Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What is CoinDash?

CoinDash describes itself as a “crypto-based social trading platform designed to help you create and maintain a winning portfolio of cryptocurrencies”. It lets you manage your crypto portfolio in a simple format while having the ability to copy other traders’ activities.

The platform is currently in the beta version stage, being tested by roughly 1,000 participants who will give feedback on possible improvements/adjustments. According to their official website, a major issue encountered by the cryptocurrency industry is the barrier to entry that inhibits mass adoption.

Barriers include “managing, investing, and interacting” with trading platforms, which often discourage inexperienced traders from entering the investment arena. This is where CoinDash comes in.

Using the CoinDash Token(CDT), users will be able to watch accomplished traders. Informed users can then replicate experienced traders portfolios “in a simple, interactive, collaborative environment”.

Similarly, users will be able to earn CDT by giving a public display of their of their personal portfolio and trading activities. This gives customers the opportunity to be both “creators and consumers at the same time”. Furthering the concept of knowledge sharing, CoinDash will offer insight into personal portfolio/trading decisions, made possible by tracking user transactions on the blockchain.

Key features of CoinDash

As stated before, CoinDash provides traders the means to make smarter choices when it comes to cryptocurrency investments. To do this, the platform includes the following features:

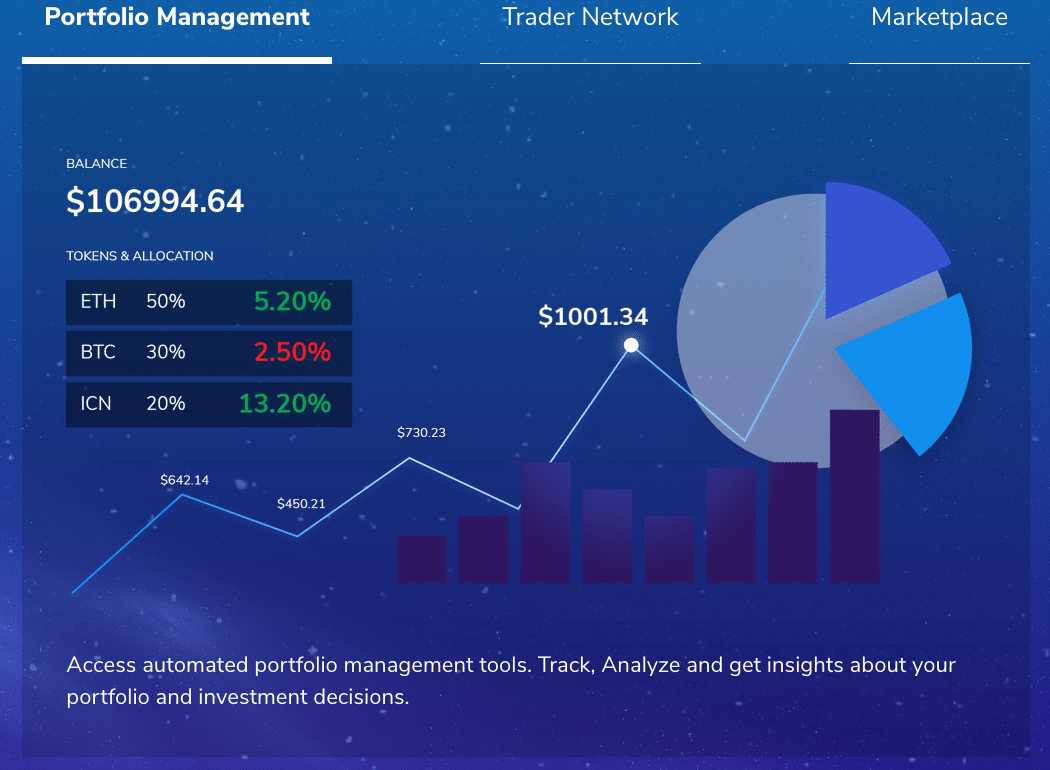

- Portfolio Management: Provides analytics and offers automated insights about users portfolio and investment choices.

- Trader Network: Social network allowing users to follow other traders real-time portfolio activities and copy their strategies. Imitating their strategies is as simple as going to a top traders portfolio and clicking “copy trade”.

- Marketplace: Explore new cryptocurrency opportunities, “receive real-time market data, and access 3rd party investment instruments”. The marketplace includes subjects like trending cryptocurrencies and updated ICO information.

How Does CoinDash Work?

