Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This answer was originally posted on Quora. You can view the answer here.

This answer was originally posted on Quora. You can view the answer here.

I think it may be months before the narrative around this get formed with any sort of certainty. However, here are the theories I read and saw yesterday that seem to shed a light on what was going on.

More New, Amateur Investors Exaggerating Rise and Falls

So, the macro-trend in cryptocurrency over the last few months has been growth like we’ve never seen. Binance, one of the fastest growing exchanges, added 250,000 new users in one hour[1].

Many of these users were completely new to cryptocurrency and hadn’t experienced a rise or crash. So they contributed to both the extent of the rise and fall. We rose from $300 Billion to over $800 Billion because of these investors, so dropping to close to $400 Billion due to the same investors is reasonable. They got excited and then scared, tanking the market. I think there are more specific answers to go into, but I think this explains why this year was so dramatic.

The January Dip

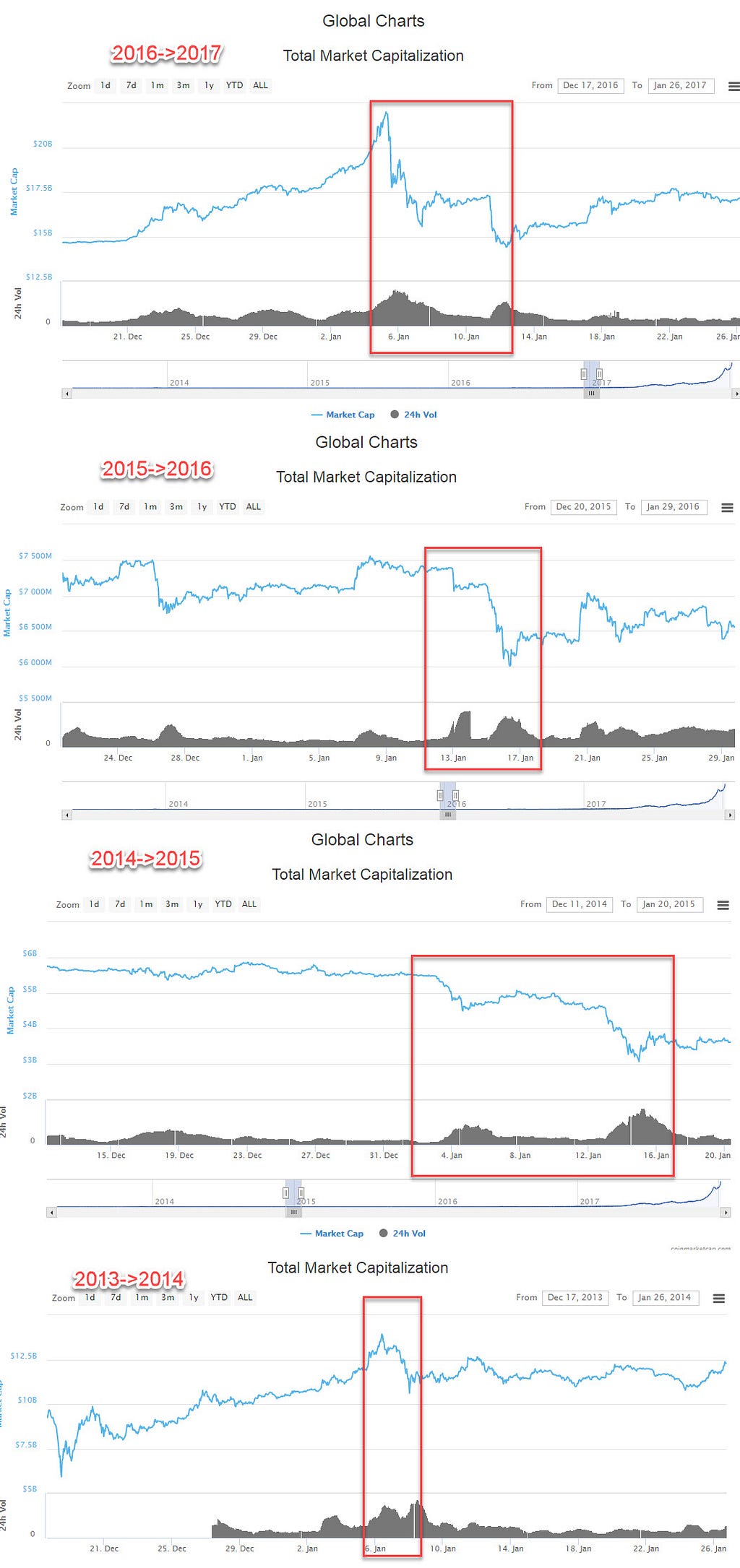

The most common explanation for why the dip took place was that in mid-January every year since 2014, there has always been a sudden 20% to 30% dip. You can look at this Reddit post for more discussion on this topic[2], but here’s the graphic they produced:

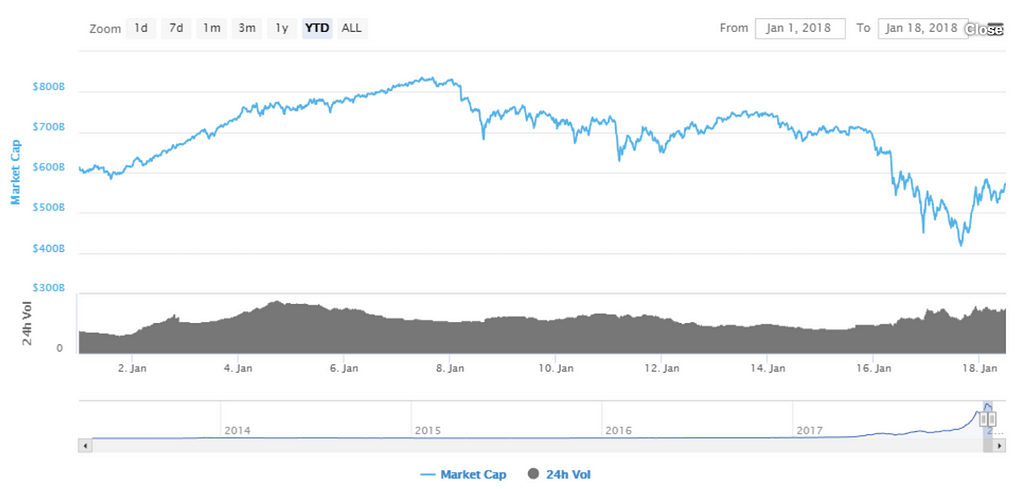

