Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Opensea competitor LooksRare, one of the major NFT markets in the business, has confirmed the cash-out of $30 million in Ethereum, causing outrage within the community.

The platform which was launched as OpenSea killer recently confimed that its official team recently made over $30 million in cash out from staked tokens of the platfom’s native token, LOOKS. Here’s how it was done.

LooksRare Takes Staked Tokens

According to the NFT marketplaces’ declared fee structure, the project’s team has amassed millions of WETH prizes by staking unattributed LOOKS tokens. Users receive a reward in LOOKS tokens when they sell their NFTs, which is commonly used as a fee compensation.

The unattributed tokens were staked, allowing the marketplace’s crew to get a massive amount of wrapped Ethereum tokens, which they were able to cash out using a Tornado Cash, a coin mixing protocol.

Update: The @LooksRareNFT team has already cashed out 23116 WETH ($73,000,000). This doesn't include the value of $LOOKS.

Most of it is going straight to Tornado Cash. https://t.co/KjBeuqDCwS pic.twitter.com/zf9YKYb60v

— tradfi guy (@0xShitTrader) February 7, 2022

LooksRare’s team member later spoke out on his Twitter account, claiming that the crew had been working for more than half a year without receiving any remuneration, income, or rewards.

(1/6)

To address this:First off, the amount is incorrect: it’s closer to 10,500 ETH and we have 10+ full-time team members.

You can verify the amount on the blockchain by checking ETH transfers sent out on the analytics tab from the team address.https://t.co/Z4Qkv5T02a

— Zodd

(@ZoddLooksRare) February 14, 2022

The price of LooksRare (LOOKS) dropped 15% within hours after the team’s actions were publicized on social media. LOOKS is LookRare’s functional cryptocurrency, a community-driven NFT platform that actively pays investors and creators for affiliates. The price of LOOKS reached an all-time high of $7.07 on January 20, 2022. The distance between the LOOKS price and the ATH level reached 69.16 percent as the team’s scandalous interest mechanism was revealed to the community.

LOOKS/USDT plummets since incident. Source: TradingView

The response was unsatisfactory, and the community demanded that the team purchase back the LOOKS tokens instead of keeping the millions of dollars in Ethereum. Unfortunately, the lengthy explanation did not prevent the token from plummeting further.

Related Reading | OnlyFans Jumps Into The NFT Profile Pictures Trend. Only Ethereum NFTs, Though

Chainalysis Says Rug Pull Are Raking In Billions

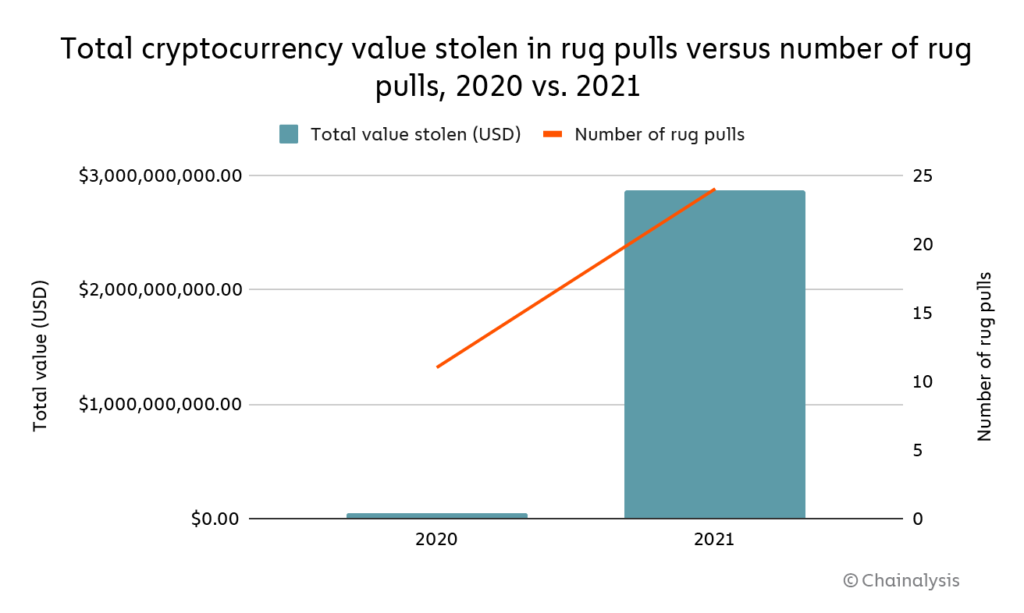

According to a research by Chainalysis, crypto investors lost over $2.8 billion in 2021 due to “rug pulls,” a colloquial name for a form of crypto scam. According to the research, the spike in scams paralleled an overall rise in bitcoin values this year.

According to a research released on Thursday, rug pulls, an apparently harmless crypto Twitter phrase, accounted for 37% of the entire illicit earnings from crypto frauds this year, totaling $7.7 billion. Rug pulls generated for less than 1% of the under $5 billion in total illicit earnings in 2020.

2021 Rug pulls. Source: Chainalysis

According to Chainalysis, the tokens are frequently listed on decentralized exchanges without a code audit, which is a third-party review that guarantees the code follows good governance norms and does not contain a mechanism that would allow the token to not be hacked.

The rapid emergence of new digital currencies such as the memecoins dogecoin and Shiba Inu, according to Kim Grauer, director of research at Chainalysis, gives criminals a window to peddle their own fraudulent commodities.

“Criminals are the most adaptive, opportunistic cohort of people out there,” Grauer said. “So, if there’s an opportunity, they’re going to take it and the hype around a lot of these new currencies is something that is exploited.”

Related Reading | Hackers Hijack India Crypto Exchanges And Influencers’ YouTube Channels

Featured image from Pexels, Charts from TradingView.com, Chainalysis

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.