Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The escalating conflict between Russia and Ukraine continues to harm the financial markets, and the crypto space is no exception. Bitcoin slumped by $3,000 in a day, while most altcoins went through double-digit price drops in 24 hours.

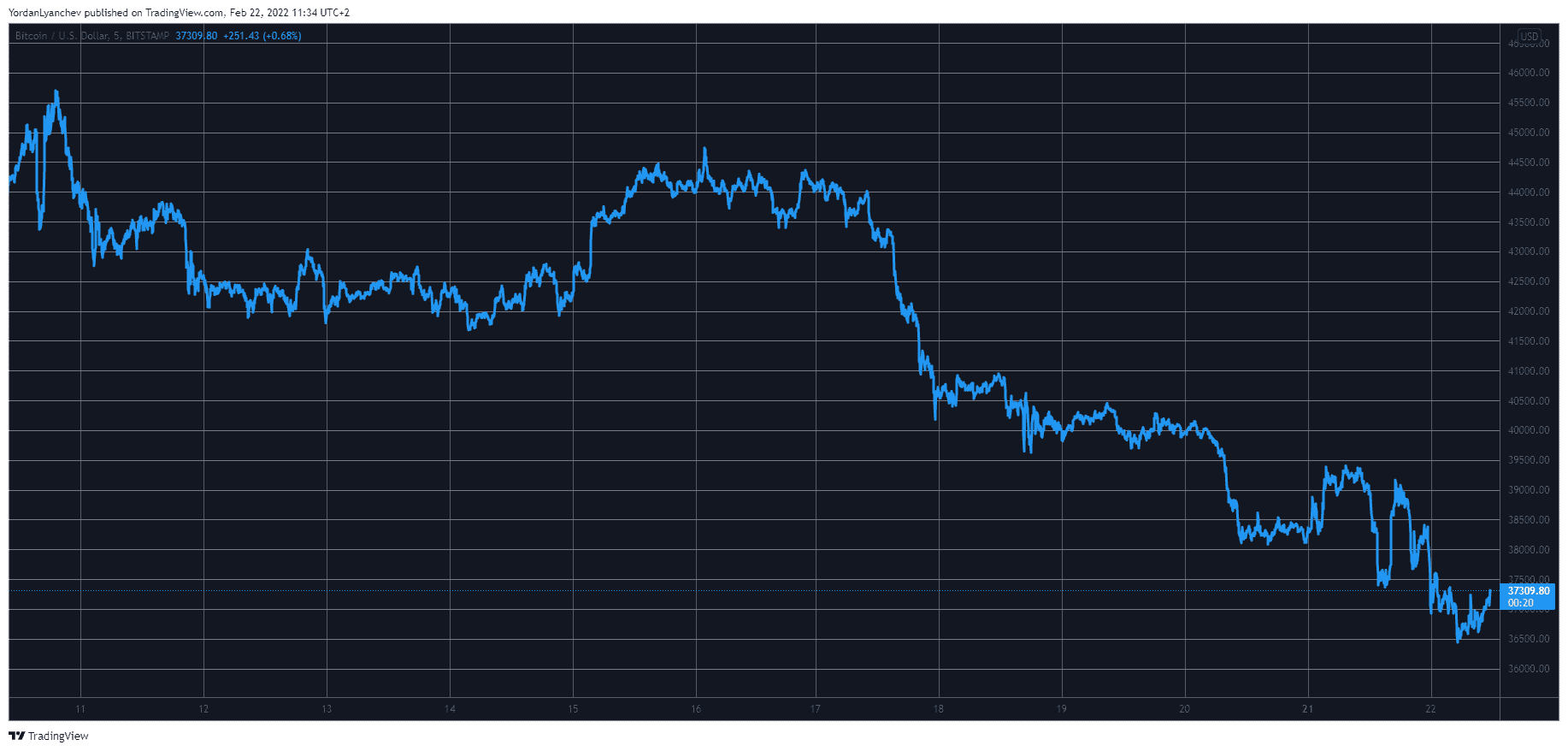

Bitcoin Nosedived to $36K

Less than a week ago, bitcoin traded at $45,000 before the bears took complete control over the market and started to push the asset south vigorously. After dropping by $5,000 to the coveted $40,000 line, BTC stood there for a while but ultimately dumped below it during the weekend.