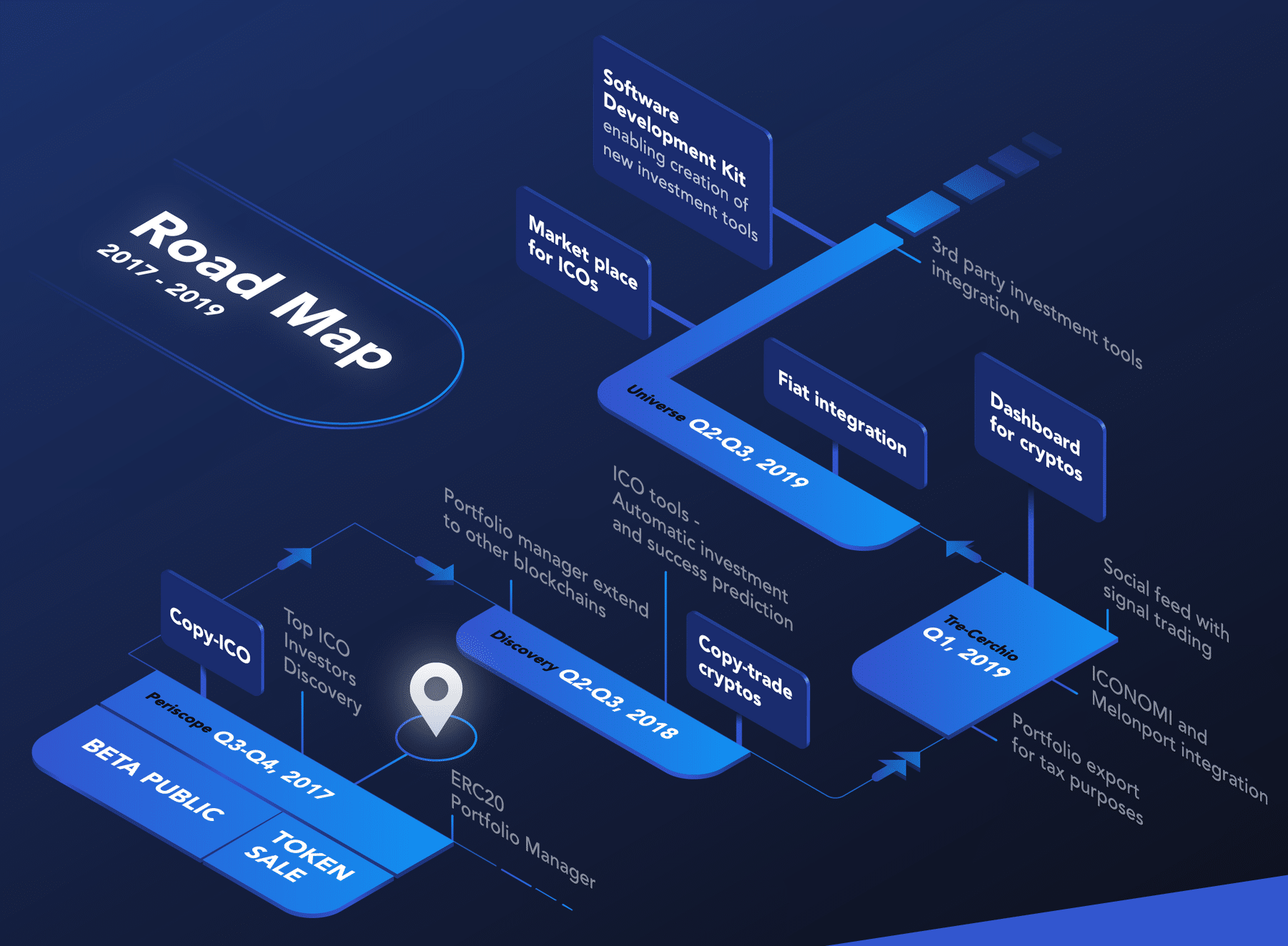

As an ERC20 token, CDT is compatible with the Ethereum blockchain. Currently, Coindash implementations support Ethereum and RSK but hopes to support all smart contract blockchains in the regards of social trading.

