Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Staking is a term often used to describe the locking up of cryptocurrency as collateral to help secure a particular blockchain network or smart contract protocol. Staking is also commonly used in reference to cryptocurrency deposits designated towards provisioning DeFi liquidity, accessing yield rewards, and obtaining governance rights. Cryptocurrency staking involves locking up tokens in a network or protocol to earn rewards, with those tokens used to help provide key services for users.

In this post, we’ll explore the basics of staking cryptocurrency, how it works, and why it is commonly used in blockchains and DeFi ecosystems. We also examine how oracle network staking dynamics compare to and differ from staking in existing implementations within blockchain networks.

How Does Staking Work in Blockchains?

For blockchains to remain secure and maintain a high degree of Byzantine fault tolerance, they need a Sybil-resistance mechanism—a method of preventing a small group of nodes from corrupting the network. If the Sybil-resistance of a blockchain is weak, the blockchain is more vulnerable to 51% attacks, where a small or colluding set of actors can engage in malicious activity such as rewriting the history of the chain and censoring users.

A block is simply a batch of user transactions that are validated together as part of blockchain ledger updates. Not only does each block contain this new transaction information, but it contains a reference to previous blocks in the form of a hash that cryptographically connects blocks together in chronological order; i.e. block + chain. Validators/miners are tasked with producing blocks and proposing them to the network. Their proposed blocks are then appended to the ledger if deemed valid by a majority consensus of other validators/miners and full nodes.

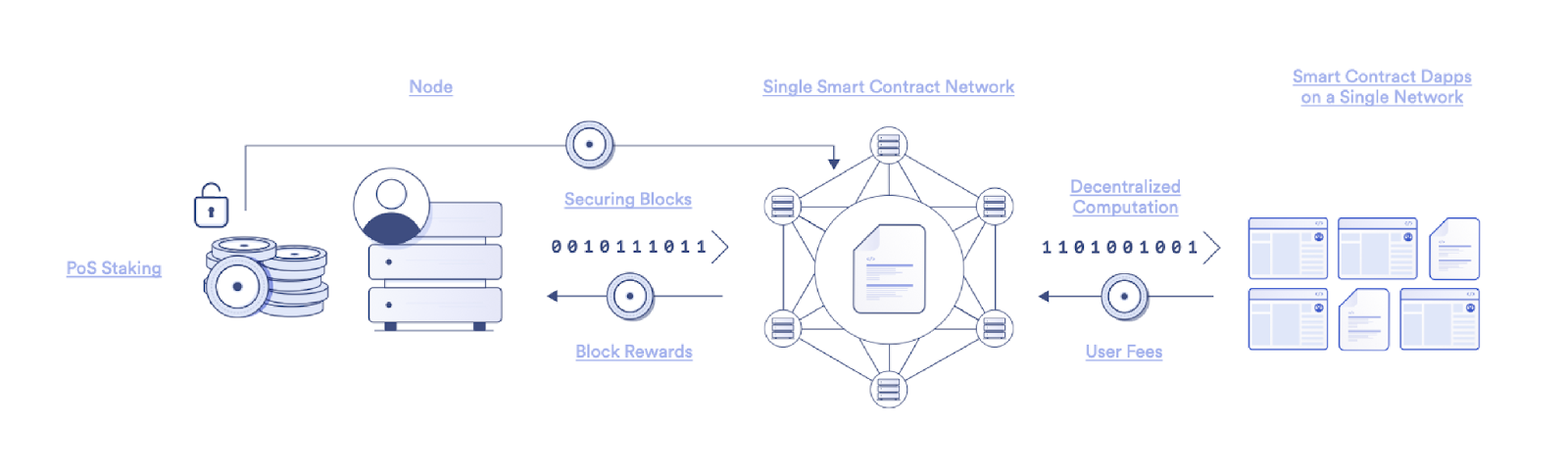

Proof of Stake (PoS) is a category of Sybil-resistance mechanisms in blockchains that obligates validators to hold a financial “stake” in the network in order to obtain the chance to append new blocks to the blockchain. In PoS blockchains, anyone staking the minimum required native coin balance can join the network and become a validator (staker) to generate blocks. The size of the validator’s staked balance or the number of validators a user operates is generally proportional to their chance of being selected for block production—the higher the staked balance or the more validators under their control, the greater the chance of selection.

