Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

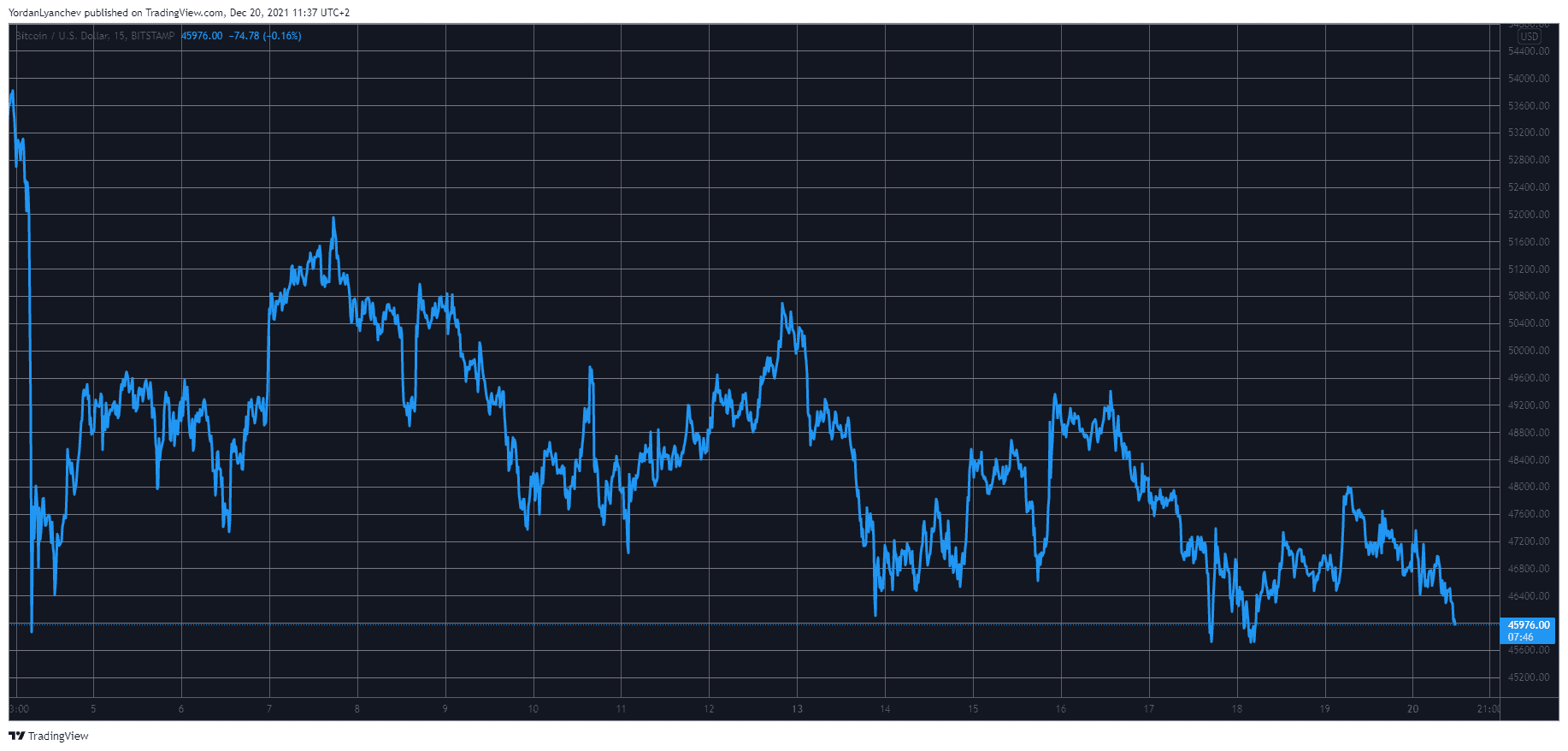

Bitcoin’s suffering continues as the cryptocurrency failed at $47,000 and dropped below $46,000. Most altcoins are also well in the red, with Ethereum trading beneath $3,800 and Binance Coin close to breaking below $500.

Omicron Fears Behind BTC’s Latest Dump?

Just several days ago, the primary cryptocurrency seemed significantly more bullish when it neared $50,000 following a US Fed statement in regards to the inflation rates.

However, it couldn’t surpass that level and started to lose value gradually. It dropped below $46,000 in the following days as reported but quickly shot up to $48,000.

