Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Plus: Bitcoin’s mining evolution

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

This week we dive into the influence global uncertainty has been having in crypto markets towards the end of a remarkable year.

We also cover the evolution of Bitcoin’s mining space as its hash rate sets new highs.

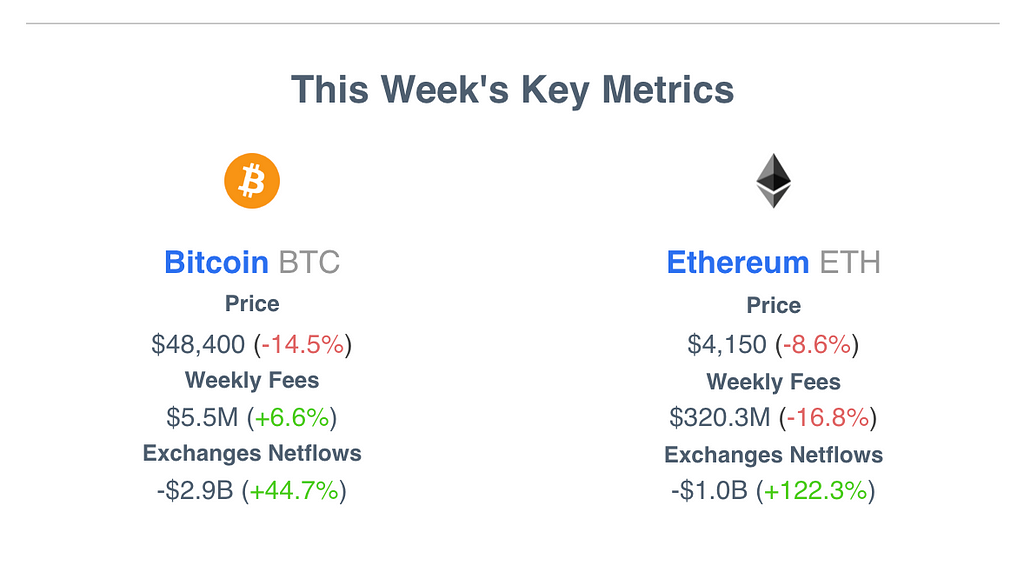

Weekly Fees — Sum of total fees spent to use a particular blockchain in a week. This tracks the willingness to spend and demand to use Bitcoin or Ether.

- Bitcoin recorded a modest increase in the fees generated by its blockchain as network activity picked up during the crash

- Ethereum’s fees decreased to a six-week low

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges over the past seven days. Crypto going into exchanges may signal selling pressure, while withdrawals potentially point to accumulation.

- Bitcoin’s weekly outflows reached a five month high with nearly $3 billion worth of BTC leaving centralized exchanges

- Ether outflows also increased to $1 billion

Macro Conditions Dominating Crypto’s Outlook

The recent correction comes towards the end of a year where Bitcoin and crypto in general have gone through a period of institutionalization with major corporations and even governments getting involved in the space. With crypto markets making up over $2 trillion in value, they are now part of the broader economy — for better or worse.

As Omicron fears and uncertainty about the federal reserve’s actions impacted markets, crypto markets suffered disproportionately from the resulting volatility.