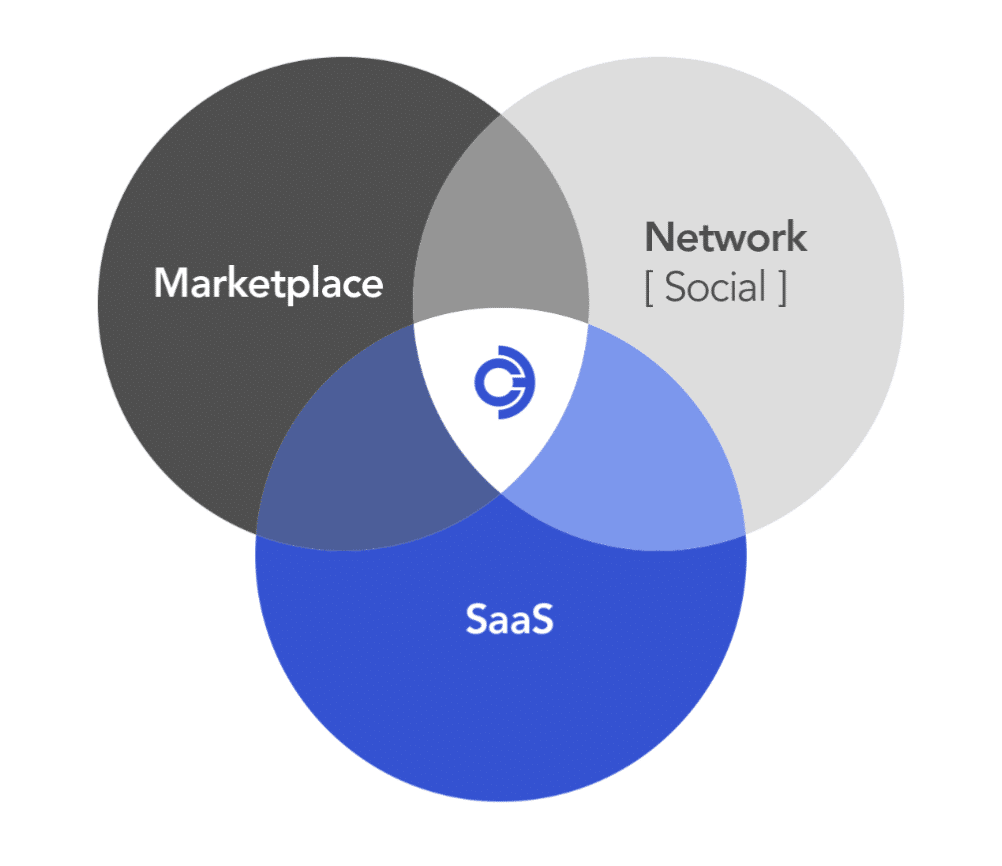

CoinDash is available on mobile apps and online. The product is considered a market network that includes a marketplace, social network, and SaaS (Software-as-a-Service) component. The market network offers integration of multiple exchanges such as Poloniex and HitBTC to keep users informed of overall analytics. It also supports “if-then automations on ICO investments. Example: invest in ICO X if 75% of the cap is raised within the first 24 hours.” Additionally, trades can be conducted under “if-then” conditions.

- Marketplace: Data produced by the SaaS and network layers enable easier discovery of investment opportunities.

- Real-time trading signals from CoinDash

- Keep users informed on the overall market along with trending cryptocurrencies

- Software development kit for developers allowing them to merge 3rd party investment instruments.

- ICO dashboard: Graphical dashboard of past, present, and future ICO’s and aids in investing in them through the platform.

- Network (Social): Enables interaction among the CoinDash investment community through content sharing.

- Signal trading: regular users will receive real-time trading signals from top investors. Users must pay fees with CDT to receive recurring signals.

- Copy trading: users can allocate a portion of their coin holdings to copy top traders using smart contract technology

- SaaS: For those who are unfamiliar with the term, SaaS is considered “a method of software delivery that allows data to be accessed from any device with an Internet connection and web browser.” This layer is comprised of tools that allow for the custom design of cryptocurrency management and interaction mechanisms.

About CoinDash

CoinDash is an Israeli blockchain startup with headquarters in Tel Aviv. Founded in 2016 by Alon Muroch, the company employs between 11-50 people. Named one of the “Top 25 Israeli Influencers In Blockchain Technologies And Cryptocurrencies” by The Jerusalem Post, Muroch isn’t an amateur to the industry.

Prior to CoinDash, Muroch co-founded Bitcoin Authenticator in 2014 and was head of iOS development at p2p (peer-to-peer) payment solutions firm PayKey. Co-founder Adam Efrima also holds an impressive resume, once being the operations director at social trading investment network eToro and investment director at Citic Group before moving on to the founding of CoinDash.

