Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockstream Markets Weekly — Feb 18, 2022

BMN completes tranche 8, Trudeau pumps BTC, Ukraine makes Bitcoin legal, Fidelity launches physical ETP, illicit transactions fall to 0.15% in 2021, and 98-year-old Charlie Munger calls BTC a venereal disease.

By Jesse Knutson

Wag the dog

A sharp drop yesterday put Bitcoin on pace to end the week down and on track for the worst weekly drop in three weeks.

A dump in global stonks following more Ukraine-related saber-rattling pulled Bitcoin lower, reversing another test of $45,000 level resistance and sending market sentiment and funding rates to multi-week lows.

Haircuts and capital controls

Responding to weeks of protests in Ottawa, Canadian Prime Minister Justin Trudeau this week enacted the Emergencies Act for the first time in Canadian history.

Deputy Prime Minister Chrystia Freeland said banks can now immediately freeze or suspend bank accounts and sanction Bitcoin addresses without a court order and without fear of civil liability. Later in the week, Candian authorities announced that they had sanctioned 34 addresses linked to the Freedom Convoy.

The announcement drove an initial price jump, and I think was reminiscent of previous moves following concerns in Cyprus and Greece that the government would impose strict capital controls and/or seize investor assets.

In 2013, Cyprus agreed to impose a 48% haircut on uninsured deposits at the Bank of Cyprus (the island’s largest commercial bank) in return for a €10 billion bailout from the ECB and the IMF. The news drove a flight to safety with Bitcoin price jumping from~$40 to $70 in a single week.

During the 2015 Grexit crisis, Bitcoin jumped from ~ $220 to $260 in just a couple of weeks following concerns that a Greek exit from the EU could result in increased capital controls or yet another haircut on bank accounts.

While the Emergencies Act resulted in a much more muted price move (it’s a much bigger lift now), I think it highlighted one of Bitcoin’s key value propositions — censorship resistance — to a much broader audience.

Illicit activity

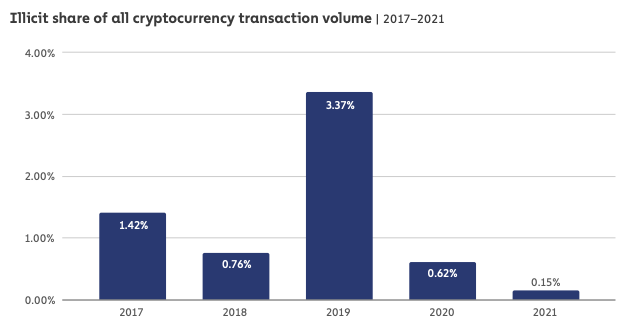

Chainalysis’ 2022 Crypto Crime report out this week showed that transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021.

The Elizabeth Warrens of the world will likely focus on the headline number of total illicit transactions gaining to a record high of $14B, ignoring the fact that the bulk of this growth was driven by price gains.

