Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitfinex/Ethfinex, Binance, and Coinmetro

One trend I’ve noticed in the later half of 2017 was the birth of exchange tokens. Two notable ones that offered exchange-specific coins for their platforms were Bitfinex and Binance. Let’s go through both of them briefly to look at the purpose and function of these tokens.

Bitfinex/Ethfinex

On August 2, 2017, Bitfinex announced their plans to release Ethfinex, “an information and exchange platform for Ethereum-based trading and discussion.”

https://blog.ethfinex.com/announcing-ethfinex-80dc97067f55

https://blog.ethfinex.com/announcing-ethfinex-80dc97067f55

Ethfinex offers an ERC20 token called Nectar (NEC). This token serves two primary functions:

- To incentivize market orders and platform liquidity

- To decentralize governance

To incentivize liquidity, market makers are rewarded with NEC to increase liquidity. At the end of every 28 day cycle, NEC is then distributed to these market makers proportionate to their total trading volume. This is significant because these traders can either trade NEC with other whitelisted cryptocurrencies, or they could hold them.

One incentive a trader might have to hold them is to participate in governance. Ethfinex platform users can vote through their tokens on matters such as what coins get listed. But perhaps the most significant part of the governance model is that if any individual or organization that manages to obtain 5%+ of NEC tokens will be eligible to “an Ethfinex board set.”

However a couple months after NEC, Ethfinex pivoted and decided to announce Honeycomb. This will not be an ERC20 token but instead run on it’s own native chain with a Proof-of-Stake blocking mechanism. It will be distributed at a 1:1 ratio to all NEC holders.

This will mean that at the point of transition, all issuance of new nectar tokens will completely change and the system will transition to a different model, with different economic parameters and a fixed total supply. -Ethfinex

Binance

This exchange deals exclusively with cryptocurrencies only. This means they don’t offer any fiat pairs of any kind. What they do offer though is a platform to trade with with new cryptoprojects such as ICO’s which give traders high risk-high reward opportunities.

Like Ethfinex, Binance also has an ERC20 token that they created called Binance Coin (BNB). The BNB token offers several advantages to its holders.

Trading Discounts

Those who trade using BNB pairs will be offered significant discounts in trading fees.

https://support.binance.com/hc/en-us/articles/115000429032-What-is-BNB-

https://support.binance.com/hc/en-us/articles/115000429032-What-is-BNB-

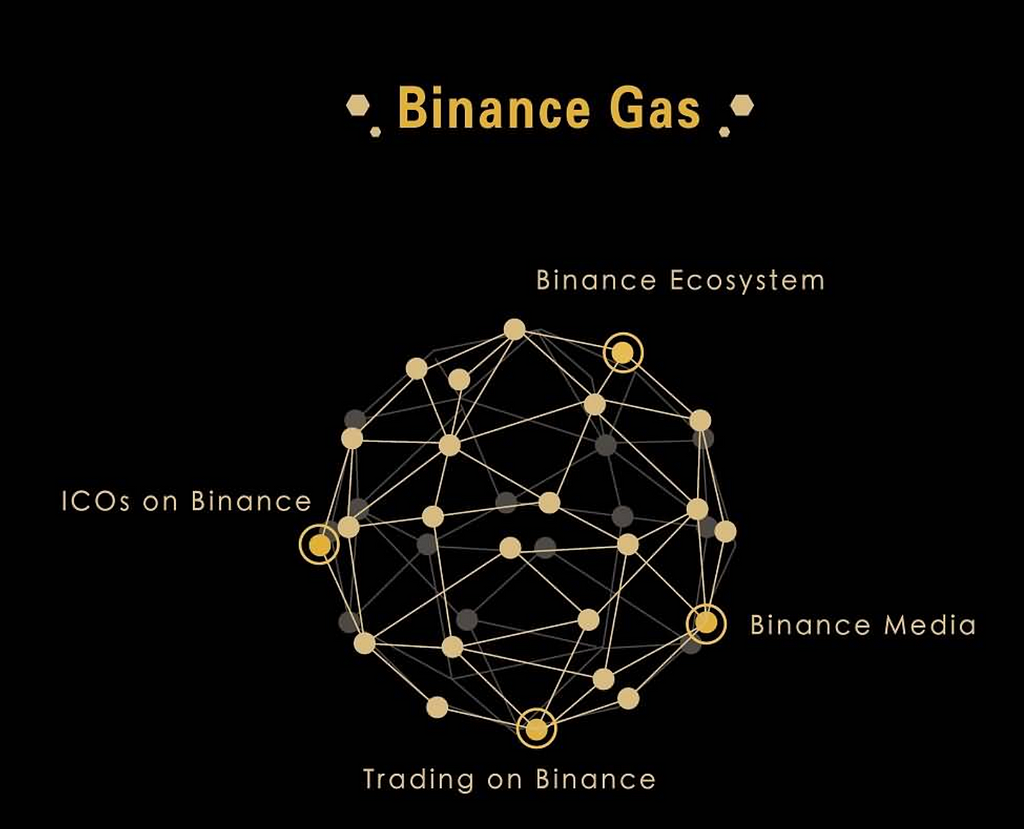

BNB as Gas

They will also benefit in the future as BNB will be used as Gas. In other words, BNB will function in a similar way to Ether in that it will be needed in order to utilize these services:

https://support.binance.com/hc/en-us/articles/115000429032-What-is-BNB-

https://support.binance.com/hc/en-us/articles/115000429032-What-is-BNB-

BNB Token Burn

Finally, Binance plans to burn the initial 200 million tokens sold in the ICO down to 100. In fact, they just recently burned 1,821,586 BNB in December.

