Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — April 8, 2022

Samson Mow launches new company and reveals Bitcoin progress in Honduras, Portugal, and Mexico, Strike teams up with retail and POS giants, MSTR and Terra buy $420M of BTC, UFC to pay BTC fight bonuses, and Peter Thiel says finance’s gerontocracy is holding Bitcoin back.

By Jesse Knutson

Correlated

Bitcoin is on track for its second weekly loss shrugging off positive Bitcoin 2022 announcements as stonks gave up three weeks of gains.

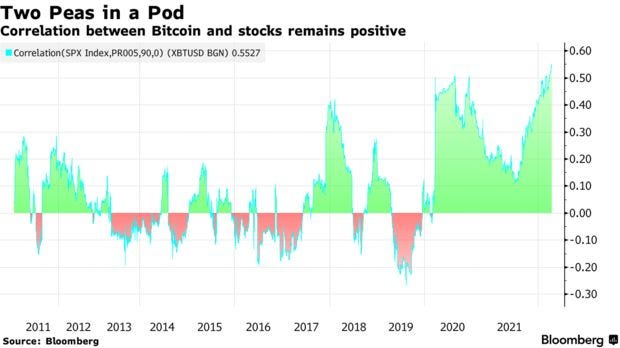

Bloomberg highlighted this week that Bitcoin’s correlation with stonks is back up to the top end of the historic range and weakness in equities looked to be spilling over into Bitcoin world after minutes from the Federal Open Markets Committee’s March meeting showed plans to trim the Fed’s balance sheet and lift rates.

Bitcoin 2022

It looks like the top announcements from Bitcoin 2022 (so far) have come from Samson Mow and Jack Mallers.

Samson announced the formation of a new company, JAN3, with $21M in funding at a $100M valuation. JAN3 will be focused on advancing Bitcoin and layer two technologies seen as key to both mass and sovereign Bitcoin adoption.

Samson also highlighted favorable Bitcoin legislation being hammered out in Honduras, Madeira (autonomous region in Portugal), and Mexico.

Jack Mallers, CEO of Strike, followed up on last year’s El Salvador integration by announcing new collaborations with Shopify, Blackhawk, and NCR.

Bitcoin sinks

A lot has been made over the last six or twelve months about the ongoing decline in Bitcoin held on exchanges and a corresponding increase in illiquid supply.

A large part of this is an increase in institutional participation and more coins being held with custodians than in exchange hot wallets. These charts mostly don’t match up with price very well and I think don’t give us much insight into market timing or where we are within Bitcoin cycles.

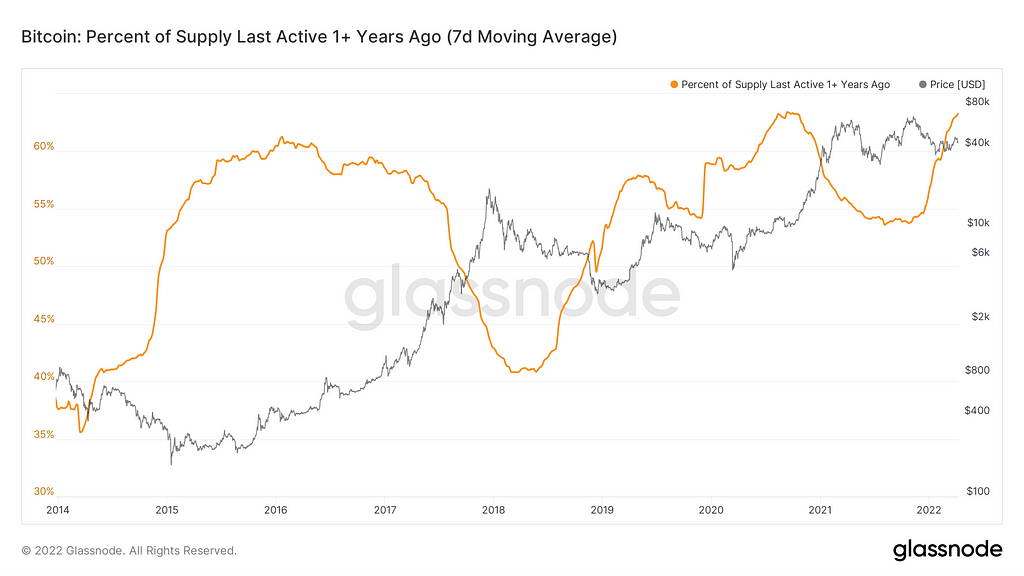

Will Clemente highlighted a chart this week, which I think is maybe a better way to look at this; the % of Bitcoin supply that hasn’t moved in a year or more.

There are a growing number of Bitcoin sinks. Entities that absorb large amounts of Bitcoin and pull it off of the market. Over time, I think these Bitcoin Sinks probably have a positive impact on supply/demand and Bitcoin price. Two of the biggest sinks in the market are MicroStrategy and Terra.

MicroStrategy announced this week the acquisition of another 4,167 BTC for ~$191M. The purchase brings MSTR’s total Bitcoin holdings up to a total of 129,218 Bitcoin worth close to $6B.

