Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

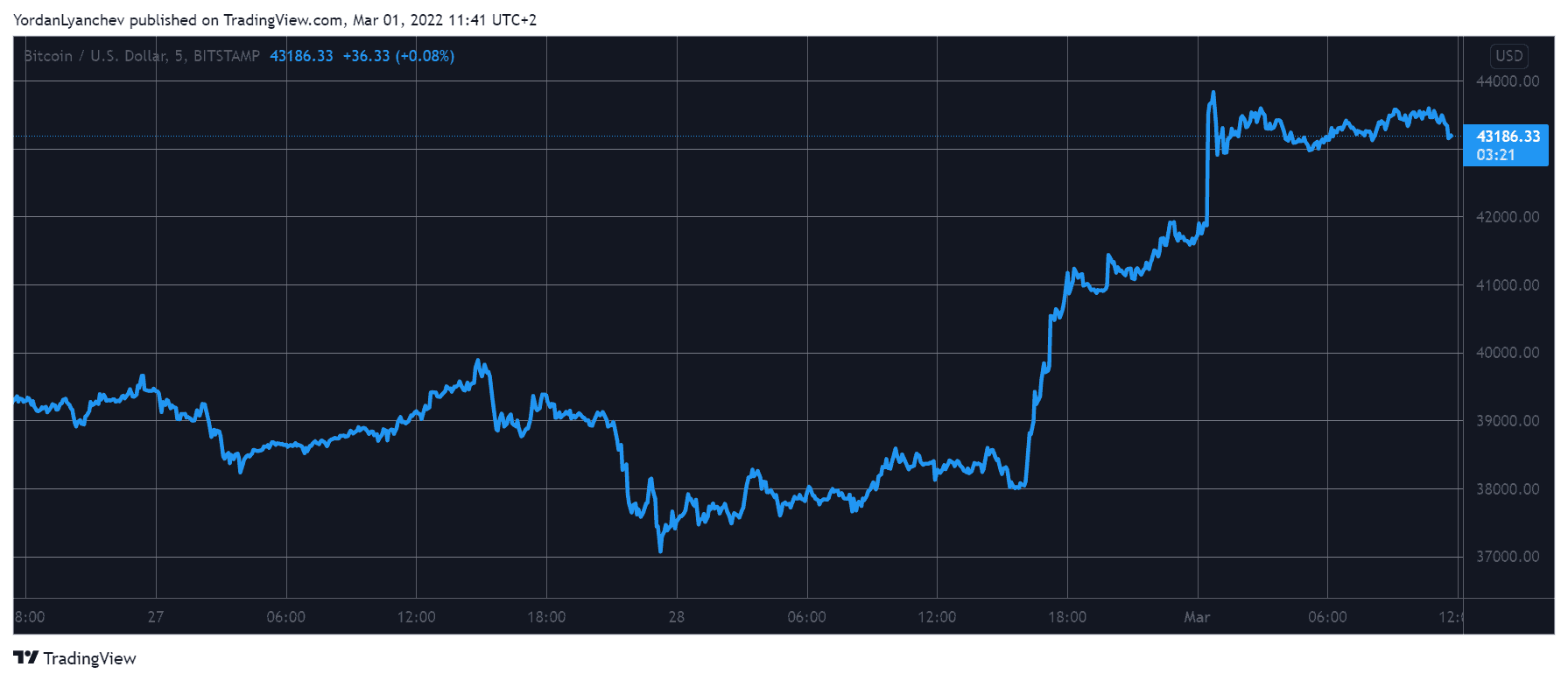

Bitcoin went on a tear in the past day or so by surging by more than $6,000 and breaking above $40,000 for the first time since the war between Russia and Ukraine started. Most altcoins marked substantial gains as well, with Ethereum nearing $3,000 and Terra exploding by 20%.

Bitcoin Marks 12-Day High

It’s safe to say that Russia’s actions to launch a special military operation against Ukraine impacted the cryptocurrency market. Bitcoin traded at around $39,000 before it plummeted by $5,000 to a monthly low of just over $34,000.

However, when the West said they will not get directly involved in the war, BTC began its rapid recovery and regained all lost value in hours. Moreover, the asset kept climbing and even challenged $40,000 a few days later.

While it was unsuccessful at first, the asset actually managed to reclaim that coveted level yesterday, as reported. It continued upwards and tapped $44,000 for the first time since February 17, resulting in over $300 million worth of liquidated positions.

As of now, BTC stands at around $43,500, and its market capitalization has soared well above $800 billion.

Interestingly, bitcoin’s increase comes amid reports indicating that Russians have enhanced their appetite for the asset with the trading volumes reaching new local peaks after the sanctions imposed by the West.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Altcoins Explode

Similar to bitcoin, the altcoins went on the offensive hard as well. Ethereum, for example, skyrocketed by 11% and now stands above $2,900. It’s worth noting that the second-largest crypto dumped all the way down to $2,200 after the war broke.

Binance Coin is up by 12% and trades above $400. Ripple, Cardano, Solana, Avalanche, Polkadot, Dogecoin, and Shiba Inu are well in the green, too.

Terra is the most substantial gainer from the larger-cap alts with a near 20% surge. Consequently, LUNA sits close to $90.

More price pumps come from Waves (40%), THORChain (24%), NEAR (22%), Theta Network (18%), NEO (16%), Fantom (16%), JUNO (15%), Oasis Network (15%), and many others.

The crypto market cap added roughly $200 billion since yesterday and is above $1.9 trillion now. The metric is up by nearly $400 billion since February 24.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.