Personally, this looks like people selling off investments for tax purposes, and then the market ‘over-reacts’ to the negative move. This year, we have a lot of unseasoned investors who are just riding the wave, so January 2018 looked like this:

Quite the dip, but not inconsistent with previous years.

Bitconnect Failing

Bitconnect wasn’t the biggest player in the cryptocurrency market by any means (less than .3% of the cryptocurrency market total), so it didn’t contribute much to the drop in value. However, the news of Bitconnect finally pulling out of US operations hung like a shadow over the entire day. A lot of social media promoters basically went into file shredding mode to get rid of all the evidence that they had promoted the Ponzi Scheme.

A more mature group of investors might have taken this news and shrugged, but given the high level of inexperience traders, I’m sure many investors saw what was happening here and took it as a bad sign for the market overall. The news of Bitconnect pulling out hit the market around 20:00 UTC on January 16th:

And here was the overall cryptocurrency market around the same time.

I think that $75 Billion valley over the next few hours was directly caused by the news about BCC. Again, I don’t think this was the predominant cause of any of the crash (it was already melting down), but it certainly seemed to accelerate things.

Footnotes

[1] Binance: 250,000 users subscribe to the exchange in 1 hour!

[2] The January dip happens every year. Lunar new year costs money, just hold tight. • r/ethtrader

Originally published at www.quora.com.

What Caused The Cryptocurrency Sell-Off on Tuesday, January 16th? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.