Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A new world of limitless possibilities… with limits

With the advent of blockchain technology came a major opening of possibilities in the world of finance…and art…and gaming…and social media, identity, supply chain management, and so so much more. As time has gone on, it has only become ever-more evident that blockchain technology has wide-ranging potential and will have wide-reaching effects. As such, the industry has seen a boom in popularity and usage.

And with popularity comes more traffic and transactions. Traffic and transactions that are straining systems designed at a time when blockchains such as the Bitcoin and Ethereum chains saw much less usage. Put simply, Ethereum can process about 10 transactions per second. With all of the developers and other users on Ethereum, there are WAY more than 10 transaction requests at any one time, which means network congestion. And when you factor in the incentives- referred to as gas fees- for validators to approve new transactions and the bidding war that ensues when users want to get their transactions approved quicker, you run into high fees.

After that, you get into the problem of keeping networks secure and decentralized at scale. And even after that, you can talk about regulatory environments and the roles they play. Hence, why we’re talking about blockchain scalability in this article, and just how choppy the waters can get when building out decentralized networks.

The blockchain trilemma

Scalability, decentralization, and security. A real Bermuda Triangle of scaling issues. Well, not really, but alas, the solution to this has proven to be a bit elusive. The blockchain trilemma refers to the problems of prioritizing/sacrificing scalability, decentralization, and security when building and growing decentralized networks.

Scalability

This refers to a blockchain’s ability to handle more traffic. Without scalability, this technology can’t be used en masse. Networks become clogged as we see with PoW consensus models, and users are disincentivized from adopting. However, what often happens when a project prizes scalability is that it includes less nodes in its consensus model, leading to more centralization. This is a problem because one of the advantages of decentralization is its security against what is called a “51% attack”.

In a 51% attack, a hacker gains control of the majority of a blockchain network, handing them the ability to change the ledger and commit acts like “double spend”, which results in mass losses of assets. If a network is centralized, 51% attacks become easier to pull off.

Decentralization

This is the hallmark of blockchain solutions and the central focus of the DeFi movement. It is an integral part of what projects like Ethereum, TRON, and Cardano seek to achieve. It means more people having a role in securing their chosen blockchains. But of course with more validators validating transactions comes an ever-lengthening timeframe to actually validate said transactions, lowering network throughput.

In short, decentralization tends to sacrifice speed and scalability.

Security

As mentioned before, within the concept of decentralization lies the advantage of security. Without a central authority validating transactions, it becomes infinitely harder for a bad actor to take control of a network. This, along with other cryptographic methods of securing a blockchain, tends to sacrifice network speed and scalability.

These gas prices, amirite?

Gas, which is the fee paid to network validators on the Ethereum blockchain to process transaction requests, has always been a bit of a thorny subject for Ethereum ecosystem participants. While it is of course the main incentive for validators to do their job, gas prices skyrocket during times of high network traffic.

This is because users can actually opt to pay higher gas fees to get their transactions approved more quickly, leading to a bit of a bidding war and driving up gas prices. And on blockchains like Ethereum where developers are deploying smart contracts and dApps, the pressure to get one’s transactions approved quicker is very, very high. Because Ethereum currently utilizes a Proof-of-Work consensus mechanism, validators must use a lot of computational power to validate transactions, and thus must use more and more to keep pace with the growing demand for transaction approval.

Regulatory hurdles

Although blockchain technology seeks to decentralize the way we conduct financial transactions, interact with each other, and access banking services, its growth is of course still contingent upon the regulatory environments in which it is being developed.

And as time goes on, blockchain technology increasingly finds itself in the crosshairs of various governmental institutions around the world. Why might this be? The simple explanation is that any new technology, especially one that handles people’s assets or even sensitive records, is seen by authorities as something that needs to be defined and treated very specifically. Part of any financial authority’s duty is to protect investors and the businesses being invested in. So they need to come up with rules and definitions surrounding new asset classes and the technology they exist within in order to appropriately respond to issues that come up.

For example, the US SEC has sought to bring oversight to crypto exchanges and NFTs. It has famously been in a lawsuit with Ripple over the definition of their native token, XMR, and whether it should be defined as a security. In India, the government has had a rather contentious relationship with cryptocurrency where it has weighed taxing, instituting more oversight over, or outright banning cryptocurrency.

With oncoming blockchain solutions that tackle medtech, supply chains, or other huge industries with government ties and important records, oversight and governmental reluctance can arise to stunt the development of blockchain use cases.

