Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

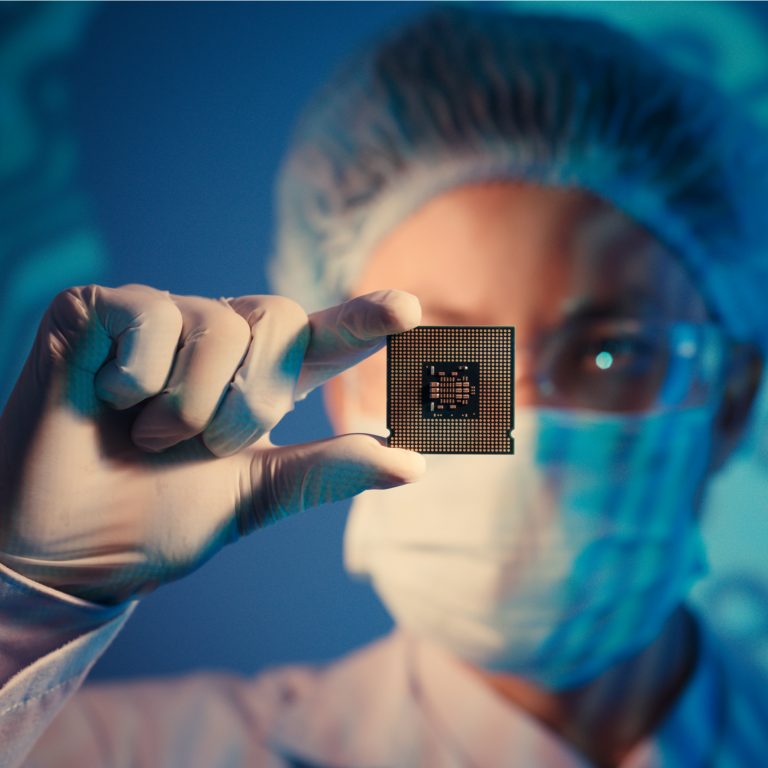

The world’s largest dedicated semiconductor foundry, TSMC, expects that the bitcoin mining industry will continue to grow this year, fueling an increased demand for its chips. Some analysts now see the cryptocurrency mining sector as offering the highest potential to cover for weak iPhone X sales for Apple’s primary chip supplier.

Also Read: Austrian Bitcoin Miner May Seek an IPO on the London Stock Exchange in 2018

Bitcoin X

Taiwan Semiconductor Manufacturing Company (TPE: 2330) today reported its Q4 2017 earnings, showing a 10.1% increase in revenue and a 10.4% increase in net income. In total, the Q4 revenue was $9.21 billion, which increased 10.7% from the previous quarter and 11.6% year-over-year. The TSMC stock rose 2.69% in response.

Taiwan Semiconductor Manufacturing Company (TPE: 2330) today reported its Q4 2017 earnings, showing a 10.1% increase in revenue and a 10.4% increase in net income. In total, the Q4 revenue was $9.21 billion, which increased 10.7% from the previous quarter and 11.6% year-over-year. The TSMC stock rose 2.69% in response.

“Our fourth quarter business was supported by major mobile product launches and continuing demand for cryptocurrency mining,” said Lora Ho, SVP and Chief Financial Officer of TSMC. “Moving into first quarter 2018, we expect the strong demand for cryptocurrency mining will continue while mobile product seasonality will dampen our business in this quarter.”

Bitcoin mining hardware is considered to offer the highest growth potential for the company with some analysts expecting that it will double and constitute up to 10% of TSMC’s revenues in 2018. They even hope it can compensate for the lackluster iPhone X sales in China for the chip maker. “The mining impact on TSMC is now akin to that of a popular new iPhone,” commented Mark Li, a Hong Kong-based analyst with Sanford C. Bernstein & Co. “The difference is that each new iPhone requires a huge amount of innovation and marketing. The Bitcoin contribution is automatic.”

Boom or Bust

Stock analysts covering TSMC are divided about bitcoin’s long term effect on the company’s bottom line. “Although some investors are bullish that Bitcoin-related chipset demand could offset soft smartphone demand in 2018, we question whether Bitcoin demand will be sustainable” if prices slide, Benjamin Chiang, an analyst at KGI Securities, commented ahead of the results.

Stock analysts covering TSMC are divided about bitcoin’s long term effect on the company’s bottom line. “Although some investors are bullish that Bitcoin-related chipset demand could offset soft smartphone demand in 2018, we question whether Bitcoin demand will be sustainable” if prices slide, Benjamin Chiang, an analyst at KGI Securities, commented ahead of the results.

However, others acknowledge it can be a winning best for the company. “Cryptocurrency is like a call option for TSMC, which is an attractive investment on its own,” said Sebastian Hou, an analyst with CL Securities Taiwan Co. “If mining demand vanishes tomorrow, it shouldn’t affect the investment outlook. But if it turns out to be strong, the company will rake it in.”

Should chip makers bet big on bitcoin mining or just stick to cell phones? Tell us what you think in the comments section below.

Images courtesy of Shutterstock.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.

The post Chip Giant TSMC Expects Strong Demand for Cryptocurrency Mining to Continue appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.