Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Living in Silicon Valley, we’ve found it impossible to avoid crypto mania. Cryptocurrencies have created an opportunity for wealth creation unlike anything else in recent history, and it seems like almost everyone is getting in the crypto game. However, despite all the buzz around the space, it’s hard to find a robust investment framework to evaluate new coins.

After talking to crypto experts, we were surprised to find that many rely on subjective metrics to make decisions — team backgrounds, whitepaper quality, and whether the idea makes sense as a blockchain-enabled platform. All of these characteristics are undeniably important. However, the beauty of cryptocurrencies is that most all of the projects are open source, with code available on Github, and there are robust discussions about many coins taking place publicly on Twitter, Reddit, BitcoinTalk, and Telegram. We believe that this data should be leveraged to assess a coin’s legitimacy.

We’ve therefore developed a rubric that combines quantitative and qualitative metrics to holistically evaluate a cryptocurrency. To start, we identified 23 metrics that fit into six key categories (product, community, code, traction, trading, and network), with the goal of ranking currencies on a scale of one to three for each metric. To determine the benchmark for a metric, we took the top 50 coins by market cap (as of 1/26/18) and aggregated scores for each.

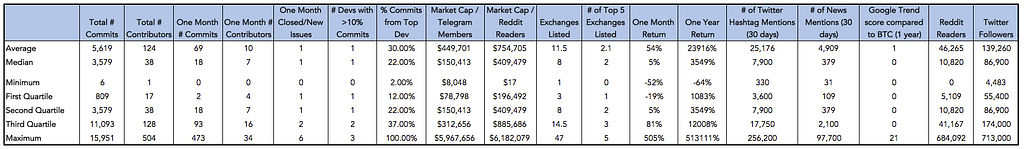

Most of the quantitative metrics were pulled from Github, CoinGecko, CoinMarketCap, and BitInfoCharts, while qualitative data was pulled from a company’s website, whitepaper, and online conversations on sites like Reddit, Twitter, and Telegram. The full data set is available in our spreadsheet, but summary statistics for quantitative metrics are below.

This analysis primarily applies to altcoins — as we will discuss at the bottom of the post, there are also important network effects that we couldn’t capture in this rubric that bode well for the longevity of BTC and ETH over all other currencies.

Below, we’ve outlined our six key categories, as well as the metrics involved in each and how we’d evaluate a sample currency based on these metrics.

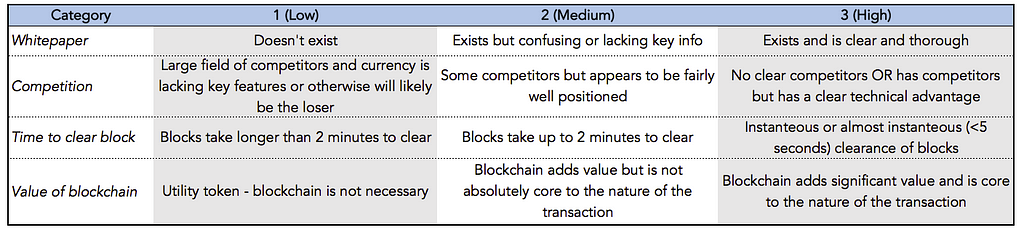

Product — Is the project a unique and valuable implementation of blockchain?

In this category, Bitcoin would score a 9 or 10/12. The whitepaper exists and is comprehensive (score of 3). There are competitors, and some argue that Bitcoin has serious technical flaws, but it obviously still has huge market share (score of 2 or 3, could be debated). Blocks currently take around eight minutes to clear (score of 1). Blockchain is core to the nature of private, decentralized, and global transactions (score of 3).

We understand that time to clear blocks is less necessary for coins acting primarily as a store of value as compared to coins acting as a medium of exchange. However, given that many coins claim to be feasible for frequent transactions, we consider shorter time to clear blocks a positive factor.

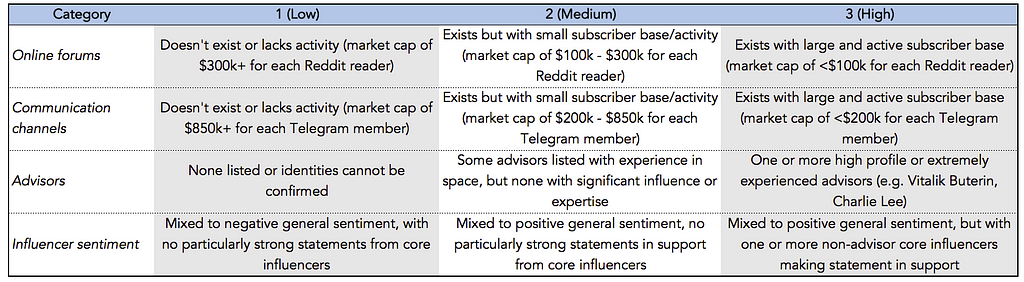

Community — What is the volume and quality of conversation around the coin, from both crypto influencers and the broader community?

