Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — April 1, 2022

EU votes for KYC crackdown, Ted Cruz introduces bill to ban CBDCs, Kraken launches LN integration, Terra’s BTC hoard gains to $1.5B, MSTR borrows $205M against their BTC holdings (to buy more BTC) as Bitcoin lets some steam out ahead of Bitcoin 2022 next week.

By Jesse Knutson

Blame JPM

Bitcoin is on pace for a weekly loss after posting a 25% rally over the previous two weeks.

Declines looked to be led by stonks after a massive JP Morgan quarterly options trade sent the S&P into a nosedive. Declines in stonks were exacerbated by profit-taking after two weeks of solid gains and reports that the EU had voted to impose KYC restrictions on ‘unhosted’ digital asset wallets.

News flow this week was relatively thin, but I think will likely pick up significantly with the Bitcoin 2022 conference kicking off in Miami next week.

Global digital collateral

Earlier this month Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, said that Bitcoin was well on its way to becoming global digital collateral.

McGlone was probably thinking along the lines of central banks when he made the comment, but I think what’s going on with Terra is probably also worth paying attention to.

Headlines this week reported that Terra, an algorithmic stablecoin backed by a combination of a token called Luna and BTC, had acquired another $139M worth of BTC. Terra’s wallets began adding BTC on Jan 21 and have reportedly now acquired a total of almost 31,000 BTC, making Terra one of the largest holders of Bitcoin (Tesla holds 43,200 BTC, MicroStrategy holds 125,051 BTC).

TerraUSD is also now the fourth-largest stablecoin with a market cap of $16.4B.

I’m not sure how Terra’s efforts to build a stablecoin (in part) collateralized by Bitcoin will turn out, but I think it’s an interesting extension of McGlone’s comments and probably an early application of Bitcoin’s acceptance as global digital collateral.

Gravity

Given the amount of volume that has accumulated at the $47,000 — $48,000 level over the previous six months, I don’t think it’s surprising to see Bitcoin take a breather around this level.

We’ve had a pretty good run over the previous two weeks, so I think a dip in stonks, negative news out of Europe, and a wobble at the above-mentioned resistance is probably a good excuse for shorter-term traders to book some gains.

With Bitcoin 2022 coming up in a few days, you can bet there will be a slew of announcements and positive news out next week.

Technically, I also think the positive flip in the weekly MACD — the first in more than four months — is encouraging and suggests that Bitcoin has already started to regain momentum on a longer time frame.

Overall, this is probably a pretty good setup for the market — let some steam out this week ahead of an acceleration in sentiment around Bitcoin 2022 announcements next week.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

MSTR borrows $205M against BTC holdings…to buy more BTC

- MSTR subsidiary, MacroStrategy, took out a three-year $205M loan from Silvergate Bank collateralized by $820M in Bitcoin

EU votes to crack down on private crypto wallets

- European Union lawmakers voted today in favor of controversial measures to outlaw anonymous crypto transactions, a move the industry said would stifle innovation and invade privacy

- The Thursday vote came in spite of objections from major industry participants, and from legal experts who warned that overly heavy-handed privacy violations could face legal challenges in EU courts

Novo lifts target price (kind of)

- Earlier this month, Mike Novogratz CEO of Galaxy Digital, forecasted a price range of $30,000 to $50,000 for Bitcoin this year

- With Bitcoin touching a 13 week high of $48,000 earlier in the week, Novogratz said he had become more constructive on digital asset prices and said he wouldn’t be surprised to see prices significantly higher by the end of 2022

Ted Cruz introduces a bill to prevent the Fed from issuing a CBDC

- US Senator Ted Cruz introduced legislation to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC) directly to individuals

- CBDCs will allow regulators and policymakers to survey, censor, confiscate and freeze assets in a very dystopian way. I think we want to stay well away from CBDCs.

- Senator Cruz commented:

“The federal government has the ability to encourage and nurture innovation in the cryptocurrency space, or to completely devastate it. This bill goes a long way in making sure big government doesn’t attempt to centralize and control cryptocurrency so that it can continue to thrive and prosper in the United States. We should be empowering entrepreneurs, enabling innovation, and increasing individual freedom — not stifling it.”

Will Strike announce an Apple partnership at Bitcoin 2022?