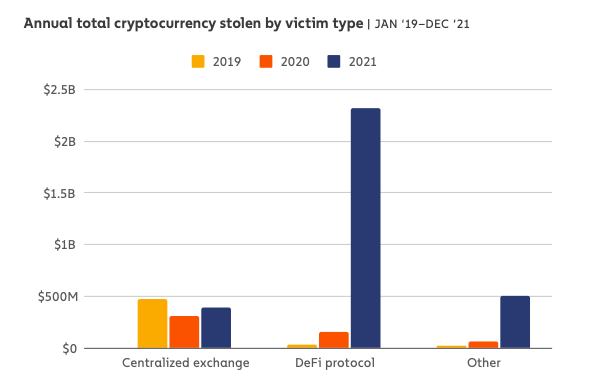

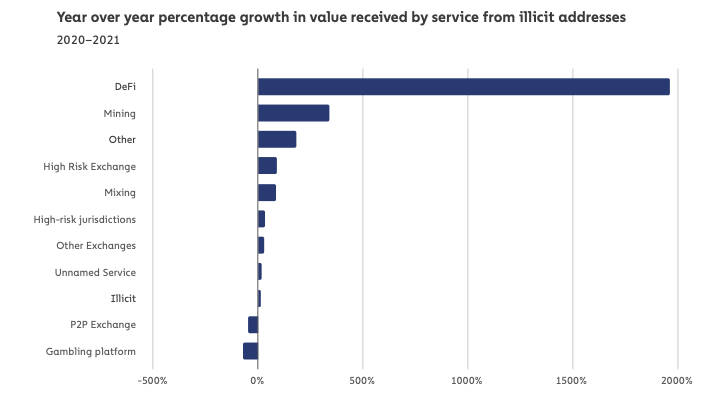

Additionally, if you split Bitcoin out, the number would be very, very small. The lion’s share of illicit activity was tied to DeFi which accounted for 72% of stolen funds and saw 1,964% YoY growth in money laundering.

To put things in perspective, the UN estimates that between 2% and 5% of global GDP ($1.6 to $4 trillion) is connected with money laundering and illicit activity. I think Bitcoin’s illicit use narrative is probably tied to its association with Silk Road in the early days. The fact of the matter is that Bitcoin is not well suited for illicit use as the recent recovery of ~$4B worth of Bitcoin demonstrates and that globally the bulk of illicit activity is executed in USD not BTC.

Stuck

After breaking out of the three-month downtrend a few weeks ago, Bitcoin is once again stuck between major areas of resistance and support.

Since January of last year, Bitcoin has accumulated a significant amount of volume at the $46,000 — $50,000 level making this area a significant level of resistance, as mentioned last week, I don’t think it's surprising to see Bitcoin struggle a bit at this level.

That said, I think the current ~ $40,000 region is a major level of support that has also built up quite a bit of volume.

A lot of steam has been let out with the aggregate 24-hour funding rate across exchanges now back to negative and liquidations over the past 24 hours hitting a three-week high.

Overall, I think the market looks exactly as you would expect it to as it attempts to regain its legs and build a new uptrend.

📬 Register your email to receive Blockstream Markets Weekly delivered straight to your inbox. 📬

Bitcoin markets news

Blockstream completes Tranche 8 of the BMN on Bitfinex Securities

- The Blockstream Mining Note is the tokenized version of Blockstream’s institutional focused mining business and entitles investors to the Bitcoin produced by ~ 2,000 over the course of 36 months

- The BMN was the first primary issuance conducted on Bitfinex Securities and will be the first asset to begin secondary trading

- The BMN hit another milestone this week with each BMN mining more than 3 BTC at 7.5 months of operation out of a 36-month product

- Sign up on Bitfinex Securities to participate in future tranches or reach out to me directly

Fidelity launches Europe’s cheapest physical BTC ETP

- The Fidelity Physical Bitcoin ETP (FBTC) is listed on the Deutsche Boerse and Frankfurt Stock Exchange with a total expense ratio (TER) of 0.75%

- Fidelity International said it launched FBTC for institutional and professional clients following a Fidelity Digital Assets survey which found 70% of institutional respondents expect to invest in digital assets in the future

- With BTC exchange-traded products now live and gaining scale in Canada and Europe, the success of futures and equity-backed ETFs in the US, and growing institutional participation in the space I think that you probably have to bet that 2022 is the year the US finally approves a spot BTC ETF

Mexican Billionaire Ricardo Salinas wants to mine Bitcoin

- Mexico’s third richest man in is eyeing Bitcoin mining from a geothermal power plant owned by one of his companies

