Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — March 25, 2022

Russia considers trading oil for BTC, gas giant Exxon looking to expand flare gas mining unit, UST said to buy billions of BTC, Florida to accept BTC, Bitcoin exchange outflows largest since Jan, as futures premium shows signs of life.

By Jesse Knutson

Up only

Bitcoin is on track for its second consecutive week of gains and on pace to end at the top end of the year-to-date range.

Positive newsflow was buoyed by a rally in global stonks as the Bitcoin fear and greed sentiment indicator recovered to just shy of a month-to-date high.

Top stories this week included reports that Russia is considering selling oil and gas for Bitcoin, speculation that stablecoin UST could buy US$ billions of Bitcoin, Exxon considering an expansion of its flare gas mining business, a continuation of exchange outflows, and Goldman Sachs’ main website highlighting crypto.

Futures and options expiry today was relatively uneventful, with Bitcoin wobbling slightly before regaining lost ground and rallying north of $45,000 for the best print in more than three weeks.

Contango

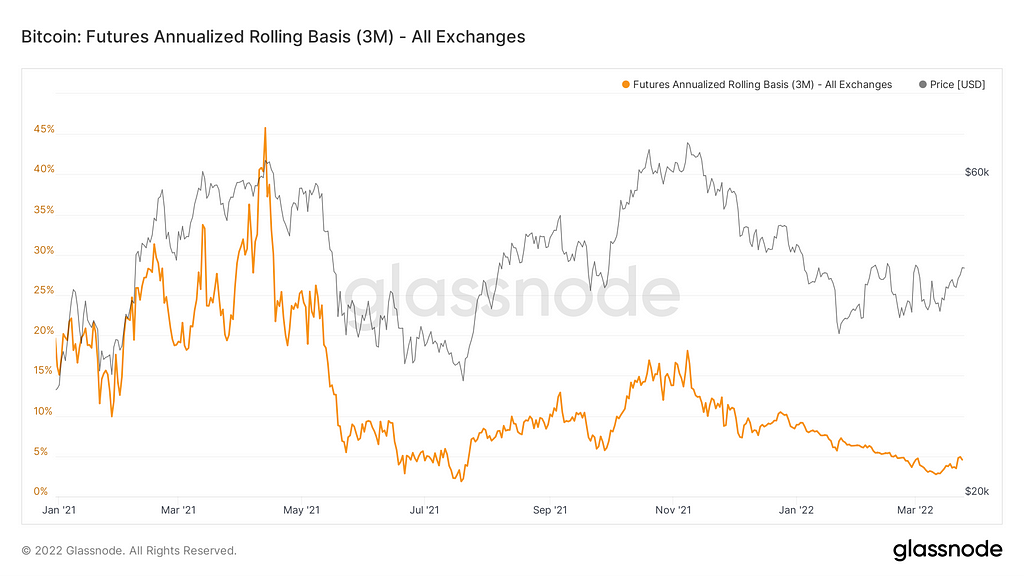

The annualized rolling premium in three-month Bitcoin futures showed signs of life this week after falling to a 20 month low of < 3% earlier in the month.

Bitcoin futures have historically traded at a significant premium to Bitcoin’s spot price and the cash carry trade has been one of Bitcoin’s best arbitrage strategies.

Over the past 365 days, the premium in three-month Bitcoin futures has averaged ~ 11% annualized across exchanges, and during the bull market of March and April 2021, the premium was consistently above 25%.

I think this is an interesting sentiment indicator — given that as Bitcoin regains momentum, investors have a tendency to expect further gains, father out, driving an expansion of the premium.

