Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Being DeFi the next financial frontier, are native DeFi index funds the future for investors interested in this type of financial products?

Index funds have historically been a great way for investors to get involved with the market. Their primary function is to facilitate the investing process for investors, enabling exposure to a specific asset or a group of them. Currently in the crypto industry there are several functioning index funds, each with a different type of exposure. Some are built on the traditional financial market while some offer their product on the crypto native market. Here we examine the success both approaches have had, analyzing potential reasons as well as key differences to keep in mind particularly for decentralized finance (DeFi) index funds.

Grayscale, a leading company in cryptocurrencies asset management, recently launched its first DeFi focused fund. The fund invests in top DeFi tokens such as Uniswap (UNI) and Aave (AAVE). Since Grayscale products focus on traditional market investors, the fund only accepts private placements with a minimum of $50k. Currently the fund has no secondary market, but intends to have shares quoted on a secondary market, following a one-year holding period.

On a similar note, DeFi Pulse Index (DPI) is currently the biggest crypto native index fund. It offers exposure to a market cap balanced portfolio of DeFi’s top tokens. Since it’s a crypto native index fund, its product is limited to crypto investors.

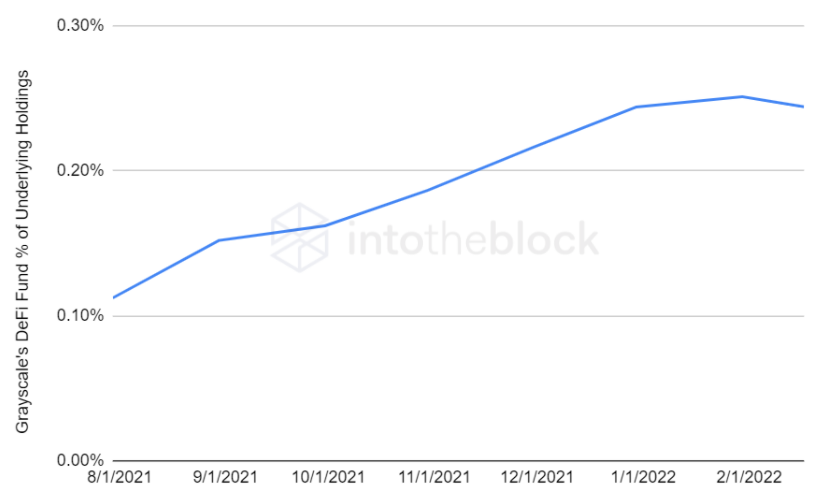

We compared Grayscale’s DeFi Fund assets under management to its underlying holdings market cap, this helps to measure the traction gained by a particular index fund in its specific market.

Recently launched Graysacle’s DeFi fund currently holds $7 million in AUM. This one has gained market share since its inception in late July 2021. Attracting investors from the traditional finance ecosystem wanting to gain exposure to DeFi assets, the fund has managed to grow from 0.11% market share by the end of July 2021 to 0.25% by the end of January 2022. Still being in an early stage, the fund takes advantage of being one of the few traditional finance investment products that offers exposure to the growing DeFi ecosystem.

Being DeFi the next financial frontier, are native DeFi index funds the future for investors interested in this type of financial products? In the indicator below we measured DPI’s market cap in relation to the weighted market cap of its underlying holdings.

It’s clearly seen in the graph how it quickly gained market share with its release to the market, capturing all the way up to 6% of its underlying holdings market cap. More recently, DPI’s percent of market share has decreased bottoming in April 2021 at 2% and currently holding about 3.77%.

DPI differs from Grayscale’s DeFi fund and all traditional finance index funds, because it offers its product in the crypto native environment. Being this the case the fund only accepts crypto investments, meaning investors need to pass through the technical barriers of converting into crypto and managing their own wallet to invest in the index fund, which may present challenges for investors not familiar with the ecosystem. Despite this, DPI’s current market cap is around $71 million, compared to Grayscale DeFi fund which has managed to capture $7 million since its inception.

This difference in capital could be the product of many reasons. First, Grayscale DeFi fund just recently launched in July 2021, while DPI launched in October 2020 almost a year before Grayscale’s DeFi fund. Secondly, another potential reason is that traditional finance investors are not yet as comfortable investing in DeFi assets. Being this the case, it gives the DeFi industry a sign of an early stage in terms of growth and that there are many investors not yet familiar with the DeFi space.

If DeFi is the next financial frontier, more traction is going to be needed, in order to make crypto native funds the new normal.

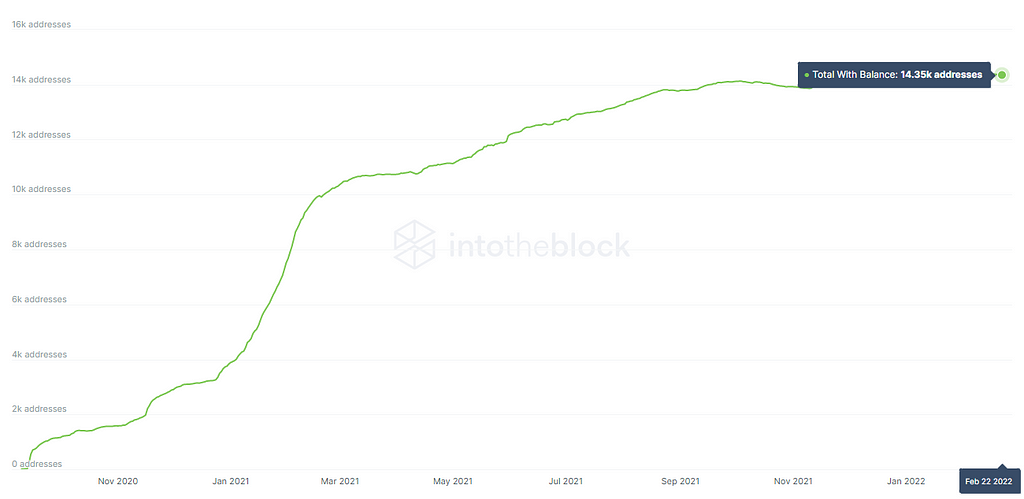

Although DPI’s holdings have decreased, it has continued to grow in terms of holders as measured by IntoTheBlock’s Total Addresses with Balance indicator. This indicator subtracts those addresses that have no balance from the total number of addresses in the network to arrive at those addresses that actually have a balance.

In this case it’s possible to track addresses with a balance for DPI because it’s all publicly visible on chain, which is not the case with Grayscale’s DeFi fund since it’s a private fund. Currently DPI’s Total Addresses with a balance stand at 14.35k, its historical rate of growth has slowed down, managing to increase around 720 addresses during the last 6 months. Some possibilities for this decrease in market share and address growth, could be due to user migration towards new recent products launched by Index Coop, the protocol behind DPI.

This gives further insight into the crypto related index funds available in the market. DeFi is an entirely new ecosystem for traditional market investors and still sits at an early stage of development. There is currently a wide variety of products on the index fund traditional markets industry with possible fit to the crypto markets. Possible new products could lead the way on DeFi’s index fund sector.

Exploring DeFi Index Funds was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.