Argentina's payment terms

- In 2021, Chainalysis ranked Argentina as a global top 10 market for crypto adoption

“To better safeguard financial stability, we are taking measures with the aim of discouraging the use of cryptocurrencies with a view to preventing money laundering, informality, and disintermediation”

- Preventing informality and disintermediation?

Bond King Bill Gross bets on Bitcoin

- Gross, 77, co-founded California-based Pimco in 1971 and rose to the pinnacle of the financial world after building it into a fixed-income behemoth

- Gross has been a long time crypto skeptic but seems to have come to see the value of Bitcoin

“I simply think that you know, the crypto coins are a bubble. I do think there are survivors…I do think we need an alternative to the dollar as we’ve seen in the last week or two and that you know, there will be several survivors and I’m invested to a small extent in bitcoin.”

EU votes down proposed proof of work ban

- The European Union has rejected a proposed rule that could have banned Bitcoin across the union

- The draft proposal on limiting PoW received backlash from the cryptocurrency community, wallet provider Ledger said in a statement:

“Individuals and organizations should be free to choose the technology most appropriate to their needs. Policymakers should neither impose nor discriminate in favor of a particular technology. This is deeply concerning and would have serious consequences for Europe”

Hut 8 posts record-breaking 2021 revenue

- Full-year 2021 revenues came in at $173.8M, +327% YoY

- BTC on the balance sheet increased to 5,518 BTC

Riot Blockchain consolidation in Bitcoin mining sector

“We anticipate that 2022 will be a year of consolidation in the Bitcoin mining industry, and we believe that, given our relative position in the competitive landscape, we are likely positioned to benefit from this consolidation.”

- Not much in terms of additional color on this statement, but I think it’s in line with previous comments from other miners. I think the consensus view is for Bitcoin price and hash rate growth to weigh on margins

- I think that hash rate will probably continue to be constrained by chip shortages to some degree, but also on power availability. Miners with access to power could possibly benefit from slower than forecast growth in hashrate

Senator Warren wants a bill to limit Bitcoin interaction with Russia

- Warren’s proposed Digital Assets Sanctions Compliance Enhancement Act would require US exchanges not to transact with crypto addresses affiliated with persons headquartered or domiciled in the Russian Federation

- Another section will also require FinCEN to require transaction reporting from individuals within the US who transact more than $10,000 worth of crypto through accounts outside of the US

Market cap of gold-backed tokens gains to USD $1B

- Follows golds brief breakout above the $2,000 mark last week

- PAXG currently has > $614M worth of gold under management while Tether’s XAUT has gained to just shy of $480M

