Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

How work-in token architectures can build micro-economies and improve quality of life for under-resourced communities.

“When the last tree is cut down, the last fish eaten, and the last stream poisoned, you will realize that you cannot eat money” — Alanis Obomsawin

“When the last tree is cut down, the last fish eaten, and the last stream poisoned, you will realize that you cannot eat money” — Alanis Obomsawin

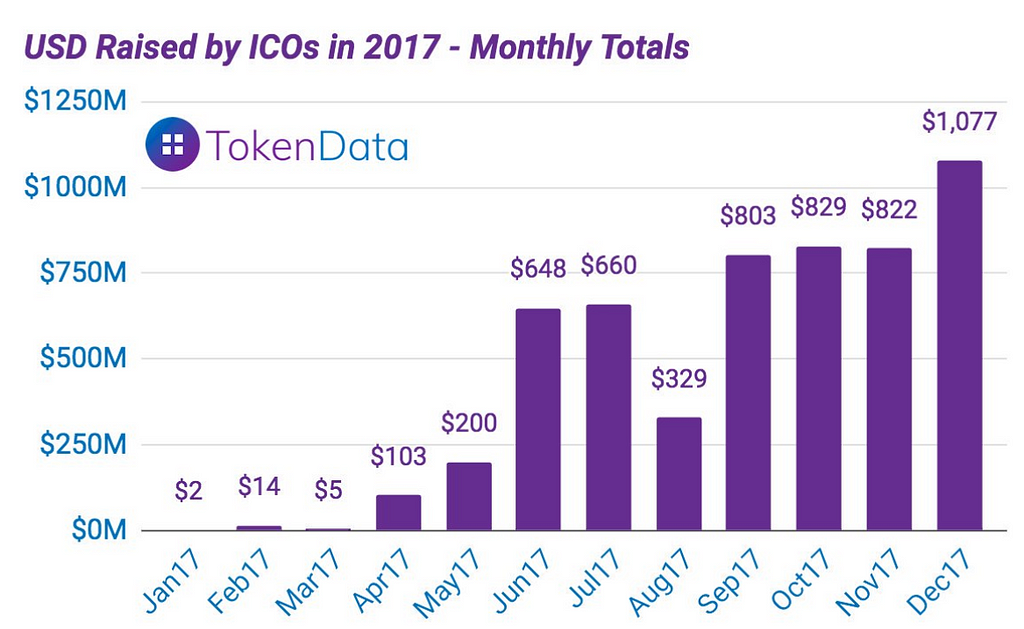

As more and more decentralized applications test the very parameters of centrally controlled, incumbent systems, the market for app-based token sales has exploded. Last month alone, “ICOs” raised over $1B.

At the same time, many token-less applications that leverage parent blockchains like Ethereum and Bitcoin still force users to “buy in”––users must convert fiat currency to the blockchain’s operating token (ETH or BTC) and face increasing transaction fees.

Burdensome interactions on exchanges can be a huge barrier to entry for even those with enough capital to invest in cryptocurrency, let alone those who don’t have enough capital to stay “banked.” This obstacle prevents mass-adoption of DApps that try to push the token aspects of blockchain rather than emphasizing the utility of decentralization and trustless economies. From a financial inclusion perspective, the “buy-in” nature of blockchain applications assumes that under-resourced localities define value the same way westernized communities do (via fiat currency rather than utility that directly adds to the consumer’s quality of life). But remember, you can’t eat money.

The Problem with Buy-In Economies

Both DApp tokens and even well-established cryptocurrencies require that potential users buy in to the digital micro-economy and sacrifice a minimal, upfront cost of participation. On generalized blockchains like Ethereum, gas fees can be upwards of $10 (with even higher minimal balance costs for Bitcoin).

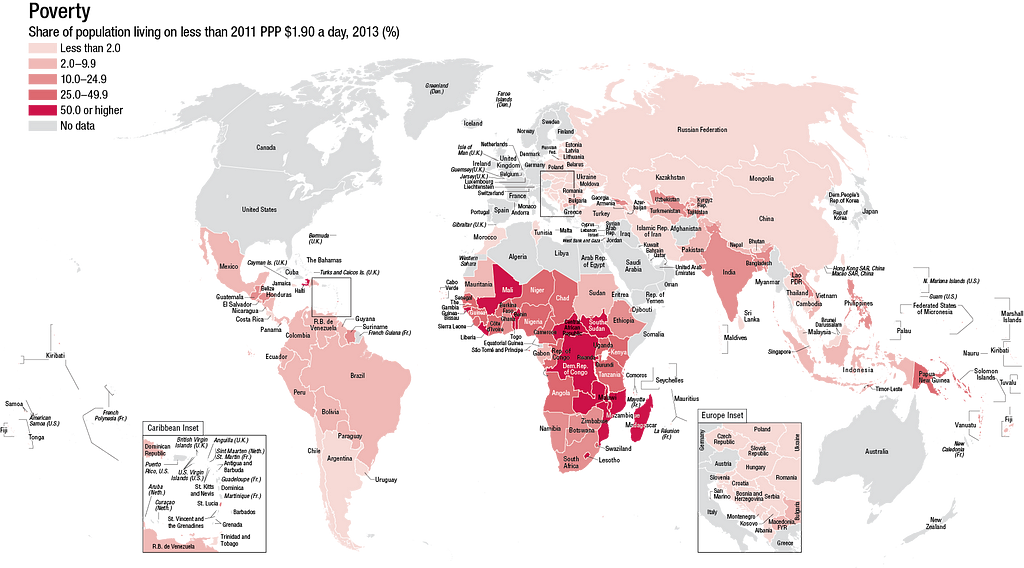

You’d think that $10 is quite minuscule, but at least 80% of humanity lives on less than $10 a day. The minimum costs to participate in the blockchain economy are in fact overwhelming for the majority of the world. And more than 80% of the world’s population lives in countries where income differentials are widening. The poorest 40% percent of the world’s population accounts for 5% of global income, and the richest 20% accounts for three-quarters of world income.