When a validator node successfully creates a valid block, they often receive a staking reward from the protocol and a portion of the user fees. To disincentivize malicious behavior, PoS blockchains also often implement a mechanism called slashing—where a validator node is punished via the loss of some or all of their staked tokens because they were determined to break the rules of the protocol. Some PoS blockchains also confiscate a portion of the validator’s stake if they go offline and do not generate blocks when they were selected to do so.

Types of Blockchain Staking: Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS)

Proof-of-work (PoW) Sybil-resistance mechanisms, such as that used in the Bitcoin blockchain, involve miners competing to solve a computational puzzle (i.e. produce a valid hash based on the information within a block). The first one to solve it and submit a valid block approved by the network earns the reward. The Bitcoin network automatically adjusts the difficulty of generating a valid hash every 2016 blocks (every 2 weeks approximately) to target an average block time of 10 minutes. The difficulty adjustment is generally based on the number of miners participating (total hashrate), where more miners lead to an increase in difficulty to keep the network decentralized.

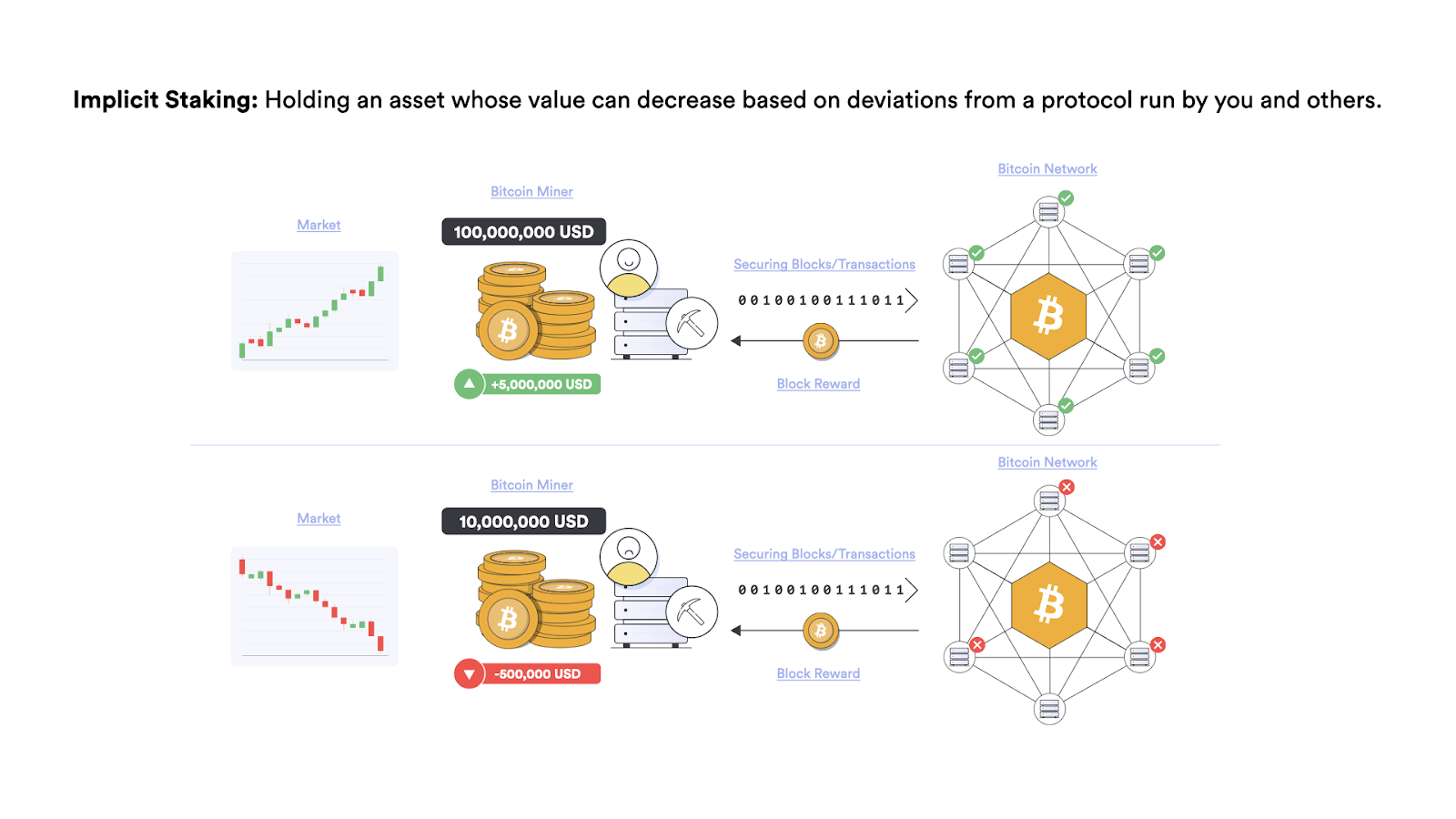

In PoW, the chance to append a new block to the blockchain is proportional to the amount of computational effort expended. So while PoW blockchains do not have conventional explicit stake mechanisms where users lock up cryptocurrency in smart contracts that are subject to slashing, they have implicit staking in the form of purchasing expensive hardware (which is often application-specific) and expending computational power just for the chance of earning a reward, in addition to having financial exposure to the coin that is being mined. If the miners do not earn revenue via mining rewards, then their capital expenditure on equipment and power consumption comes at a loss. If the security of the network is not upheld, then the value of the equipment used for mining and the assets generated by mining can decrease in market value, creating an implicit financial penalty.

Though Bitcoin does not have conventional staking, it does have a form of implicit staking where miners are rewarded in an asset (BTC) that only remains valuable and covers their expenses if they uphold the security of the network.

Though Bitcoin does not have conventional staking, it does have a form of implicit staking where miners are rewarded in an asset (BTC) that only remains valuable and covers their expenses if they uphold the security of the network.