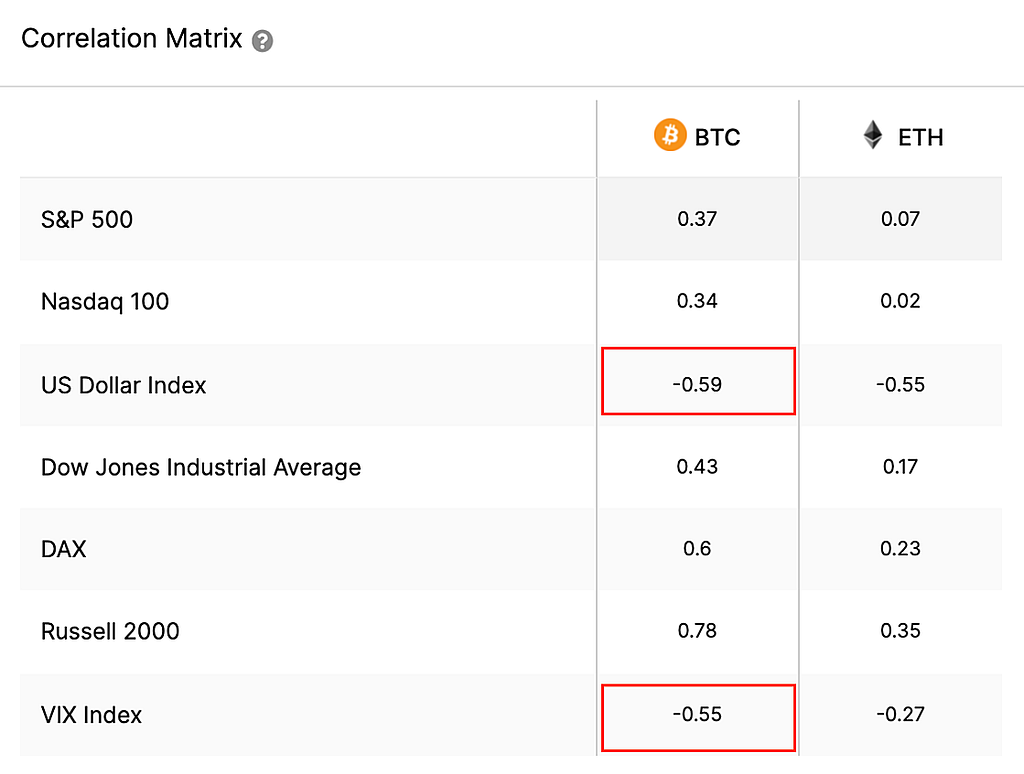

As of December 9, 2021 through IntoTheBlock’s capital markets insights

As of December 9, 2021 through IntoTheBlock’s capital markets insights

Bitcoin weakness — although most traditional markets recovered most of their losses, Bitcoin remained below $50k, 30% down from its all-time high.

- Bitcoin’s underperformance comes at a period where both the dollar (DXY) and the volatility index (VIX) are at their highest in months

- BTC has become strongly negatively correlated to these indices, while Ethereum less so as seen above

- Year-to-date, though, Bitcoin has significantly outperformed traditional markets, potentially leading to profit-taking activity amid uncertain conditions

Inflation hedge? Bitcoin’s recent weakness comes at a point where inflation numbers in the U.S. reach multi-year highs, raising concerns

- As signs of increasing inflation became apparent many recognized investors such as Paul Tudor Jones saw Bitcoin as a hedge

- Bitcoin’s recent lackluster performance may be beginning to diminish institutional investors’ hopes of it acting as an inflation hedge

- With the U.S. CPI inflation numbers due today, the market will be likely keeping a close eye to (in)validate this thesis

In the event of inflation numbers surpassing expectations, markets are likely to drop as this could accelerate an increase in interest rates. Potentially, this may exacerbate Bitcoin’s sell-off.

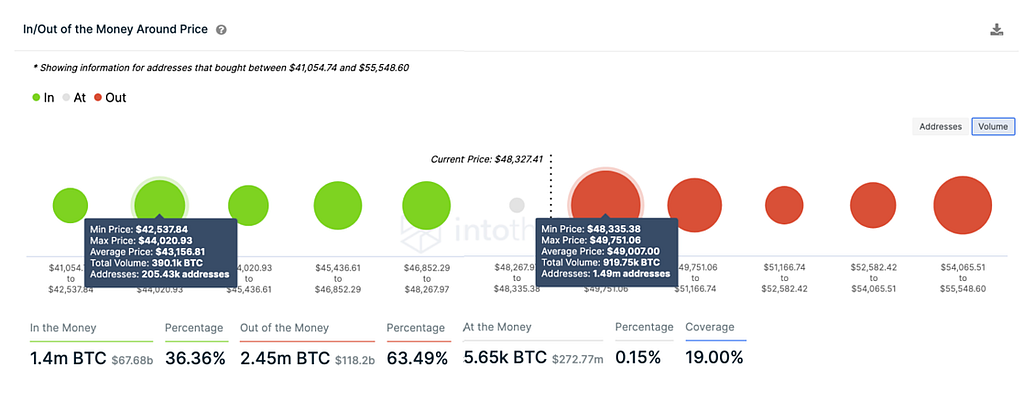

As of December 9, 2021 through IntoTheBlock’s Bitcoin IOMAP

As of December 9, 2021 through IntoTheBlock’s Bitcoin IOMAP

Where to Next? Using IntoTheBlock’s In/Out of the Money Around Price (IOMAP) we can observe the levels where buying activity has been concentrated around.

- There is strong resistance just below $50k, where 1.49 million addresses previously acquired 919k BTC

- The IOMAP shows less buying activity right below current prices, opening up the possibility for a deeper correction to $43k, where 200k addresses bought 390k BTC

- Bitcoin perpetual swaps’ funding rate remain near zero, pointing to neutral expectations near-term

Overall, Bitcoin’s role in macro portfolios has grown remarkably throughout 2021. While this was a main driver throughout the beginning of the year, it has acted as a double-edged sword now that uncertainty with the Omicron variant and interest rates impact global markets.

Bitcoin’s Mining Evolution

As many will know, price is only one of the many layers of a crypto-asset. For proof of work blockchains like Bitcoin, mining is another important layer.