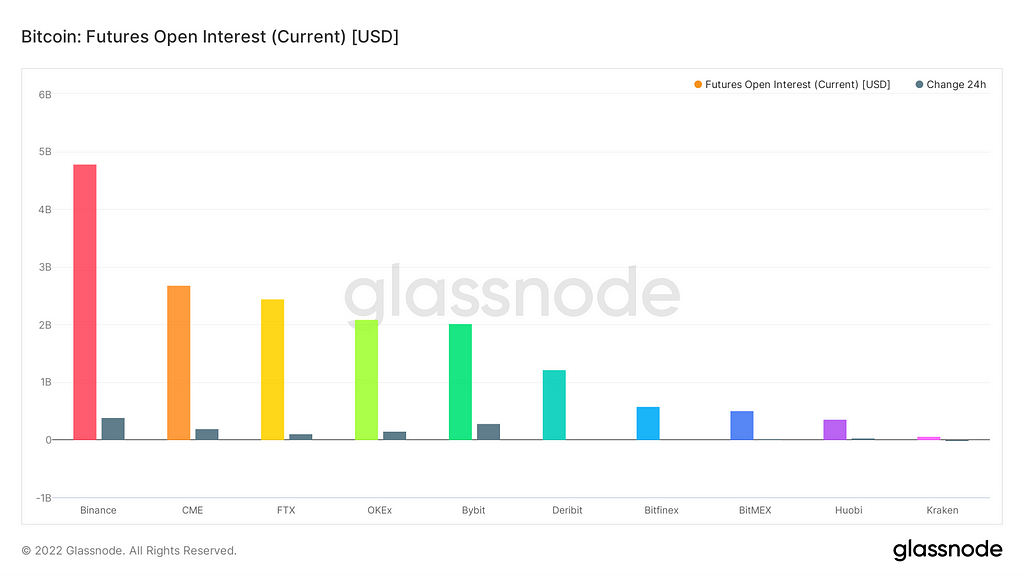

It’s also worth noting that a significant chunk of institutional exposure to Bitcoin comes through CME futures (CME is probably the biggest player in the futures space by open interest — chart below), so I think is potentially also an indicator of institutional interest.

Squeeze

Bitcoin looks to be re-building a pretty solid base above the $40,000 mark. We’ve now been above $40,000 for 10 days consecutively, the longest stretch since mid-February.

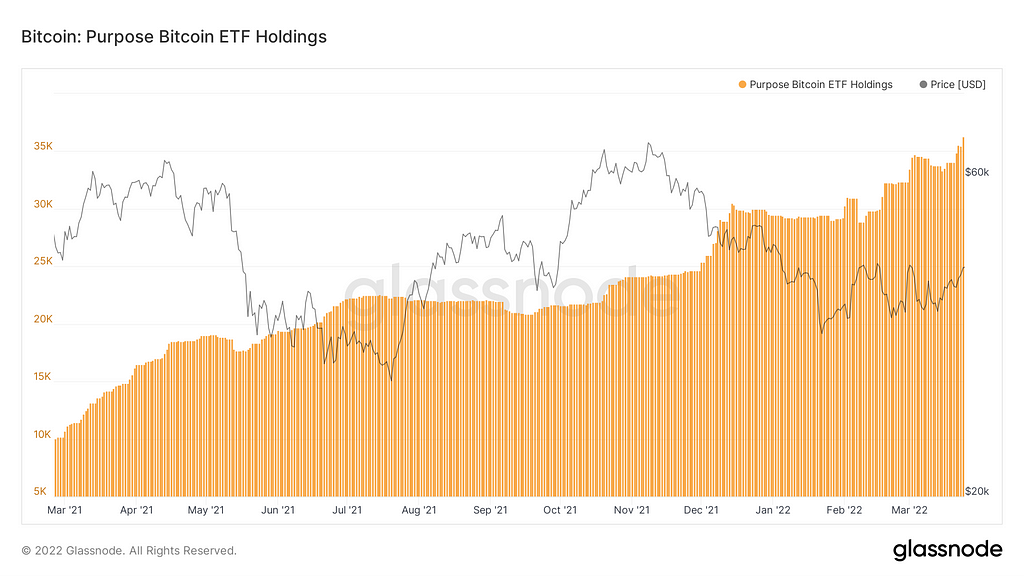

Fund flows also look to be improving with the Purpose BTC ETF seeing a net inflow of more than 2,500 BTC in the past 10 days and hitting an all-time high of 36,272 BTC under management.

Volatility, as measured by Bollinger bandwidth, fell to the second-lowest level of the year this week and already looks to be mean reverting setting us up for a bit of a volatility squeeze.

