Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Here’s how trading begins and evolves for most successful traders:

Losing all your money every trade

Depending on how quickly you adjust your risk management style, this phase can last for months, or even never end. FOMO helps encourage this phase by selling bottoms and buying tops. You risk your entire account on one trade trying to win the lottery. This is closer to gambling than it is trading.

Breaking Even (BE)

Phase when risk management begins to work but starting to become too risk averse. You become very good at analyzing downside risk but not good enough at understanding the appropriate amount of risk to allow for higher gains.

Small Wins

System is working. Risk management is working. Emotions are preventing trades from running their course because you’ve never been on top of a trade before. You close the trade early by moving stops too much, not using a target that is large enough, or you panic close. Often, it takes many small wins to realize what is wrong with this style of trading.

Big Wins

God Tier of trading which takes most people years to achieve. You still have losing trades and BE trades but a majority of your trades are large winners, which far outweigh the losers. You have variable position sizing appropriate for risk. You take multiple positions and close 50–75% of your positions at various predetermined levels while letting some of the winner run.

It’s important to spend your time losing money, learning a trading system on your own, and establishing rules for your trading style.

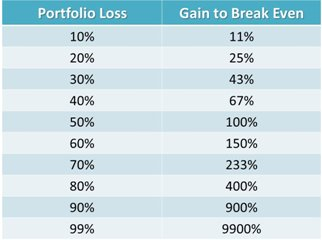

Remember — Big losses are always more difficult to recover than small losses!

What is Your Mindset?

Many people, including myself initially, buy cryptocurrency, then follow price very closely, which is a gateway to essentially becoming a day trader driven by emotions. Trading, or active management, is not for everyone. In fact, it’s really not for most people. Over 90% of all traders lose money and will not be able to beat simple a buy and hold strategy. If you can’t beat buy and hold, your not only losing money, but you’re wasting time — which is even more valuable.

Investing

Many use this buy and hold (hodl) strategy for bitcoin which typically occurs over months or years. Some traders use this for alts but I don’t recommend it for most alt coins. This is a passive strategy which often beats active management for most people, especially new traders.

Trading

This is an active management strategy that can occur over any timeframe but often occurs over minutes, weeks, or days. Generally, this process involves a few steps where Technical and Fundamental Analysis can be used.

- Recognition

What do high probability trades look like?

How do I find them?

Which indicators, oscillators, or chart patterns on which timeframe do I trust for actionable signals?

- Entry, Exit, Stop Loss

Using my system;

where do I enter the trade,

where should the target/exit be,

how big is my risk?

- Execution

Following through with ideas bound to your system. Many traders spend time analyzing a market they never trade. Paper trading or back-testing is great for testing your system, but at some point you need to actually put money on the line with your ideas. The sooner you have skin in the game, the better.

- Trading Size

Determining trading size can take finesse but can also be a fixed percentage on every trade or based entry type,

I’m going to trade 10% on each tradeI’m going to trade 20% on chart pattern entries and add on pullbacks

or, surrounds a key target/support/resistance is established.

There is heavy support around 10,000 based on x, y, z. I’m going to place a majority of my bid at or below 10,000 but I also want to place a smaller percentage of my bid above 10,000 to make sure I get an entry.

Where Should I Chart?

For simplicity sake, all charts in this guide will be from www.tradingview.com. It’s a free site and you don’t need a pro account to be a successful trader. Other charting options include:

Where should I trade?

Highly dependent on citizenship and the KYC/AML process. Here are some options:

- Coinbase/GDAX

- Bitfinex

- Bitstamp

- Bitmex

- OKEX (formerly OkCoin)

- Gemini

- Kraken

- Poloniex

- Bittrex

- Binance

- 1broker/1fox (soon)

- AltCoin.io (soon)

- QuadrigaCX (Canadian)

Where Should I Find Key Market Information?

Market Capitalization Tables

- https://onchainfx.com/ (my favorite)

- https://bravenewcoin.com/market-cap/

- https://coinmarketcap.com/

Heat Map http://cryptomaps.org/

https://bitcoin.clarkmoody.com/tickers/

Finding The Best Timeframe

There is no best timeframe for any market or coin at a given time. The market is fluid. Higher timeframe signals and ideas also take precedent but that does not mean there are perfectly actionable signals with high probability trades on lower timeframes. It’s important to scan multiple timeframes and judge trades appropriately.

Lower timeframe trades often have a smaller upside or downside whereas higher timeframes have a larger upside or downside. I see many new traders on low timeframes making multiple trades when instead they need to be making fewer trades on higher timeframes.

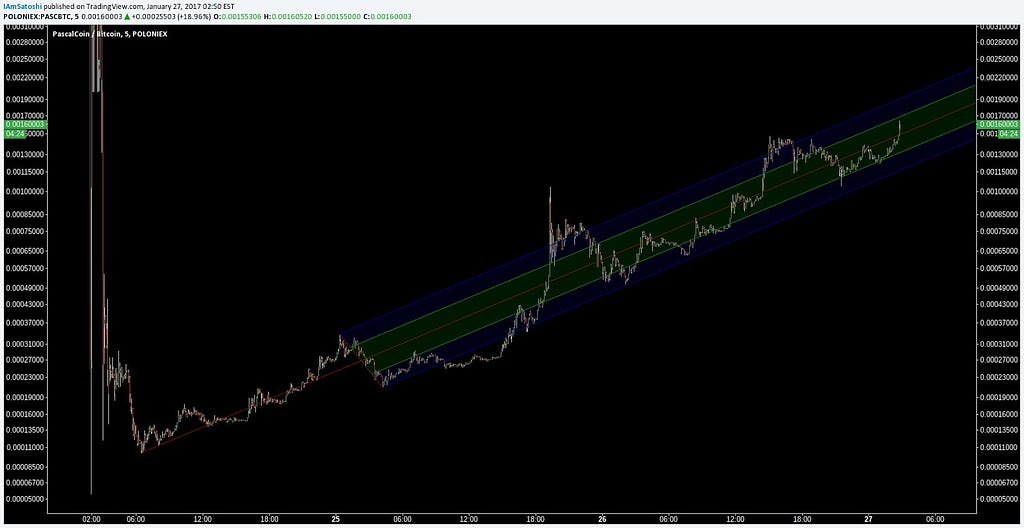

For alt coins, especially newly listed coins, there will be plenty of actionable signals on low timeframes. When $PASC was released, it had excellent signals on the 5 minute timeframe.