Terra, meanwhile, reportedly also added another ~5,000 BTC, increasing their total to 35,767 Bitcoin.

I would guess that in a year's time there will be many more Bitcoin sinks.

Wobble

Last week I felt that a bit of a price pullback ahead of Bitcoin 2022, and a reacceleration in sentiment around new announcements could be a pretty good setup for the market.

Price action still feels pretty heavy, though, and there hasn’t been much of a reaction to headlines out over the past 24 hours.

Looking back at previous weekly positive MACD flips, there’s often been an initial price wobble. With a good chunk of the global Bitcoin community in Miami, perhaps we just need everyone to get back to the desk and start lifting offers again.

In the mid-term, I think the near record-high number of BTC dormant for a year or more is probably a very bullish signal. Short-term, I think we need to see how sentiment plays out once the dust settles from Bitcoin 2022.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Samson Mow launches new company as more countries turn to BTC

- I’m sure anyone reading this wrap will be aware that Samson was previously Blockstream’s Cheif Strategy Officer

- JAN3 has signed an MOU with El Salvador to supply digital infrastructure around Bitcoin City

- Samson highlighted adoption efforts from policymakers in three new jurisdictions

- In Honduras, a special economic zone announced that:

“Bitcoin within Prospera operates as legal tender. That means no capital gains tax on BTC, you can transact freely using BTC, and you can pay taxes and fees to the jurisdiction in BTC”

- In Madeira, an autonomous region of Portugal. Miguel Albuquerque, president of the regional government, said that Bitcoin had also been accepted as legal tender and that:

“Individuals in Maderia are not subject to capital gains taxes when buying and selling Bitcoin”

- Mexican Senator Indira Kempis floated the possibility of legislating Bitcoin as legal tender, saying:

“In Mexico, 67 million people are not included in our financial system. Bitcoin is the solution to this problem. Through financial inclusion and financial education, the people can have a better quality of life.”

Jack Mallers announces partnerships with US retail and POS giants

- Strike has partnered with three of the world’s largest payments providers, Shopify, NCR, and Blackhawk Network to enable bitcoin payments at stores throughout the US

“You’re gonna be able to walk into a grocery store, to Whole Foods, to a Chipotle, if you want to use a Lightning node over Tor, you do that…Any online merchant that uses Shopify can accept payments without the 1949 boomer [credit card] network, receive it instantly, cash final, no intermediary, no 3% fee.”

- US tax regulations remain a major impediment to Bitcoin payments in the US, but as Tuur Demeester points out, demonstrating that millions actually can and want to use Bitcoin for payments is a key step in reforming those regulations

UFC to pay fighter bonuses in BTC

- Ultimate Fighting Champion (UFC) athletes will be paid bonuses in Bitcoin as a result of the partnership with Crypto.com

- Bitcoin bonuses will be awarded to the top three fighters at each UFC pay-per-view event as voted for by fans across the world

Bitcoin comprises 60% of Ricardo Salinas Pliego’s liquid assets

- Pliego is thought to be the third richest man in Mexico

“I have 60% in Bitcoin and Bitcoin equities and then 40% in hard-asset stock like oil and gas and gold miners and that’s where I am”

Peter Thiel: finance’s gerontocracy is holding Bitcoin back

- That’s a good line. Seems to apply to politics, too

- Calls out Buffet, Fink, and Dimon

- Calls Warren Buffet the “the sociopathic grandpa from Omaha”

Scaramucci predicts 2024 presidential candidates will be pro-BTC

- I think this is a very interesting prediction. Coinbase alone has close to 90 million verified users. Bitcoin is an issue that I think uniquely crosses traditional party, geographic and demographic lines

“They got the life scared out of them during that Infrastructure bill. The pro-Bitcoiners or crypto were trying to put on pro-language. The anti-ones are trying to put in anti-language. They were putting that in and then all of a sudden everyone got freaked out because you have 73 million people that own the stuff. This is a ‘DLO’– decentralized lobbying organization. 73 million people descending on these people, calling them. That’s how Washington works.”

MicroStrategy buys another $191M worth of Bitcoin

- Michael Saylor’s MSTR reported acquiring another 4,167 BTC at an average price of $45,714

- Likely funded by the $205M loan reported last week from Silvergate Bank

Terra buys another $230M worth of Bitcoin

- Looks like the beat MSTR on VWAP with an average price south of $45,500

- Terraform Labs now holds 35,767 BTC in their wallet

Lightning Labs lands $70M to facilitate ‘Bitcoinizing’ fiat currencies

- The company announced a $70M Series B with investors such as Baillie Gifford, Brevan Howard, and Valor Equity Partners

Charts

63% of Bitcoin hasn’t been active for ≥ 1 year

- Looks like we’re getting close to an all-time high on a seven-day rolling basis

- I wonder if this starts to impact the supply/demand dynamic over the coming months

Chart credit: Glassnode

Bitcoin’s correlation with stonks

- Interesting, but looks like a chart ripe for mean reversion

Chart credit: Bloomberg

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — April 8, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.