Given the higher lows we mentioned last week, the recovery in the Bitcoin futures premium, and a sharp pick up in fund flows it feels likely that this volatility squeeze will resolve itself to the upside.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Russia considers selling oil and gas for Bitcoin

- Russia is reportedly considering accepting Bitcoin as payment for oil and gas exports as Western sanctions stiffen

- The article mentioned that both the national currency of the buyer and Bitcoin were being considered and mentions Turkey and China as ‘friendly countries’ and potential trade partners (would probably want to take BTC from Turkey)

Exxon considers taking gas-to-Bitcoin pilot to four countries

- The oil giant launched its Bakken crypto pilot in January 2021

- Exxon is running a pilot program using excess natural gas that would otherwise be burned off from North Dakota oil wells

- Exxon, the largest U.S. oil producer, is considering similar pilots in Alaska, the Qua Iboe Terminal in Nigeria, Argentina’s Vaca Muerta shale field, Guyana, and Germany

Terra will reportedly buy US$ billions of Bitcoin to back stablecoin

- Lots of very big numbers are being thrown around here with the long term plan being to build a $10B Bitcoin reserve for the UST stable coin

- Terra reportedly recently sent $125M USD to exchanges to facilitate BTC buys

- TerraUSD (UST) is a stablecoin that isn’t backed by US dollars in a bank account, but by a process of burning LUNA tokens

India’s crypto tax rules likely to pass this week

- The proposals include a 30% capital gains tax a 1% tax deducted at source

- The bill is expected to pass as it is despite a fair bit of push back on the 1% TDS in particular

Florida Gov. DeSantis: ‘We Will Accept Bitcoin’ for state taxes

- At a signing ceremony Tuesday for a bill to mandate high school financial literacy classes, DeSantis said:

“I’ve told the state agencies to figure out ways where if a business wants to pay tax in cryptocurrency to Florida, we should be willing to accept that…We will accept Bitcoin, we’re working on doing that, for payments in the state of Florida.”

J Pow highlights risks of digital finance

- The Federal Reserve chair called for more crypto regulations during a panel this week

- He said that regulations were not designed for digital finance and that regulations must be updated and created anew

- Powell also discussed concerns around financial stability, investor protection, and illicit activity as related to cryptocurrency

El Salvador delays Bitcoin Bond release

- President Nayib Bukele says the short delay is because El Salvador is prioritizing a congressional review of pension reform plans

- And still plans to issue the Bitcoin Bond with Bitfinex Securities

Honduras denies rumors of making BTC legal tender

- The Central Bank of Honduras said in a statement that

“Bitcoin for the moment in our country is not regulated”

- The BCH, the bank continued, is the only issuer of legal tender in Honduras, and that remains solely the lempira

Bitcoin sees largest outflows since January

- > $2.6B worth of Bitcoin has been removed from exchanges in just 15 days

- Outflows look to have accelerated since Bitcoin broke above the $40,000 mark

Goldman Sachs website highlights crypto

- The main Goldman Sachs landing page reads:

“Digitalization. From cryptocurrencies to the metaverse, explore the megatrends that are reshaping economies.”

- The Digital Asset reports the site links to are mostly from 1H21, but there are some interesting comments in a podcast featuring Mathew McDermott, head of Digital Assets for GS from earlier this month:

“In terms of institutional demand we have seen no signs of that abating, and when we talk about institutional demand, we talk about the whole cross-section of the industry sectors…I’m referring to hedge funds, to asset managers, to macro funds, to banks, to corporate treasurers to insurance and pension funds. And I think it’s pretty fair to say that all of that institutional discussion is really focused around Bitcoin, where the questions aren’t really what is it, thankfully, but more how can we get exposure? what are the instruments we can transact? and what is Goldmans offering today?”

Charts

Volatility squeeze

- Volatility, as measured by Bollinger bandwidth, fell to the second-lowest level of the year this week and already looks to be mean reverting setting us up for a bit of a volatility squeeze

Fund flows

- The Purpose BTC ETF seeing a net inflow of more than 2,500 BTC in the past 10 days and hitting an all-time high of 36,272 BTC under management

Chart credit: Glassnode

Futures premium

- The rolling three month premium on dated futures returned above 5% this week after briefly falling to a ~ 20 month low of < 3%

- I think this indicates an improvement of sentiment and possibly a pick up in institutional activity

Chart credit: Glassnode

CME is a big part of BTC futures open interest

- Binance numbers can probably be discounted somewhat

- CME is likely the largest player in the dated futures space, and I think probably a decent proxy for institutional sentiment

Chart credit: Glassnode

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.