Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What is ETHLend?

ETHLend is a decentralized lending application (DAPP) running on the Ethereum Network that offers secure, peer to peer lending Smart Contracts. ETHLend strives to democratize the process-heavy lending process by removing power and control held by traditional banks and large financial institutions. Unlike other blockchain loan applications, ETHLend allows a borrower and a lender to decide essential loan details without the need of a middleman. Essentially, this means that a lender and buyer anywhere in the world can create a loan contract on their terms.

Problems Solved by Decentralized Lending

Decentralization can fix many of the innate problems associated with our current centralized borrowing system. Here are the three biggest reasons the decentralization of loans makes sense.

- Trust: Decentralization completely removes the need to trust your loan provider and your counterparty. Loan collateral is locked and controlled by Smart Contracts that are broadcasted on the public blockchain.

- Transparency: The Ethereum network provides a transparent ledger which is open for inspection. Every transaction is recorded and can be verified. Ethereum’s transparent accounting removes the blind trust required by transactions between two banking institutions.

- Access: By utilizing the Ethereum network, ETHLend lenders and borrowers can arrange loan transactions from anywhere in the world. Loan transactions take place from Ethereum address to Ethereum address allowing unrestricted, worldwide access. Unconstrained, both borrowers and lenders can access a much broader pool of loan liquidity.

How does ETHLend lending work?

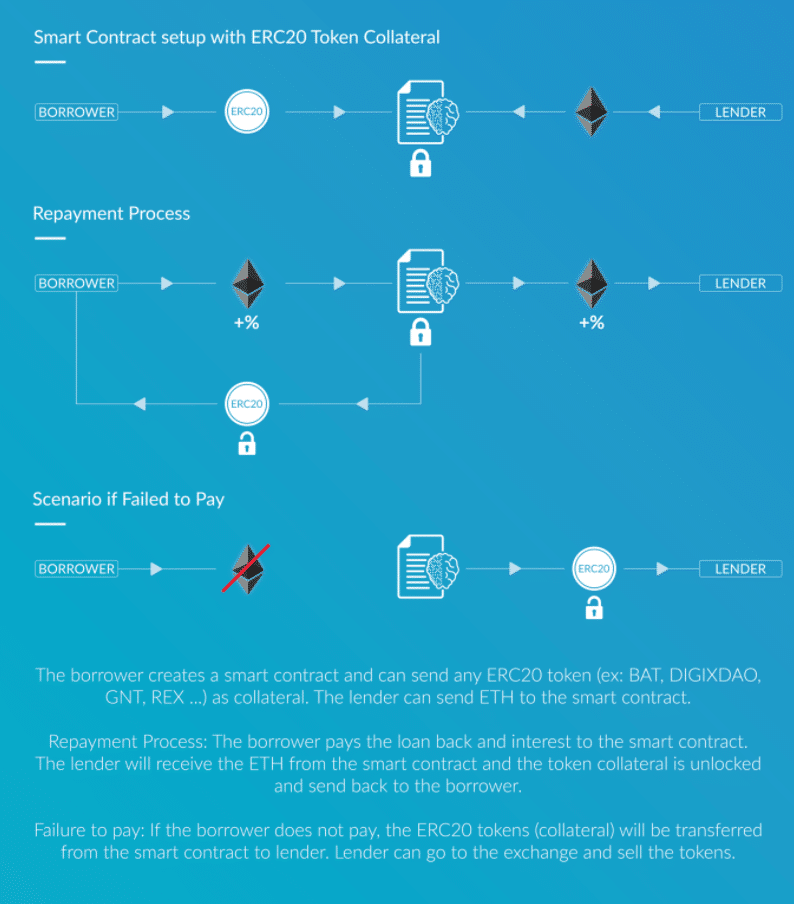

ETHLend requires borrowers to post ERC-20 compatible tokens or Ethereum Name Service (ENS) domains as collateral against Ethereum Loans in case the borrower defaults. Currently, only borrowers can create loan requests on ETHLend. To place a loan request, a borrower must set data such as the loan’s length, interest premium, and amount of tokens needed for collateral. If a lender agrees to these terms, a loan agreement will be created. Only two scenarios can result from the creation of any loan:

- The borrower repays the loan. The lender then receives his or her original principal plus interest. Or

- The borrower fails to repay his or her loan. The lender would then receive the borrower’s posted collateral

The LEND Token Sale and Current Price

ETHLend’s token sale of LEND ended November 30th, 2017. According to ICODrops, ETHLend raised $17,860,000 of its $17,900,000 goal. The maximum supply of LEND tokens to be created is 1,299,999,942 while the current circulating supply of LEND tokens is 1,032,154,231. LEND’s price significantly dropped for a ten-day period starting on January 7th. During this ten-day period, Lend’s price dropped all the way from 40 cents to 10 cents.

