Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — April 15, 2022

Inflation jumps to a 40-year high, BMN goes live on MERJ, Blockstream teams up with Tesla and Block on solar mining, BlackRock to be the primary manager of USDC cash, Luna loads up on another $100M of BTC, and Elon looks to take Twitter private as macro uncertainties push BTC to third weekly loss in a row.

By Jesse Knutson

Stagflation

Bitcoin is on track for its third weekly loss as weakness in traditional markets continued to offset generally positive headlines.

Global stonks were down again with major US indices looking on pace to finish around a four-week low. Treasury yields continued to climb as hotter inflation readings raised the odds of further rate hikes. The 10-year benchmark topped 2.8%, the highest level since December 2018.

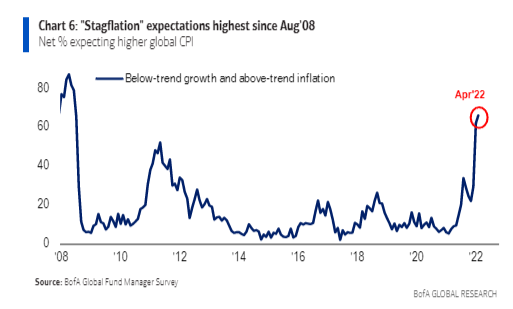

According to this month’s bank of America fund managers survey, stagflation expectations (high inflation, low growth) gained to 66%, the highest level since 2008. Europe looks to be a particular area of concern and reluctance to normalize rates this week helped push the USD to a ~ two-year high.

In short, macro remains in the driver's seat and continues to weigh on Bitcoin.

HFSP

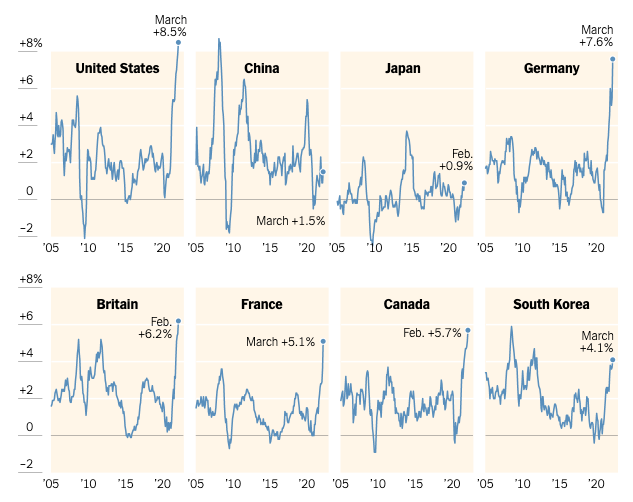

March inflation data came at 8.5% YoY, the fastest rate of growth in 40 years following a surge in the cost of energy and food.

Inflation is rough across the Western world with Germany reporting a 7.6% gain in March, the UK +6.2%, and Canada +5.7%.

It feels like CPI has probably understated inflation for a long time, and over the years, the methodology used to calculate the CPI has undergone numerous revisions. Inflation is probably even worse on the ground than it looks on paper. Data from Shadowstats, reportedly based on methodology from 1980, suggests that the real number is north of 17% — a 75-year high.

As US Senator Ted Cruz highlighted this week, long-term, this will probably drive more money — globally — toward Bitcoin.

When spark, ser?

Given the increase of institutional participation in Bitcoin and a high relative correlation with US tech stonks, central bank tightening and broader macro ripples remain a big headwind for Bitcoin.

After three weeks of consecutive losses, we’re probably due for a relief rally next week. Four-week losing streaks are pretty rare, we haven’t had one of those since June of 2020, so odds are we probably get a bit of a bounce next week.

As Glassnode put it this week — the market remains largely holder-dominated and there have been minimal inflows of new demand.

Bitcoin pullbacks have a tendency to wash out weak hands and concentrate ownership in very, very reluctant sellers.

Bitcoin 2022 was unable to provide a spark sufficient to rekindle new inflows which leaves us with a bullish supply dynamic, but still lacking a driver on the demand side.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Blockstream Mining Note goes live on MERJ

- Investors on MERJ Exchange will be able to trade the BMN1 in denominations of 0.00001 BMN

- Through a combination of MERJ’s regulatory status and internationally recognized listing standards, BMN1 on MERJ will carry the status of a listed security and be open to all classes of investors

Blockstream, Block, and Tesla team up on solar mining project

- Blockstream and Jack Dorsey’s Block, formerly Square, are breaking ground on a solar and battery-powered bitcoin mine in Texas using solar and storage technology from Tesla

- Tesla’s 3.8 megawatts solar PV array and 12 megawatt-hours Megapack will power the facility

- Blockstream CEO, Adam Back said:

“This is a step to proving our thesis that bitcoin mining can fund zero-emission power infrastructure and build economic growth for the future…People like to debate about the different factors to do with bitcoin mining. We figured, let’s just prove it. Have an open dashboard so people can play along, maybe it can inform other players to participate”