In this category, Decred would score a 11/12. The Reddit (score of 3) and Telegram (score of 2) communities are of fairly standard size for the market cap of the coin. Charlie Lee is an advisor (score of 3), and Twitter sentiment (can be visualized here) is fairly positive, and non-advisor influencers like Tai Zen and Garry Tan have spoken out in support (score of 3).

Twitter is another important forum for discussing crypto. However, given the volume of spam/fake users, we decided not to evaluate currencies based on the size or frequency of posts in their Twitter communities (at least in the “community” category — we will return to this in “network”). Also, we decided to evaluate Reddit and Telegram communities as a function of the market cap of the coin, instead of as raw data points. We believe it would be unfair to penalize coins that are still fairly unknown (with small market caps) that therefore naturally have smaller online communities.

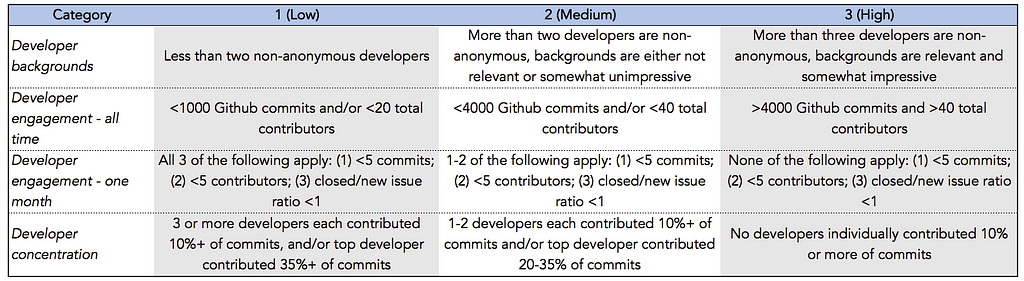

Code — Can the code generated actually do what the product promised, and is there a talented and active team making progress on it?

In this category, BitShares would score a 8/12. Most of the developers are anonymous, and the website’s team page is no longer available (score of 1). The GitHub has 5,212 commits from 79 contributors (score of 3). Over the past month, there have been 78 commits from 20 developers, and the closed/new ratio is 2.3 (score of 3). However, the top developer committed 43% of commits (score of 1).

Having concentration in code committed by a certain developer may not necessarily be a negative. However, given that many coins are still in the very early stages and that dependence on a sole developer can be risky, we consider a highly concentrated developer community to be a negative.

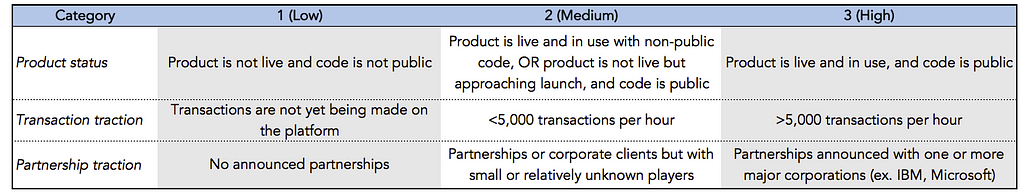

Traction — How far along is the platform in development, and is it being used to make transactions or being implemented by companies?

In this category, Omise Go would score a 8/9. The product is live but does not have public code, as it was the product of a venture-backed company (score of 2). However, it is processing millions of USD worth of transactions daily (score of 3) across more than 6000 merchants in Southeast Asia — including powering payments at 240 McDonalds locations in Thailand (score of 3).

We understand that 5,000 is a fairly arbitrary measurement of transaction volume. However, we’re trying to differentiate between coins that are fairly regularly used in transactions from coins that are still difficult to use or relatively unproven. Given the transaction data we were able to locate for the top 50 coins, 5,000 per hour seemed like a reasonable cutoff.

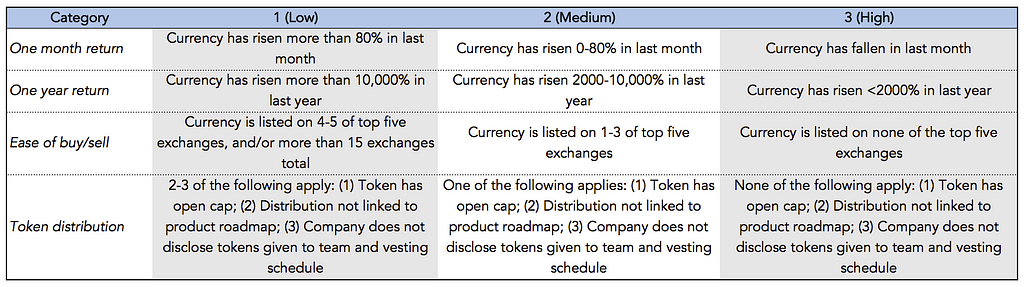

Trading — What is the recent trading activity around the currency, and what is the process for investors to buy into or sell out of it?