Proof-of-stake Sybil-resistance mechanisms replace this computational effort requirement with a requirement of staked cryptocurrency. In other words, miners in PoW systems compete with computational power, while validators in PoS systems compete with monetary value. Another notable difference is that for each block, PoW blockchains host an open competition between all miners for the chance to produce a block while PoS blockchains commonly rotate between validators to produce blocks, often based on stake-weighted randomness. Ethereum is an example of one blockchain that is moving from PoW to PoS as part of a process called The Merge.

PoS blockchains utilize explicit staking, where validators put down a staking deposit that can be confiscated if they deviate from the protocol rules.

PoS blockchains utilize explicit staking, where validators put down a staking deposit that can be confiscated if they deviate from the protocol rules.

One variation of PoS is delegated proof of stake (DPoS), which aims to separate the roles of stakers and validators by allowing token holders to delegate their stake to existing validators. Separating these roles gives token holders the ability to participate in block production to passively earn rewards as opposed to only validators. However, the trade-off sometimes comes at a reduction in the number of network validators when compared to traditional proof-of-stake systems where each staker runs their own validation software clients.

Staking Rewards

Stakers in blockchain networks are incentivized to produce valid blocks through user fees attached to each transaction and a block reward—newly issued cryptocurrency that is assigned to validators that have successfully created and/or attested to a block.

Protocols calculate staking rewards in different ways, depending on a number of factors such as the number of coins staked per validator, the amount of time a validator has been staking, the total amount of tokens staked in the network, the amount of tokens in circulation compared to total supply, and various other parameters. PoS blockchains take different approaches to the rate of rewards issued over time, but generally target issuance and yield rates based on total stake deposited in the network.

In some proof-of-stake systems, groups of token holders can combine their resources (staking power) via a collective staking pool to increase their chance of getting selected for block validation and earning a staking reward. If the network has a minimum staking requirement, staking pools allow users to stake their tokens in a PoS blockchain even if they don’t meet the minimum. The rewards earned by the pool are then shared between depositors and operators of the pool.

