Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Complex Game Economy of DeFi Kingdoms

The past months have seen crypto games such as Axie Infinity and DeFi Kingdoms (DFK) reach a combined market cap of several billion dollars. While this is significant[1], in the future:

Gaming could bring millions of new users into a blockchain-powered metaverse — where, for this article, we adopt the following short definition:

Metaverse: Open virtual world hosting societies with their own economies.

Terra’s enormous success at offering trustworthy algorithmic stablecoins such as UST has been contingent on their adoption by a vibrant ecosystem of high-quality protocols. Every additional such project further strengthens the foundation of trust that the Terra peg can rely on in the rarest and most extreme market conditions. Due to network effects, the total here is more than the sum of the parts, and any effort in increasing adoption is time well spent.

Simultaneously, the money of a truly open metaverse ought to be decentralized, yet ideally be of stable value in the real-world. It must also be easy to deploy and practical to use. All of this is true for Terra’s stablecoins leveraging a blockchain with fast consensus, a clean wallet interface, and protocols such as Anchor serving as a convenient decentralized neobank. Bridges give developers freedom to connect to other chains. For example, the IBC protocol allows for the easy acceptance of Terra stablecoins on new gaming chains chains that could be powered by the Cosmos SDK with fast block times and Tendermint’s instant finality; speedy transaction settlement and high throughput are important for games as much as for anything else.

Terra is therefore actively implementing the synergy between its product and the metaverse and is working with game developers to enable further adoption of its products in virtual economies — expect more news on this soon! In the future, millions of new users enjoying the utility of Terra’s product will create a bandwagon effect that will cement Terra as the world’s stablecoin.

While current games such as DFK are not aiming to provide a realistic virtual reality, they can be stepping stones bootstrapping the metaverse. DFKs complex economy is indeed deserving a closer look: as we will argue shortly, this is a feature that can play a crucial role in achieving the goal of mass-onboarding gamers onto the blockchain. But is it sufficient to ensure a stable virtual market?

Are Gaming & DeFi Compatible?

There is an elephant in the room that we must address. Are crypto games ever to appeal to traditional gamers?

Gamers are skeptical. One of the crypto community’s figureheads, @cobie, known for his cheerful manners moderating the popular uponly.tv podcast, recently had to learn this the hard way:

But who wouldn’t understand the gamers’ frustration? One reason that is often cited is that of hardware availability. For example, the Geforce RTX 3060, supposed to be an affordable entry to ray tracing-improved 3d graphics, but also well suited for Ethereum mining because of its energy efficiency, was available for exactly 4 days until Christmas 2021 at a popular electronics online store of our choice (during which time the price jumped up by 20%).

Perhaps more importantly: Money and gaming is a double-edged sword. Gamers in the past have been burned by novel concepts invented to extract money from them. A recent article by the NY Times summarized the dire situation [2].

Gamers presumably care about (in varying proportions depending on person and game):

- Community: From close buddies to clans to the wider community that shares gaming experience and/or lore.

- Opportunity: The opportunity to experience fun and entertainment, take on different roles in a virtual world, and bond with peers on joint adventures.

- Fairness: Skill-based ranking (skill ranges from manual control abilities to total play time and experience).

It’s easy to see that the metaverse idea maps well to the first two points. It enriches the community aspects and realism of the virtual experience offered by the game. In particular, the emergence of complex dynamics of an in-game economy for NFT assets and fungible assets can create a much more fascinating and believable world than what could have been hard-coded.

The last point, fairness, is the tricky one. Rewarding real-world-rich players in the game with unfair skill advantages is arguably the wrong path. Instead, one should do the inverse: skilled players may be rewarded monetarily with either NFTs or fungible tokens. This is fine as eSport leagues that pay prize money have been well-accepted since the early 2000s.

The open metaverse enables a new way of fairly rewarding gamers beyond winning prizes in competitive leagues. With increasing experience in the world, players increase their ability to leverage their knowledge about the virtual economy for profit.

Sure enough, NFTs that represent unique and useful assets in the game need buyers. Measures must then be taken to avoid unskilled gamers winning by doing nothing except buying these assets. Requirements around skill should be set to make use of them (either effectively, e.g. in a shooter, without skills of movement and aiming, a more powerful weapon will be nearly useless, or even strictly by requiring the virtual player to have leveled up enough to carry this weapon).

The metaverse enables a new way of fairly rewarding gamers: with increasing experience in the world, players increase their ability to leverage knowledge about the virtual economy for profit.

DeFi Kingdoms

DFK self-characterizes as “A game, a DEX, a liquidity pool opportunity, and a market of rare utility driven NFTs”. Or, even shorter, as a “DeFi game with NFTs”. Since its inception, it has successfully relocated the usual token trading on automated market makers into a fantasy game world.