Both of these two exchanges utilize exchange-specific tokens for very different purposes. Ethfinex is using NEC as a form of governance and incentive to increase liquidity. Binance used BNB initially to fundraise and incentivize liquidity with discounts on trading fees, but will ultimately be used to power the Binance Ecosystem that they are building. But what if there was an exchange similar to Binance that wasn’t restricted to just cryptocurrencies and helped introduce new investors to cryptocurrency?

Coinmetro

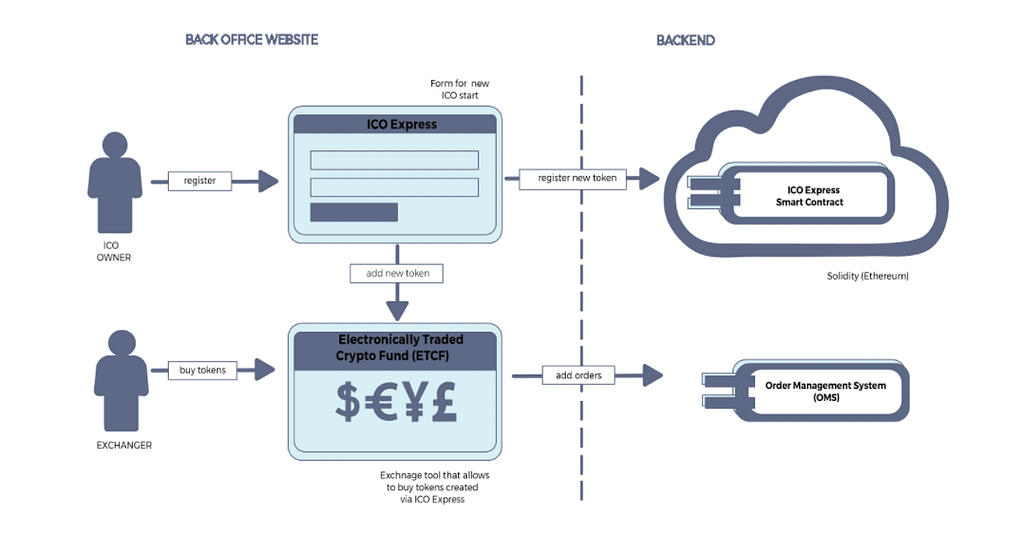

CoinMetro is a start-up exchange that is hoping to get started in a similar way to Binance with an ICO. They will also focus on easily assimilating ICO’s into their trading platform to offer high risk-high reward situations to traders. However, one key distinguishing characteristic of Coinmetro will be that users will have access to fiat. Now let’s take a look at how their ERC20 token XCM will help facilitate the onboarding of new cryptoinvestors.

XCM holders will benefit in two similar ways to BNB holders:

- XCM will allow reduced fees in trading

- XCM also has a buyback program

Where Coinmetro’s token differs from Ethfinex and Binance is that it will also be used for managing cryptoportfolios in two ways: 1. Tokenized Asset Management 2. Electronically Traded Crypto Fund

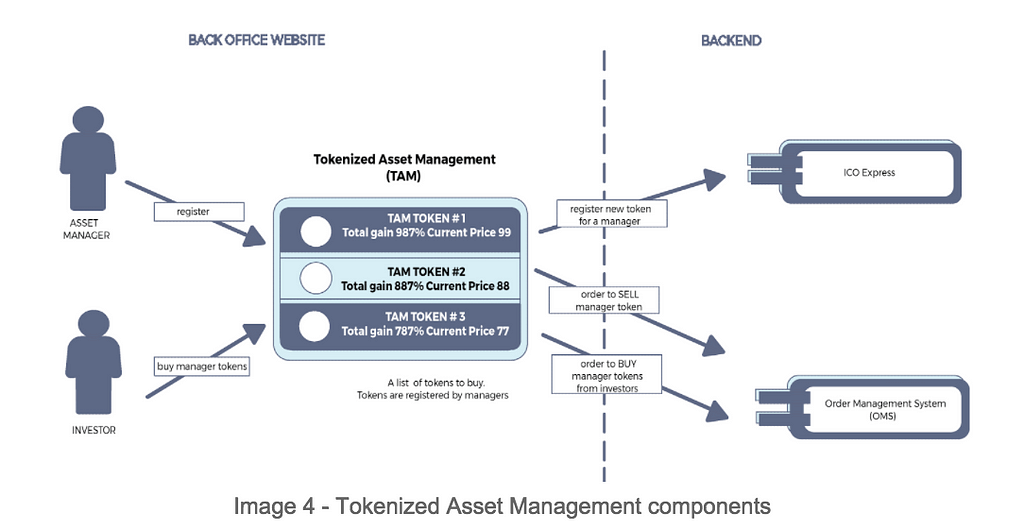

Tokenized Asset Management (TAM)

Coinmetro platform users will be able to offer XCM to “asset managers” to trade on their behalf. Rather than having to spend hours on researching the hundreds of new ICO’s appearing, you can hand over this responsibility to someone who does this professionally.

Electronically Traded Crypto Fund (ETCF)

Coinmetro users will also be about to join ETCF’s. Rather than trusting an asset manager with your finances, you can buy into curated cryptobaskets which would be diversified into different cryptocurrencies.

Through TAM and ETCF, Coinmetro plans to distinguish themselves from other exchanges by helping ease cryptoinvesting for newcomers. By offering asset managers and cryptobaskets with XCP, they hope to mitigate their risk until they are comfortable enough to utilize their more advanced trading platform.

Remember to give me claps to the left and share with your friends! Until next time, onwards and upwards. 😁

*This article was submitted to Coinmetro’s bounty program.

The Utility of Exchange Tokens was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.