Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

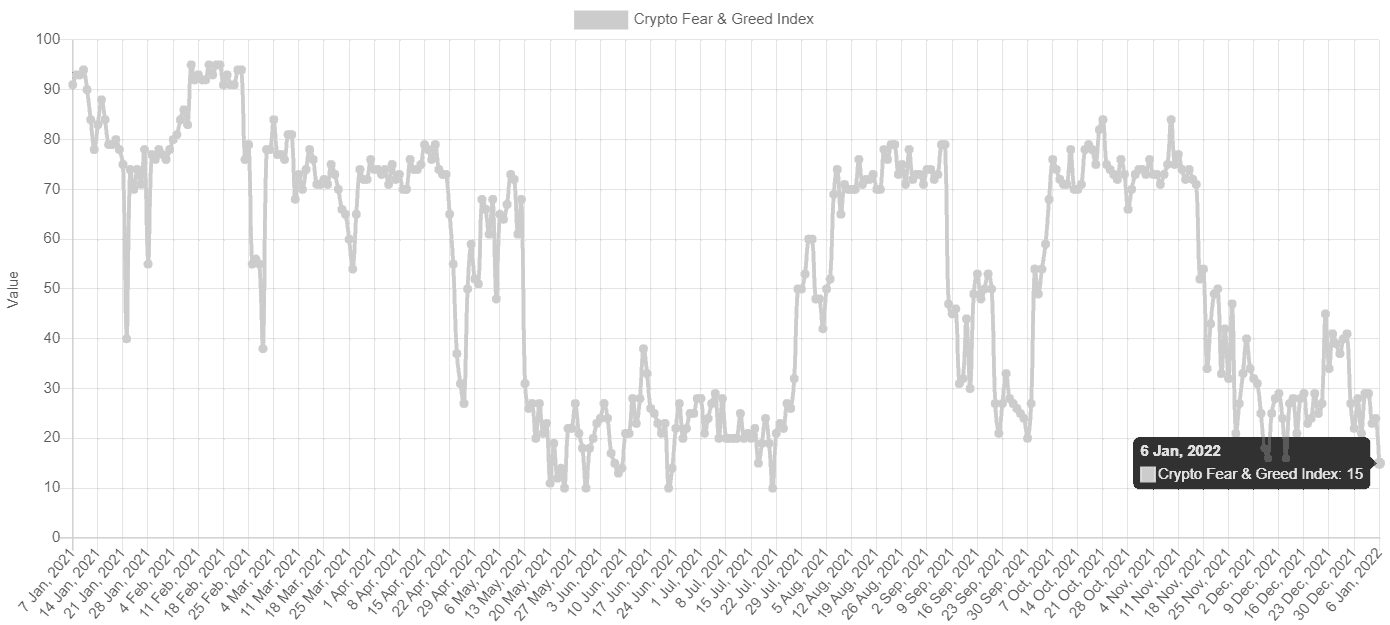

The Bitcoin Fear and Greed Index, which tracks the community’s general sentiment on the leading digital asset, has gone deep into a territory of “Extreme Fear.” The metric currently points at 15, which is the lowest level since July 21, 2021.

Lowest Levels in Six Months

The Bitcoin Fear and Greed Index indicates the momentary investor feelings towards BTC scaling them from 0 (“Extreme Fear”) to 100 (“Extreme Greed”). To do that, it tracks numerous segments, including the volatility of the cryptocurrency, surveys, social media activity, and others.

On January 5, bitcoin’s price plummeted from $47,000 to $43,000 in a matter of a few hours. On the following day, it continued its downtrend and went below the $43K level. As it usually happens in the cryptocurrency space, BTC’s price decrease affected the aforementioned metric and it plunged to 15 – a state of “Extreme Fear.”

Bitcoin Fear and Greed Index, Source: alternative.me

Bitcoin Fear and Greed Index, Source: alternative.me

Its tumble might be a result of the reports that the Federal Reserve would soon start raising interest rates to combat inflation in the US. The latter’s current rate stands at almost 7% – the highest in nearly 40 years.

Nearly a month ago, the newly detected COVID-19 variant – Omicron – disturbed all financial markets, including the primary cryptocurrency, which decreased to $42,000. Following those developments, the Bitcoin Fear and Greed index dropped to 16 (again a territory of “Extreme Fear”).

Nonetheless, the asset swiftly got back on its feet and finished 2021 at almost $49,000, marking a 60% price increase for the past year.

Is That a Good Buying Opportunity?

This is not the first time bitcoin has lost a significant chunk of its value in a matter of a few days. So far, it has always managed to overcome the lost ground, meaning that these drops could not be considered a major concern for long-term investors.

Earlier this week, the third-largest bitcoin whale took advantage of the relatively low price and purchased 456 BTC for approximately $21 million. Following the development, the address increased its holdings to 120,845.57 BTC, worth over $5.6 billion.

Another bullish sign for the asset’s future is Goldman Sachs’ viewpoint. The US multinational investment bank, which is usually not so supportive of the crypto industry, recently opined that investors might swap their preferences from gold to bitcoin in the following years. Thus, BTC could hit $100,000 in the near future, the institution concluded.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.