SEC may be inching closer to spot ETF approval

- The recent futures backed ETF approval filed by Teucrium may offer a glimmer of hope to future spot ETF applications

- The Teucrium futures backed ETF was filed under the Securities Act of 1933 — the same law under which spot bitcoin ETFs have been filed

- Previous futures backed ETFs were all filed under the Investment Company Act of 1940

Bitcoin bill expected to be approved in Brazil

- The bill regulating the cryptocurrency market in Brazil is expected to be approved by the National Congress in the first half of this year

- The proposed law would allow the Brazilian president to determine a federal entity responsible for establishing rules for cryptocurrencies

- Another point highlighted in the bill is a set of incentives for crypto miners to set up shop in Brazil

BlackRock to become primary manager of USDC reserves

- Follows reports that Circle, the company behind USDC, has raised $400M from investors including BlackRock, Fidelity Management and Research, Marshall Wace, and Fin Capital

- BlackRock has also entered into a strategic partnership with Circle to be its primary asset manager of USDC cash reserves and explore capital market applications for its stablecoin

Elon looks to take Twitter private

- I’m sure everyone is aware of the details as the story seems to have taken over the news cycle

- Not exactly sure how, but this feels like if he’s successful it should somehow be marginally positive to Bitcoin — given Elon’s generally positive position on Bitcoin

- Perhaps with a more robust Lightning Network or payments integration

Senator Ted Cruz: DC spending is fueling Bitcoin adoption

- Cruz might be the most vocal Bitcoin proponent in American politics (though that will change if Bruce Fenton wins his bid for a New Hampshire senate seat…check out my interview with Bruce before he announced his dive into politics)

“The massive spending in Washington is what is fueling the inflation that is hurting the American people so profoundly right now, and it is one of the things that is fueling the move to Bitcoin”

Luna Foundation said to have bought another $100M BTC

- LFG’s balance now reportedly sits at $2.4B, 69% is BTC

- In total, there are now 42,410 BTC in LFG’s wallet, making its wallet the 19th largest in total bitcoin holdings

Singapore High Court recognizes BTC as property

- The ruling was made as part of a theft case involving $7M worth of BTC and ETH

“For cryptocurrency exchanges that are based or have operations in Singapore, this decision means that there is now a possibility of being served with disclosure orders issued by the Singapore Courts to disclose information relating to user accounts and freezing injunctions to freeze cryptocurrency held in user accounts”

Charts

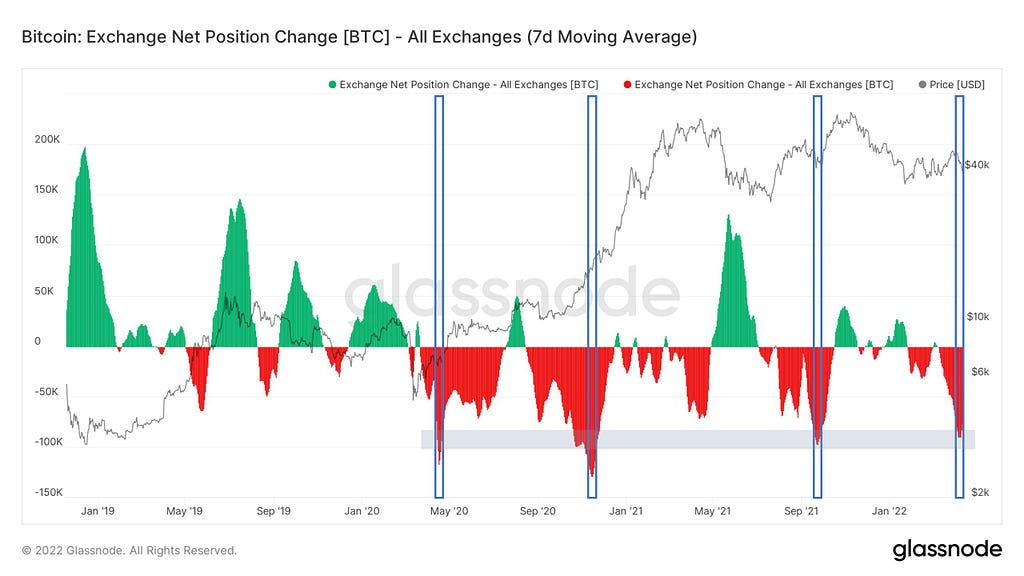

Bitcoin pulled from exchanges

- Less Bitcoin being stored on exchanges is clearly a long term trend which I think is probably driven mainly by institutional investors holding coins with custodians

- Unlike most on-chain analysis charts, this one looks to have a decent relationship with price

- The supply dynamic is increasingly bullish, but we still lack a driver on the demand side

Chart credit: Will Clemente

Inflation around the world

- Inflation is bad across the Western world

Chart credit: The New York Times

Fund managers expect stagflation

- According to this month’s bank of America fund managers survey, stagflation expectations (high inflation, low growth) gained to 66% — the highest level since 2008

Chart credit: BofA via Bloomberg

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.