Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Current state of affairs

The cryptomarkets have experienced a downward slide in 2018. The technical analysis (TA) charts for major crypto assets continue to form a downtrend in prices; even with the most recent bounce.

Further food for thought

- TA Indicators: 50 day moving average trending towards the 200 moving average, fibonacci retracement levels appear only a matter of time, and less than strong support until the $4,500 — $6,000 range.

- Lack of New Demand: Retail investors who missed the Q4 “pump,” wanting to gain access to the cryptomarkets were either unable because of ill-equipped exchanges or deterred by technological layers. We have heard countless anecdotes as such.

- Negative News: Most bull markets shake off bad media news as prices continue to push higher. This happened all throughout 2017, but has since halted in 2018. Every negative press release seems to hurt the markets.

- Self Preservation: Newly minted crypto-millionaires who are watching their paper fortunes drop 30% may begin or already have begun to sell some portion of their crypto holdings, which further exacerbates the downward price pressure. It is basic human nature to fear losses more than desire gains. Furthermore, a recent Cointelegraph article highlights how some of these investors may be rotating into Gold as a safer haven.

- Reflexivity: Reflexivity works the same way on the downside as it does to the upside. Simply put, price decreases change investor’s expectations downward, which affect the market’s fundamentals negatively, which begets further price depreciation. Rinse and repeat until a bottom is found.

Historicism

No one knows the future but the historical context is foreboding. Analysis of prior bubbles show that an accelerated velocity of price appreciation usually collapses shortly thereafter; approximately within 12 to 18 months. The cryptomarkets are at least 12 months into this acceleration phase.

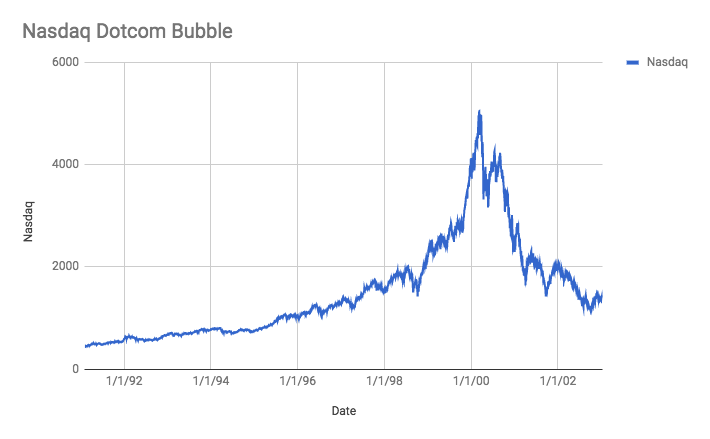

The dotcom bubble started as a normal bull market but then transformed into a bubble when the price growth turned exponential from October 1998 to March 2000. From peak to trough, the Nasdaq fell ~77% in value.

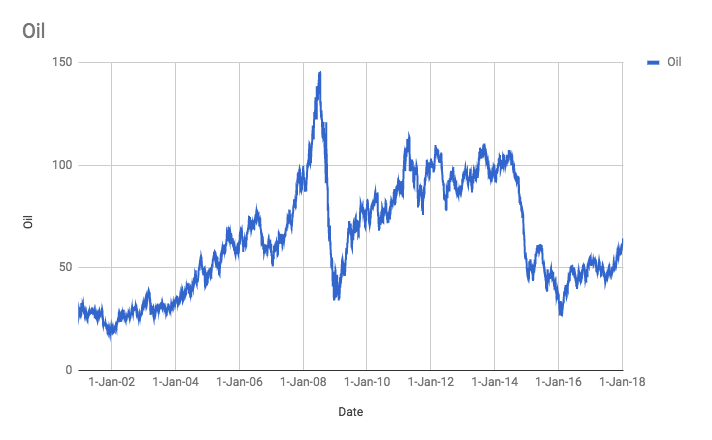

Once again, Oil started out as a bull market and then price growth turned exponential from January 2007 to July 2008. Almost eerily, the peak to trough price plunge was ~77%.

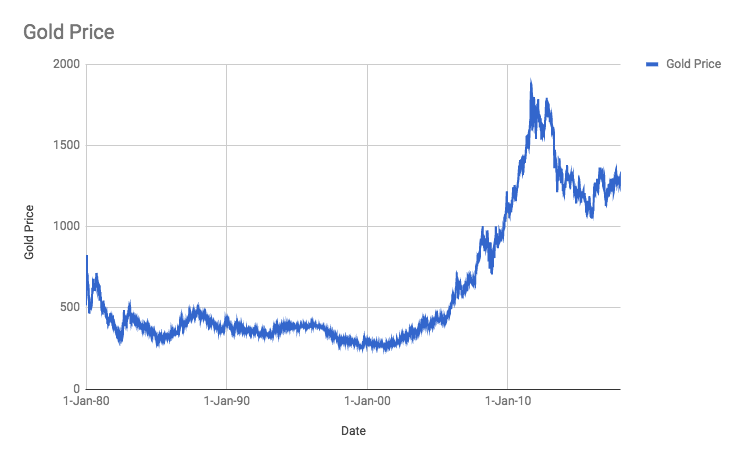

After reviewing the data, I would not consider Gold a bubble but rather an asset that was driven by changing economics, i.e. excessive monetary base creation to finance wars and stave off a depression, coupled with libertarian accumulation of a “hard” currency to fight impending hyperinflation (read Steve Keen as to why this is probably folly). Gold’s growth was far more reminiscent of a strong bull market and the subsequent fall was less severe than the Nasdaq and Oil; the peak to trough decrease was ~44%.

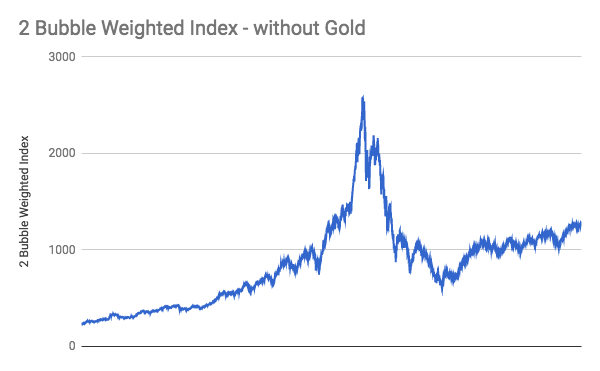

Pugilist Ventures created a weighted bubble index from the 2 “bubble” assets to gauge potential price deflation. We removed Gold because as stated prior, we did not necessarily consider Gold’s growth fitting the bubble model. Looking at this chart, we see peak to trough depreciation of ~72%.

Summary

Humans are notoriously poor forecasters, and history only rhymes; it seldom repeats. However, the market action has made Pugilist Ventures very cautious in the short term and excited in the long term given this devaluation may permit the crypto ecosystem to refocus on long term innovation versus short term gains.

— — Disclaimer: Neither the author of this article, nor Pugilist Ventures, provide investment, financial, or legal advice. This cannot substitute for professional advice and independent factual verification. The content provided on this site is for informational purposes only and should not be construed as any kind of solicitation for investment in any investment opportunity.

Historicism for Cryptomarkets was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.