New users visiting game.defikingdoms.com in their web browser can connect their wallet and get greeted with captivating medieval music and a stunning pixel art world map that behaves similar to Google maps. This map can be used to navigate to different rooms and DeFi menus by clicking on locations and then NPCs. There are no dynamic dialogues or events, nor (for the moment) interactions with other users outside of market menus. The fantasy world seen in the browser is merely a fun and surprisingly efficient frontend that organizes access to the virtual economy of DFK. Yet, it appears to be somewhat alive due to looped animations and updates in the markets that involve other players.

Tokens

The main in-game currency of DFK on Harmony is JEWEL (DFK plans to expand to other chains in the future with new main tokens). This token is the linkage between the game and the outside economy — the denomination of the most important assets (hero NFTs), and the reward token for liquidity providers. It is carefully designed with lock-up mechanics and emission / unlock schedules. There are other currencies as well that have more specific in-game purposes and must be traded against JEWEL or each other.

The core elements of the game are the hero NFT trading cards. Players are able to buy these from other players using an in-game market, gain rewards by doing profession quests, level them up and improve their stats, mint new heroes combining two parents, rent them out for this purpose, and ultimately use them for PvP rule-based fights. Another kind of NFT are plots of land. At the time of writing, the floor price for heroes is about $400, and land auctions are just beginning.

The DeFi Kingdom’s Economy

To assess the complexity of the hero NFT market, we have built a machine learning model that aims to predict hero prices from the trading card properties, trained on sales data. To accomplish this, besides using the features that can directly be read on the cards, we have constructed a series of informed nonlinear features such as alignment of the hero class and subclass with the profession gene and with the stat boosts, further alignment with the relevant profession skill, and some others. We have excluded the highest ranking classes, the genesis generation 0, the highest “mythic” rarity, and sales below 20 and above 1000 JEWEL since there are not enough data points to expect a machine learning algorithm to understand what is going on. For better performance, we have modeled the logarithm of the price because of its otherwise long-tailed distribution.

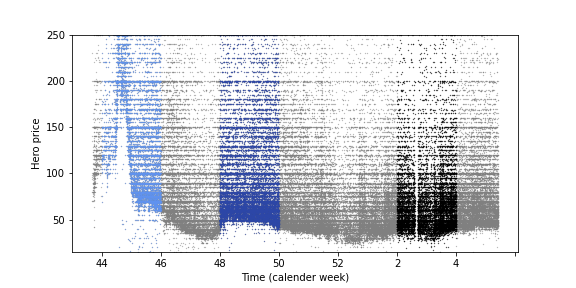

We have partitioned the data of all hero sales over the past three months into seven complete (isocalendar) two-week blocks, see Figure 3. We have then trained a so-called random forest regressor on one randomly selected half of sales data of each of the three blocks that are marked in the plot above. A random forest is an ensemble of decision trees that is particularly similar in its working to the thinking process of a group of humans.[3] The other half of the data is reserved for the performance evaluation plots below.

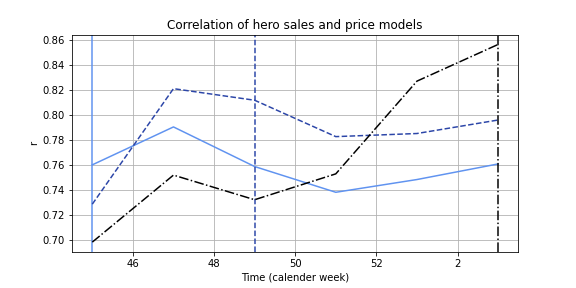

Figure 4 shows an error percentage of the price prediction for the three models (with their center fitting time again shown by vertical lines) when they are applied to the test data in each of the other blocks as well.

As expected, each model has the least error among the three of them at the time when it is fitted. The black one reaches down to nearly 10% of the median price most recently (here we consider the median absolute error, meaning in this particular case that half of the predictions are within an error margin of about 7 JEWEL, given that the median price is 60 JEWEL at the block indicated by the black vertical line from week 2 to 4). No model performs as well at early times, and the early model (light blue curve) amasses nearly 100% error later. This large error can easily be understood by a general shift in hero prices: the early median sale price is 140 JEWEL instead of 60.

It is therefore advisable to consider a metric that removes general market effects such as the overall price evolution. A particularly convenient choice is Pearson’s correlation coefficient r (see footnote [4] for a technical explanation of how to arrive at this conclusion). In this metric, if the model has understood better what hero properties matter most, we expect larger correlations, even if the model does not know how much heroes cost overall at the current market condition.

We note that the early model in Figure 5 is now indeed rather flat. It seems to capture some basic facts that were already evident months ago. We further confirm that each model works better than the other two around the time it was fitted. The latest model (black) again performs particularly well now, but much worse at early times, suggesting that new hero properties matter now and much more so today than those that played a role in the past.