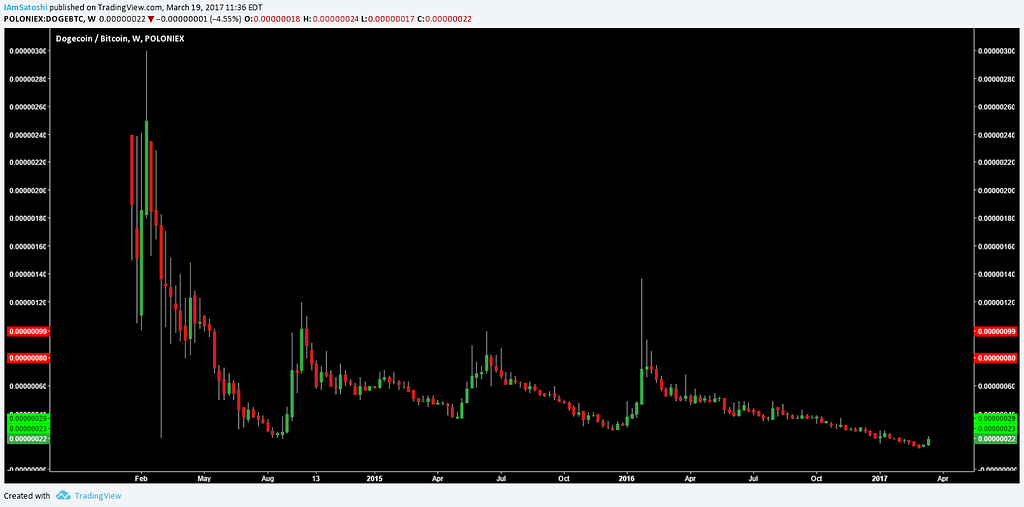

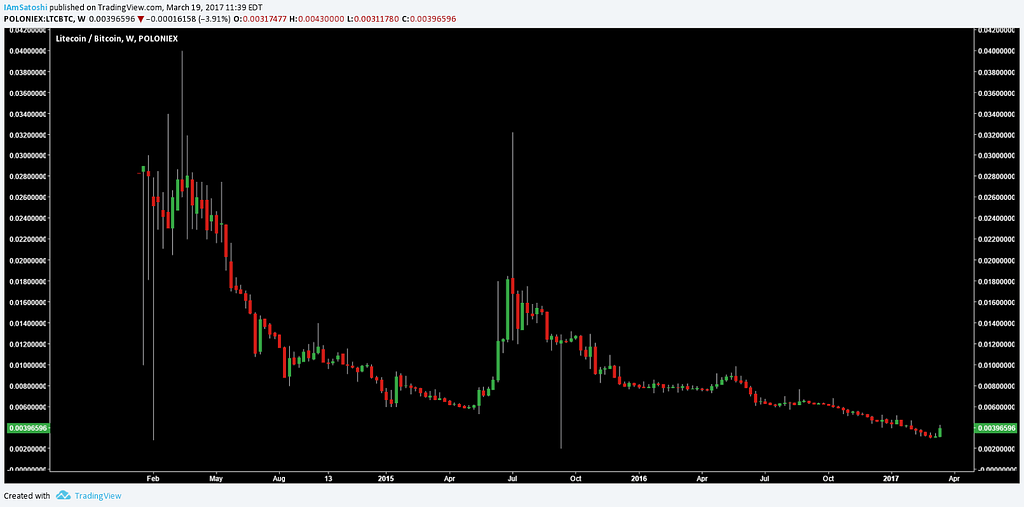

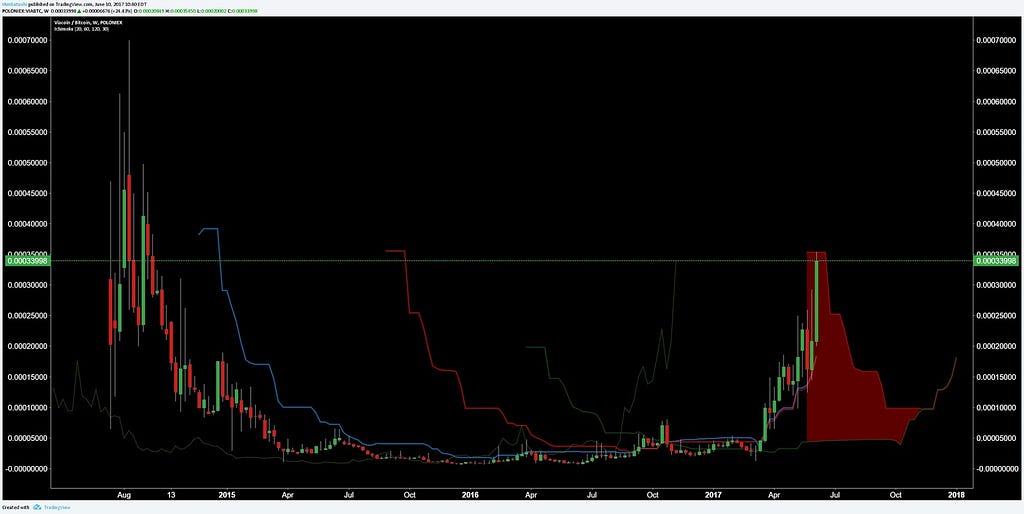

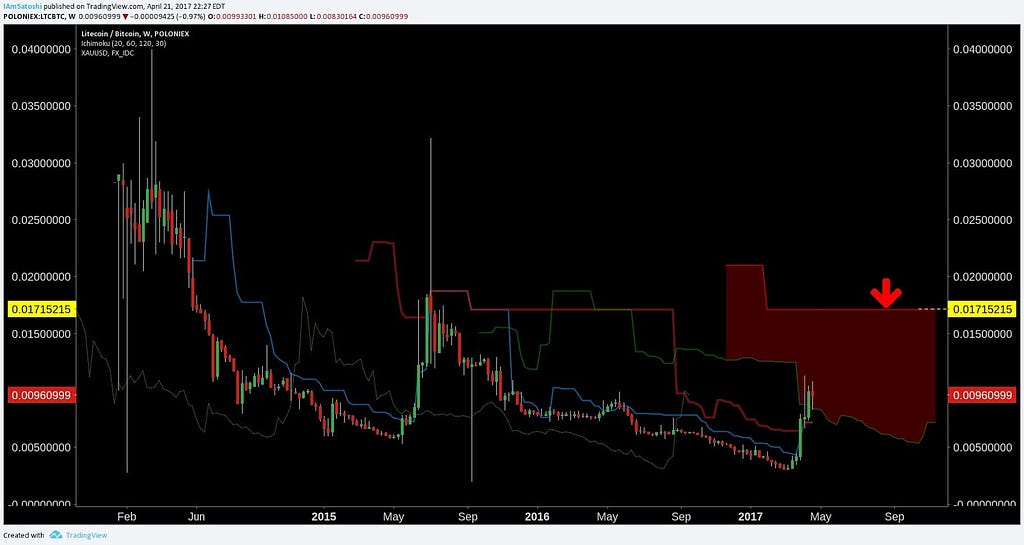

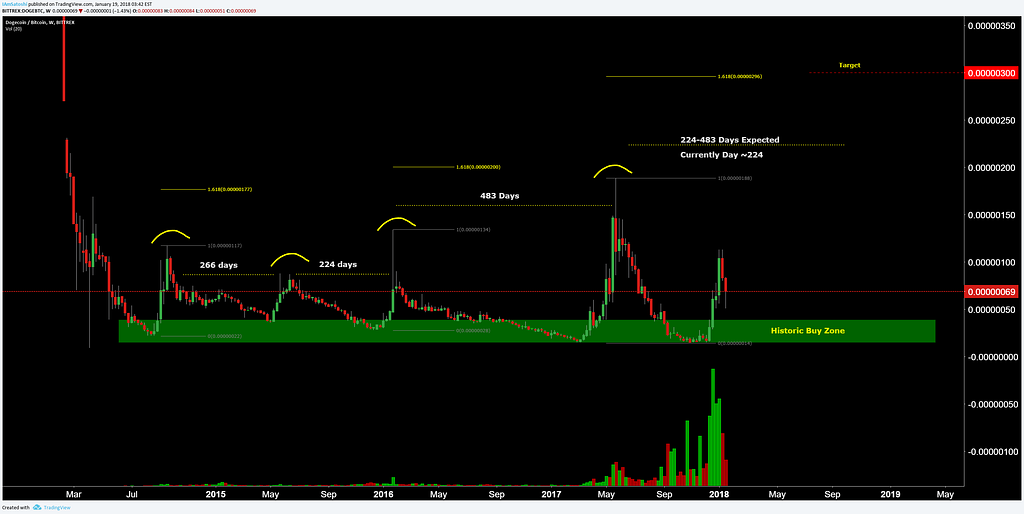

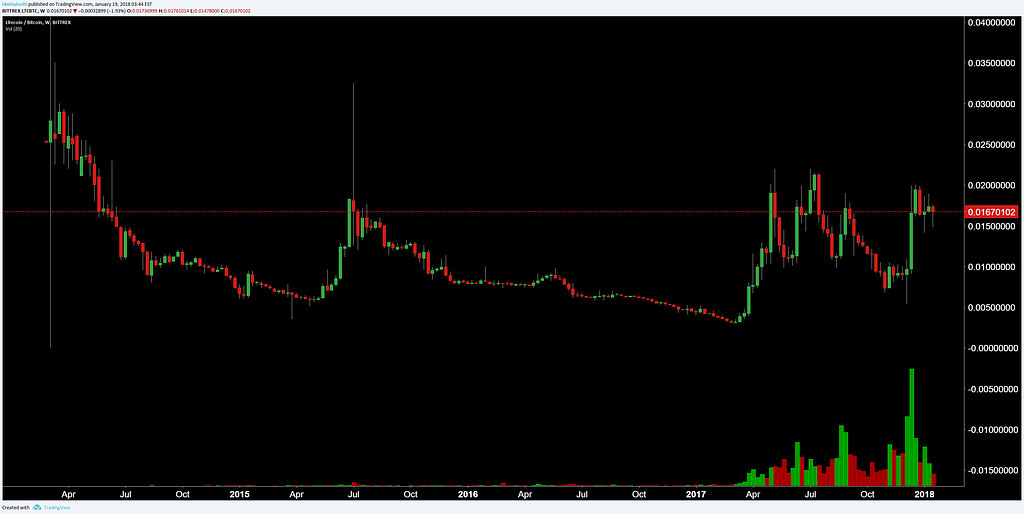

$DOGE and $LTC on the other hand have very clear actionable signals and trends on the weekly timeframe. Mainly because they have been around for so long, relative to other alt coins. That also means these markets move relatively slower than newly released coins. Knowing the speed of the market is critical for determining the correct timeframe. When the market is swinging violently, a lower timeframe is often more appropriate than a higher timeframe to determine better entries and exits.

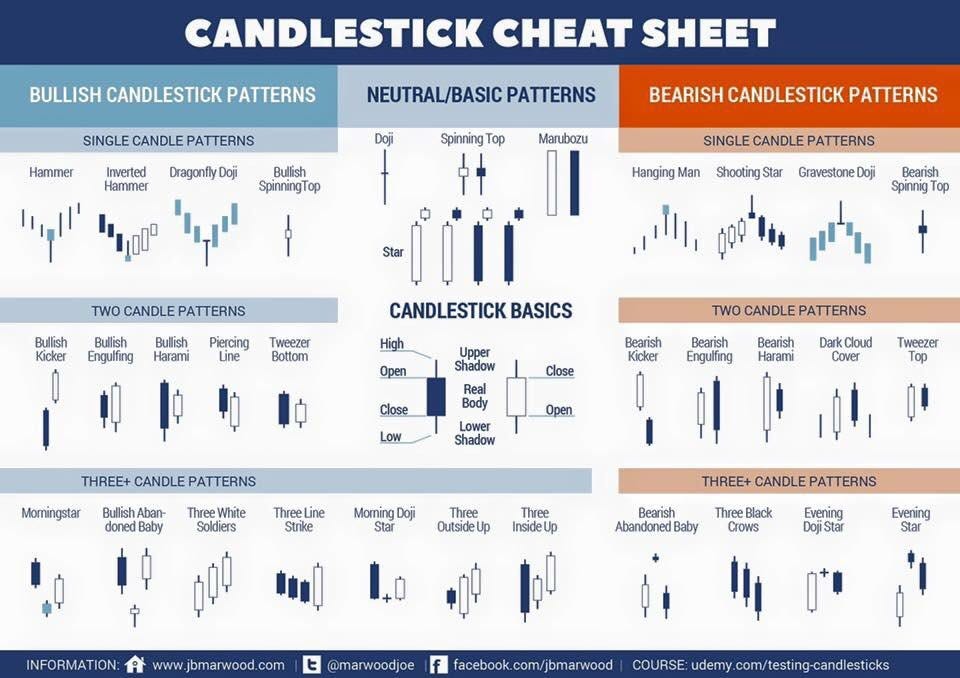

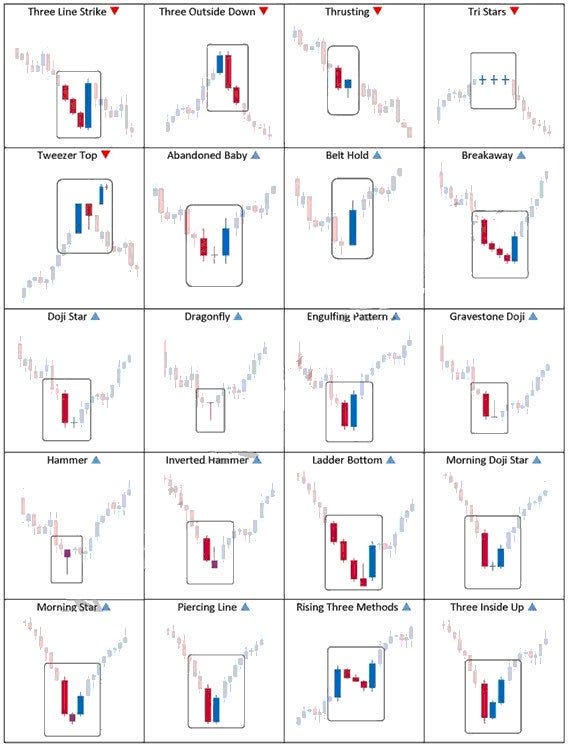

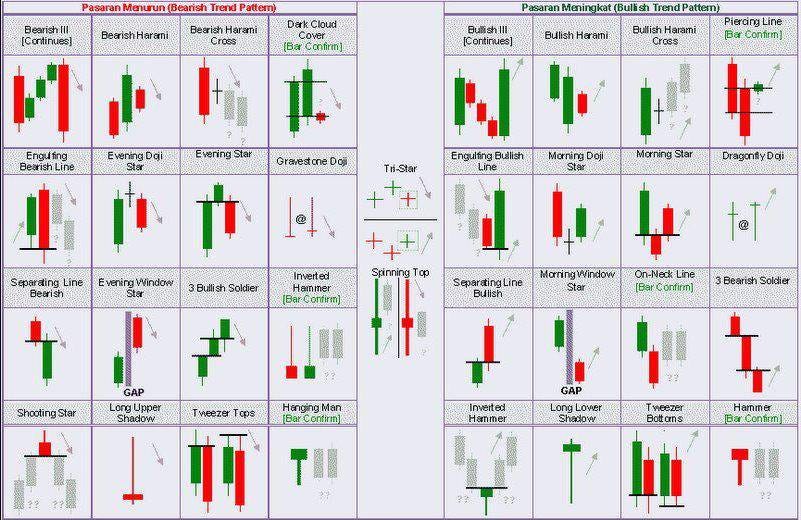

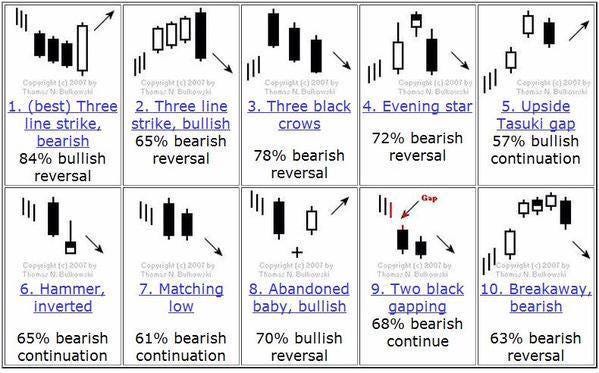

Candles

A candle consists of a body, upper/lower wick, and color. If the open price is lower than the close price, the candle will be green. If the open price is higher than the close price, the candle will be red.

The opens/closes will be determined by the timeframe of the chart. On an hourly chart, each candle represents one hour of data. Candle closes occur somewhat variable depending on the exchange or charting website, as well as timezone. There is no true standard for crypto since it is 24/7, although you’ll find that most charting sites have identical candle close times.

Single candle patterns or groups of Candle patterns can be found within price structure to add or subtract from confluence of the current trading idea. As with any pattern, there are continuation or reversal candles or patterns also known as bullish or bearish candles or candlesticks. A key part of mastering candle patterns is simple pattern or fractal recognition.