Lend’s massive price drop may be attributed to the false rumors that the South Korean government planned to ban bitcoin and cryptocurrency exchanges. This news seemed to cause the entire market to slide. Since bottoming, the price of LEND has stabilized and moved sideways in the 15 to 20 cents range. The cryptocurrency market seems to be following its historical trend of slumping in January. It wouldn’t be surprising to see the market to move sideways another week or two before returning to a slow-moving bull market.

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[ scripts.length - 1 ];

(function (){

var appName = encodeURIComponent(window.location.hostname);

if(appName==""){appName="local";}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl+'serve/v3/coin/chart?fsym=LEND&tsyms=USD,EUR,CNY,GBP';

s.src = theUrl + ( theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

LEND Token Functions

ETHLend’s LEND token is an ERC-20 compatible token that was sold in the presale offering and ICO. The LEND token has several important functions on the DAPP.

Discount Fees

Users of LEND tokens will receive 25% price reduction on platform fees compared to paying with Ethereum. Although LEND tokens can be bought and sold on exchanges, the primary use for LEND is to create a discount when paying for ETHLend DAPP deployment fees.

Airdrops

Active lenders and borrowers will be paid with quarterly airdrops. ETHLend plans to use 20% of its decentralized application fees to purchase LEND from the market and “airdrop” the LEND to all lenders and borrowers on ETHLend. Airdrops will be used to increase user adoption and also to add more volume to loan books.

Exclusive Functions

Particular services on ETHLend will be only accessible to be purchased by LEND. Examples of these features include featured loan listings as well as email marketing campaigns.

Referral Bonuses

ETHLend plans to purchase additional LEND to reward lenders and borrowers who add new participants on to the decentralized lending platform.

Creation of a Decentralized Credit Rating of Borrowers

ETHLend also plans to offer unsecured loans to its user base eventually. Unsecured Loans, loans in which the borrower does not post collateral in the case of default, are much riskier for the lender. To help lenders address the difficulty of evaluating the underlying risk of unsecured loans, ETHLend plans to create a decentralized credit rating for all its users. Concisely, Ethlend borrowers will have the ability to build their reputation over time as they successfully pay back loans.

Each ETHLend borrower will have a decentralized credit rating created from several data sources. The primary source of data for these credit ratings will be Credit Tokens (CRE) which will be issued from ETHLend itself. Reputation-based lending will allow Ethlend to introduce the concept of unsecured borrowing for users as well as provide more information for secured lenders. Additionally, ETHLend plans to enable users to broadcast their decentralized credit rating to other blockchains. Borrowers then will be able to use their well-earned credit score on applications on different blockchains as well.

Credit Tokens (CRE)

Credit Tokens are an ECR-20 compatible token that will be exclusively used in ETHLend to represent a borrower’s reputation. These tokens cannot be traded or even transferred to another address. The more Credit Tokens associated with a user’s account, the more trustworthy the user’s account is.

ETHLend will manage borrower’s reputations by issuing Credit Tokens to users who successfully pay back loans. For every 1 ETH a user successfully pays back, the user will receive 0.1 CRE. Likewise, ETHLend plans to “burn” Credit Tokens away from accounts that that fail to pay back loans. A user with a high amount of CRE will be able to obtain loans that another user with a low amount of CRE couldn’t. Users with higher amounts of CRE will be rewarded with better interest rates as well as be required to post lower levels of collateral for similar loans compared to users with less CRE.

ETHLend Team & Progress

The ETHLend team is currently comprised of a large group of twenty-two members and six advisors. ETHLend is presently lead by its founder and CEO, Stani Kulechov. Other notable members of ETHLend’s team are Jordan Lazaro Gustave, Head of Management, as well as Martin Wichmann, Head of Token Sale, who raised almost 100% of ETHlend’s ICO goal. Additionally, the ETHLend team has several members entirely focused on marketing and media correspondence. Finally, the team has multiple technical and nontechnical advisors that cover almost any business issue including security, legal, and development concerns.

