Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

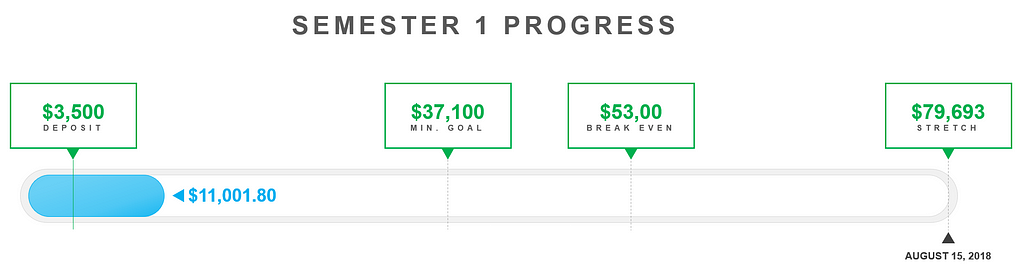

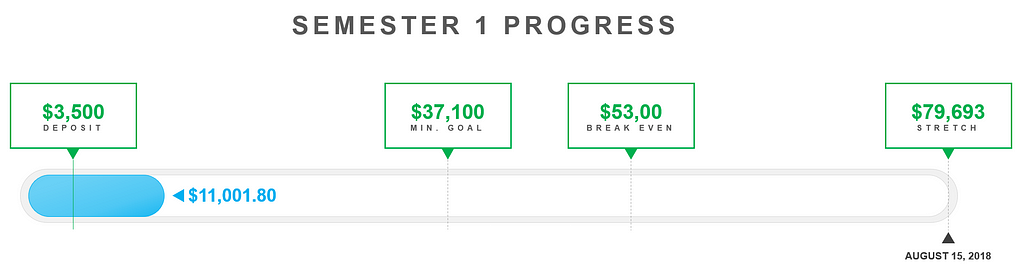

In total portfolio is valued at 14,501.80; minus the $3,500 investment, the total profit is $11,001.80.

In total portfolio is valued at 14,501.80; minus the $3,500 investment, the total profit is $11,001.80.

On January 8th, 2018, I published my first article about my intention to invest my deposit to MIT’s Business School into a crypto-investment funds for the goal of turning it into full tuition; i.e., I’m using crypto to try to pay for my business school. You can read more about it here:

$3.5k to $80k: Pay for Business School with Cryptocurrency Investments

The Waves of Bad News Trickle In

Just when you think things are going fine in the crypto world, bad news comes swinging at you

Just when you think things are going fine in the crypto world, bad news comes swinging at you

As soon as I published my first article, the cryptocurrency market was hit by a wave of bad news:

- CoinMarketCap removed South Korean exchanges from its market cap analysis, which artificially deflated the value of many coins, which then led to more panic selling.

- Bitcoin ETF requests were derailed by SEC, which left disappointing news for institutional investors.

- South Korean FUD about bitcoin being banned resulted in a significant dip in prices, as much of the speculation and pricing of cryptos are driven by Korean investors. The reality was that the government wanted to start examining ways to regulate the markets, which is a very fair move.

The bad news took a hit on my portfolio. For the next several days after my post, my portfolio, which started off at $3.5k and went to $13k at the time of writing the intial post, dropped to as low as $9k. Seeing 30% of your portfolio value gone in just a couple of days can be a tough pill for any investor to swallow, but that’s just a normal day in the life of crypto-trading.

When Life Gives You Lemons, Make Lemonade

Rather than immediately pulling out and trying to save whatever money I had left, I decided to take a look at the markets and diversify a bit by picking up altcoins at lower prices. After trading in the market for a while, you start to get used to the fluctuations, no matter how terrible.

Personal Investment Story: my worst mistake so far in my crypto investing journey happened when I first started trying to actively trade. I pulled out of one of my active trade investments when it dropped by 50% in a matter of a few days. I made the mistake of putting too many funds into it, rather than trickling my investment, and I immediately lost half of my investment on it after pulling out. It’s recovered since then, and looking back now, if I had held it, I would be up by almost 2x.

I looked through a list of recommendations of coins from readers who suggested ones to me on my previous post, Reddit communities, and friends. And I found FlypMe (FYP), an exchange-based cryptocurrency with a low market cap.