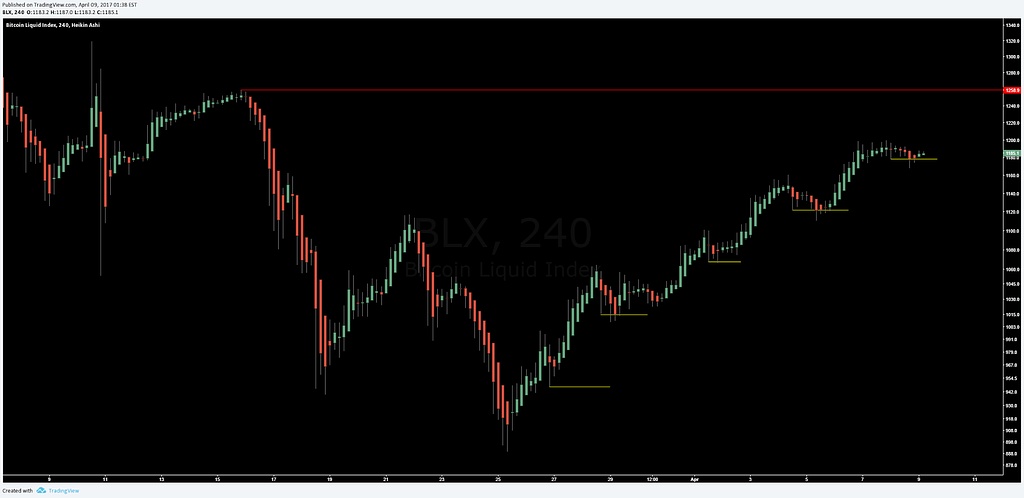

Heikin-Ashi (HA) candlesticks

HA candles use open and close data from the previous period, and open and close data from the current period.

An open and a close above the previous period suggests strong momentum of the given trend. An open and a close within the bounds of the previous period suggests a slowing of trend. A color flip from green to red or red to green indicates the possibility of the beginning of a new trend and the end of the previous trend. These flips in signals should be considered a long or short entry signal.

Typically, on the 3rd or 4th same colored candle, the local top is also breached, adding confluence to the entry signal. A SL is placed either below a momentum-less candle such as a spinning top or doji, or, below the first opposite colored candle’s wick (below).

Bill Williams Fractals

Logic similar to HA candles, slightly more lagging than HA. A bull fractal consists of a low-high-low candle pattern whereas a bear fractal consists of a high-low-high candle pattern. A bull trend should not break bear fractals and a bear trend should not break bull fractals. More info here.

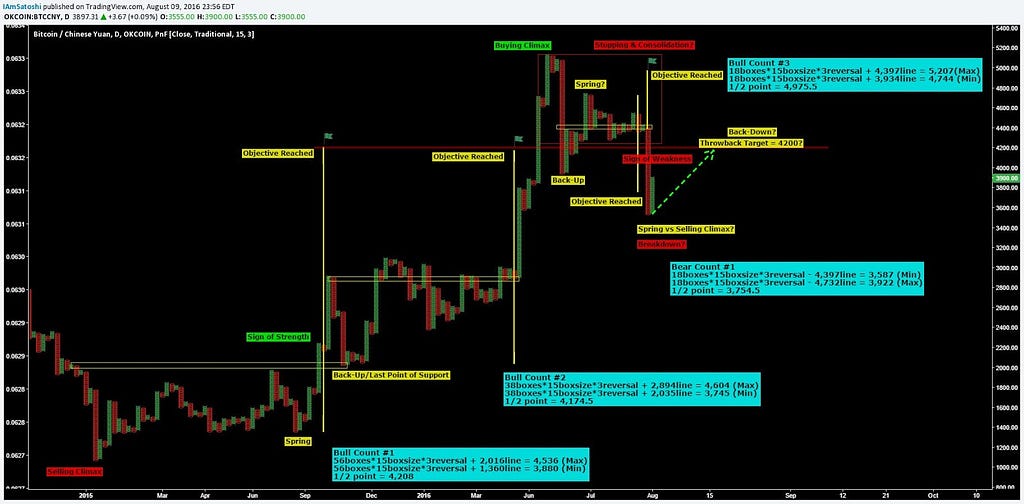

Point & Figure (P&F) Charts

A rarely used form of charting that was first developed by “Hoyle” in 1898 with an emphasis on the closing price. This form of charting is used for measuring moves with Wyckoff structure and is not based on time but rather price action.

Indicators

With indicators, it’s important to remember that there are more which tell you less and only a few which tell you more. I prefer indicators which draw themselves, use math, and avoid my own biases.

For this reason, I lean heavily on Ichimoku Cloud, Pivots, and Moving Averages. I tend to avoid entities like Elliot Wave which are very subjective and easily edited with far less actionability.

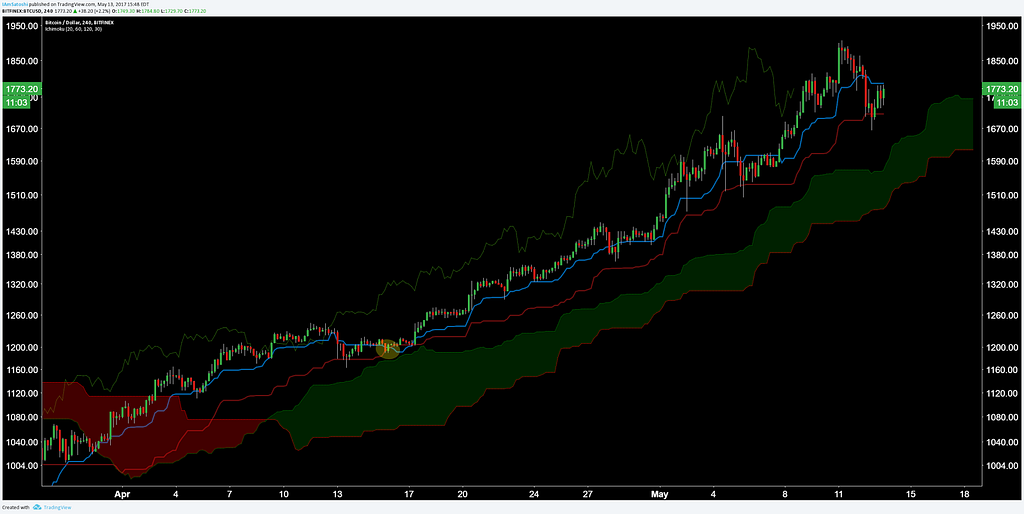

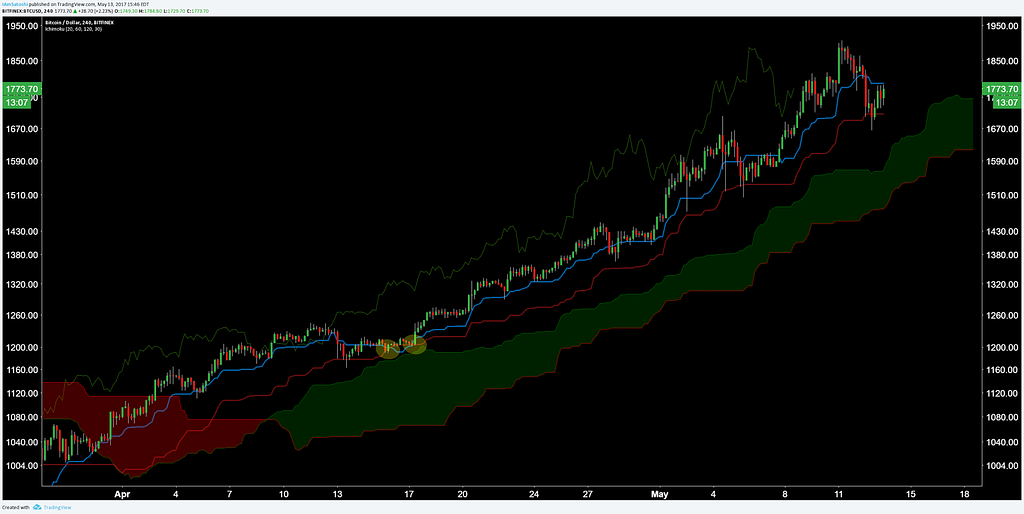

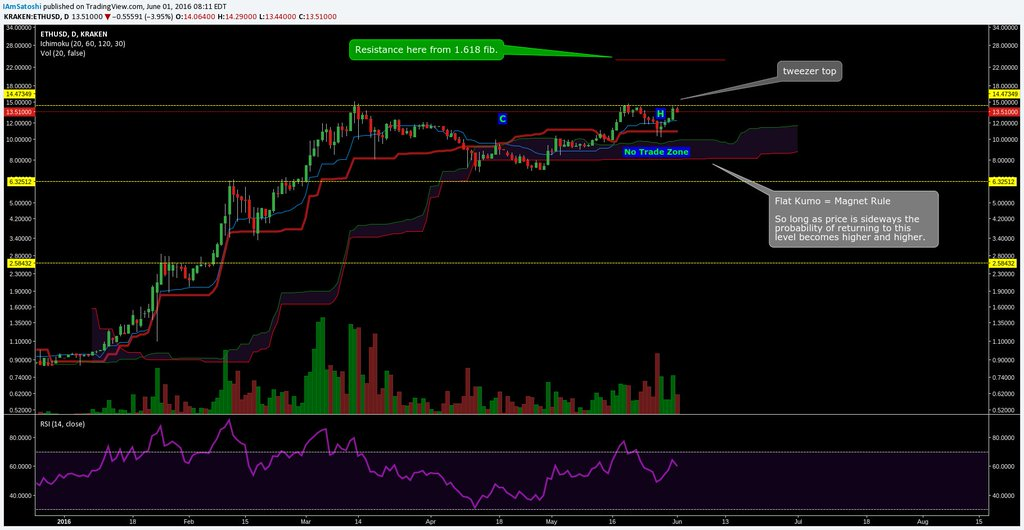

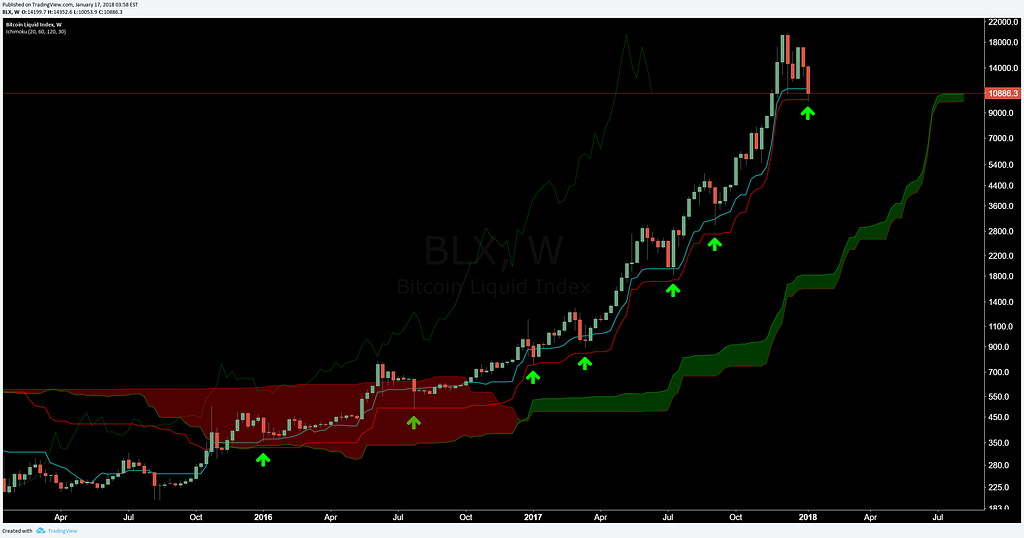

Ichimoku Cloud

Useful for: Trend Determination, Entry Signals, Exit Signal, Re-entry signals

Do not use when: market is clearly trend less and sideways. In these instances, use Bollinger Bands or Chart Patterns.

