Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The bears continue to have complete control over the cryptocurrency market with numerous double-digit price losses from almost all assets. This comes just hours after the US stock market dumped in value again.

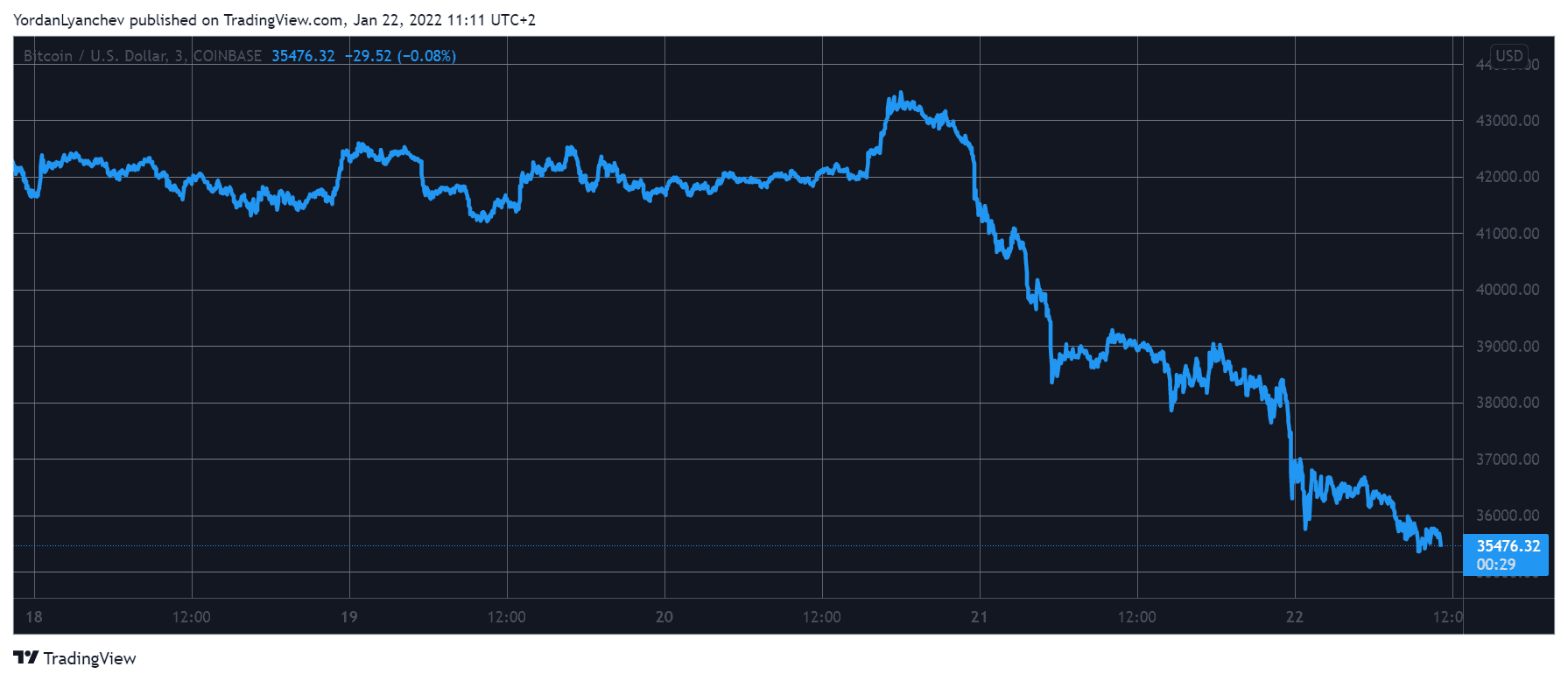

Bitcoin Dumps $8K in Two Days

It’s safe to say that the primary cryptocurrency has seen better days. In fact, they weren’t all that long ago as the asset jumped to $43,500 on Thursday following a $1,500 price hike.

However, the situation changed vigorously hours later. BTC started to dump in value rapidly and dropped to a six-month low of $38,250, as reported yesterday. This enhanced volatility resulted in more than $700 million worth of liquidations in just a day.

As bitcoin attempted its recovery and touched $39,000, the bulls took another major hit. BTC dumped by almost $4,000 again and reached its lowest price line since late July at $35,000.

As the asset currently stays just a few hundred dollars above that level, its market capitalization is down below $700 billion.

Bitcoin’s price slides coincide with the recent correction in the stock markets. The three most prominent US stock market indexes are all in the red in the past few days. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite declined about 5% last week and approximately by 2% on Friday alone.

Altcoins See Double-Digit Dumps

The altcoins are in even worse shape in the past two days. Ethereum traded above $3,100 on Thursday, but it’s down below $2,500 as of now. This comes after another 15% drop since yesterday.

Double-digit drops are evident everywhere across the alt charts. This includes Binance Coin (-20%), Cardano (-16%), Ripple (-14%), Solana (-20%), Terra (-30%), Polkadot (-23%), Dogecoin (-14%), Avalanche (-22%), MATIC (-20%), and many others.

More losses come from Theta (-30%), PancakeSwap (-28%), Gala (-26%), Harmony (-26%), Loopring (-25%), Theta Fuel (-25%), Oasis Network (-25%), Curve DAO Token (-25%), and others.

The cumulative market capitalization of all crypto assets has decreased to just over $1.6 trillion. This means that the metric is down by $200 billion in a day and $400 billion in two days.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.