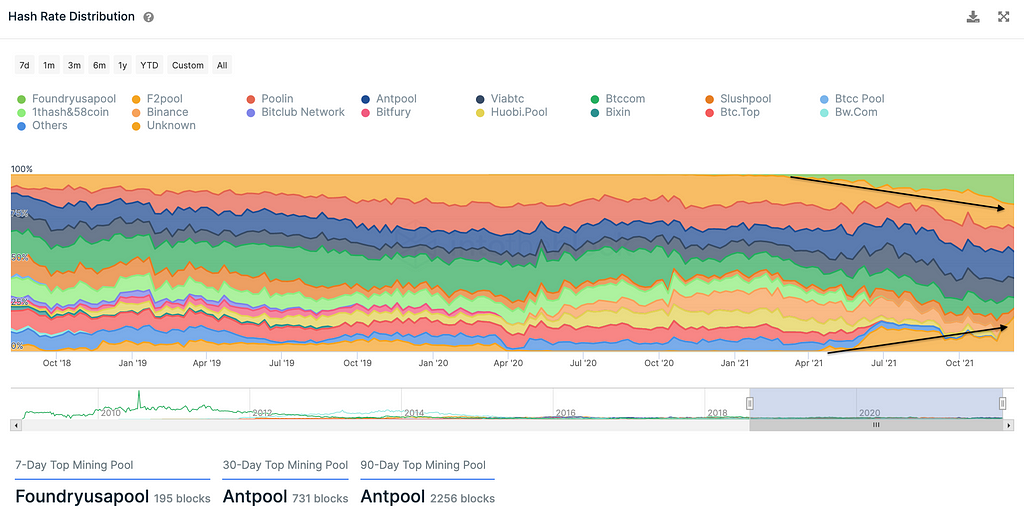

Following Bitcoin’s mining migration throughout this summer, the landscape in this industry has shifted significantly despite the hash rate being near the same level it was prior to the Chinese mining ban.

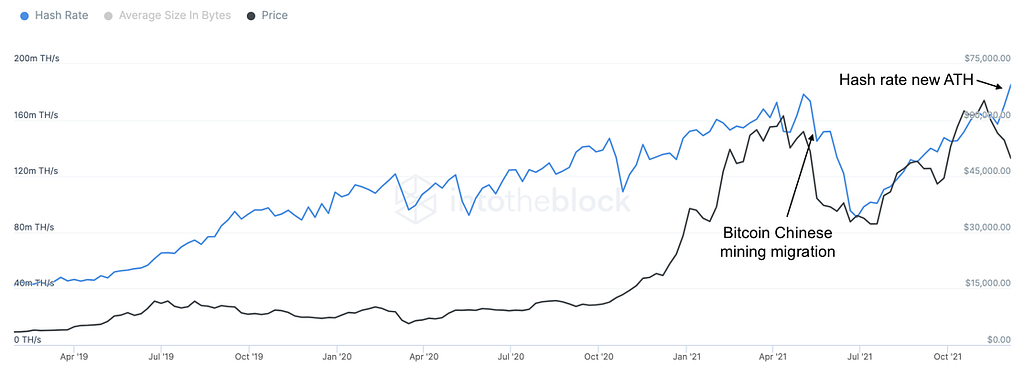

As of December 9 through IntoTheBlock’s Bitcoin mining indicators

As of December 9 through IntoTheBlock’s Bitcoin mining indicators

Quick refresher — The hash rate is the aggregate power contributed by computers to secure a proof of work blockchain.

- Over half of Bitcoin miners used to be located in China up to this year

- Following China’s crack down on cryptocurrency mining, the hash rate dropped over 50% as these miners relocated

- After hitting a bottom in June, the hash rate has consistently climbed, reaching new highs this week despite the price drop

These changes have led to a redistribution of the miners powering Bitcoin.

As of December 9 through IntoTheBlock’s Bitcoin mining indicators

As of December 9 through IntoTheBlock’s Bitcoin mining indicators

Mining redistribution — Here are the two major changes since:

- American miners where among the largest benefactors from the Chinese mining ban, with the U.S-based pool Foundry currently generating the largest share of Bitcoin issued

- Unknown, independent miners have also grown significantly, suggesting there are now more rogue entities mining on their own without relying on pools

The bottom-line — Though the Chinese mining ban led to uncertainty short-term, it has made the network more resilient as it is now more globally dispersed and decentralized.

Upcoming Webinar

Sign up for our next webinar. Limited amount of free seats available.

Staking in a Multi-Chain World — Key Analytics & Concepts to Know

Proof of Stake (PoS) has become the de facto consensus mechanism for smart contract platforms. While the core concept is the same, implementations of PoS can vary significantly depending on a set of optimizations brought forward by developer teams.

In this webinar we’ll dive deep into the rise of PoS and some of its main variations. We will also cover the emergence of liquid staking protocols such as Lido and opportunities likely to arise from this growing space over the coming years.

Macro Conditions Dominating Crypto’s Outlook was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.