Here’s a primer on my crypto settings and why they are different than default.

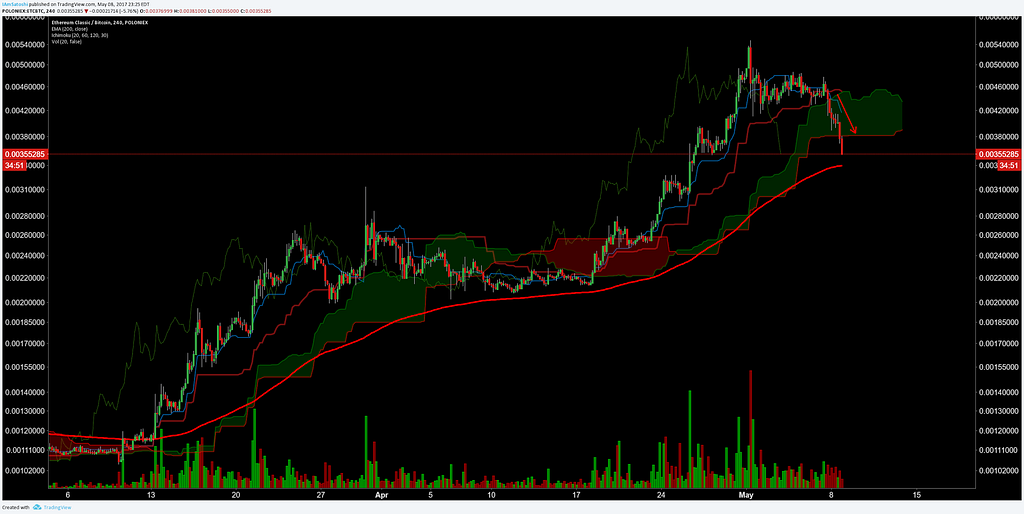

For alts, backtesting has shown that on the 1D timeframe, 10/30/60/30 gives a superior entry and exit signal compared to the doubled settings. This is likely because alts have very explosive moves relative to Bitcoin, a more mature market with a larger market capitalization. In other words, the alt markets usually move faster than bitcoin.

Entry Signals — in order of importance

- Price Above/Below Cloud — Gold standard of determining bullish or bearish trend on any given timeframe.

- Bullish/Bearish Cloud — Shows whether or not there is a bullish or bearish leaning future.

- Bullish/Bearish TK Cross — Very similar to EMA crosses.

- Lagging Span Position Above/Below Price/Cloud — Many cloud traders ignore this entirely. I use the LS when i am on the fence about opening a position or not. The LS can save you from taking a suboptimal position, especially when price is essentially sideways.

Exit Signals

- TK Cross

- Other — Bill Williams Fractals, HA candlesticks, Horizontal Levels

Re-entry Signals

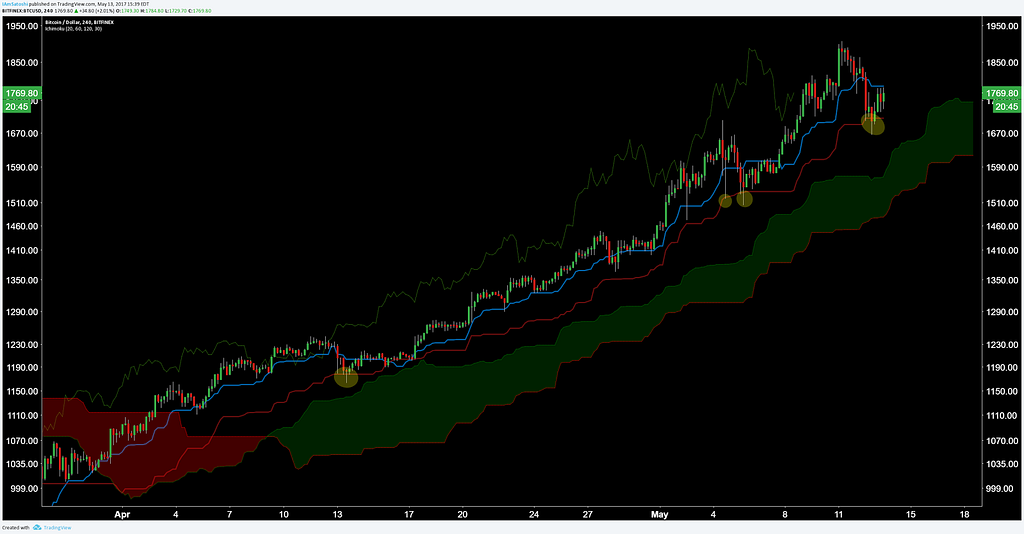

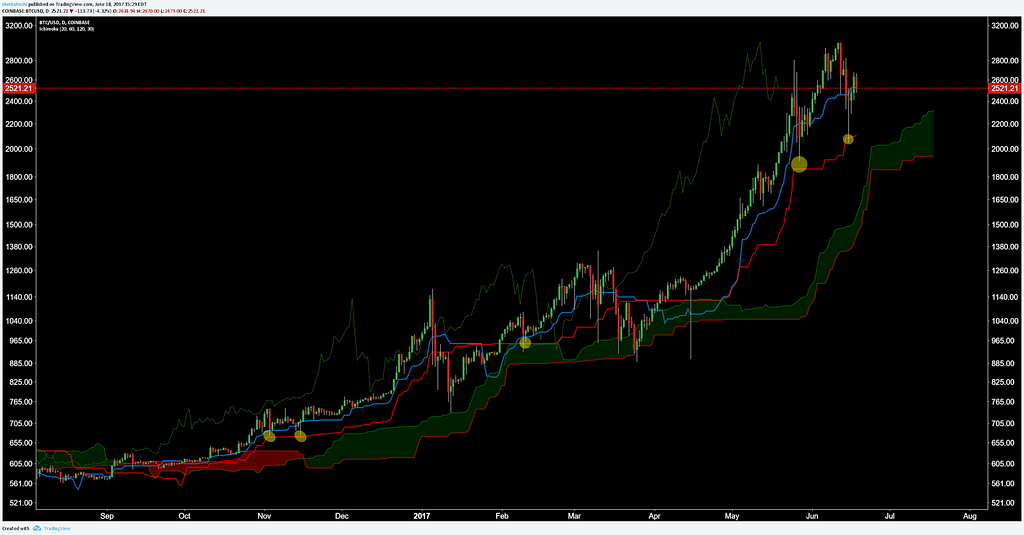

- TK Cross/Recross (yellow)

A classic Ichimoku Cloud entry includes all signals matching either bullish or bearish. When a bearish TK cross occurs above the cloud, this should not be considered a short entry signal, but rather, a long close signal. This is only a weakly bearish sign. A TK recross above cloud is an extremely bullish predictor of future price action and should be seen as a high probability long re-entry.

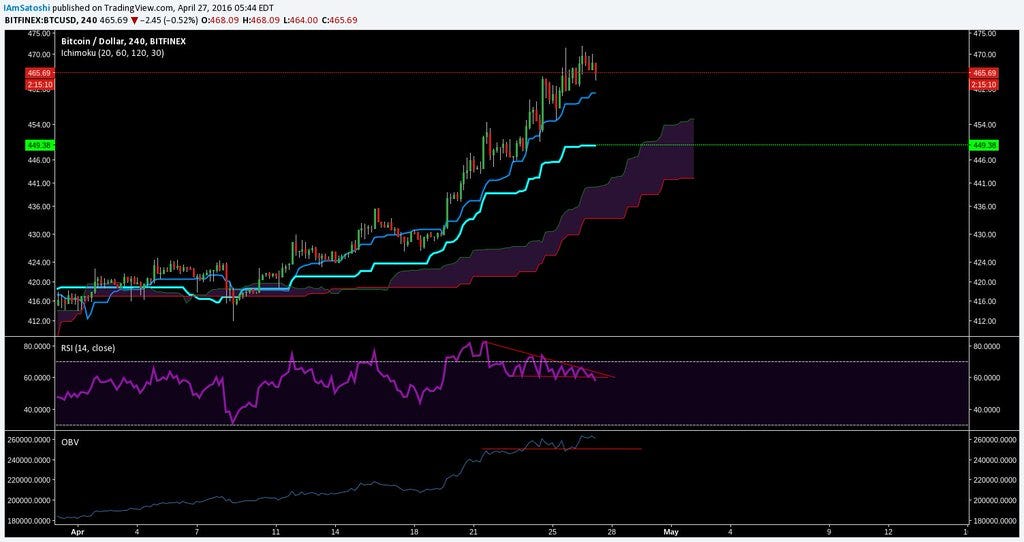

- Kijun Bounce

The Kijun is essentially the mean of any given trend. Ichimoku Cloud prefers everything to remain in equilibrium. When price moves faster than the given timeframe’s Kijun can keep up with price, the Kijun moves farther and farther away.

The Kijun bounce occurs when price returns to equilibrium and then continues the current trend. This can also be thought of as a correction or a test of support.

Kijun Bounces can occur multiple times on any timeframe, the higher the timeframe, typically the larger the correction. For this reason, I always consider orders on or around the Kijun a safe entry. No matter how far price is from Kijun, it is likely to return and test that level at some point.

If I miss an ideal entry, or miss a trade entirely, my default entry for a trend is always the Kijun. Instead of FOMOing in 100%, place a higher percentage of your trade size on the Kijun instead. Keep in mind, this is a dynamic support/resistance level and will need to be adjusted as it moves with price.

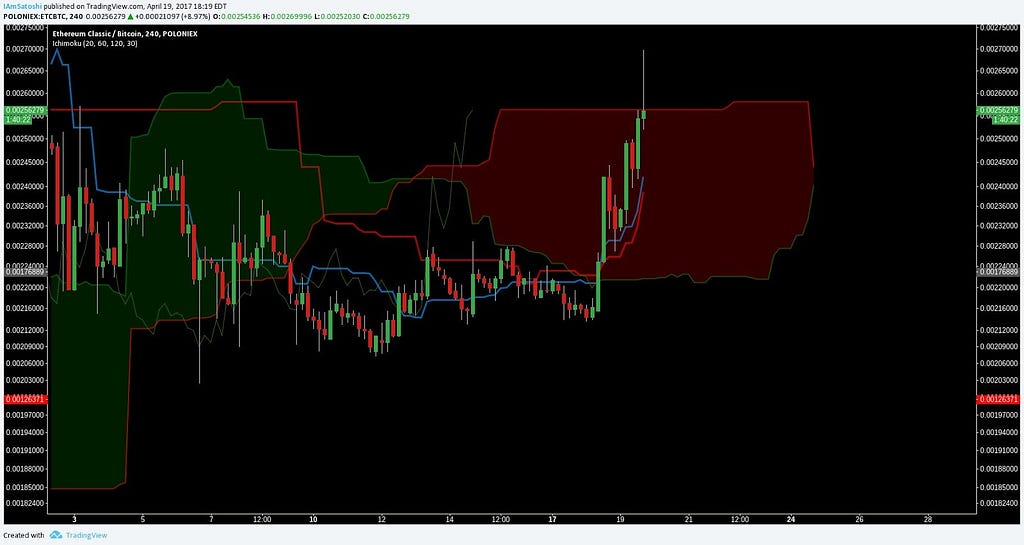

- Edge to Edge (E2E) Trades

Entry signal: when a candle close occurs inside the Cloud, you can with reasonably high probability expect price to reach the other end of the Cloud. The larger the Cloud, the larger the payoff. I think of this as the cloud edges representing hard support/resistance. Should that break, the remaining support/resistance is the opposite end of the Cloud. These can occur on any timeframe, higher timeframes always better.