- The plant has an installed geothermal power generation capacity of 25 MW

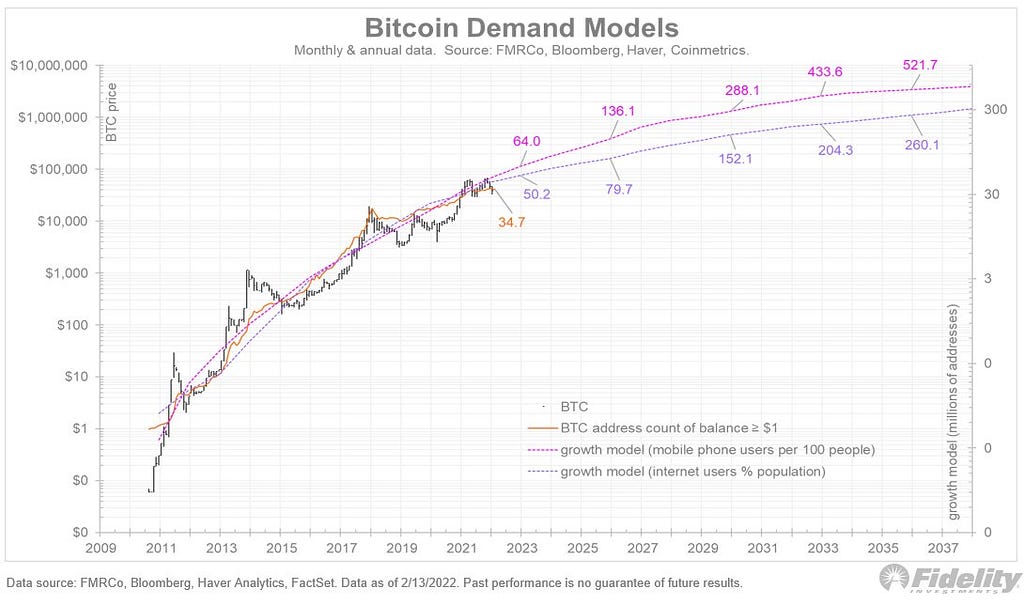

Fidelity’s Director of Global Macro: Bitcoin is like Apple

- Fidelity’s Director of Global Macro, Jurrien Trimmer’s analysis looks at the growth of Bitcoin from a network perspective and compares it to Apple’s rise to network dominance since the 1990s

- Timmer says that Bitcoin and Appl follow a similar path — one dictated by their network growth

“What matters most is where the demand curve is going, and the answer continues to be up and to the right.”

Ukraine legalizes Bitcoin

- Bitcoin is now legal in Ukraine as its parliament approved in final reading a bill that caters to the president’s recommendations. However, the country has not made bitcoin a legal tender

- The irony of western countries sanctioning Bitcoin addresses within weeks of Russia and Ukraine legalizing Bitcoin is not unexpected, but still disappointing

“By creating a high-tech, innovative cryptocurrency market that plays by clear rules, the country expects the speedy arrival of crypto investors from all over the world”

Charlie Munger thinks Bitcoin is a venereal disease

- Charlie Munger and Warren Buffet previously called Bitcoin rat poison when it was ~ $100 and downgraded it to rat poison squared at $9,000

- Combined they are 188 years old

Charts

Up and to the right

- The chart below is from Fidelity’s Director of Global Macro, Jurrien Timmer

- Timmer compares Bitcoin’s growth to the network effects seen in Apple in the 1990s by applying a Metcalf’s Law analysis

- The chart below suggests Bitcoin breaking >$100,000 sometime between this year and 2025

Chart credit: Jurrien Timmer

There is very little illicit activity in crypto

- To put things in perspective, the UN estimates that between 2% and 5% of global GDP ($1.6 to $4 trillion) is connected with money laundering and illicit activity

Chart credit: 2022 Crypto Crime report

Rugged

- DeFi accounted for 72% of stolen funds

Chart credit: 2022 Crypto Crime report

Heat score

- To be fair, a good part of the surge in DeFi’s 1,964% YoY growth in money laundering is probably driven by the growth of DeFi itself

- Regardless, I think this kind of growth will definitely attract a lot more regulatory attention and ultimately will probably be positive in driving the growth of truly decentralized financial platforms

Chart credit: 2022 Crypto Crime report

The most concise roundup of Bitcoin market action in the industry.

Subscribe through Medium, or register your email to receive the latest updates directly to your inbox. You can unsubscribe at any time.

Blockstream Markets Weekly — Feb 18, 2022 was originally published in Blockstream Markets Weekly on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.