Staking in DeFi

Staking is also a term commonly used in decentralized finance (DeFi) protocols. Instead of securing block production, DeFi staking often refers to locking up tokens within a protocol to achieve a specific goal or result. While “staking” in this context could be considered a misnomer for some use cases, it is a common phrase used throughout the industry.

Some uses of DeFi staking include:

- Protocol insurance — Decentralized lending protocols such as Aave use staked tokens as a liquidity backstop, where holders can lock up their AAVE tokens within the protocol’s Safety Module to provide an additional layer of security and insurance for depositors should a black swan event occur. Stakers then earn rewards from the protocol.

- Governance — Curve, a decentralized exchange (DEX), leverages staking as a way to align long-term incentives between liquidity providers and governance participants. CRV holders can “vote lock” their CRV to receive voting escrow CRV (veCRV), where the longer they lock for the more veCRV they receive. Vote locking enables holders to vote on governance proposals, influence the CRV yield earned within specific liquidity pools, and receive a portion of the protocol’s trading fees.

- Liquidity provision — Decentralized liquidity protocol Synthetix incorporates staking as a way to supply collateral for the creation of synthetic assets that track the price of an external asset and are collateralized by staked SNX. SNX stakers are incentivized to provide liquidity to the protocol through inflationary staking rewards and the distribution of trading fees earned through dApps such as Kwenta that use the Synthetix protocol.

- Token distribution — DeFi protocols such as Alchemix employ staking as a way to distribute tokens to the community and bootstrap liquidity in a decentralized ecosystem. ALCX tokens can be obtained by staking certain tokens in the Staking Pools contract.