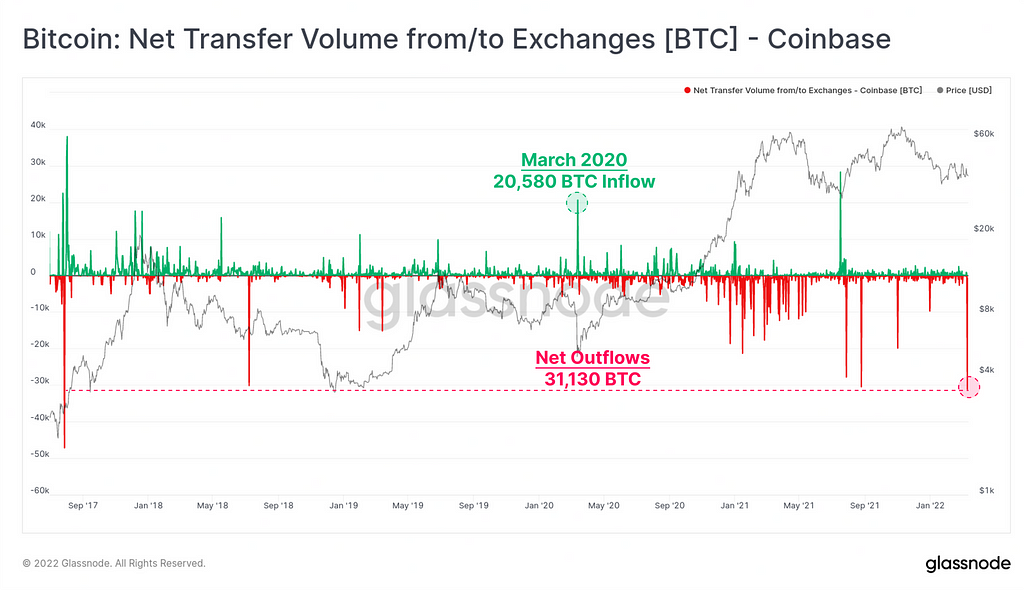

$1.2B of Bitcoin reportedly pulled off of Coinbase

- Glassnode noted that Coinbase saw a very large net outflow this week, totaling 31,130 BTC ($1.18B)

- This is the largest net outflow since 28-July-2017

- Given Coinbase’s dominance in the US OTC market, this is thought to indicate Buying from US institutional investors

Fed hikes rates for the first time since 2018

- The U.S. central bank lifted its benchmark Federal Funds Rate by 0.25%, to a target range of between 0.25% and 0.50%

- projections released by the policy-setting Federal Open Market Committee signal the likelihood of the Fed raising rates up to six more times this year (which would mean rates 1.75% higher at the end of this year than last)

- The median expectation is for rates to be between 2.5% and 3% by the end of 2024

Charts

Higher lows

- On a 50-day rolling basis, we saw the first uptick in price lows this week since November of last year (red line)

- Price continues to work itself deeper into the wedge of the triangle highlighted last week

Large Coinbase net outflow

- Glassnode noted that Coinbase saw a very large net outflow this week, totaling 31,130 BTC ($1.18B)

- This is the largest net outflow since 28-July-2017

- Given Coinbase’s dominance in the US OTC market, this is thought to indicate Buying from US institutional investors

Chart credit: Glassnode Insights

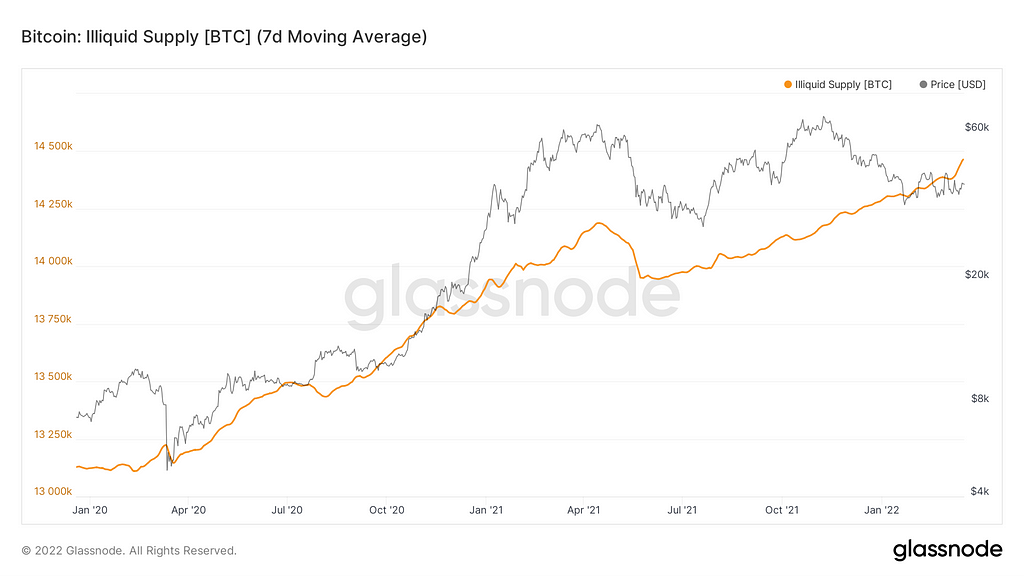

Illiquid Supply

- It looks like these coins contributed to an uptick in the total illiquid supply

- Suggesting that these withdrawn coins have been moved into a wallet with little-to-no history of spending…diamond hands!

Chart credit: Glassnode Insights

A long run of very bad sentiment

- Bitcoin’s fear and greed sentiment index has been below 30 for most of the past 100 days — the longest run of very bad sentiment since 2018

Chart credit: LookintoBitcoin.com

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — March 18, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.