Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Shortly after dipping below $41,000, bitcoin went on the offensive once again and briefly exceeded $43,000. The altcoins are also in the green today, with ADA nearing $1 and Ethereum touching $3,000.

Bitcoin’s 20-Day High

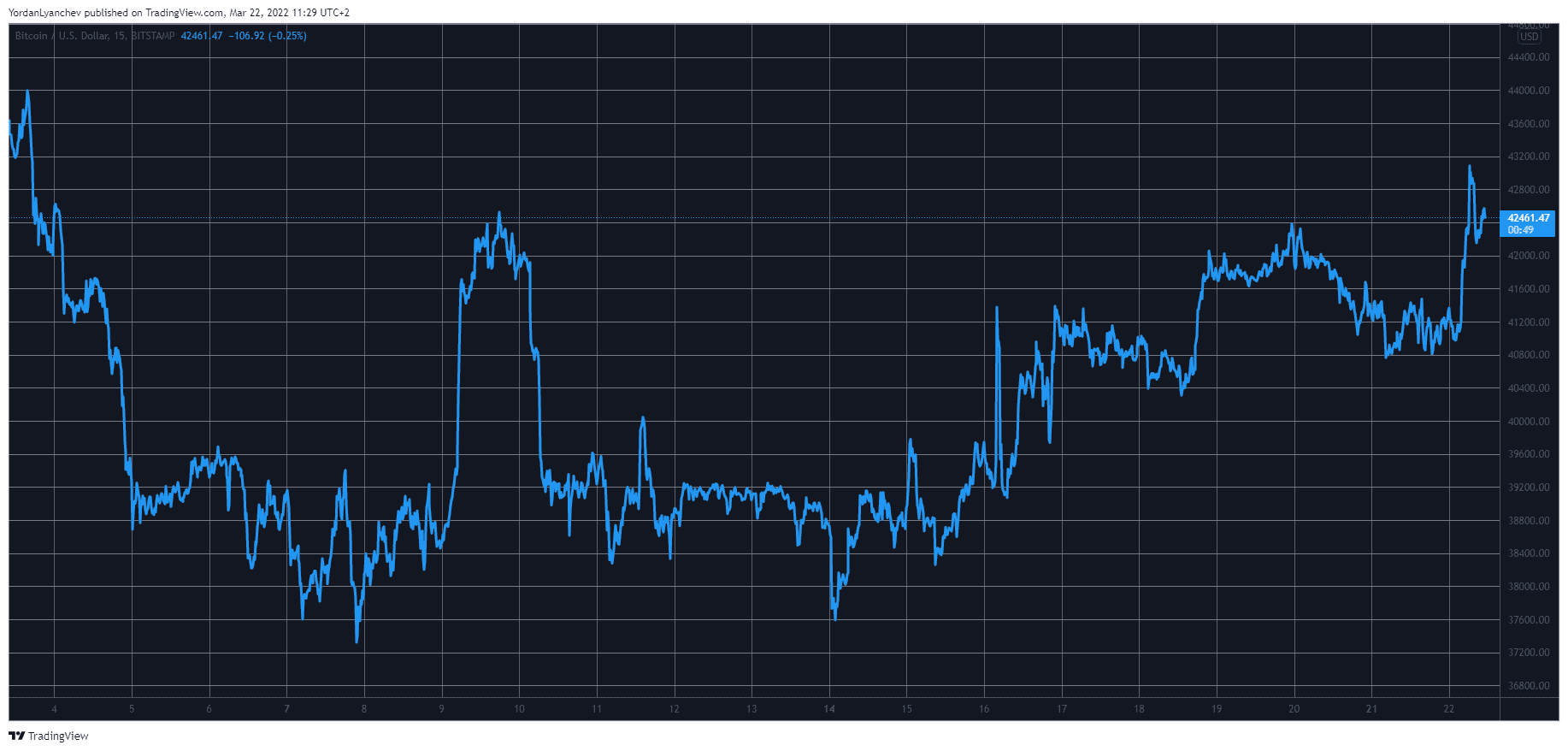

CryptoPotato reported yesterday bitcoin’s brief retracement that drove the asset from $42,500 to under $41,000. This came after several relatively positive trading days in which the cryptocurrency reclaimed $40,000 following a week, standing below that coveted level.