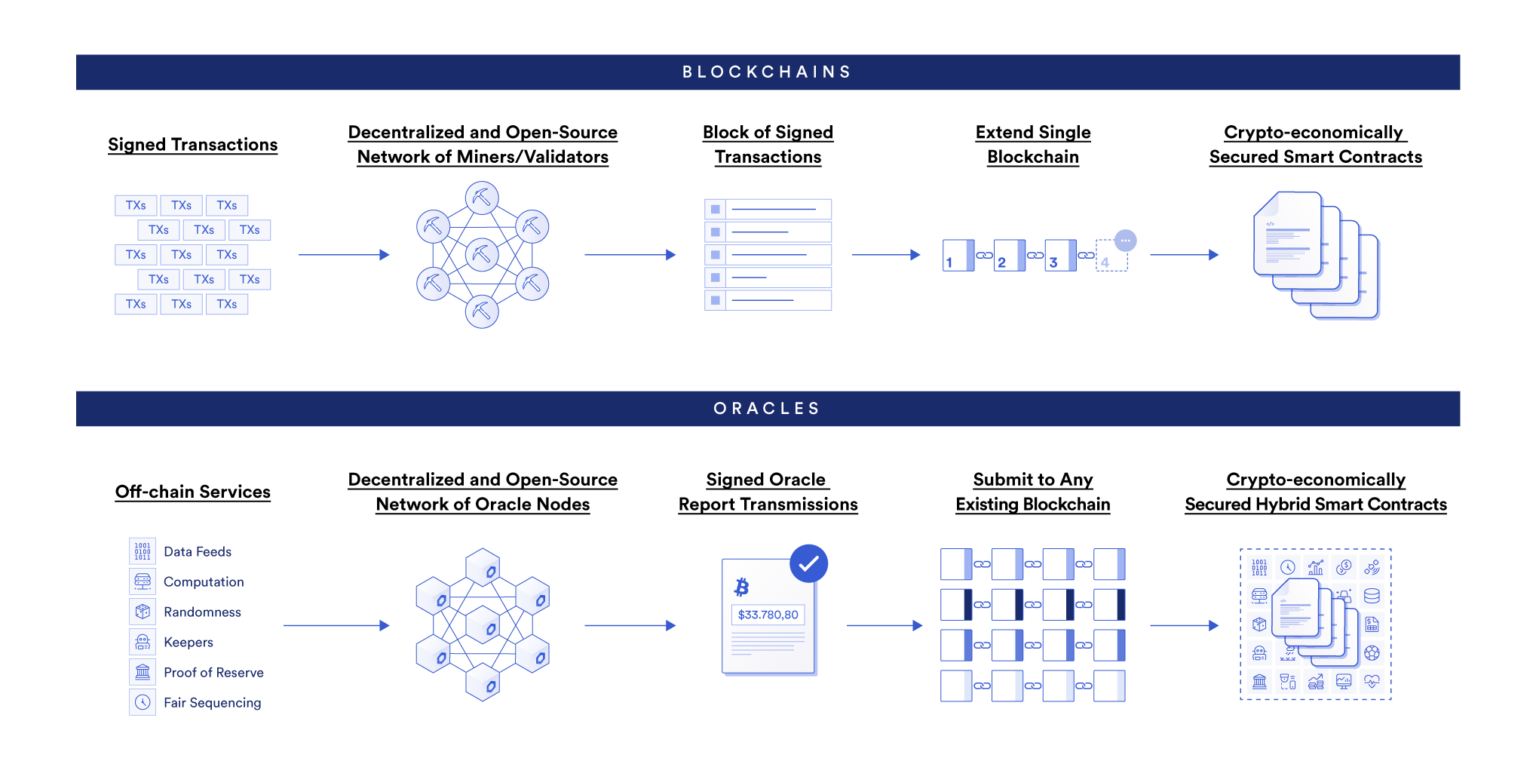

Blockchain vs. Oracle Network Staking Dynamics

Staking within decentralized oracle networks aims to achieve a fundamentally different goal than staking within blockchains. As outlined in the Chainlink 2.0 Whitepaper, “transaction validation in blockchains is a property of internal consistency, while the correctness of oracle reports on a blockchain is a property of external, i.e., off-chain data.” To further understand the deeper nuances between blockchains and oracles, check out the blog post: Blockchains and Oracles: Similarities, Differences, and Synergies.

In essence, blockchains offer one service (i.e. validate blocks) that follows a collectively agreed upon and predefined set of rules. Thus, blockchains use one type of staking design to secure the entire network. Alternatively, Chainlink decentralized oracle networks offer a wide range of different services (i.e. supply external data, perform off-chain computation, enable cross-chain interoperability, deliver outputs to traditional systems) that can each be customized in numerous ways to fit users’ own performance requirements, budgets, and trust assumptions. Thus, oracles require a highly flexible staking implementation to accommodate for the many ways users want to validate external data and events.

In proof-of-stake blockchains, staking mechanisms are used to incentivize honest consensus on the validity and approval of a set of pending network transactions. Slashing conditions for validators can include but are not limited to:

- Cryptography — a validator contradicts itself by generating and signing two different blocks at the same block height (e.g. double signing blocks).

- Internal State — a block is created containing invalid transactions that spend funds a user doesn’t have (e.g. double spend transactions).

- Internal Rules of the Network — a block generated by a validator does not conform to the rules of the protocols (e.g. minting more coins than the block rewards allows).

When it comes to staking in decentralized oracle networks (DONs), the goal is not around securing the production of valid blocks but rather ensuring the creation of reliable and tamper-resistant oracle reports that accurately reflect the state of the external world. Due to the dynamic and non-deterministic nature of generating truth about the environment outside a blockchain, slashing conditions for oracle nodes may not be the same for all users and may not be verifiable by cryptography or internal state/rules alone. Instead, oracle services make use of on-chain service-level agreements (SLAs) between users and the oracle network that outline slashing conditions, rewards/penalties, and verification techniques used to determine whether or not the slashing event occurred.

Blockchains achieve consensus around validated blocks of transactions, while oracle networks achieve consensus on external data and off-chain computation.

Blockchains achieve consensus around validated blocks of transactions, while oracle networks achieve consensus on external data and off-chain computation.