During its ICO phase, CoinDash was hacked by an “unknown perpetrator” who changed the designated investment address to a personal address. While the company was still able to raise $6.4 million, the hacker had already stolen roughly $7 million in Ethereum. CoinDash ultimately closed the token sale 13 minutes after its start.

In a statement, the company said: “this was a damaging event…but it is surely not the end of our project.” Besides the initial setback, the company has continued to move forward with the project and outlined its roadmap as seen below.

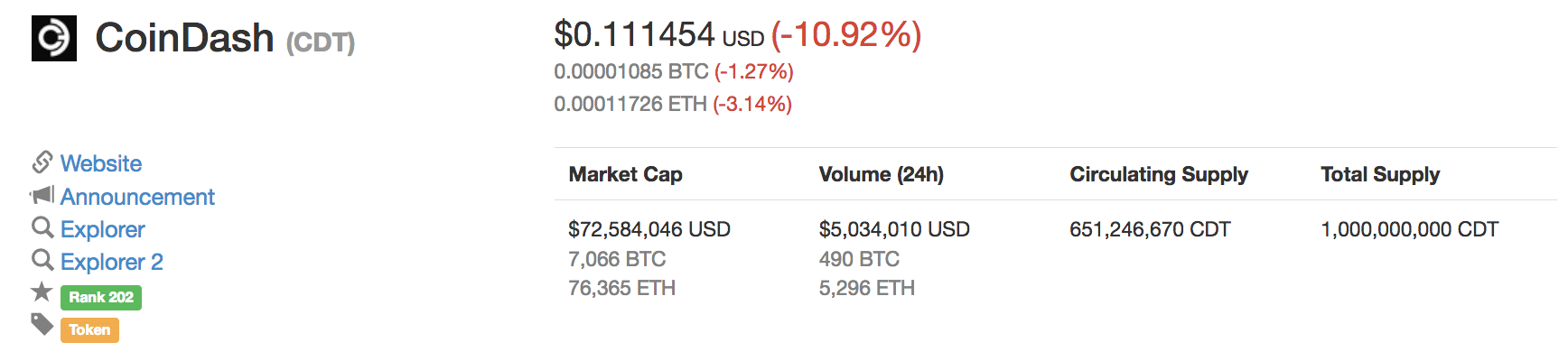

CoinDash Coin Supply

CoinDash has a total supply of 1,000,000,000 CDT with a circulating supply of 651,246,670 CDT. Although the market has been keeping traders up at night from anxiety, CoinDash revealed some good news.

As a part of their loyalty program, ICO participants will receive tokens via distribution for a total of 15,000,000 CDT. Moreover, during the month of February, CoinDash “will ‘buy-back’ a total of 2.5 million CDT from circulation in order to keep it in the company’s reserves”. Coindash currently ranks at 195 among all coins in terms of market cap.