- Last year, Jack Mallers, the CEO of Stripe announced that El Salvador would make bitcoin legal tender

- This year, Mallers seems to be hinting at a collaboration with Apple in a couple of recent tweets (Exhibit A, Exhibit B)

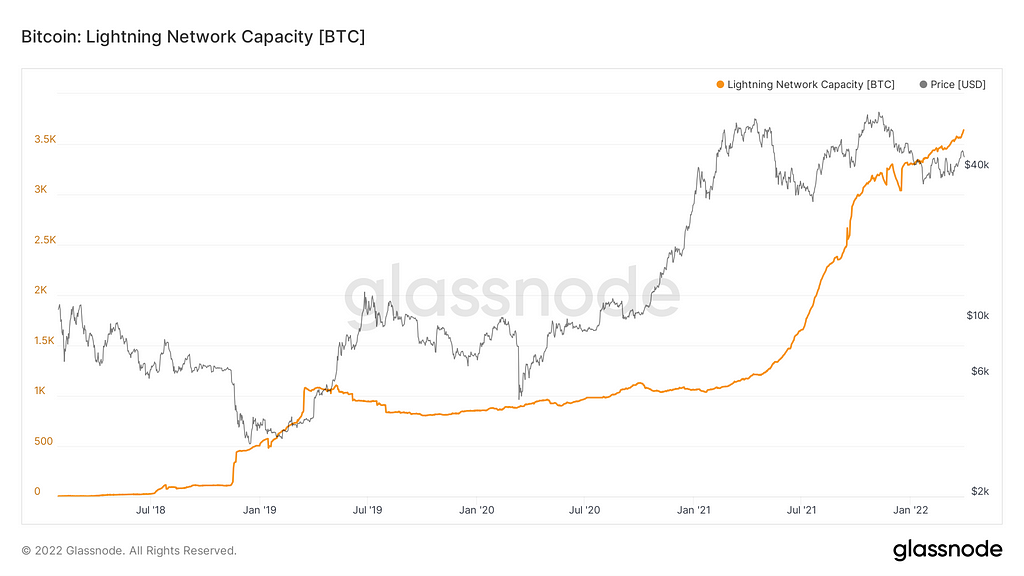

Kraken integrates with Lightning Network for all users

- Kraken users can now deposit and withdraw up to 0.1 BTC with instant and cheap Lightning payments

- Krakens Lightning Network integration saw the total BTC locked on the LN gain to 3,640

Charts

MACD Green

- Moving average convergence divergence (MACD) is a trend-following momentum indicator

- MACD flipped green on a weekly basis after 17 consecutive weeks in the red

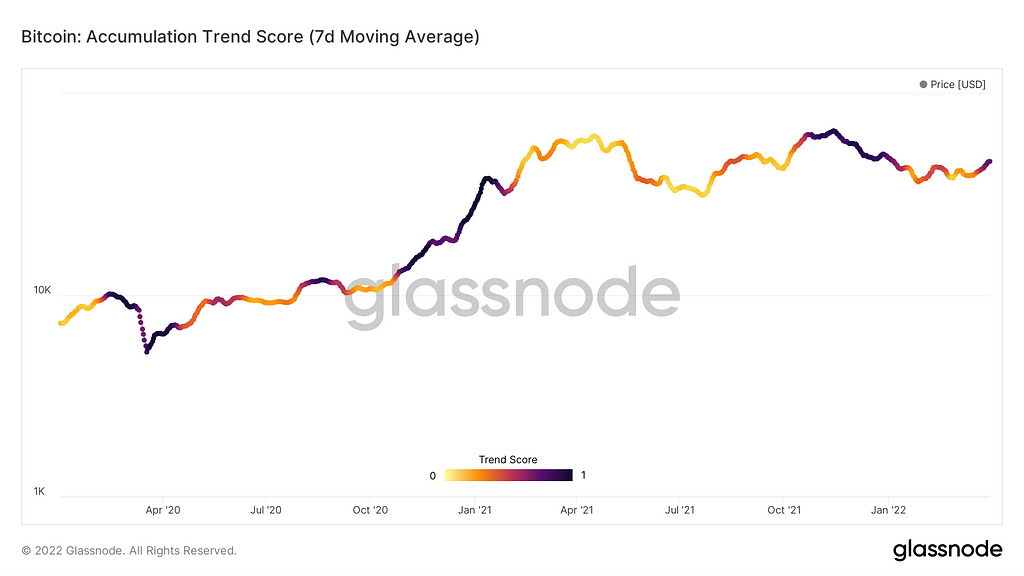

Accumulation Trend Score

- Glassnode’s accumulation trend score, a measure of how aggressive bigger entities are buying, continues to heat up

- The current 7-day value is just off of a YTD high

Chart credit: Glassnode

Lightning Network Capacity

- Lightning Network capacity hit a new ATH high following Kraken’s Lightning Network integration

- In total, there are now 3,640 BTC locked on the network

Chart credit: Glassnode

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — April 1, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.