Solutions to the problem

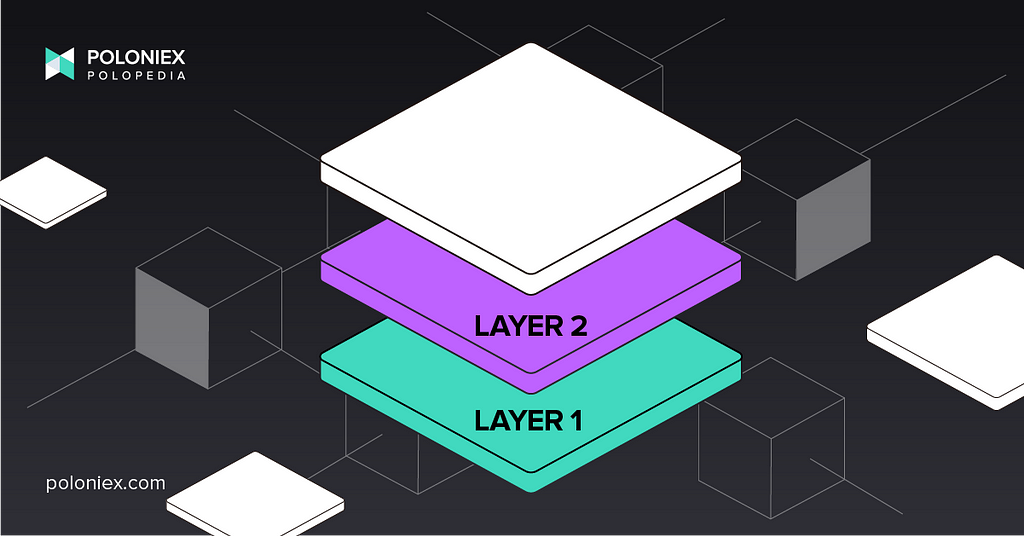

Of course, with such a dedicated populace behind the construction of all things crypto, Web3, DeFi, and the “Internet of Things” comes a dedication to scaling solutions. After all, this technology is better when everyone uses it, right? Let’s go through some solutions, of which the first two are Layer 1 solutions- meaning they talk about affecting the consensus methods and the actual blockchain- and the latter covers a Layer 2 solution, or one that is built on top of a blockchain.

Proof-of-Stake

An oft-cited problem of current blockchains is that they run on a Proof-of-Work consensus mechanism. With an ever-growing blockchain record with a growing number of network participants, this PoW protocol becomes unwieldy and slow. For starters, it relies on advanced computers to solve complex math problems in order to verify, or “mine” transactions. This has led to ever-growing mining setups, leading to higher barrier-to-entry (which also contributes to centralization), environmental impact, and just plain difficulty in keeping up. PoW has rather low throughput as well, which means that networks become congested when they experience high traffic. And on networks like Ethereum where validators get paid to approve transactions, the fees that are paid to them skyrocket.

Enter Proof-of-Stake. What this entails is that instead of a node/validator having to prove correctness of a transaction by working to solve a problem, a validator need only stake their crypto and is chosen by the network to approve a transaction proportional to how much of a token they have staked. Already, this wipes out the need for giant expensive mining rigs. PoS systems also have much higher throughput. Cardano, for example, which utilizes a PoS system, can process up to 250 transactions per second.

Sharding

So what about the decentralization aspect of blockchain’s scalability problem? How is it maintained? Even with Proof-of-Stake systems, the barrier to entry can be high, as one would have to stake a lot of crypto to become a validator. Not only this, but as it stands, blocks must contain an entire copy of the blockchain from present back to the genesis block, taking up a lot of memory on one’s computer.

Sharding, as explained in our “What is Ethereum?” article, is the act of splitting the record of a blockchain into smaller chains, so that validators need only have a partial copy of the blockchain in order to verify transactions and add new blocks. This makes it possible for more participants to secure the network, adding to its decentralization and security. Kinda cool, right? This concept is still in its infancy, but is one of the proposed upgrades to the Ethereum blockchain, which you can also read about here.

The Lightning Network

To understand what a Layer 2 solution is trying to do, let’s consider an existing solution- the Lightning Network. This Layer 2 operates on top of the Bitcoin blockchain and off-loads transactions by utilizing a Peer-to-peer system of micropayments where the entire record of the transaction doesn’t need to be recorded on-chain. Its security and speed come from its utilization of smart contracts, which are digital contracts based on computer code, immediately executing when pre-defined conditions are met. Here, the final state of any one transaction is recorded on the blockchain, but the rest of the transaction is offloaded, increasing speed and scalability.

Blockchain’s scalability issue is quite the beast, and it can be a bit frustrating to consider that this problem only grows with its popularity. At the moment, problems like high gas fees have proven to be pretty burdensome, but fear not! While certain blockchain projects are dedicated to solving world issues, there are also scaling solution projects that are equally dedicated to helping them grow, beat these issues, and eventually sail on smoother waters🌊

⛵️Smooth Scaling: The growing pains of blockchains was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.