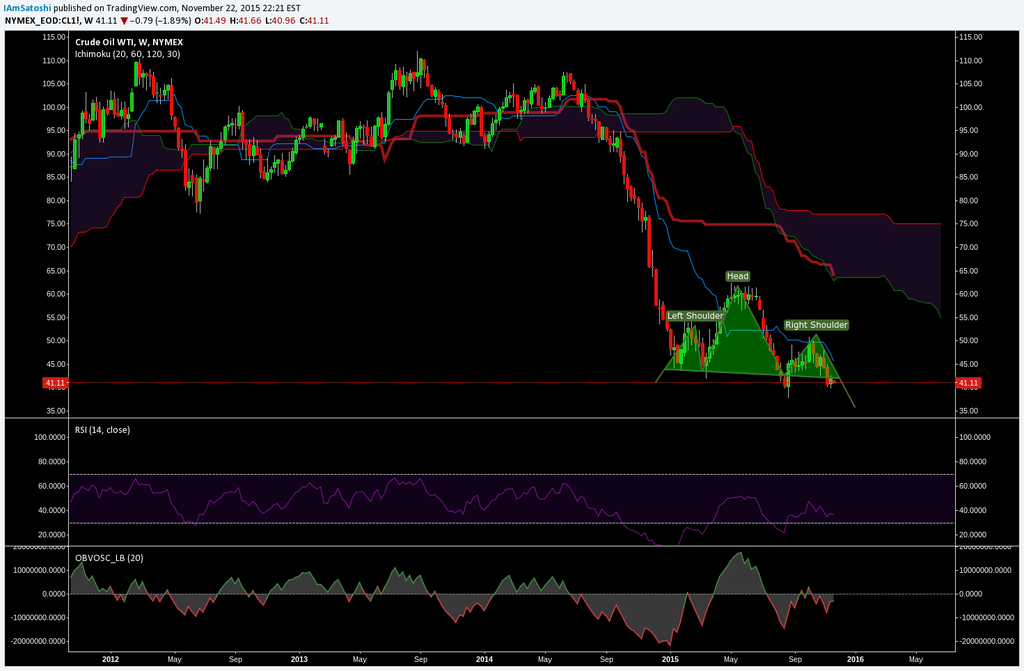

This example occurred on the weekly bitcoin chart and signaled the end of the bear market. The other option illustrated here was a bearish kijun bounce signalling continuation of bear trend. Although this took weeks to complete, the E2E target remained valid. Another key aspect of E2E trades are there predictability and actionability. When they appear and then occur, you know exactly what you should be doing. Although I’d consider E2E trades high probability, you should still use appropriate stops just as you would any other trade.

E2E trades often occur after a TK cross as well and can either overshoot or undershoot the opposite edge of the cloud.

Here are a few more examples

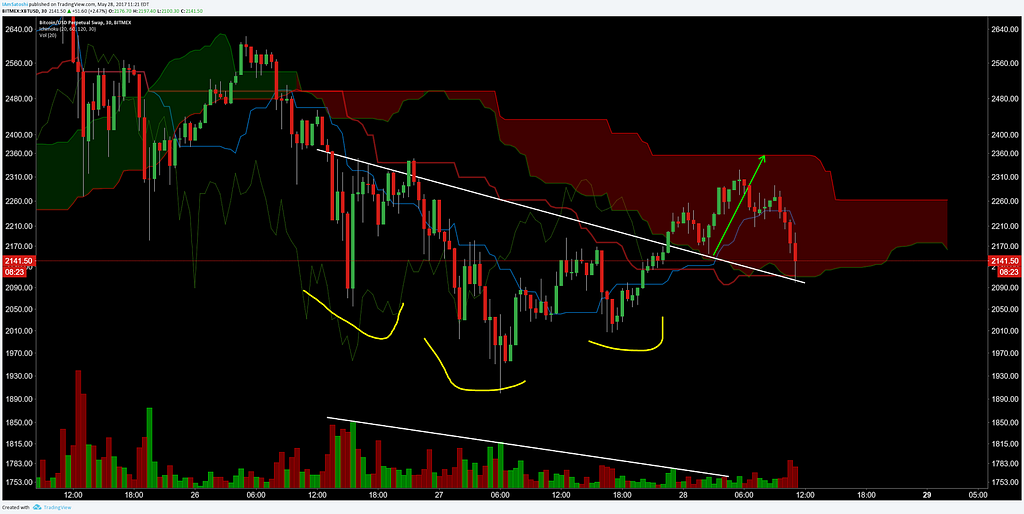

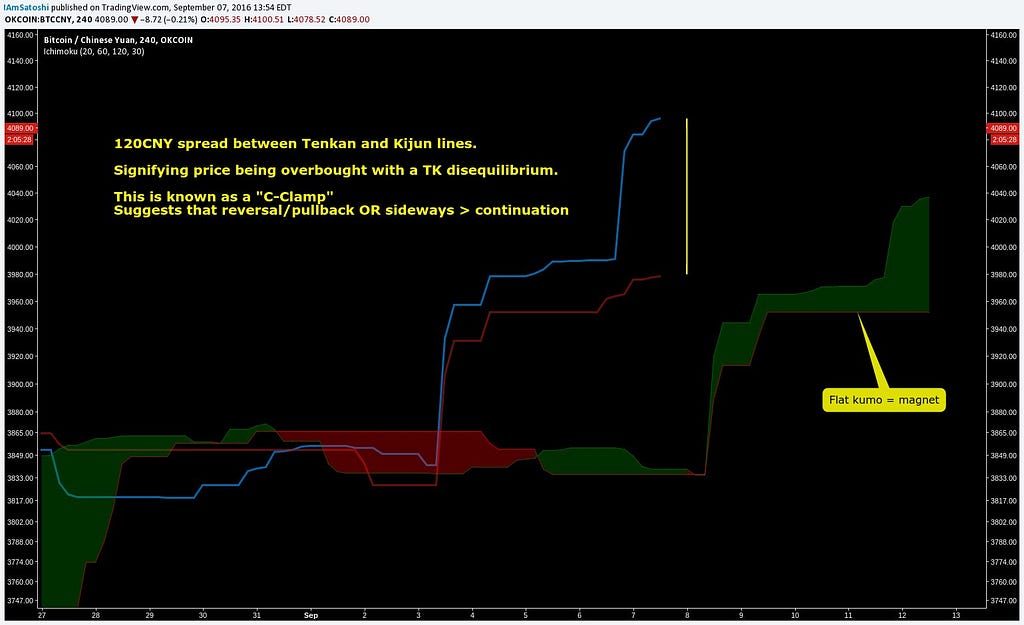

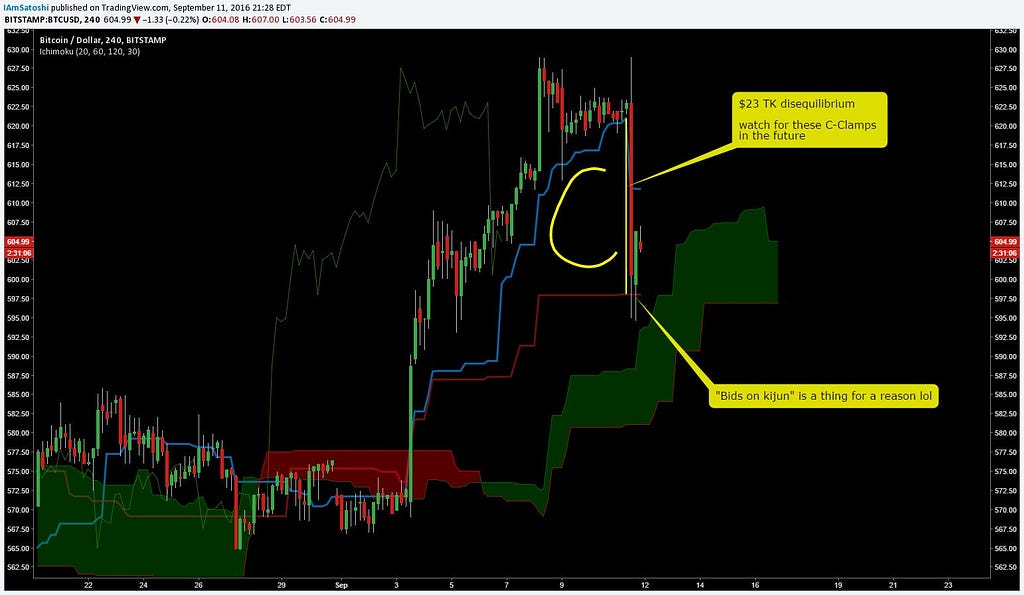

- C-Clamp or TK Disequilibrium

Again, Ichimoku cloud prefers everything to remain in equilibrium. When the TK lines are spread far apart, this signals price moving quickly in one direction and can be thought of as an overbought/oversold indicator. For this reason, these will always represent counter-trend trade opportunities.

These trades have increased risk, but also increased reward, and usually have better payoff when they match the macro trend over the micro trend. In other words, trying to short a bull rally usually means you get bulldozed unless your entry is near the exact top, easier said than done. However, an oversold c-clamp occurring during a bullish macro trend has a much better payoff.

C-Clamps are often accompanied by other reversal indicators like a bearish divergence, rising/falling wedge, or head and shoulders.

The resolution of a C-Clamp is often the kijun, where then, a kijun bounce can occur.

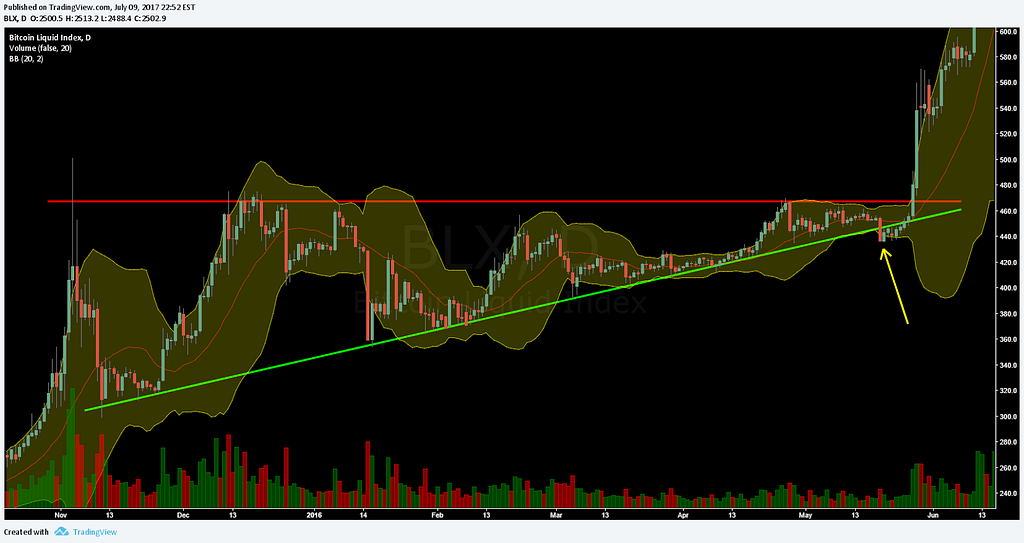

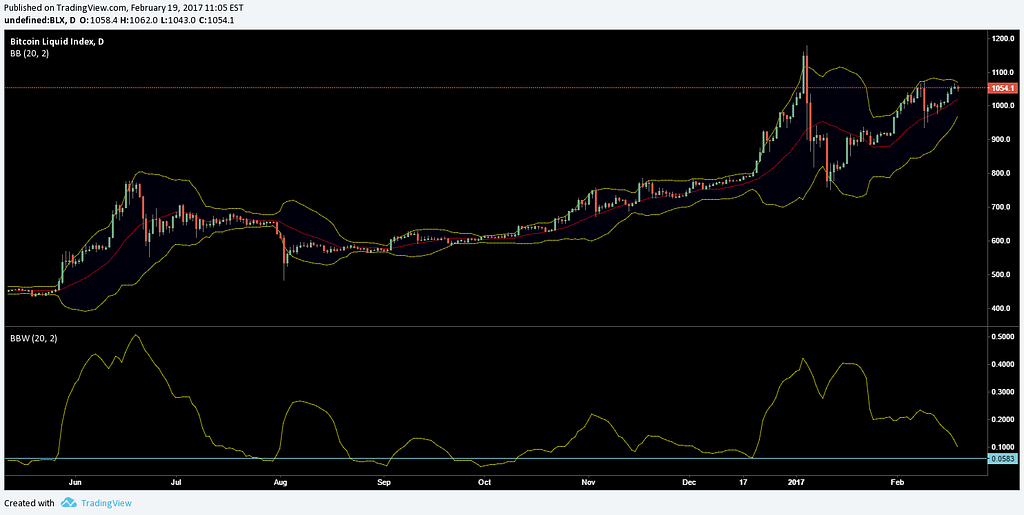

Bollinger Bands — aka My Favorite Sideways Indicator

- One standard deviation above and below the average. As price consolidates, BBands tighten, a break above or below bands constitutes a BBand breakout, or entry signal.