After falling by $2,000, bitcoin initiated a brief recovery yesterday but was stopped at around $39,500. It nosedived once again to $37,500 before the bears pushed it to a new three-week low of just over $36,000, leading to roughly $400 million worth of liquidations.

Despite recovering several hundred dollars since then, bitcoin is still deep in red on a daily scale. This comes amid the growing tension between Russia and Ukraine. The latest news from that direction informed that Russia had ordered troops into two of the rebel-held regions in eastern Ukraine after recognizing them as independent states.

The US and the EU continue to threaten President Putin and its administration with severe sanctions, but they seem to have a little-to-no effect yet.

Altcoins Bleed Out Heavily

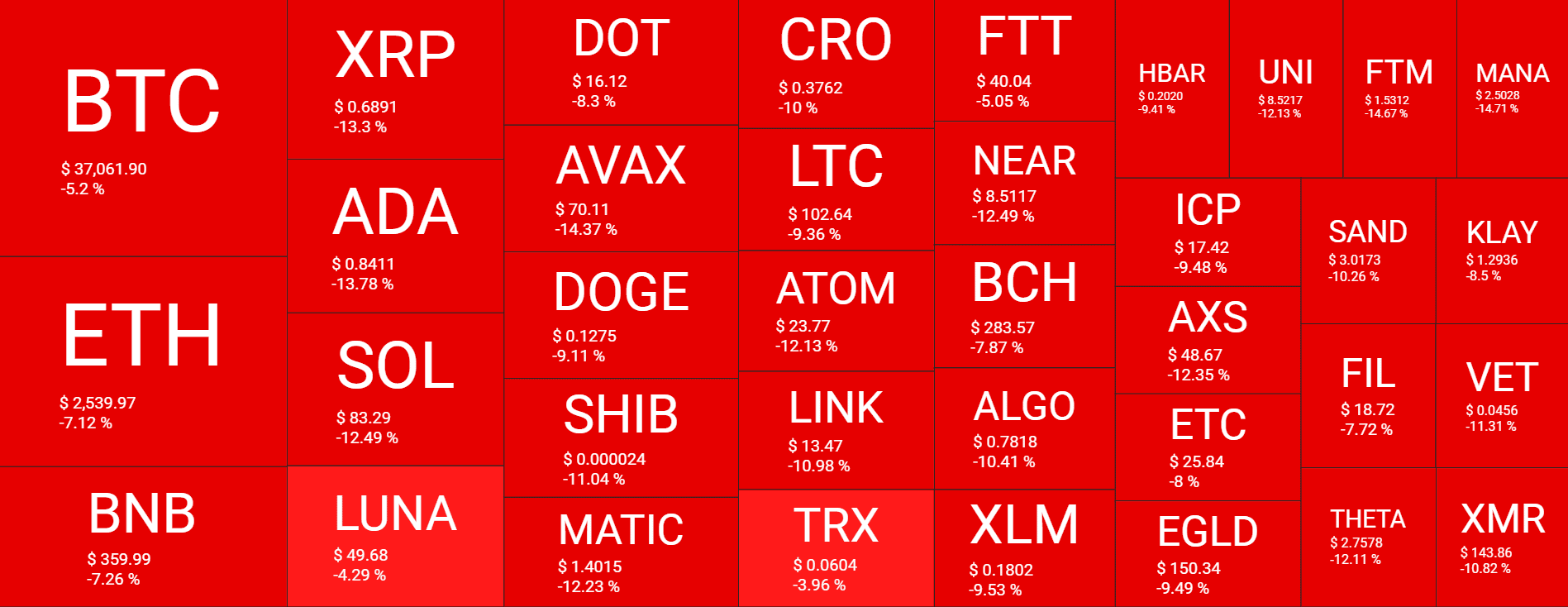

As it typically happens when BTC suffers, the alts are in an even worse shape. Ethereum is down to a new monthly low of around $2,500, following a massive 7% decline. Just days ago, the second-largest cryptocurrency stood above $3,200.

Binance Coin has lost a similar percentage and now sits at $360. Even more substantial price losses are evident from Ripple (-13%), Cardano (-14%), Solana (-12.5%), Polkadot (-8.5%), Avalanche (-14.5%), Dogecoin (-9%), Shiba Inu (-11%), MATIC (-12%), CRO (-10%), and many others

The situation with the lower- and mid-cap altcoins is somewhat similar. As a result, the cryptocurrency market cap is down by $140 billion since yesterday and $400 billion in less than a week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.