Progress Roadmap

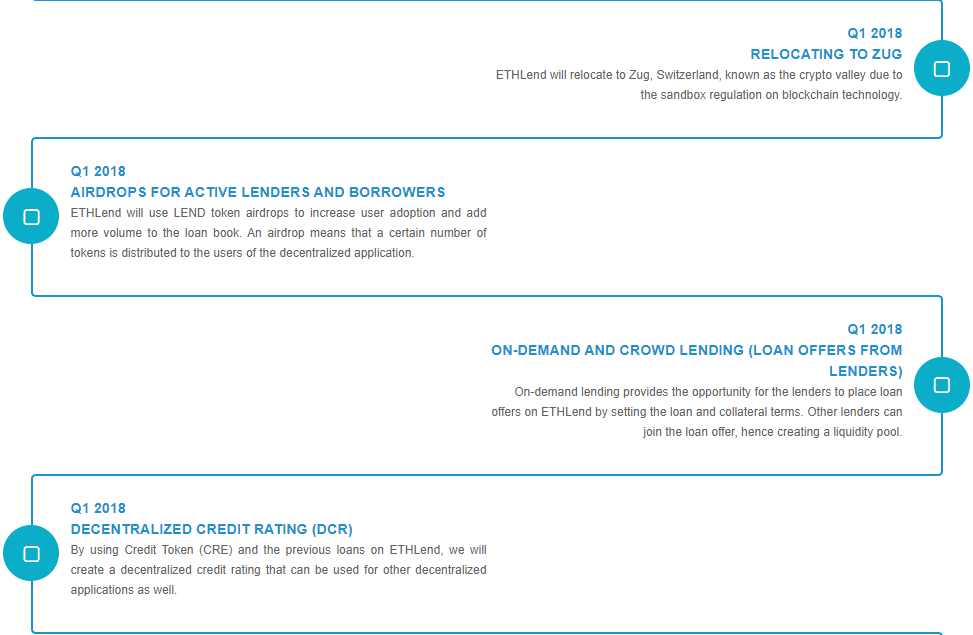

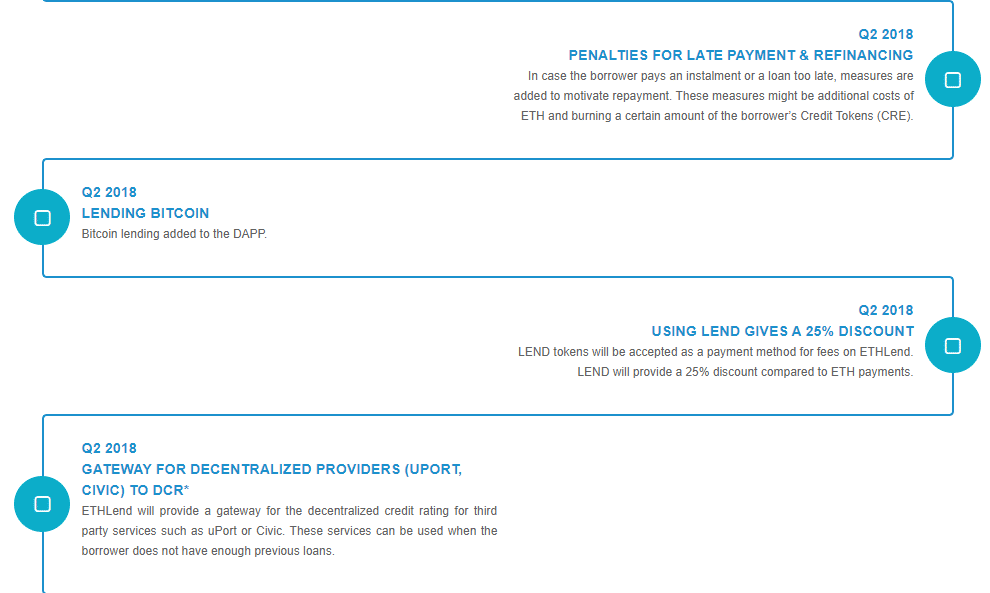

The ETHLend Team has set out ambitious goals for next two years. In the near future, ETHLend plans to add both Bitcoin and unsecured loans to its decentralized application. Here are the team’s primary goals for first two quarters of 2018.

Quarter 1 Goals

Quarter 2 Goals

Conclusion

ETHLend provides a decentralized platform where secured, peer to peer Ethereum loans can take place between any two people in the world. Removing politics and borders from the equation, ETHLend hopes to revolutionize the lending industry. ETHLend ultimately aspires to create a truly global marketplace that will benefit all participants looking to both give and receive loans.

The post What is ETHLend? | Beginner’s Guide appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.