- Default Settings= 20, built to be used on daily timeframe on legacy markets.

- 30 = captures more data, may be more appropriate for bitcoin and cryptocurrencies which are 24/7 and not 5 day a week markets (20 days a month)

- Example

- 14 = quicker setting which on the 1D timeframe captures two weeks of data. Appropriate for some market conditions where a faster signal is needed.

There is often a fake out break out of bands in the opposite direction and for this reason, BBands should not be used alone for trading decisions.

- Can occur to represent strong bullish or bearish continuation

- Often a leading indicator of price action to come

- Bollinger Band Width (BBW)

Quantifies the size of squeeze and is useful for comparing previous squeezes with active squeezes. If a current squeeze is active, I often look to the most previous squeezes to determine what a reasonable size of squeeze should occur.

- Follow John Bollinger on twitter — @BBands

Moving Averages — MA/SMA/EMA/TEMA

- Settings — 50, 100, 200, any 2 or more values

- A fast, low moving average, ie 50, closing above a slower moving average is a bullish entry signal. Closing below a slower moving average is a bearish entry signal.

- A slow, high moving average, ie 200, closing above a faster moving average is a bearish entry signal. Closing below a faster moving average is a bullish entry signal.

- Golden Cross = 50 breaks above 200 — Start of Bullish Trend

- Death Cross = 50 breaks below 200 — Start of Bearish Trend

Additional EMA Strategy Explanation

Pivot Points

- Settings — Daily, Weekly, Monthly, Yearly

- I prefer to use high timeframe pivots like monthly or yearly, regardless of the current timeframe chart I’m using. For many alts, only the monthly or lower pivots are available and are therefore less reliable.

- There are also multiple types of pivots, I stick with traditional most of the time.

- Pivot Point Math — uses previous period high and low to determine support/resistance levels

- Each pivot is calculated and prints at the beginning of the selected period. The yearly pivots print on January 1st and remain the same for the entire year. Monthly pivots are recalculated at the end of each month and print at the beginning of each month.

When the R5 yearly pivot is broken, I rely on monthly pivots for further support/resistance targets.

Pivots can also be used to predict price action based on price movement of previous moves. The idea here was that if price hit the R3/S3 monthly pivot with the Bollinger Band squeeze of this caliber, it would also do it again.

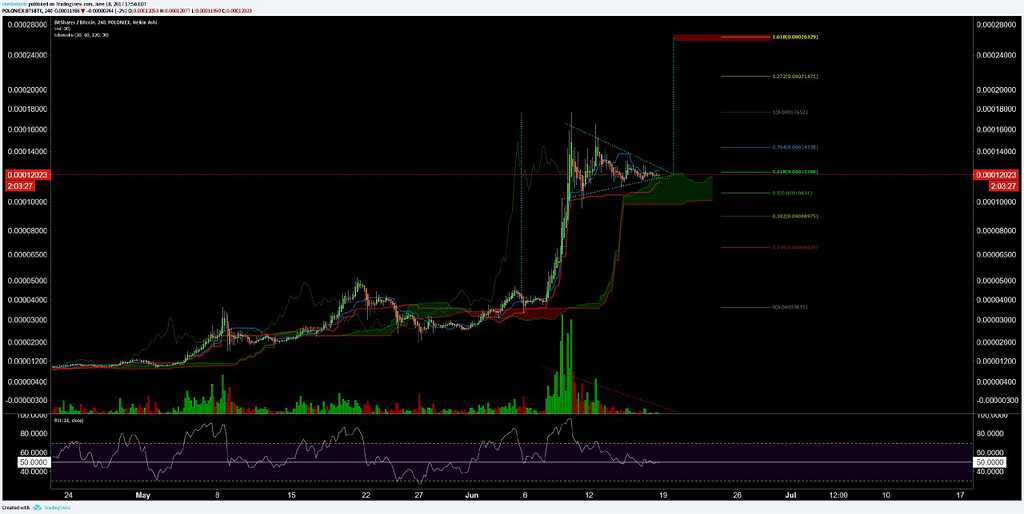

Fibonacci Retracements and Extensions

- Fibonacci retracement levels can be drawn from the extreme high to the extreme low for any price movement. Within this price range, static support/resistance lines are drawn, and can be thought of as Potential Reversal Zones (PRZ) for price. These are levels that traders often use to open or close trades, making them more consistent.

- Fibonacci retracements also include Fibonacci Extensions which give additional support/resistance above or below the extreme high to an extreme low of any price movement, the 1.618 fibonacci extension being the most widely used.

- 50% of the entire distance between established support and resistance is a key zone. Any large price move will retrace at least 50% of the move and make a decision from there. This is known as Dow Theory.

You can use fibonacci retracements and extensions for the macro or micro trend, or even a significant price movement on a lower timeframe.