FlypMe is a coin that has a very similar model to the other recent successful wave of crypto exchange coins. You hold the coin, and the exchange pays you dividends using the trading fees they collect from their buyers/sellers. Because coins like COSS (which I’m already invested in for this portfolio), Kucoin, and Bibox have been so successful using the same model, I decided to sell some of my Dogecoin holdings to buy FlypMe.

Current Status of the Business School Fund

After a rough week of seeing my portfolio dip by 30%, it recovered recently to $14,501.80. This recovery number actually brings it higher than before. Since the last update, my portfolio has increased by 10.4%.

The progress bar has moved up by 1.7% since the last update

The progress bar has moved up by 1.7% since the last update

After taking out my initial investment of $3,500, I have a total of $11,001.80 profit to put towards my business school tuition. While percentage-wise that’s only a 1.7% increase toward the goal, the portfolio increased by $1,361.80 since last week, and that represents a 10.4% growth.

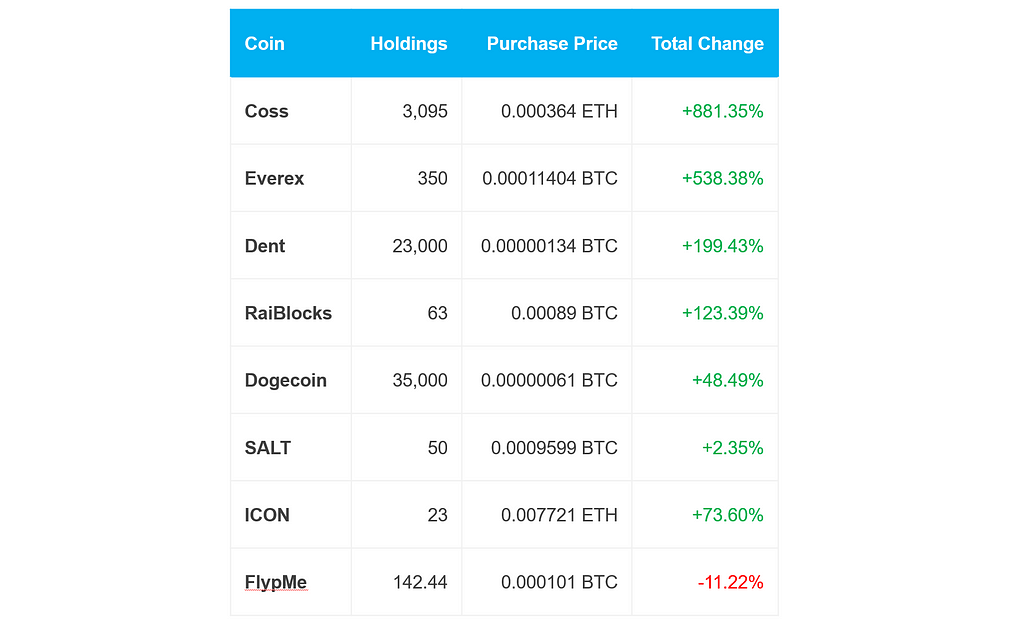

As mentioned before, I sold some of my Dogecoin for FlypMe; specifically, I sold 15,000 Doge for 142.44 FlypMe:

COSS and Everex have been the biggest percentage gainers for my portfolio. My recent purchase for FlypMe has not yielded a positive return, yet.

COSS and Everex have been the biggest percentage gainers for my portfolio. My recent purchase for FlypMe has not yielded a positive return, yet.

Overall, there were times when I was tempted to sell to preserve my losses, history often repeats itself in this volatile marketplace, so my resiliency paid off for now. At this point, I’m considering my next move to be to withdraw my initial investment so I would be using investment money only moving forward. I’ve decided I’ll to do this once the portfolio hits and maintains $15,000 or above for at least 24–48 hours.

Resources to Keep Updated on My Progress

If you have any questions or want to reach out to me directly, the best way to do it is through Twitter @kennymuli

First and foremost, I recommend you follow me on Medium:

You can always check the summary of my progress by following my publicly available spreadsheet (it’s not the most glamorous spreadsheet, but it’ll give you the information you’re likely looking for):

Crypto Investing for Business School Tuition

You can also read more about the details of each update:

$3.5k to $80k: Pay for Business School with Cryptocurrency Investments

$3.5k to $80k: Business School Crypto Fund Update — HODL! was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.