In summary, this analysis shows that

- Hero prices can be predicted with machine learning methods.

- There are still considerable fluctuations of sale prices that cannot be explained with carefully built models. This suggests that players themselves do not agree among each other either, although this is improving with time (black curve increasing).

- With time passing, what is considered valuable changed.

Together, this proves that DFK’s hero market alone is complex enough to reward experienced players. Since it is clearly impossible for a newcomer to know more than what the machine learning algorithm has learned here, these players will sometimes sell under and buy above a fair price, causing fluctuations. On the other hand, the correlations that are exposed here can only come from (experienced or helped) players that do not act randomly. Additionally, the idea of what makes a good hero is changing with time, demanding continuous engagement of the players to remain on top of things.

Avoiding Pyramid Schemes

The law of conservation of money dictates that not everyone can end up in profit simultaneously from playing a game. Instead, money will ultimately have been moved around between players. What nature are these transfers going to have? Are they predominantly:

- Transferred from late players to those who have been in early (a pyramid)

OR

- Transferred from unskilled to skilled (… a flat-roofed house)?

Assuming a game that is appealing and successful in the long term, eventually we are going to find ourselves in the second situation. On the other hand, rewarding early birds is necessary to provide initial liquidity for the in-game market makers, and creating demand for the game token may be used to fund development. Thus, there is a need for a transition, and the goal must be to avoid this transition being painful for gamers who are joining in-between.

DeFi Kingdoms’ approach

For the moment, DFK is still attracting new players mostly by promise of profit, such as LP staking rewards paid in JEWEL. Additionally, earlier players hold a large part of the JEWEL supply in locked form since the JEWEL APYs were much higher in the past and JEWEL was cheaper. The locking prevents them from realizing all of their gains for the moment. For a smooth transition to a sustainable game economy, JEWEL being bought by new players must compare to the locked supply during the time the latter is unlocked.

DFK appears to be on track with its efforts. We have illustrated how complex the economy is becoming, and with PvP fights starting, a more complete game will be emerging that rewards players for their experience and time they put in. Meanwhile, the narrative of such a game being developed by an obviously talented team is certainly playing a role in the growth of DFK.

The Future

There are two ways to further ease the transition to a stable economy. The obvious one requires capital from the developer side to fund much of the game development before going public, and potentially to provide initial liquidity for in-game markets. This would reduce the transition phase to an initial turbulent economy before reaching equilibrium, which may come with its own difficulties.

The second path to more stability of the game economy during its growth is once more powered by the metaverse paradigm: to increase the likelihood that early adopters are long-term supporters of the game ecosystem, they could be rewarded with less liquid and less crucial NFT assets instead of the main token. Such assets can be particularly attractive when they promise utility and composability across games. After all, this is a core novel feature NFTs are bringing to the table: their association to a wallet address that serves as a metaverse identity gives them the power to transcend any particular game. Users are incentivised to come up with and build new projects, giving meaning to owning NFTs of popular games.

On the other hand, NFTs do not even necessarily have to be tradable. Their value may be confined to the metaverse, providing benefits and status to the original wallet owner. And while the supply of assets of one particular class would need to be limited, their utility could be tied to sustained user activity such that inactive wallets lead to the permanent deactivation of the utility of the asset.

There are certainly many paths towards a future that is exciting and fair to traditional gamers. Admittedly, novelty implies an increased level of unpredictability which may be seen as a risk. Terra helps to mitigate such uncertainties since costs and asset values remain stable and transparent when denominated in Terra stablecoins, while preserving censorship resistance for a truly open metaverse. Terra welcomes gamers with open arms and is on a mission to help create positive-sum experiences for everyone.

[1] This number is significant as a crypto project but also starting to be noticeable when compared to the $100+ billion gaming market.

[2] https://www.nytimes.com/2022/01/15/technology/cryptocurrency-nft-gamers.html

[3] Linear models, after introducing new coordinate dimensions for each option of the categorial part of the data, also perform decently thanks to the nonlinear features we have added.

[4] Shifts in price are removed when considering a metric called the explained variance. It considers the ratio of the fluctuations of the model errors (differences of prediction and truth) versus those of the truth alone (this ratio, which is zero for a perfect model, is then subtracted from 1 for a convenient measure reaching 1 for a perfect model). Next, one may further construct a measure that is also invariant under rescalings of price. To this end, we can introduce a factor rescaling the model predictions before taking the difference with the truth and optimize it to maximize the explained variance. One can show that this leads to (the square of) Pearson’s correlation coefficient r, which simply relates the covariance of model and truth to the product of the respective standard deviations and is indeed invariant under linear transformations.

Bootstrapping the Metaverse was originally published in Terra Money on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.