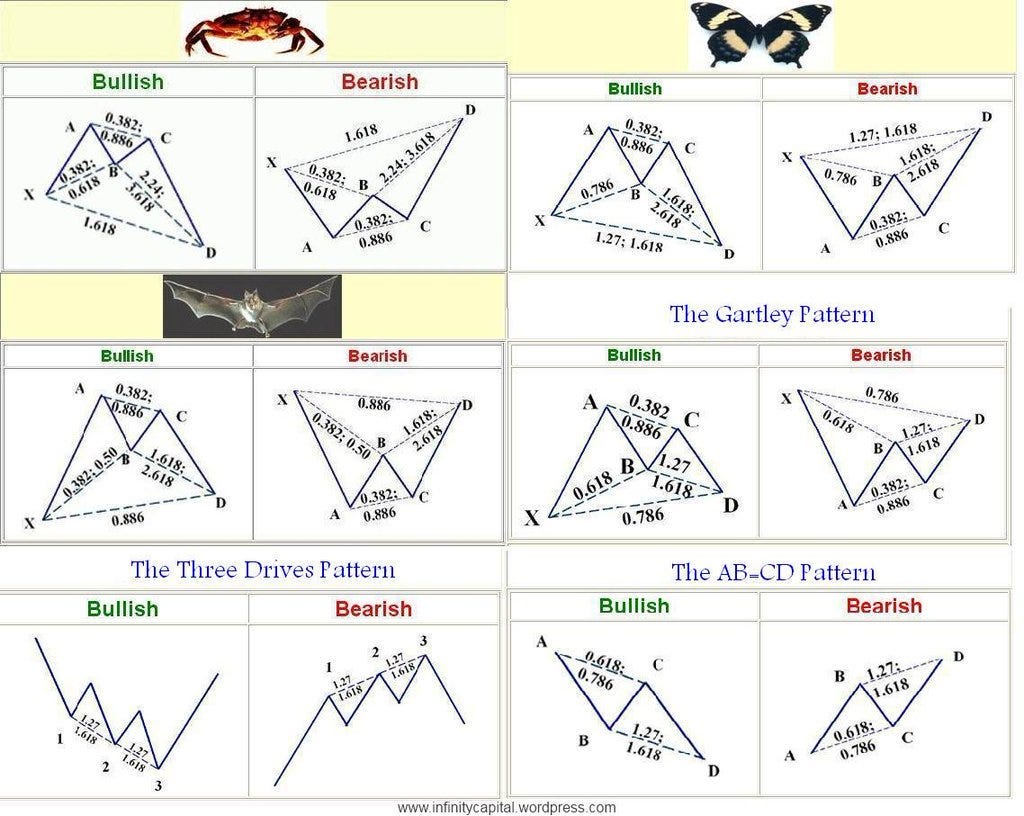

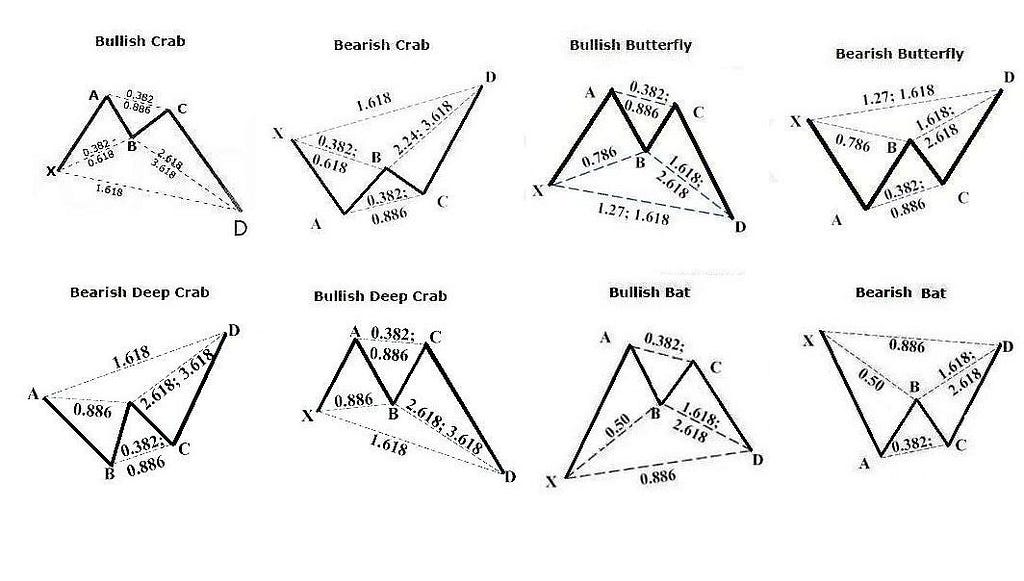

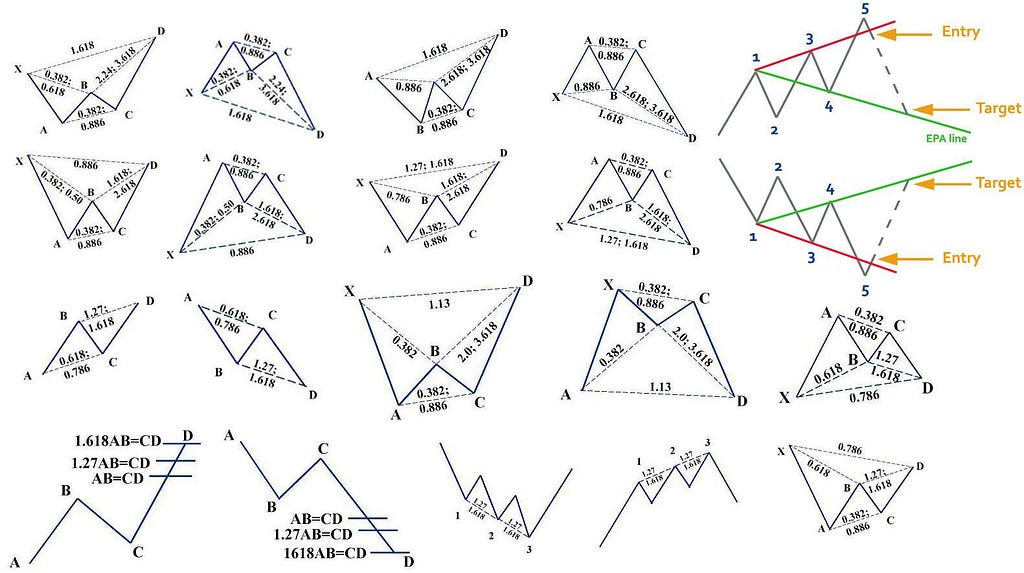

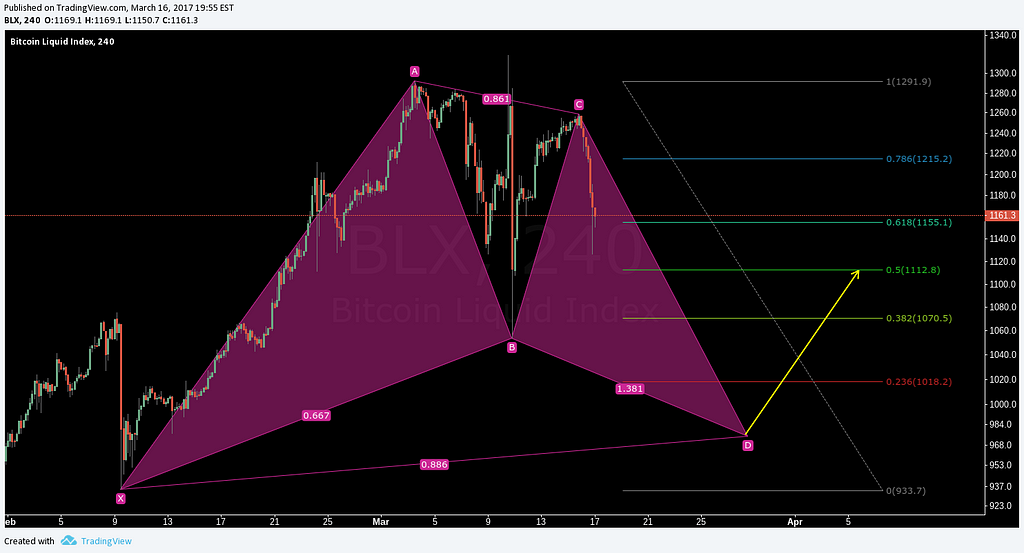

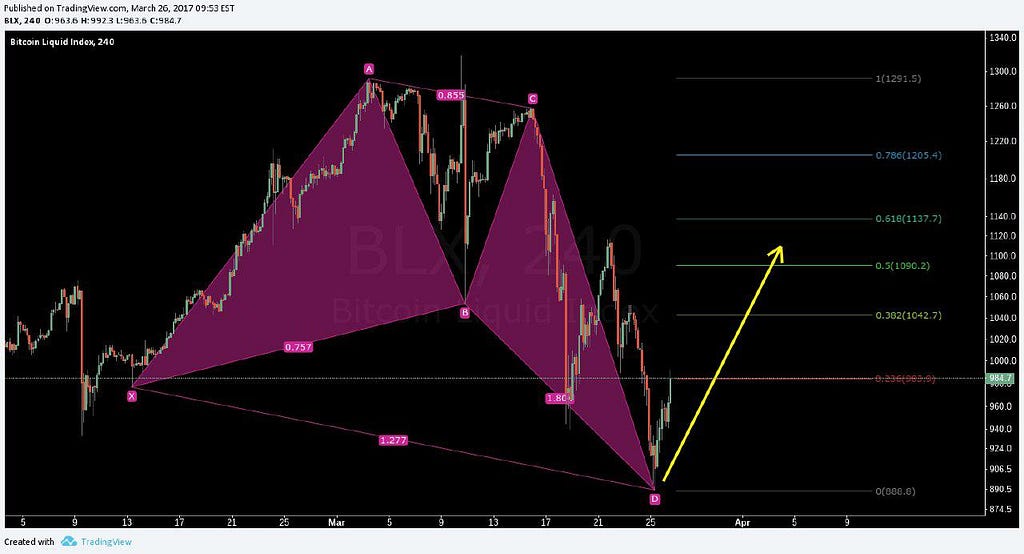

Harmonic Patterns

- Harmonics can be identified once three points form and can be adjusted as price meets or breaks those levels. The fourth point can be deduced based on the harmonic value.

- To draw: Find a double top or double bottom. Then find the extreme high or low and project or identify the 4th point, an extreme high or low. These can be found on any timeframe, but higher timeframe identification is always a more realistic signal.

- The target I use for all harmonic pattern completions is the 50%-61.8% zone from points A to D or, diagonal resistance from points A to C.

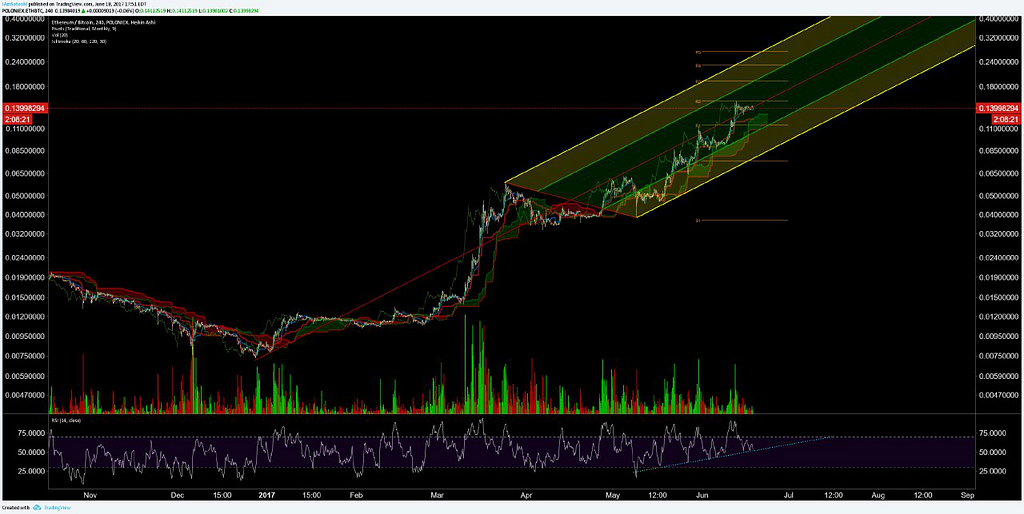

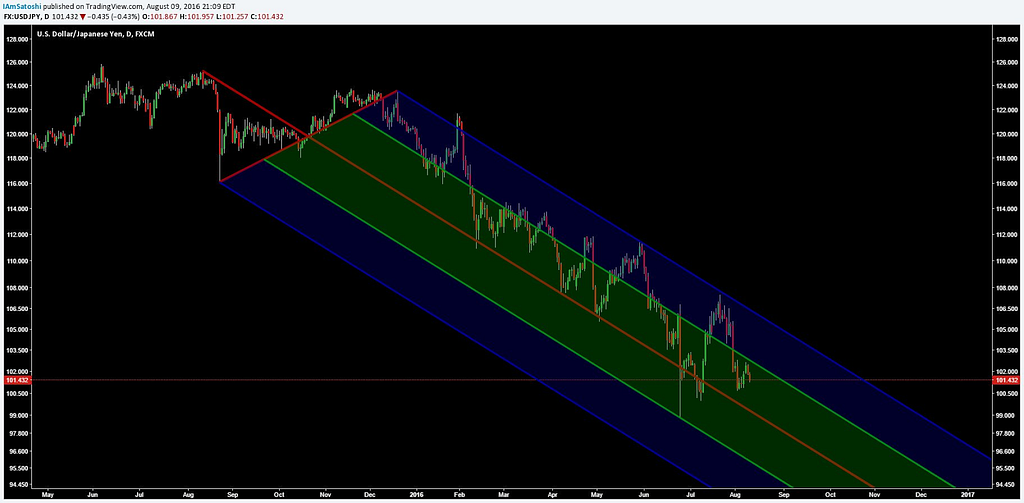

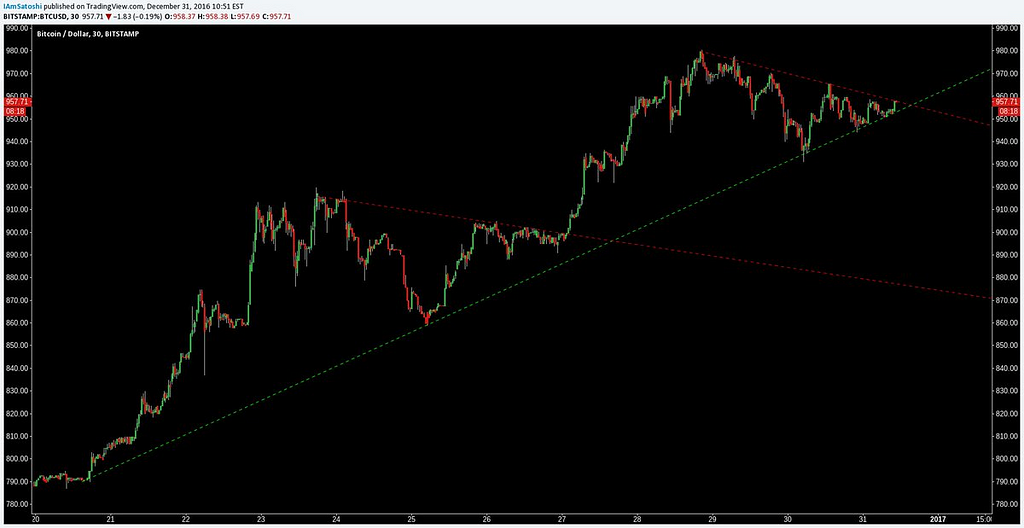

Pitchfork

- The pitchfork is drawn from an extreme high or low to another extreme low or high with an anchor point being a previous extreme low or high. The median line (red) gives the expected mean of the trend. Price will continually attempt to return to this diagonal.

- Each diagonal of the Pitchfork can be thought of as a potential reversal zone or support/resistance line. The upper blue diagonal zone being ‘most overbought’ or the top bounds of the trend and lower blue diagonal zone being ‘most oversold’ or the bottom bounds of the trend.

- To draw: look for three points, an extreme high/low, and a swing high and low.

- BTC Chart Example

- Multiple pitchforks can be drawn within any given trend. A pitchfork should be considered valid if support/resistance of price matches the diagonals once the pitchfork has been drawn. Do not try to fit the pitchfork to price, but rather, pick the anchor points and decide on validity.

Examples

Fractals

- Fractals can be any repeating pattern on a price chart for an asset. Chart patterns and harmonics are examples of known repeating fractals.

- I mainly use random repeating fractals as loose predictor of future outcomes on a big time scale, but I personally don’t use them as actionable signals alone.