Yet, the bears continued to have a strong grip on the market and pushed the asset south again. As of now, bitcoin trades around $46,000, having dipped below that line minutes ago.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

The situation with the global stock markets is somewhat identical. Most stock indexes lost value last week on fears for the new variant of the COVID-19 pandemic and US politics.

The futures contracts of the S&P 500, Nasdaq, and Dow Jones all went down ahead of the trading day.

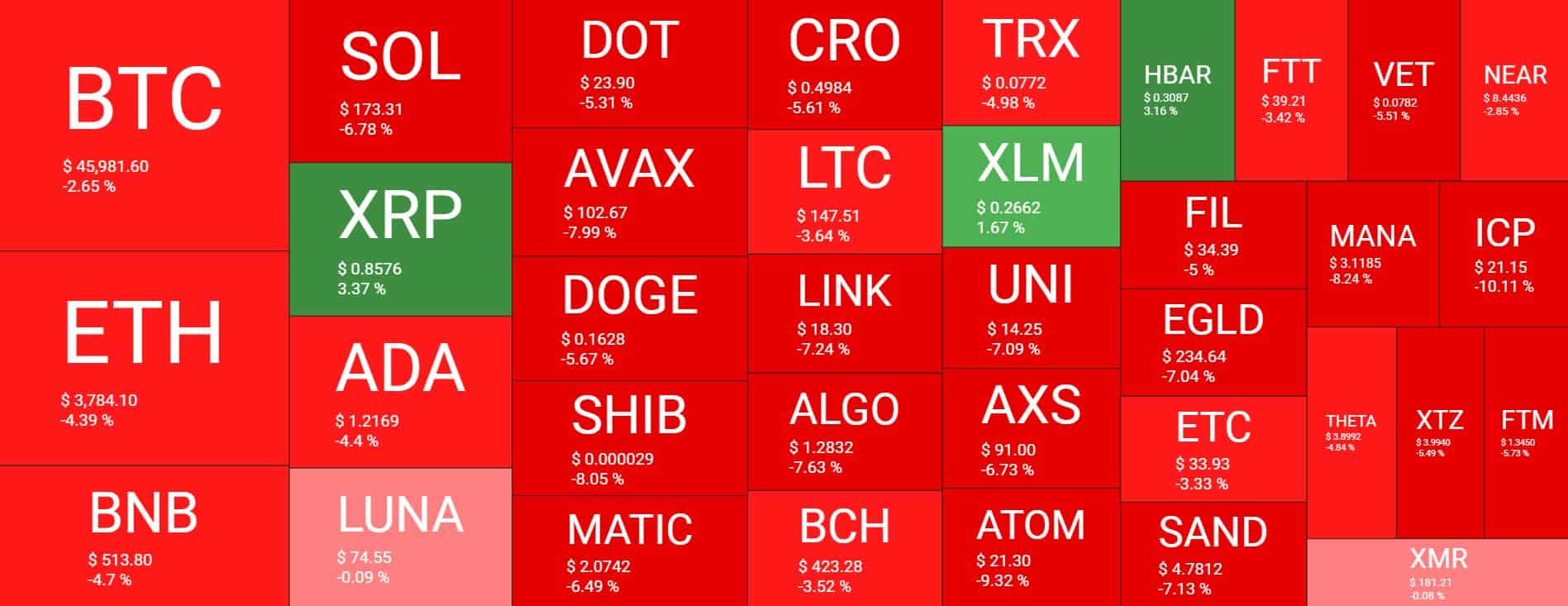

Altcoins See Red Too

Similar to bitcoin, most altcoins are also in the red today. Ethereum has lost another 4.5% of value and now sits beneath $3,800. The second-largest cryptocurrency has been stuck below the coveted $4,000 line for almost a week now.

Binance Coin is down by nearly 5% since yesterday and is just over $510. Solana (-7%), Cardano (-4.5%), Polkadot (-5.5%), Avalanche (-8%), Dogecoin (-5.5%), Shiba Inu (-8%), and MATIC (-6.5%) are all deep in red as well.

Interestingly, XRP is the only larger-cap altcoin slightly in the green. Ripple’s native token is up by more than 3% and stands at $0.85

A few more gainers come from the lower-cap alts, with Revain leading following a 13% increase.

However, most other altcoins are in the red, and the cryptocurrency market cap is down by $100 billion in a day to just over $2.1 trillion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.