CoinDash Trading History

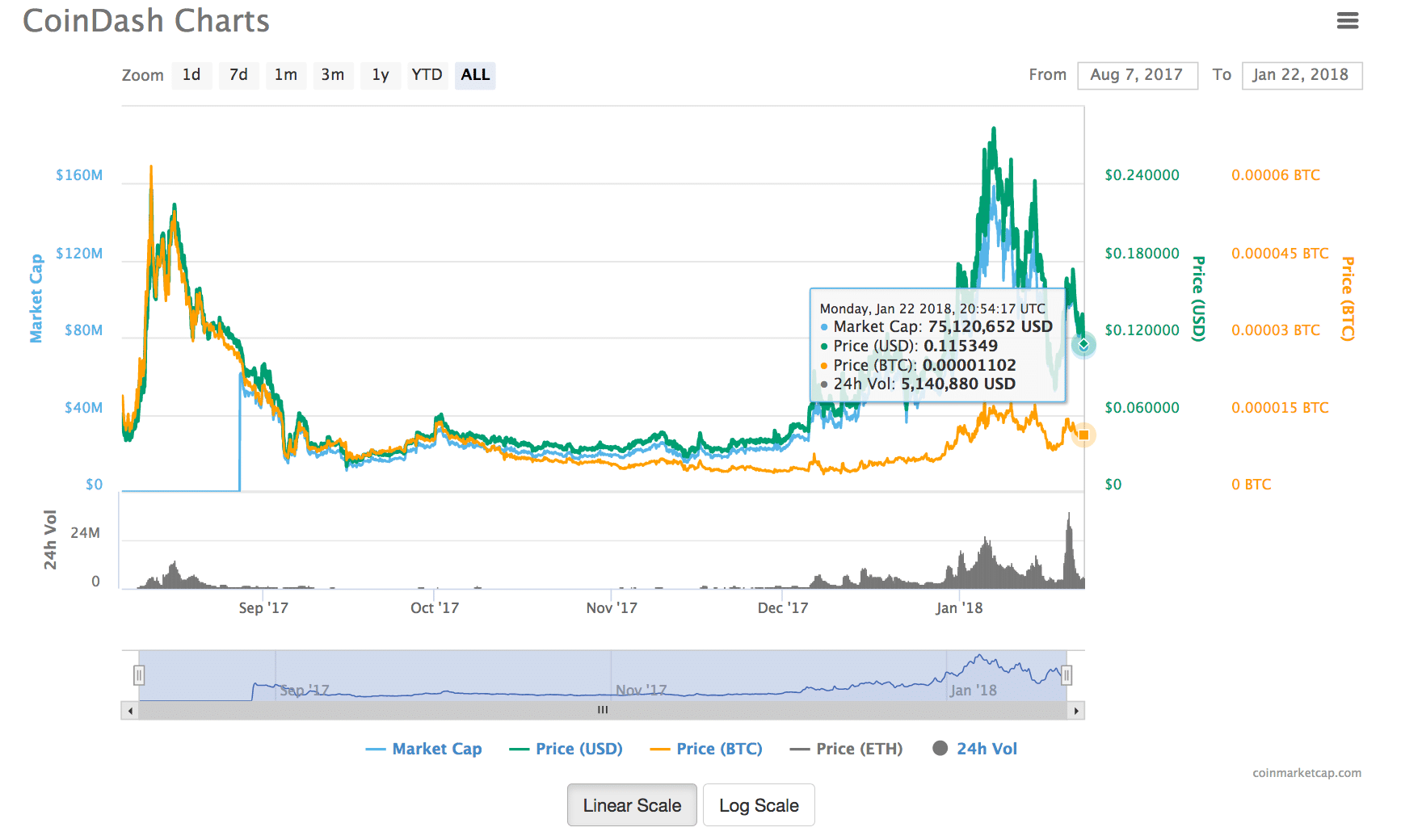

On August 7th, 2017, CoinDash was treading for around $.05. At the time of writing, CDT was trading for roughly $.11, reaching ATH’s of $.27 on January 7th, 2018. The dramatic swings in the price of this digital asset reflect the overall volatile nature of the cryptocurrency market. In recent weeks, the bear market has also plagued CDT.

Where Can You Buy CoinDash?

Binance, Gate.io, HitBTC, EtherDelta, Gatecoin, Mercatox, and BigONE are all exchanges you are able to purchase CDT with ETH or BTC. However, Coincentral highly suggests Binance due to its user-friendly format and low trading fees.

New users can purchase BTC or ETH coins on Bitstamp, CoinMama, Coinbase, or Gemini and deposit it to their respective addresses on Binance. These exchanges allow for ETH and BTC purchases with credit cards and/or bank transfers.

Where Can You Store CoinDash?

Because CoinDash is an ERC20 token, you can store it on hardware wallets that support the Ethereum blockchain such as Ledger Nano S and Trezor. You can also store it on MyEtherWallet (MEW). To check out more wallets, refer to our guide The Best Ethereum Wallets.

Conclusion

In its whitepaper, CoinDash states both experienced and novice cryptocurrency investors will be attracted to the platform through its high-performance analytics and social networking tools. Currently in the last stage of testing, a finished product ready for public launch in the near-term is likely.

A project like this seems to set itself apart from the many “scam” blockchain projects. With CoinDash, the project offers a clear use case for CDT. According to the team, “the more people who use the platform, the more fees will be paid, the more tokens will be bought–ultimately pushing the price of the token up.”

As many traders lose money on the daily, it comes as no surprise a product launched to help give traders a helping hand. Therefore, it would not be unreasonable to foresee the success of this relatively new altcoin.

To find out more about CoinDash, take a look at the projects official Twitter page, or watch this Youtube video explaining how the futuristic trading platform works.

The post What is CoinDash (CDT)? Beginner’s Guide appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.