In this category, Augur would score a 10/12. The price has dropped 2% in the past month (score of 3), and has risen 1876% over the past year (score of 3). Augur is listed on two of the top five exchanges (score of 2). The number of tokens is capped at 11M. Almost all of the tokens were distributed in a 2015 crowdsale — 20% were reserved for the founders and the Augur foundation (vesting schedule not disclosed). Therefore, the currency has a token distribution score of 2.

We assume that a high recent return from a coin is negative from the perspective of expected short term return. There are a variety of micro cap cryptocurrencies (price of <$1), and some have a chance to see 100x, 1000x, or 10,000x returns in the next few months or year. Coins that have already significantly appreciated are less likely to see another big pop.

We also look at exchanges from the perspective of short term returns. If a coin is not yet listed on any major exchanges, we can expect a significant pop in price once it joins one of these exchanges and becomes easier to buy. However, in the long term, we believe that coins that are more easily attainable will perform better, so the 1 to 3 criteria would be reversed. Also — the standards in the rubric for both one-month and one-year returns should be recalculated on a monthly basis based on averages for the top 50 coins.

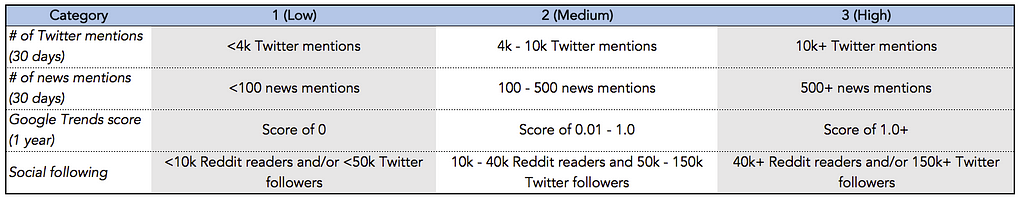

Network — are people talking about and/or purchasing the currency?

We believe that in the medium to long term, success of a given cryptocurrency will be heavily dependent on network effects (see Vitalik Buterin’s great post here). The more people own a coin, the easier it is for the coin to gain legitimacy and widespread adoption, and the more difficult it is to disrupt. We’ll outline below why this is so important, but with the metrics above we are essentially trying to get at how many people either own or are aware of or knowledgable about the currency.

In this category, Bytecoin would score a 7/12. The coin has seen 7.2k Twitter mentions (score of 2) and 317 news mentions (score of 2) in the past 30 days, and has 9.6k Reddit readers and 29.3k Twitter followers (score of 1). It also has an average Google Trends score (compared to bitcoin) over the past year of 0.06 (score of 2).

A few examples of crypto network effects to keep in mind:

- Trading. Almost all exchanges that trade altcoins require you to make purchases with Bitcoin and/or Ethereum—you can’t just buy with your credit card or PayPal! A coin that is used as a medium of exchange for trades benefits from investors purchasing (and potentially holding) the coin in order to transact in altcoins.

- Institutional interest. Institutional investors can pour a huge amount of capital into a currency, but are concerned about risks surrounding a coin’s legitimacy, liquidity, and price stability. Larger coins are generally perceived as more legitimate, and typically have enough liquidity to sustain significant investments without a huge jump in price. In addition, they often have more stable prices, as there are more investors with an interest in preventing a massive depreciation.

- Security. Widely adopted coins will naturally have better security — larger consensus groups are more difficult to attack, and there should be more developers to identify and patch potential vulnerabilities. Assuming investors want to purchase coins built on more secure platforms, better security will result in more capital flowing into a coin.

- Press. With so many new cryptocurrencies to cover, the press is primarily focusing on the coins with the highest adoption. Many individual investors purchase the coins they hear mentioned most often in the press, which creates a cycle as these coins therefore have even larger user bases and then get more press coverage. Bitcoin is practically synonymous with cryptocurrency to many people at this point.

- Medium of exchange. The largest currencies will likely be the first to be adopted by retailers (e.g. Overstock.com accepting Bitcoin), as there will be more people interested in using the currency for transactions and most retailers will want to limit initial exposure. As a coin is accepted by a larger number of retailers, it’s reasonable to assume that it will attract more consumers to own the coin, which will then attract even more retailers.

- Regulatory legitimacy. It would be more difficult for regulators to shut down a large cryptocurrency with millions of owners than a small currency with only a few investors. Regulators are incentivized to work with the most widely adopted currencies, while smaller altcoins may find that regulators take a more hostile stance.

Thanks for reading! We’d love your thoughts and feedback at olivia@crv.com and justine@crv.com, as well as on Twitter @venturetwins.

A VC’s take on evaluating cryptocurrencies was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.