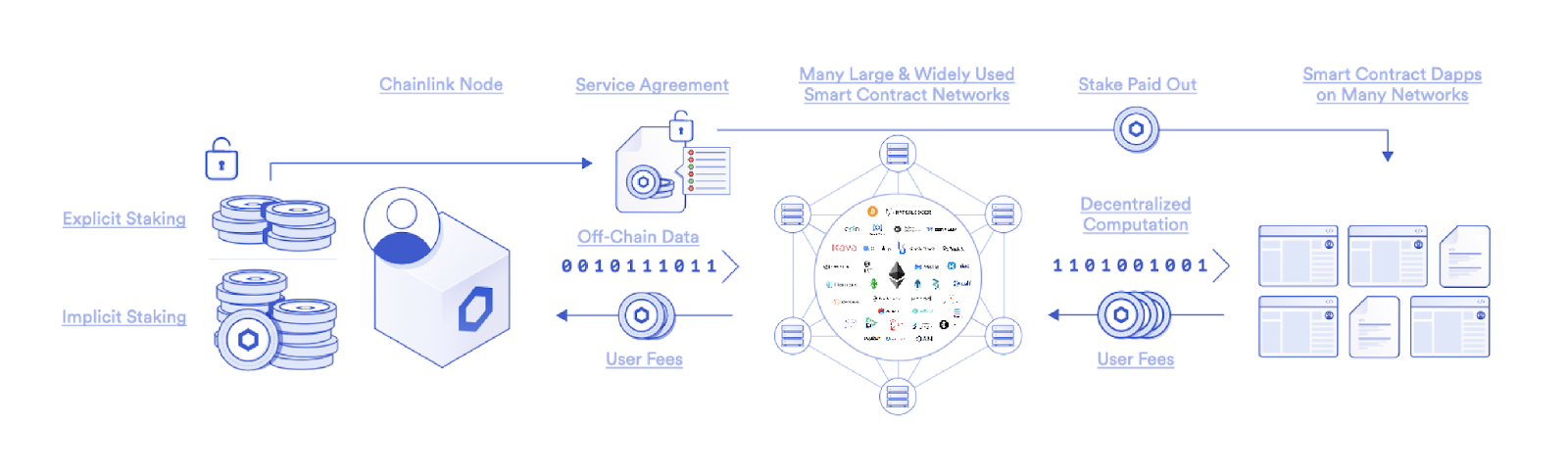

With Chainlink already supporting 800+ oracle networks across different types of services and blockchains, the Chainlink explicit staking model, which is under active development, must cover a very wide range of customizable slashing conditions, penalties/reward systems, and validation techniques that work natively across various blockchains. It’s why the Chainlink explicit staking system is being designed to properly incentivize correct oracle node operator behavior while accounting for the variation between different Chainlink oracle networks and services.

Chainlink staking combines implicit staking in the form of oracle node reputation systems and future fee opportunities, and explicit staking in the form of node deposits subject to slashing by the terms and conditions laid out in SLA smart contracts.

Chainlink staking combines implicit staking in the form of oracle node reputation systems and future fee opportunities, and explicit staking in the form of node deposits subject to slashing by the terms and conditions laid out in SLA smart contracts.

Notably, an attribute that is common to staking mechanisms across blockchains, DeFi applications, and oracle networks alike is the sharing of user fees with the stakers who help secure and facilitate the services offered. As the adoption of a protocol’s services increases, a greater pool of fees can be generated and shared with stakers.

The Future of Staking

Staking is an increasingly popular cryptoeconomic model across the smart contract ecosystem that also has direct relevance for oracle networks. While initially a system design that aimed to bring security and economic sustainability to blockchains, staking has become a valuable mechanism across DeFi protocols for managing liquidity and governance and will help power an additional layer of security for Chainlink oracle networks.

For a broad overview of how staking will help scale the security of Chainlink oracle networks, read Chainlink Staking: An Overview, or watch Chainlink Co-founder Sergey Nazarov’s presentation The Future of Chainlink, where he walks through the fundamentals of Chainlink’s network economics.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow @chainlink on Twitter.

- Explicit Staking in Chainlink 2.0: An Overview

- Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks

- Chainlink 2.0 Lays Foundation for Adoption of Hybrid Smart Contracts

The post What Is Staking? Blockchains, Oracles, and DeFi appeared first on Chainlink Blog.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.