However, this price dip was somewhat short-lived. The BTC bulls regained control over the market and pushed it north again. This time, the primary digital asset added more than $2,000 in hours and spiked to over $43,000.

As such, BTC painted its highest price tag since March 3rd. As of now, bitcoin has lost some ground and stands around $42,500.

Nevertheless, its market capitalization has reclaimed the coveted $800 billion mark, and its dominance over the alternative coins has gone to 42%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Alts in Green: ETH at $3K

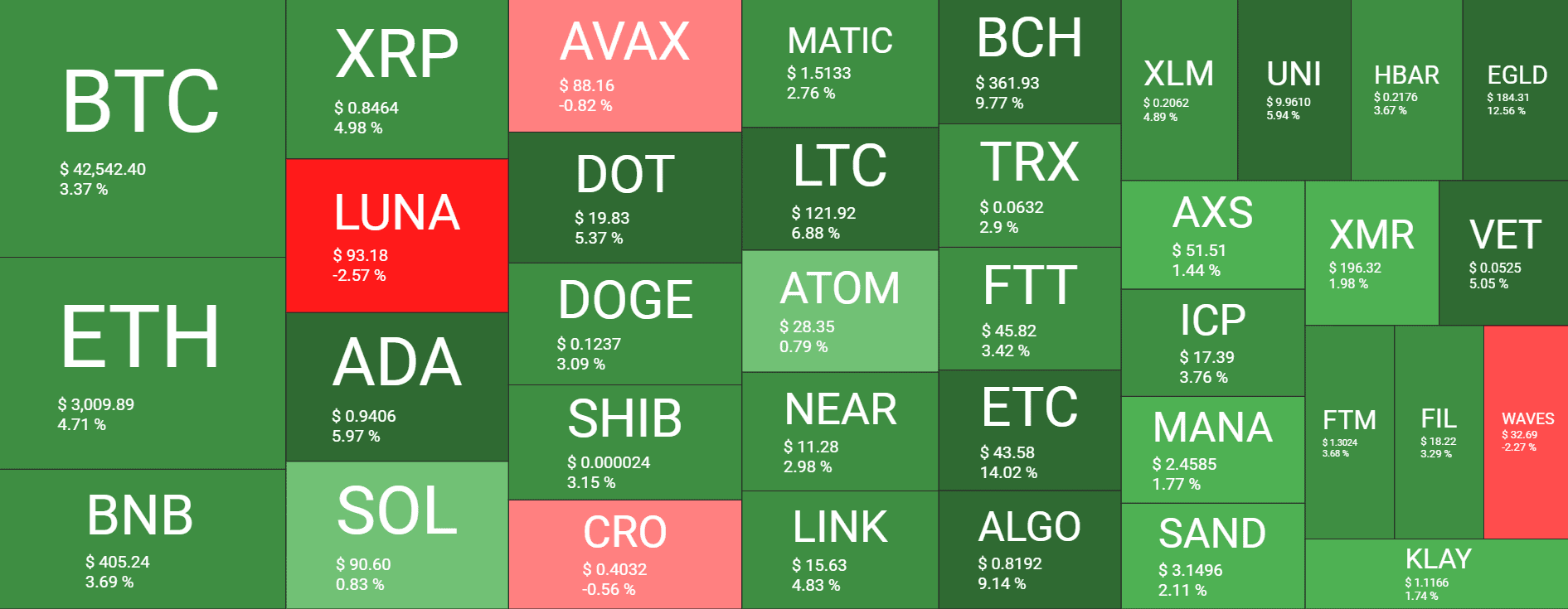

The alternative coins have largely mimicked BTC’s performance as of late, and most have turned green today.

Ethereum is among the prime examples. The second-largest crypto tried its hand at $3,000 a few times in the past few days but to no avail. Yesterday’s market correction pushed ETH south to just over $2,800. Since then, though, the situation changed, and the asset jumped to $3,000, where it’s situated now as well.

Binance Coin has increased by over 3% in a day and trades above $400. Ripple, Solana, Polkadot, Dogecoin, and Shiba Inu have all charted similar gains.

Ethereum Classic is once again among the best performers, with a notable 14% surge to $44. Bitcoin Cash, Algorand, and EGLD are also well in the green.

The cumulative market cap of all crypto assets is up by $60 billion in a day and has reclaimed the $1.9 trillion level.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.