Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin markets and cryptocurrencies values across the board are seeing healthy rebounds after the past three weeks of price dips. At the moment there is some substantial consolidation happening, and BTC bulls are still trying to breach the $12K zone. They came awfully close last night, but failed to break the key price region. Now, during the late afternoon of January 28, 2018, the BTC/USD global market average has been hovering between $11,700-11,800 USD per coin.

Also Read: U.S. Rating Agency to Issue Bitcoin and Cryptocurrency Grades Wednesday

Markets See Some Healthy Gains After This Week’s Exchange Hack

Coincheck’s president Wakata Koichi Yoshihiro during a press conference after the hack.

Coincheck’s president Wakata Koichi Yoshihiro during a press conference after the hack.

Another exciting week has passed in the world of cryptocurrencies as digital asset proponents witnessed yet another big exchange hack. This time the compromise came from the Japanese trading platform, Coincheck, as the platform has reportedly lost between $400-534Mn USD worth of the cryptocurrency NEM on January 26. The cryptocurrency community was, of course, shocked to hear that the funds were kept in a hot wallet, and the entire digital asset ecosystem took some percentage losses. However, bitcoin core markets and a good majority of other digital assets have bounced back to the price regions they held before the hack.

Today BTC/USD markets are seeing a rough global volume of around $8.2Bn USD traded over the past 24-hours. Trade volume for the past two weeks has been meandering in this range as traders are pushing between $8-12Bn worth of BTC traded every day. Right now the exchanges commanding the most BTC volume today includes Okex, Bitfinex, Upbit, Binance, and GDAX. The USD and the Japanese yen are going head to head as both currencies capture close to the same amount of trade volume. The U.S. dollar (34.9%) is still the top currency traded with bitcoin core markets followed by the yen (33.2%), tether (USDT 13.6%), the euro (7%) and the Korean won (5.2%). It’s worth noting that the data statistic site Coinmarketcap now includes South Korean exchange volume again in the website’s global average. The company previously removed Korean trading prices from the global price averages due to inconsistencies.

Technical Indicators

Looking at the hourly, daily and weekly charts show a reversal seems to be in the cards after some significant triangular consolidation. Technical indicators also suggest the same, as the two Simple Moving Averages (SMA) have a widening gap taking place after crossing hairs on January 27. The short-term 100 SMA is now above the longer term 200 trendline, showing the path to the upside will have less resistance.

January 28, 2018, BTC/USD RSI levels on the Bitstamp exchange are on the upside.

January 28, 2018, BTC/USD RSI levels on the Bitstamp exchange are on the upside.

Order books show the same, as sell walls are consistent but not entirely massive. If bulls push the value upwards, there will be pit stops at $12K, $12.4K, and $12.9K before the value can exceed the $13,000 region. On the back side, there’s some solid foundations and support between $11,200 all the way to $10,400. A break under the $10.4K value could quickly lead to sub-$10K price levels. The Relative Strength Index (RSI) and Stochastic levels are on the upside as well, and the oscillators indicate bulls are going to keep pushing at least for now.

January 28, 2018, BTC/USD markets at 4 PM EDT. The price is currently hovering between $11,700-11,800 per BTC.

January 28, 2018, BTC/USD markets at 4 PM EDT. The price is currently hovering between $11,700-11,800 per BTC.

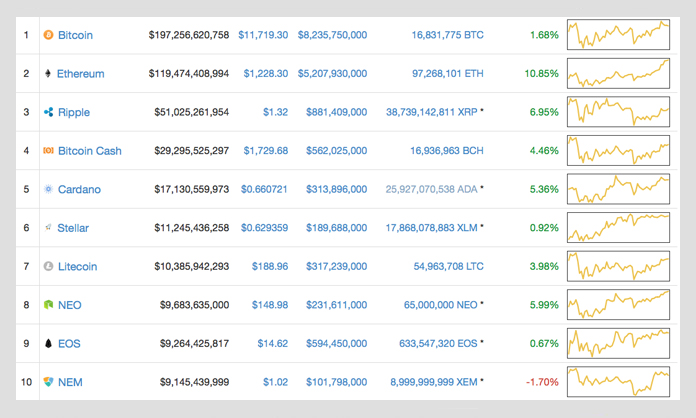

The Top Cryptocurrency Market Values

Overall the top ten cryptocurrencies are all in green as the top ten crypto-caps are seeing percentage gains between 0.6 to 11 percent. The only cryptocurrency not seeing price gains is NEM, the digital asset tied to the recent Coincheck breach. NEM markets are still above a $1 but markets are down 1.7 percent. Ethereum (ETH) markets are performing the best today, as prices are up 10.8 percent and each ETH is worth $1,228. Ripple (XRP) values are also up 6.9 percent, and the price per XRP is $1.32. The fourth largest market cap held by bitcoin cash (BCH) is up 4.4 percent, and each BCH is averaging roughly $1,729. Lastly, Cardano (ADA) is still holding the fifth position at $0.66 per ADA and its markets are up 5.3 percent.

January 28, 2018, the top ten cryptocurrency market caps.

January 28, 2018, the top ten cryptocurrency market caps.

The Verdict

Most traders believe the first month of the year price storms are coming to an end, and lots of them are placing long positions. Leveraged long positions on trading platforms like Bitfinex, Bitmex, Kraken, and other trading platforms outnumber short contracts right now. Further, as new.Bitcoin.com reported earlier mainstream positions using Cboe’s bitcoin futures products show positions in those markets are also bullish. No one can honestly pinpoint where the markets will take us after the extended period of bearish dips and triangular consolidation. Traders only know that after the sideways action, cryptocurrency markets are only going one of two ways and hope their forecast positions are placed correctly before the next big move.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Bitcoin Wisdom, AP, and Coinmarketcap.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrencies Recover Gains After the Coincheck Hack appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.