Source: The World Bank World Development Indicators.

Source: The World Bank World Development Indicators.

For these impoverished communities––the world’s vast majority––the utility of most emerging technologies isn’t realized until decades after mainstream adoption through charitable, tertiary markets, and these are the communities that stand to benefit the most from decentralized technologies, whether for thwarting corruption, relieving macroeconomic issues like national hyperinflation, or fostering multi-party transparency. The western world may want blockchain, but the rest of the world needs it.

A Work-In Economy

SteemIt, a decentralized social media platform, has emerged as a compelling counterexample to the buy-in economy. Using a blockchain-based reputation system, the SteemIt platform awards users STEEM tokens for both producing and curating popular content. SteemIt therefore functions much more as a “work-in” economy.

From the Steem Whitepaper (emphasis mine):

“There are two ways people can get involved with a crypto-currency community: they can buy in, or they can work in. In both cases, users are adding value to the currency, however, the vast majority of people have more free time than they do spare cash. Imagine the goal of bootstrapping a currency in a poor community with no actual cash but plenty of time. If people can earn money by working for one another, then they will bootstrap value through mutual exchange facilitated by a fair accounting/currency system.”

The idea of “bootstrapping value through mutual exchange” is extremely powerful in the context of social impact. Finding ways to mold your blockchain architecture to protect users from transaction fees and build a micro-economy of services that is mutually tethered to incentives (and disincentives) provides a more sustainable pathway to empower impoverished communities with blockchain technology.

The work-in concept is not exclusive to the SteemIt blockchain and can be implemented in ecosystems like Ethereum and others by using smart contracts. uPort, for example, leverages its fueling server “Sensui” to pay for users’ gas fees, making the identity tool that much more accessible to the people who need it worldwide.

An Economy of Votes

A major tenet of the work-in model is the establishment of a voting system of token holders. The opportunity to earn currency is directly correlated to the opportunity to work, but the challenge is how to judge the relative quality and quantity of work that individuals provide and to do so in a way that efficiently allocates awards to millions of users.

“The first step in rewarding millions of users is to commit to distributing a fixed amount of currency regardless of how much work is actually done or how users vote. This changes the question from being “ Should we pay? ” to “ Whom should we pay? ” and signals to the market that money is being distributed and is being auctioned off to whoever “bids” the most work.” — SteemIt

The act of minting value within a work-in economy re-establishes economic incentives around enhancing the quality of life of that community. A true utility token only has value when the transactions that it accounts for are valuable to the transacting community. The token is just a method of “keeping score” between the services being exchanged. What’s even more important is how score is being kept when determining a fair payout system based on the work being done.

“The next step is to reward everyone who does anything even remotely positive with something. This is accomplished by ranking all work done and distributing proportionally to its value. The more competitive the market becomes, the more difficult (higher quality or quantity) it becomes to earn the same payout.” — SteemIt

In a social impact economy, “ranking all work done” could be accomplished by simply letting community members vote on which services (or, better put, which actions) are in most demand. This is the near equivalent of developing a curated registry of needed services, a system well-supported by the Token-Curated Registries (TCRs) protocol, which literally dedicates its micro-economies to curating lists in a well-ranked order where token holders are the voters.

This is not to say that token holder voting is the sole solution for a local micro-economy, particularly one that is under-resourced. A proof-of-concept demonstration may simply use highest service transaction volume to curate lists, rather than a more complex voting system.

With a TCR layer as the foundation of a ranking service exchange in a work-in economy, capital is directly tethered to the overall community’s quality of life, with no transaction fees or even the need to convert to crypto. All transactions would be in that community’s local token and transacted automatically between vendors and consumers alike.

Accounting for Quality of Life

In the end, a work-in utility token architecture is simply an accounting mechanism for that locality’s quality of life. Developing micro-economies via blockchain is essential to fast-tracking development in impoverished areas and recreating economic incentives that have since failed due to corruption and corporate exploitation. Impoverished communities don’t have to wait decades for blockchain technology to cross over from modernized nations. A work-in model can serve as the framework for decentralized applications to take root worldwide and start empowering under-resourced users today.

Want to learn more? Check out ConsenSys.net, the ConsenSys Media blog, and our weekly newsletter.

Disclaimer: The views expressed by the author above do not necessarily represent the views of ConsenSys AG. ConsenSys is a decentralized community with ConsenSys Media being a platform for members to freely express their diverse ideas and perspectives. To learn more about ConsenSys and Ethereum, please visit our website.

Developing Work-in, Not Buy-in, Token Economies was originally published in ConsenSys Media on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.