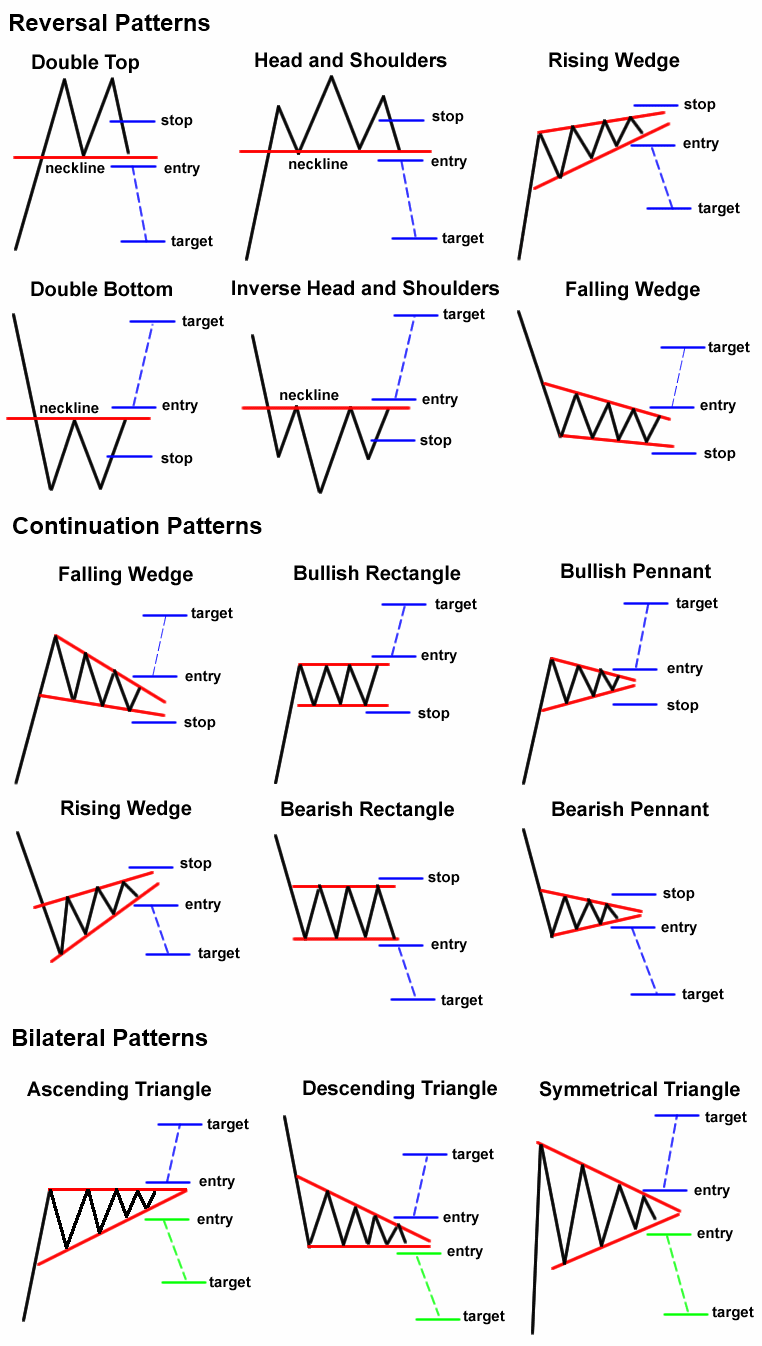

Chart Patterns

All chart patterns consist of:

Volume

If volume profile does not match pattern, it does not mean pattern does not exist, it merely suggests that the probability of the pattern playing out as expected is significantly lower. Confidence and position sizing should be adjusted to accommodate. A matching volume profile for the pattern considerably increases confidence and probability of the pattern playing out as expected.

Measured Moves

Each pattern has an expected measured move, which I will highlight below. Generally, all measured moves are simply the size of the pattern. I also use the 1.618 fibonacci extension as a resistance target for the patterns. Although the patterns have expected moves, they should not be considered 100% slam dunk trades. Use position sizes accordingly.

Trade Entry

All patterns can be drawn and predicted as soon as information allows, but trade entry should never occur until after the pattern has completed. There is also typically a volume confirmation with the completion of each pattern.

Strict Rules

You do not often see reversal patterns as continuation patterns in a trend, ie, you do not often see head and shoulders pattern at the bottom of a bear trend. When you do however, that pattern should be seen as a strong continuation signal.

Cheat Sheet

Here are a few examples

Bullish Continuation

“U” shaped price structure with and sharp pullback and break of horizontal resistance. The pattern remains valid so long as the handle does not break 50% of the entire cup.

Bearish Continuation

- Flags/Pennants — opposite of bullish flags/pennants

- Descending Triangle — opposite of Ascending Triangle

- Giraffe — Established by Hernz — Long neck followed by break of rounded double bottom

Bullish Reversal

Inverted Head & Shoulders

- Occurs after an established uptrend

- Descending volume profile

- Measured move = distance from neckline to head or 1.618 fib

Double Bottom

- W for Win

- Two sharp bottoms

- Occurs after a pullback from an uptrend

- Descending volume profile

- Measured move = distance from neckline to head or 1.618 fib

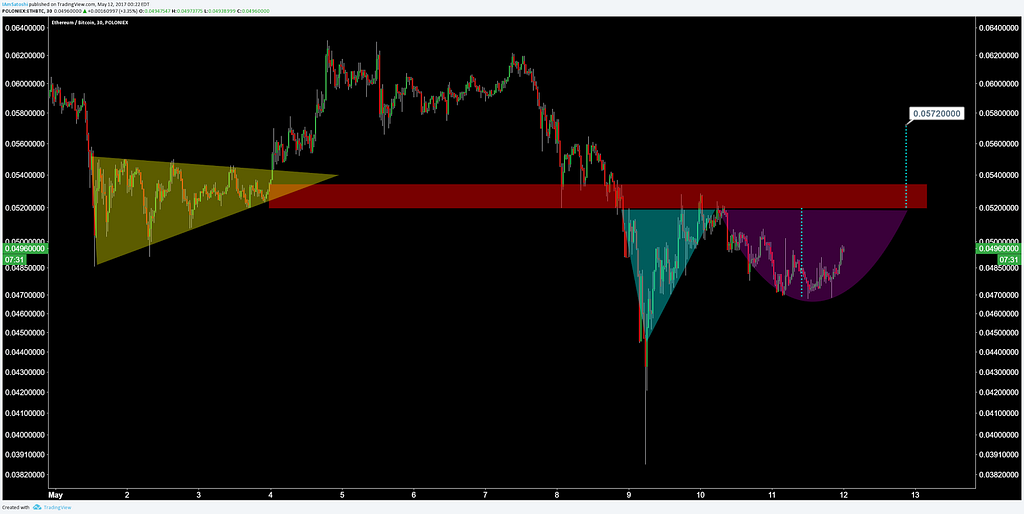

Adam & Eve

- A ‘V’ and a ‘U’ shaped bottom

- Occurs after a pullback from an uptrend

- Descending volume profile

- Measured move = distance from neckline to head or 1.618 fib

Bearish Reversal

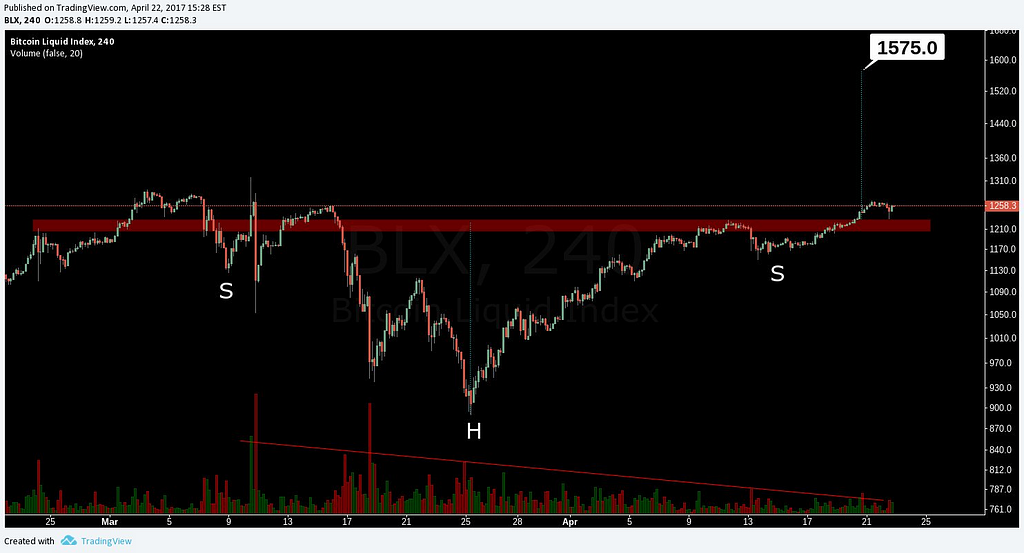

Head & Shoulders — opposite of inverted head & shoulders

- Occurs after an established downtrend

- Descending volume profile

- Measured move = distance from neckline to head or 1.618 fib

Double Top

- M for Murder — Opposite of W

- Inverted Adam & Eve — Opposite of Adam & Eve

Oscillators

I never use oscillators alone when deciding on the actionability of a trade. I mainly use them for finding divergences

- Mean Average Convergence divergence (MACD) = trend following momentum oscillator

- Relative Strength Index (RSI) = measures momentum in price

- Stochastic RSI (Stoch) = faster than RSI

Divergences — Cheat Sheet

Should be used as evidence of reversal for confluence but not traded on solely. Divs can build gradually until broken.

- Bullish = lower lows in price on higher oscillator = weakening bearish momentum

- Bearish = higher highs in price on lower oscillator = weakening bullish momentum

- Hidden bullish = higher low in price on lower oscillator = increased bearish momentum did not drop price

- Hidden bearish = higher high in price on higher oscillator = increased bullish momentum did not drop price

Tips

- Fundamentals tell you what to buy. Technicals tell you when to buy.

- Loser average Losers. Stick to your system of entry and stops religiously.

- Use stops and stick to them.

- When euphoria kicks in, that’s usually a local top.

- Much of the trading-related news & social media troll boxes are noise. Ignore them.

- Trades should end in 3 ways: Big Win, Small Win, Small Loss

- Repeat after me. “The trend is my friend”.

- Don’t scalp the counter-trend.

- Keep a trading journal. Determine flaws. Eliminate them.

- If you open a trade based on a high timeframe signal, don’t self-sabotage and close that trade based on a much lower timeframe signal.

- Good sleep, proper diet & exercise are just as important for trading as they are for most things in life.

- If there is blood in the streets…clean up the street.

- Don’t get chopped up trying to trade/scalp sideways price.

- Expect consolidation after large price movements, not continued volatility.

- All indicators are using the left side of the chart to try and predict the right side of the chart.

- Chart the exchange with the most volume.

- Most traders lose a significant number of trades when starting. Those who are most successful are persistent.

- Trade your own account. Don’t let others trade it for you.

- Agree with the ideas, not the people with supply them.

- Don’t be married to any one coin, position, or idea. Constantly reevaluate for flaws.

- If you’re winning a lot, someone else is losing more.

- A big loss will ALWAYS be more emotional than a big win.

- You need a large sample size to determine if you are a winner or a loser. Variance happens to everyone.

- No one strategy is a holy grail. Use multiple signals and find confluence prior to entry/exit. Use what you like and toss the right.

- Trading tools can get sharper or duller. Don’t be afraid to brush up on concepts you’ve already mastered.

- Look at everything as a number and not money. Always look to be increasing that number.

- Start trading using high leverage and small position sizes. This tests the quality of your entries.

- Fear, uncertainty, and doubt (FUD) are great drivers for panic buying and selling.

- After a big winning or losing trade. Step away and regather your emotions.

- If you’re getting emotional in a losing trade, then your position size is too high.

- Stop trying to rationalize everything. Trade the chart that is in front of you.

- There will always be early bears and early bulls. Being right is more important than being early.

- Zoom out first. Zoom in later.

- On the way up, coins look cheap. On the way down, they look expensive. Don’t let the market play with your mind. Stick to your trading plan.

Additional Reading List

Common Acronyms

OB = orderbook

TF = timeframe

SL = stop loss

BE = break even

HS/H&S/H+S = head and shoulders

iHS = inverted head and shoulders

A&E = adam and eve

TL = trendline

Fib = fibonacci retracement level

FUD = fear, uncertainty, doubt

FOMO = fear of missing out

BTC Tipjar 3PCQX1AxDQiAJxBpo5zgQqVBQ9oKrMa6Qb

168XPsDX4F6V2mM1rpBqwu7XtwsCA1rNak

LTC TipjarMQ9JXuGmDbcLyCmH6XTUPawPiXTF4an6LvLbvFbdGwZMKCppp45CWHhDiQnAiSjbfsjX

ETH Tipjar0x3012a06de1A552B05783514206656f4c1E580cBA

XRP TipjarrDk2hup8y8Qejmxgm9ETv5XYpBHg9gNYMA

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.